Automobiles Insurance

In the complex world of automotive ownership, one aspect stands out as a necessity: Automobile Insurance. This crucial coverage protects drivers and vehicle owners from financial risks and potential liabilities associated with road accidents and other mishaps. It is an indispensable component of responsible car ownership, ensuring peace of mind and financial security for all involved. This comprehensive guide will delve into the intricate world of automobile insurance, exploring its various facets, benefits, and the considerations that go into choosing the right policy.

Understanding Automobile Insurance

Automobile insurance, often referred to as car insurance, is a contractual agreement between an insurance provider and a policyholder. This contract ensures that the insurance company will provide financial protection against bodily injury, property damage, and other specified losses associated with using a vehicle. It is a vital safeguard, offering coverage for a range of incidents, from minor fender-benders to catastrophic accidents.

Types of Automobile Insurance Coverage

The insurance landscape for automobiles is diverse, offering a range of coverage options tailored to meet specific needs. Here’s a breakdown of the primary types of automobile insurance coverage:

- Liability Coverage: This is the most fundamental type of automobile insurance. It covers the costs associated with bodily injury or property damage that you, as the policyholder, cause to others while driving. It’s mandatory in most states and serves as a legal and financial safeguard.

- Collision Coverage: This type of insurance covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. It’s particularly beneficial for newer vehicles or those with outstanding loans, as it ensures financial protection even when you’re at fault.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages that aren’t caused by collisions. This includes theft, vandalism, natural disasters, and other non-collision incidents. It’s a broad coverage type that offers peace of mind for comprehensive protection.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of the policyholder and their passengers, regardless of fault. It ensures quick access to medical treatment without waiting for liability determinations.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder and their passengers if involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

- Roadside Assistance: This optional coverage provides emergency services like towing, flat tire changes, and fuel delivery. It’s especially valuable for drivers who frequently travel long distances.

Factors Influencing Automobile Insurance Premiums

The cost of automobile insurance, known as the premium, is determined by a variety of factors. Understanding these factors can help policyholders make informed decisions and potentially save money on their insurance coverage. Here are some key considerations:

- Vehicle Type and Usage: The make, model, and age of your vehicle, along with the primary purpose (commute, business, pleasure) can significantly impact your premium. Sports cars and luxury vehicles, for instance, often carry higher premiums due to their higher replacement costs and increased likelihood of theft.

- Driver Profile: Your age, gender, driving history, and even your marital status can influence your premium. Younger drivers and those with a history of accidents or traffic violations may face higher premiums. Conversely, safe drivers and those with a clean driving record may enjoy lower rates.

- Coverage Amount and Deductible: The amount of coverage you choose and the deductible you’re willing to pay also affect your premium. Higher coverage limits and lower deductibles generally result in higher premiums, as the insurance company assumes more risk.

- Location and Driving Environment: The area where you live and the conditions you drive in can impact your premium. Urban areas with higher traffic density and crime rates may have higher premiums. Similarly, regions prone to natural disasters or severe weather conditions may also see higher insurance costs.

- Credit Score: Surprisingly, your credit score can influence your insurance premium. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score may lead to lower premiums, as it indicates financial responsibility and stability.

- Discounts and Bundling: Insurance companies often offer discounts for various reasons. These can include safe driving records, anti-theft devices, multi-policy discounts (bundling your auto insurance with other policies like home or life insurance), and loyalty discounts for long-term customers.

The Benefits of Automobile Insurance

The advantages of having automobile insurance are manifold, offering financial protection, legal compliance, and peace of mind to policyholders. Here’s a closer look at some of the key benefits:

Financial Protection

One of the primary benefits of automobile insurance is the financial protection it provides. In the event of an accident, your insurance policy can cover the costs of repairing or replacing your vehicle, as well as any medical expenses or property damage you’re liable for. This can be especially crucial for major accidents, where the costs can quickly escalate into the tens of thousands of dollars.

Legal Compliance

In most states, having automobile insurance is a legal requirement. This means that if you’re involved in an accident and you don’t have insurance, you could face legal consequences, including fines, license suspension, or even criminal charges. Having the right insurance coverage ensures that you’re in compliance with the law and protects you from potential legal issues.

Peace of Mind

Knowing that you’re protected in the event of an accident or other mishap provides immense peace of mind. Automobile insurance ensures that you’re financially prepared to handle unexpected situations, allowing you to focus on other aspects of your life without worrying about the potential financial impact of an accident.

Additional Perks

Beyond the core benefits, automobile insurance often comes with additional perks that can further enhance your driving experience. These can include roadside assistance, rental car coverage, and even discounts on your policy for maintaining a safe driving record. Some insurance companies also offer digital tools and apps that provide real-time updates on your coverage and claims, making it easier to manage your policy.

Choosing the Right Automobile Insurance

Selecting the right automobile insurance policy involves careful consideration of your specific needs and circumstances. Here are some steps to guide you in making an informed decision:

Assess Your Needs

Start by evaluating your specific requirements. Consider factors like the make and model of your vehicle, your driving habits and mileage, and any additional coverage you may need (e.g., for custom parts or equipment). Understanding your needs is the first step toward finding the right policy.

Research Insurance Providers

Take the time to research different insurance providers. Look for companies with a strong reputation, good financial ratings, and positive customer reviews. Consider their range of coverage options, customer service quality, and any additional benefits or discounts they offer.

Compare Quotes

Obtain quotes from multiple insurance providers to compare prices and coverage. Be sure to compare apples to apples, ensuring that you’re comparing similar coverage limits and deductibles. This step is crucial for finding the best value for your money.

Review Policy Details

Once you’ve narrowed down your options, carefully review the policy details. Understand what’s covered and what’s excluded, as well as any conditions or limitations. Ensure that the policy aligns with your needs and provides the protection you require.

Consider Additional Coverage

Depending on your circumstances, you may want to consider additional coverage options. For example, if you have a high-value vehicle or a classic car, you may want to explore specialty insurance policies that provide more comprehensive coverage. Similarly, if you frequently travel or drive in hazardous conditions, you might benefit from added roadside assistance coverage.

Choose a Reputable Agent

Working with a reputable insurance agent can be beneficial. They can provide personalized advice, answer your questions, and guide you through the policy selection process. A good agent will ensure that you understand your policy and are comfortable with your coverage choices.

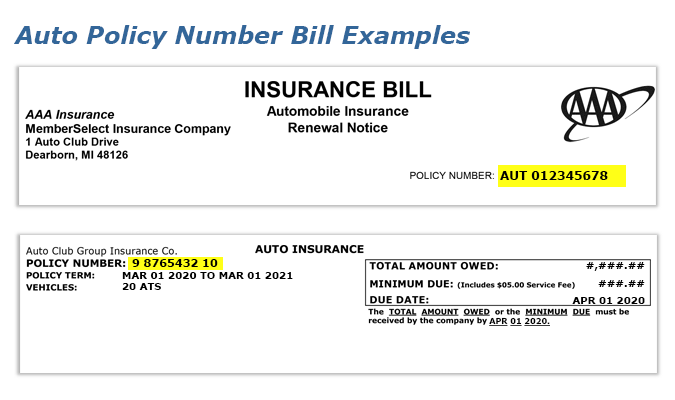

Automobile Insurance Claims Process

Understanding the automobile insurance claims process is essential for policyholders. Here’s a step-by-step guide to navigating this process effectively:

Report the Incident

The first step is to report the incident to your insurance company as soon as possible. Provide them with all the relevant details, including the date, time, location, and circumstances of the accident. Be sure to include any police report numbers or other relevant documentation.

Assess the Damage

Your insurance company will send an adjuster to assess the damage to your vehicle and any other property involved. They will determine the extent of the damage and the cost of repairs or replacement. It’s important to allow the adjuster access to your vehicle and any other relevant information.

Submit a Claim

Once the damage has been assessed, you’ll need to submit a formal claim to your insurance company. This typically involves filling out a claim form and providing any supporting documentation, such as estimates for repairs or medical bills.

Receive a Settlement

After your claim has been reviewed and approved, your insurance company will provide a settlement offer. This offer will detail the amount they are willing to pay for the repairs or replacement, as well as any additional costs covered by your policy. It’s important to carefully review this offer to ensure it aligns with your policy and the actual costs incurred.

Choose a Repair Shop

In most cases, you’ll have the freedom to choose your own repair shop. Be sure to select a reputable shop that offers quality work and has experience with your vehicle’s make and model. Your insurance company may have a list of preferred repair shops, but you’re not obligated to use them.

Monitor the Repair Process

Keep in touch with your repair shop throughout the repair process. Ensure that they’re providing regular updates on the progress of the repairs and that any additional costs are approved by your insurance company. This will help prevent delays and ensure a smooth repair process.

Final Settlement and Payment

Once the repairs are complete and the shop has submitted the final bill to your insurance company, you’ll receive a final settlement. This will include any additional costs approved by your insurance company, and you’ll be responsible for paying any applicable deductible. Once the payment is made, your claim will be considered closed.

Future Trends in Automobile Insurance

The world of automobile insurance is constantly evolving, influenced by advancements in technology, changing driving behaviors, and shifting regulatory landscapes. Here are some key trends and developments that are shaping the future of automobile insurance:

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and GPS to track driving behavior, is increasingly being used by insurance companies. This technology allows insurers to offer Usage-Based Insurance (UBI) policies, where premiums are based on actual driving behavior rather than traditional risk factors. This shift towards UBI is expected to continue, offering drivers more personalized and potentially more affordable insurance options.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is poised to have a significant impact on automobile insurance. As self-driving cars become more prevalent, the nature of accidents and liabilities will change. Insurance companies will need to adapt their policies to address the unique risks and benefits associated with autonomous driving. This may involve developing new coverage options and liability models.

Digitalization and Automation

The insurance industry is increasingly embracing digitalization and automation to streamline processes and enhance customer experiences. This includes the use of digital platforms and apps for policy management, claims submission, and real-time updates. Automation technologies, such as robotic process automation (RPA) and artificial intelligence (AI), are also being leveraged to improve efficiency and accuracy in various insurance processes.

Risk Assessment and Data Analytics

Advanced data analytics and risk assessment tools are being utilized by insurance companies to more accurately predict and manage risks. This involves the use of sophisticated algorithms and machine learning to analyze vast amounts of data, including driving behavior, vehicle performance, and environmental factors. By leveraging these tools, insurers can offer more precise pricing and coverage options, tailored to individual policyholders.

Regulatory Changes and Sustainability

Regulatory changes and a growing focus on sustainability are also influencing the automobile insurance industry. As governments and societies prioritize environmental sustainability, insurance companies are adapting their policies and practices to align with these goals. This includes offering incentives for eco-friendly vehicles and promoting sustainable driving behaviors.

Cybersecurity and Data Protection

With the increasing reliance on digital technologies and the collection of vast amounts of data, cybersecurity and data protection have become critical concerns for the insurance industry. Insurance companies are investing in robust cybersecurity measures to protect customer data and prevent cyber attacks. This includes implementing advanced encryption technologies, secure data storage solutions, and regular security audits.

Conclusion

Automobile insurance is an essential component of responsible vehicle ownership, providing financial protection, legal compliance, and peace of mind. Understanding the various types of coverage, the factors influencing premiums, and the benefits of insurance is crucial for making informed decisions. By carefully selecting the right policy and staying informed about the evolving landscape of automobile insurance, policyholders can ensure they have the protection they need while enjoying the freedom of the open road.

How often should I review my automobile insurance policy?

+It’s recommended to review your automobile insurance policy annually or whenever there are significant changes in your life or driving circumstances. This ensures that your coverage remains up-to-date and adequately protects your needs.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time. However, be aware of any cancellation fees or penalties that may apply, and ensure that your new policy provides the coverage you need without any gaps.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first priority is to ensure the safety of all involved. Call emergency services if needed. Then, exchange information with the other driver(s) and take photos of the scene and any damage. Report the accident to your insurance company as soon as possible, and follow their instructions for the claims process.