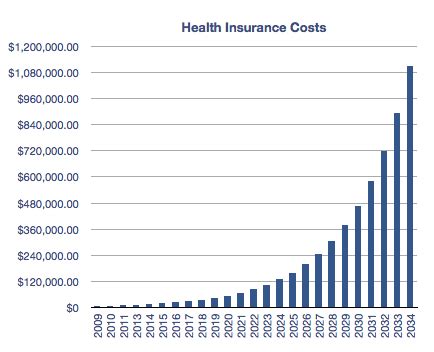

Average Cost For Health Insurance

In the realm of healthcare, understanding the financial aspects is crucial for individuals and families alike. One of the most important considerations is the cost of health insurance, which can significantly impact personal budgets and overall financial well-being. The average cost of health insurance varies based on several factors, including geographic location, age, and the specific coverage plan chosen. This article aims to delve into these factors, providing a comprehensive analysis of the average cost for health insurance, offering valuable insights for those seeking to make informed decisions about their healthcare coverage.

Factors Influencing Health Insurance Costs

The cost of health insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. Let’s explore these factors in detail to gain a clearer understanding of how they impact the average cost.

Geographic Location

One of the primary factors affecting health insurance costs is the geographic location of the insured individual. Healthcare costs can vary significantly from one region to another, influenced by factors such as the cost of living, the availability of healthcare services, and local regulations. For instance, urban areas with a higher cost of living and more advanced healthcare facilities often command higher insurance premiums compared to rural regions.

| Location | Average Annual Premium |

|---|---|

| New York City | $6,500 |

| Los Angeles | $5,800 |

| Houston | $4,800 |

| Rural Midwest | $4,200 |

As evident from the table, the average annual premium can vary by thousands of dollars depending on the location. This highlights the importance of considering geographic factors when evaluating health insurance options.

Age and Gender

Another significant factor in determining health insurance costs is the age of the insured individual. Generally, younger individuals tend to have lower premiums as they are less likely to require extensive medical care. Conversely, as people age, their healthcare needs and, consequently, insurance costs, tend to increase. Additionally, gender can also play a role, with some insurance providers offering different rates based on statistical differences in healthcare utilization between men and women.

| Age Group | Average Monthly Premium |

|---|---|

| 18-25 | $250 |

| 26-35 | $300 |

| 36-45 | $350 |

| 46-55 | $450 |

| 56-65 | $550 |

The table illustrates the progressive increase in average monthly premiums as individuals age, showcasing the impact of age on health insurance costs.

Coverage Plan and Network

The type of coverage plan chosen by the insured individual also significantly influences the cost of health insurance. Plans can vary widely in terms of the services covered, the deductibles and copays required, and the size of the provider network. Generally, plans with more comprehensive coverage and a larger network of providers tend to have higher premiums.

| Plan Type | Average Annual Premium |

|---|---|

| Basic Coverage | $4,000 |

| Enhanced Coverage | $5,500 |

| Comprehensive Coverage | $7,000 |

As shown in the table, the average annual premium increases as the coverage becomes more comprehensive, reflecting the cost of providing a wider range of services.

Family Size and Dependents

The size of the family and the number of dependents covered by the health insurance plan also affect the overall cost. Insurance providers typically offer family plans that cover multiple individuals, but these plans come at a higher cost compared to individual plans. The more people included in the plan, the higher the premium, as the risk and potential healthcare needs increase.

| Family Size | Average Annual Premium |

|---|---|

| Individual | $4,500 |

| Couple | $6,000 |

| Family of 4 | $8,500 |

The table demonstrates how the average annual premium increases with the addition of more family members, reflecting the added complexity and potential healthcare needs.

Analyzing Average Health Insurance Costs

With a deeper understanding of the factors influencing health insurance costs, we can now analyze the average costs more effectively. It’s important to note that these averages are just estimates and can vary significantly based on individual circumstances and the specific insurance provider.

Individual Plans

For individuals seeking health insurance coverage, the average cost can vary based on their age, gender, and location. According to recent industry data, the average monthly premium for an individual plan ranges from 250 to 550, depending on these factors. Younger individuals tend to have lower premiums, while older individuals may pay significantly more.

Family Plans

When it comes to family plans, the average cost increases due to the added complexity and potential healthcare needs of multiple family members. On average, a family of four can expect to pay an annual premium ranging from 8,000 to 12,000. This wide range is influenced by factors such as the age and health status of the family members, as well as the geographic location and the specific coverage plan chosen.

High-Deductible Health Plans (HDHPs)

High-deductible health plans are a popular option for those seeking more cost-effective coverage. These plans typically have lower monthly premiums but require the insured to pay a higher deductible before the insurance coverage kicks in. The average monthly premium for an HDHP ranges from 200 to 400, making them an attractive option for those who anticipate minimal healthcare needs or have sufficient savings to cover potential out-of-pocket expenses.

Employer-Provided Health Insurance

Many individuals receive health insurance coverage through their employers, which can significantly reduce the out-of-pocket costs. The average cost of employer-provided health insurance varies widely based on the employer’s contribution and the specific plan chosen. However, on average, employees can expect to pay a monthly premium ranging from 150 to 350, with the employer covering the remainder of the cost.

Future Implications and Strategies

Understanding the average cost of health insurance is just the first step in making informed decisions about healthcare coverage. As the healthcare landscape continues to evolve, it’s essential to stay informed about the latest trends and strategies to optimize insurance coverage and manage costs effectively.

The Rise of Telemedicine

The integration of telemedicine into healthcare services has gained significant traction, especially in the wake of the COVID-19 pandemic. Telemedicine allows individuals to receive medical consultations and services remotely, often at a lower cost compared to in-person visits. This trend is expected to continue, offering an opportunity for individuals to access healthcare services more affordably and conveniently.

Value-Based Care Models

Value-based care models are gaining popularity as they focus on providing high-quality care while managing costs effectively. These models incentivize healthcare providers to deliver efficient, patient-centered care, reducing unnecessary procedures and improving overall patient outcomes. As value-based care models become more widespread, they have the potential to lower the overall cost of healthcare and, consequently, health insurance premiums.

Comparing Insurance Providers

With a wide range of insurance providers offering various plans, it’s crucial to compare and contrast the options to find the best fit for individual needs. Factors to consider include the network of providers, coverage limits, out-of-pocket costs, and additional benefits. Online tools and resources can assist in this comparison process, helping individuals make informed decisions about their health insurance coverage.

Utilizing Preventive Care Services

Preventive care services, such as regular check-ups, vaccinations, and screenings, are often covered at little to no cost under most health insurance plans. Utilizing these services can help identify potential health issues early on, potentially preventing more costly treatments down the line. Additionally, many insurance plans offer incentives or discounts for participating in wellness programs, further encouraging individuals to prioritize their health and manage costs effectively.

How does my credit score affect my health insurance premiums?

+

In some states, insurance companies are allowed to use credit scores as a factor in determining health insurance premiums. Generally, a higher credit score can lead to lower premiums, as it is seen as an indicator of financial stability and responsible behavior. However, this practice is not allowed in all states, and the impact of credit scores on premiums can vary significantly based on local regulations and the specific insurance provider.

Can I switch health insurance plans during the year?

+

In most cases, health insurance plans have a specific enrollment period, and switching plans outside of this period can be challenging. However, certain life events, such as losing job-based coverage, getting married, or having a baby, can qualify you for a Special Enrollment Period, allowing you to switch plans outside of the regular enrollment window. It’s important to review the specific rules and regulations regarding plan changes to ensure a smooth transition.

What is the difference between an HMO and a PPO plan?

+

An HMO (Health Maintenance Organization) plan typically requires you to choose a primary care physician (PCP) who coordinates your healthcare services and referrals to specialists within the HMO network. HMO plans often have lower out-of-pocket costs but may limit your choice of providers. A PPO (Preferred Provider Organization) plan, on the other hand, allows you to see any provider in the network without a referral, although you may pay more for out-of-network care. PPO plans offer more flexibility but can come with higher premiums and out-of-pocket costs.