Average Home Insurance Price

Understanding the cost of home insurance is crucial for homeowners and aspiring buyers alike. The price of home insurance varies significantly depending on several factors, including the location, the size and value of the home, and the coverage limits chosen. This article aims to delve into the average home insurance price, exploring the factors that influence it and providing valuable insights to help individuals make informed decisions about their coverage.

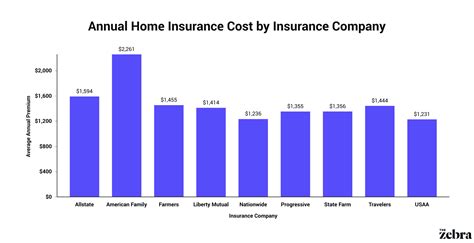

Average Home Insurance Costs Across the United States

According to industry data, the average annual cost of home insurance in the United States is approximately $1,274. However, it’s important to note that this figure serves as a general guideline and may not accurately reflect the cost in specific regions or for individual circumstances.

Home insurance rates can vary significantly from one state to another due to factors such as natural disaster risks, crime rates, and the cost of living. For instance, Florida, known for its susceptibility to hurricanes, often has higher insurance rates compared to states like Wisconsin, which faces fewer natural disasters.

| State | Average Annual Home Insurance Cost |

|---|---|

| Florida | $2,500 |

| California | $1,400 |

| Texas | $1,350 |

| Wisconsin | $950 |

| Vermont | $750 |

Within states, prices can also fluctuate based on local conditions. For example, coastal regions often face higher premiums due to the risk of storms and flooding. Urban areas might have elevated rates due to increased crime or the potential for vandalism, while rural areas could offer more affordable options due to lower risks.

Factors Influencing Home Insurance Costs

The cost of home insurance is influenced by a multitude of factors, including:

- Location: As mentioned, the geographical location of your home plays a significant role. Areas prone to natural disasters, high crime rates, or extreme weather conditions often command higher insurance premiums.

- Home Value and Size: Larger homes with higher replacement costs will generally require more extensive coverage, resulting in increased insurance premiums. The materials used in construction and any unique architectural features can also impact the cost.

- Coverage Limits: The level of coverage you choose directly affects the cost. Higher coverage limits, including liability protection and personal property coverage, will result in higher premiums.

- Deductibles: Opting for a higher deductible can reduce your premium. However, it’s important to ensure you can afford the deductible in the event of a claim.

- Claim History: Insurance companies consider your claim history when determining your premium. A history of frequent claims can lead to higher rates or even non-renewal of your policy.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as having multiple policies with the same insurer, installing safety features like smoke detectors or security systems, or being a loyal customer for an extended period.

Breaking Down Home Insurance Coverage

Home insurance policies typically provide a combination of coverage types to protect against various risks. Here’s a breakdown of the key components:

- Dwelling Coverage: This is the core component of home insurance, providing protection for the physical structure of your home. It covers damages caused by perils like fire, wind, hail, and vandalism, among others.

- Personal Property Coverage: This covers the contents of your home, including furniture, electronics, clothing, and other personal belongings. It provides financial assistance in the event of a covered loss.

- Liability Coverage: This protects you against claims of bodily injury or property damage caused to others on your property. It covers legal defense costs and any damages you’re legally obligated to pay.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage helps with temporary living expenses, such as hotel stays or restaurant meals, until your home is repaired or rebuilt.

- Medical Payments Coverage: This provides coverage for medical expenses incurred by visitors who are injured on your property, regardless of who is at fault.

Understanding Coverage Limits and Deductibles

When selecting a home insurance policy, it’s crucial to understand coverage limits and deductibles. Coverage limits represent the maximum amount your insurance company will pay for a covered loss. It’s important to choose limits that adequately reflect the replacement cost of your home and its contents.

Deductibles, on the other hand, are the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it's essential to ensure you can afford the deductible in the event of a claim. It's a balance between reducing your monthly premium and having the financial resources to cover a potential loss.

Frequently Asked Questions

What is the average cost of home insurance per month?

+

The average monthly cost of home insurance in the United States is approximately 106. However, this can vary significantly based on location, home value, coverage limits, and other factors.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How much is home insurance for a 200,000 home?

+

The cost of home insurance for a 200,000 home can vary widely. On average, you might expect to pay around 1,200 to $1,500 annually, but this can be higher or lower depending on your specific circumstances and location.

What is the cheapest home insurance option available?

+

The cheapest home insurance option will depend on your individual circumstances and the insurance provider. Shopping around and comparing quotes is essential to find the most affordable coverage for your needs.

Are there any ways to reduce home insurance costs?

+

Yes, there are several strategies to reduce home insurance costs. These include increasing your deductible, bundling your insurance policies, maintaining a good credit score, and taking advantage of any available discounts, such as for safety features or loyalty.

What should I do if I can’t afford my home insurance premium?

+

If you’re struggling to afford your home insurance premium, consider increasing your deductible or reviewing your coverage limits to see if there are any areas where you can reduce costs. You can also shop around for more competitive rates or speak with your insurance agent to explore options.