Quote For Automobile Insurance

Welcome to this comprehensive guide on understanding and securing the best automobile insurance quote. In today's fast-paced world, having adequate car insurance is not just a legal requirement but also a financial safeguard. This article aims to demystify the process of obtaining insurance quotes, offering expert insights and practical tips to help you navigate the often-complex world of auto insurance with ease.

The Importance of Auto Insurance

Automobile insurance is a crucial aspect of vehicle ownership. It provides financial protection against a variety of risks associated with owning and operating a motor vehicle. These risks can range from damage to your own vehicle in an accident to liability for bodily injury or property damage caused to others.

Furthermore, auto insurance can cover medical expenses resulting from accidents, as well as provide protection against theft or vandalism. It's an essential safety net that ensures you're financially prepared for the unexpected.

With a myriad of insurance providers and coverage options available, finding the right policy and getting an accurate quote can seem daunting. This is where understanding the key factors that influence insurance rates and knowing how to navigate the quote process becomes invaluable.

Factors Influencing Insurance Quotes

The cost of your automobile insurance is determined by a multitude of factors. These factors can be broadly categorized into personal, vehicle, and environmental aspects.

Personal Factors

Your personal details play a significant role in determining your insurance quote. This includes your age, gender, driving record, and credit score. For instance, younger drivers, especially males, are often considered higher risk and thus pay higher premiums. A clean driving record, on the other hand, can lead to substantial discounts.

Additionally, your credit score can impact your insurance rates. Studies have shown a correlation between credit scores and insurance claims, with individuals with higher credit scores often making fewer and less costly claims. Therefore, maintaining a good credit score can lead to lower insurance premiums.

Vehicle Factors

The type of vehicle you drive and its usage also significantly influence your insurance quote. Factors such as the make, model, and age of your vehicle, as well as its safety and anti-theft features, are taken into account. Vehicles that are more expensive to repair or that have higher instances of theft will generally result in higher insurance premiums.

The primary use of your vehicle also matters. If you use your car for business purposes, your insurance rates will likely be higher compared to someone who uses their vehicle solely for personal use.

Environmental Factors

Environmental factors, such as where you live and the average cost of car repairs in your area, can also impact your insurance quote. Areas with higher crime rates or a history of severe weather conditions may result in higher insurance premiums.

Moreover, the cost of living and average income in your area can influence insurance rates. Areas with a higher cost of living often have higher insurance premiums due to the increased cost of labor and parts for vehicle repairs.

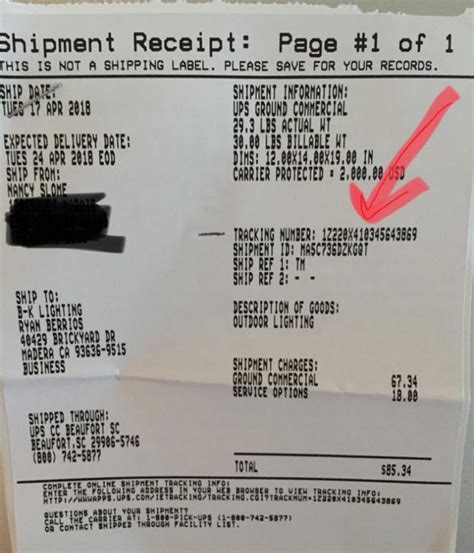

Obtaining an Accurate Insurance Quote

Now that we’ve explored the factors influencing insurance quotes, let’s delve into the process of obtaining an accurate quote. This involves understanding the different types of coverage, comparing quotes from multiple providers, and utilizing online tools and resources.

Types of Coverage

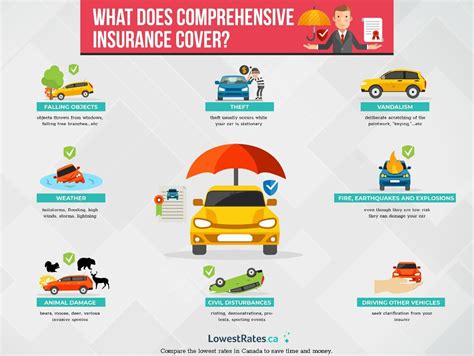

Auto insurance typically consists of several types of coverage, each designed to protect against specific risks. These include liability coverage, collision coverage, comprehensive coverage, medical payments coverage, and uninsured/underinsured motorist coverage.

Liability coverage is the most basic form of auto insurance and is required by law in most states. It covers the costs associated with bodily injury or property damage that you cause to others in an accident. Collision coverage, on the other hand, pays for the repair or replacement of your own vehicle after an accident, regardless of fault.

Comprehensive coverage provides protection against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. Medical payments coverage helps cover the cost of medical treatment for you and your passengers, regardless of fault.

Lastly, uninsured/underinsured motorist coverage protects you if you're involved in an accident with a driver who either doesn't have insurance or doesn't have enough insurance to cover the costs.

Comparing Quotes

To obtain the best automobile insurance quote, it’s essential to compare rates from multiple providers. This allows you to find the most competitive prices and the best coverage for your needs. Online comparison tools can be particularly useful for this, as they provide a quick and easy way to get quotes from various insurers.

When comparing quotes, pay attention to the coverage limits and deductibles. Higher coverage limits and lower deductibles generally result in higher premiums, but they also provide more financial protection in the event of a claim.

Utilizing Online Tools

The internet offers a wealth of resources to help you navigate the auto insurance landscape. In addition to comparison tools, there are various online guides and articles that provide valuable insights and tips on choosing the right coverage and getting the best rates.

Many insurance providers also offer online quote tools that allow you to get an estimate of your insurance costs based on your personal and vehicle details. These tools can be a great starting point for understanding the range of insurance rates you might expect.

Tips for Lowering Your Insurance Costs

While obtaining an accurate insurance quote is crucial, it’s equally important to explore ways to lower your insurance costs. Here are some expert tips to help you save on your automobile insurance:

Improve Your Driving Record

Maintaining a clean driving record is one of the most effective ways to lower your insurance costs. Insurance providers offer discounts for safe driving, so avoid any violations or accidents to keep your premiums low.

Increase Your Deductible

Opting for a higher deductible can significantly reduce your insurance premiums. However, it’s important to ensure that you can afford the higher deductible in the event of a claim.

Take Advantage of Discounts

Insurance providers offer a variety of discounts, including multi-policy discounts (if you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance), good student discounts, and loyalty discounts. Be sure to inquire about all available discounts when getting your quote.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a type of policy where your insurance premium is based on how much you drive and how you drive. This can be a great option for low-mileage drivers or those with safe driving habits, as it offers the potential for significant savings.

The Future of Auto Insurance

As technology continues to advance, the auto insurance industry is also evolving. The rise of autonomous vehicles and connected car technologies is expected to have a significant impact on insurance rates and coverage in the future.

With autonomous vehicles, the risk of human error is greatly reduced, potentially leading to lower insurance rates. However, the liability for accidents involving autonomous vehicles is still a complex and evolving issue that will need to be addressed by insurance providers.

Connected car technologies, such as telematics and advanced driver-assistance systems (ADAS), are also expected to play a significant role in the future of auto insurance. These technologies can provide real-time data on driving behavior and vehicle performance, allowing insurance providers to offer more personalized and accurate coverage.

💡 It's important to stay informed about these technological advancements and their potential impact on insurance rates. Keeping up with the latest trends can help you make more informed decisions about your auto insurance coverage and potentially save money in the long run.

Conclusion

Understanding and obtaining an accurate automobile insurance quote is a crucial step in ensuring you have adequate financial protection for your vehicle. By familiarizing yourself with the factors that influence insurance rates and following the tips provided in this guide, you can navigate the quote process with confidence and find the best coverage at the most competitive price.

Remember, auto insurance is not just a legal requirement but a vital investment in your financial security. With the right coverage and an understanding of the insurance landscape, you can drive with peace of mind, knowing you're protected against the unexpected.

How often should I review my automobile insurance policy?

+It’s recommended to review your auto insurance policy annually, or whenever your circumstances change significantly. This could include a move to a new location, a change in your marital status, or the addition of a new driver to your policy.

Can I switch insurance providers if I find a better quote?

+Absolutely! Insurance providers understand that customers may seek better rates and coverage, so they typically make it easy to switch. Just ensure you understand the terms of your current policy, especially any cancellation fees or penalties, before making the switch.

What is the average cost of automobile insurance?

+The average cost of auto insurance varies widely depending on numerous factors, including your location, the make and model of your vehicle, your driving record, and the coverage limits you choose. According to recent data, the national average cost of auto insurance is around $1,674 per year.