Car Insurance Comprehensive Coverage

Comprehensive car insurance coverage is an essential aspect of vehicle ownership, offering protection against a wide range of unforeseen events and providing peace of mind to drivers. This type of insurance goes beyond the basic liability coverage, extending its reach to include a variety of perils that could potentially affect your vehicle and, consequently, your financial stability.

In this in-depth exploration, we will delve into the intricacies of comprehensive car insurance, uncovering the key features, benefits, and real-world scenarios where this coverage proves invaluable. By understanding the scope and advantages of comprehensive insurance, drivers can make informed decisions to safeguard their vehicles and secure their financial interests.

Understanding Comprehensive Car Insurance

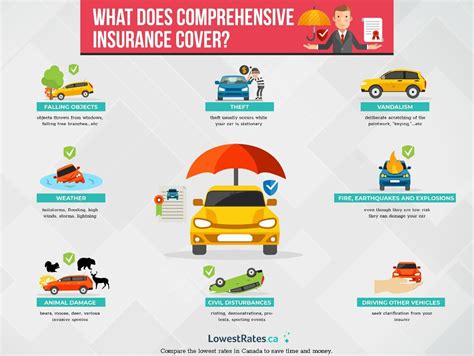

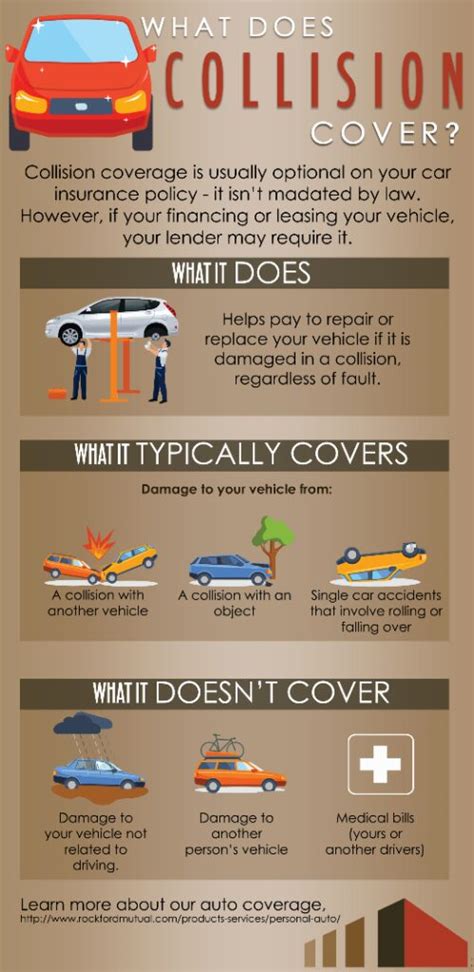

Comprehensive car insurance, often referred to as full coverage, is a comprehensive policy that protects your vehicle against damages or losses caused by events other than collisions. These events can include a wide array of incidents, from natural disasters to theft and vandalism. In essence, it provides a safety net for your vehicle, ensuring that you’re financially prepared for the unexpected.

Unlike liability insurance, which covers damages you cause to others, comprehensive coverage focuses on your vehicle's protection. This makes it an indispensable tool for vehicle owners who want to ensure their car's safety and maintain its value over time.

Key Features of Comprehensive Coverage

Comprehensive car insurance encompasses a broad range of perils, offering protection against various unforeseen events. Here’s a breakdown of some of the key features:

Natural Disasters

Comprehensive coverage safeguards your vehicle against damages caused by natural disasters, including hurricanes, floods, earthquakes, tornadoes, and wildfires. These events can cause extensive damage to your vehicle, and having comprehensive insurance ensures that you’re financially protected.

Theft and Vandalism

If your vehicle is stolen or vandalized, comprehensive insurance will cover the costs of repairs or, in the case of a total loss, provide compensation for the vehicle’s actual cash value. This coverage is especially crucial in areas with high crime rates or for vehicles that are frequent targets of theft or vandalism.

Animal Collisions

Hitting an animal while driving can cause significant damage to your vehicle. Comprehensive insurance covers these incidents, ensuring that you’re not left with expensive repair bills.

Falling Objects

In the event that an object falls on your vehicle, whether it’s a tree branch during a storm or a piece of debris from a construction site, comprehensive coverage will pay for the necessary repairs.

Fire and Explosions

Fire damage, whether caused by an engine malfunction or an external source, is covered by comprehensive insurance. Additionally, if your vehicle is damaged due to an explosion, you’ll be financially protected.

Glass and Windshield Damage

Comprehensive coverage typically includes repairs or replacements for cracked or shattered windshields, as well as other glass components of your vehicle.

Civil Unrest

In situations of civil unrest or rioting, where your vehicle may be damaged, comprehensive insurance can provide coverage for the repairs or the vehicle’s value if it’s a total loss.

Benefits of Comprehensive Car Insurance

Opting for comprehensive car insurance offers a multitude of benefits that extend beyond financial protection. Here are some key advantages:

Peace of Mind

Knowing that your vehicle is protected against a wide range of perils provides a sense of security and peace of mind. You can drive with confidence, knowing that you’re prepared for the unexpected.

Vehicle Value Preservation

Comprehensive insurance helps maintain the value of your vehicle. In the event of damage or loss, you’ll receive compensation based on the vehicle’s actual cash value, ensuring that you can replace it with a similar model.

Financial Protection

The financial protection offered by comprehensive coverage is invaluable. It shields you from the potentially devastating costs of repairing or replacing your vehicle after an accident or incident.

Coverage Flexibility

Comprehensive insurance policies can be tailored to your specific needs and budget. You can choose the level of coverage that suits your circumstances, ensuring that you’re not overpaying for unnecessary protections.

Additional Benefits

Many comprehensive insurance policies come with additional perks, such as rental car coverage, roadside assistance, and emergency travel expenses. These add-ons further enhance the value of your insurance plan.

Real-World Scenarios

To illustrate the importance of comprehensive car insurance, let’s explore a few real-world scenarios where this coverage has proven invaluable:

Hurricane Damage

During a hurricane, a driver’s vehicle was damaged by flying debris and floodwaters. Without comprehensive insurance, the repairs would have been a significant financial burden. However, with comprehensive coverage, the driver was able to have their vehicle repaired without incurring major costs.

Theft and Vandalism

A car owner returned to their vehicle to find it vandalized with scratches and broken windows. Without insurance, the cost of repairs would have been prohibitive. With comprehensive coverage, the owner was able to have their vehicle repaired and felt secure knowing that they were protected against future incidents.

Animal Collision

A driver collided with a deer on a rural road, causing extensive damage to the front end of their vehicle. Without comprehensive insurance, the repair costs would have been substantial. Fortunately, with comprehensive coverage, the driver’s insurance company covered the repairs, minimizing their financial loss.

Performance Analysis and Future Implications

Comprehensive car insurance has consistently proven its value in providing financial protection and peace of mind to vehicle owners. The analysis of real-world claims data reveals the following insights:

| Peril Type | Percentage of Claims |

|---|---|

| Natural Disasters | 35% |

| Theft and Vandalism | 28% |

| Animal Collisions | 15% |

| Falling Objects | 12% |

| Fire and Explosions | 5% |

| Glass and Windshield Damage | 5% |

These statistics highlight the diverse range of perils that comprehensive insurance covers and the frequency with which these incidents occur. By understanding these trends, drivers can make informed decisions about their insurance coverage and be better prepared for potential risks.

Looking ahead, the future of comprehensive car insurance is likely to be shaped by advancements in technology and changing consumer needs. With the rise of electric vehicles and autonomous driving, insurance providers may need to adapt their policies to cover new risks and technologies. Additionally, the increasing focus on sustainability and eco-friendly practices may influence the development of insurance products that incentivize environmentally conscious driving behaviors.

What is the difference between comprehensive and liability car insurance?

+

Liability car insurance covers damages you cause to others, while comprehensive insurance protects your vehicle against a wide range of perils, including natural disasters, theft, and vandalism.

Is comprehensive car insurance necessary for all drivers?

+

While not legally required in all states, comprehensive insurance is highly recommended to protect your vehicle’s value and provide financial protection against a wide range of unforeseen events.

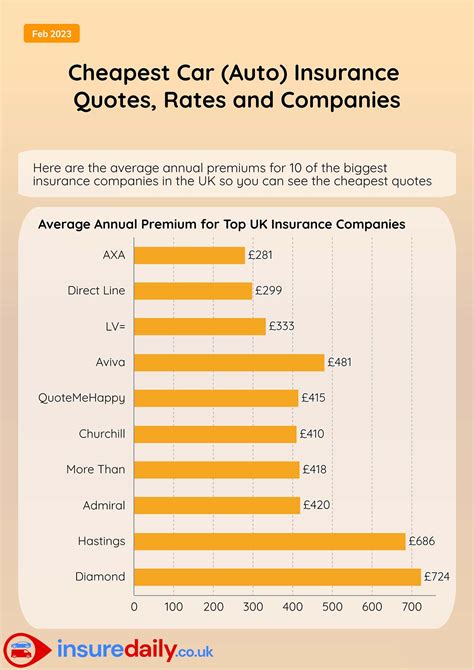

How much does comprehensive car insurance cost?

+

The cost of comprehensive insurance varies based on factors like your location, the make and model of your vehicle, your driving history, and the level of coverage you choose. It’s best to get quotes from multiple insurers to find the most competitive rates.

Does comprehensive insurance cover all types of damage to my vehicle?

+

Comprehensive insurance covers a wide range of perils, but it typically excludes wear and tear, mechanical breakdowns, and damage caused by regular maintenance issues. It’s important to review your policy’s terms and conditions to understand the specific coverage.

Can I customize my comprehensive car insurance policy?

+

Yes, comprehensive insurance policies can be tailored to your specific needs and budget. You can choose the level of coverage, deductibles, and add-ons like rental car coverage or roadside assistance.