What Does Self Insured Mean

The concept of self-insurance is a crucial aspect of the financial and healthcare industries, offering a unique approach to managing risks and costs. Self-insurance is a strategy adopted by organizations and, in some cases, individuals, to provide coverage for their own potential losses or liabilities, rather than relying solely on traditional insurance policies.

In this article, we will delve into the intricacies of self-insurance, exploring its definition, mechanisms, benefits, and potential challenges. By understanding the concept of self-insurance, we can gain valuable insights into its role in modern risk management and its implications for various stakeholders.

Understanding Self-Insurance: Definition and Mechanism

Self-insurance, at its core, is a strategy where an entity chooses to assume the financial responsibility for its own risks and losses, instead of transferring that responsibility to an external insurance company. This approach involves setting aside funds, often in the form of dedicated reserves or trust accounts, to cover potential claims and liabilities.

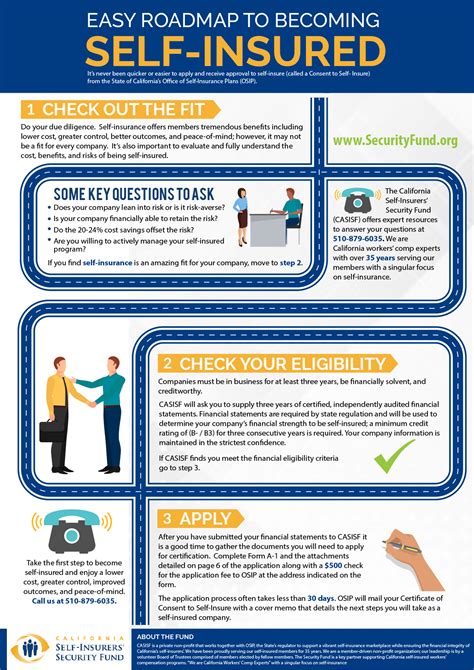

The mechanism of self-insurance typically involves the following key steps:

- Risk Assessment: The entity conducts a thorough evaluation of its potential risks, considering factors such as the nature of its operations, historical loss data, and industry trends. This assessment helps determine the level of risk the entity is willing to retain.

- Funding Reserve: Based on the risk assessment, the entity allocates a specific amount of funds to create a self-insurance reserve. This reserve acts as a financial buffer to cover potential losses and liabilities.

- Claims Management: When a claim arises, the entity handles the process internally. This involves investigating the claim, determining its validity, and making a decision on whether to pay the claim or deny it based on predefined criteria.

- Risk Control and Mitigation: Self-insurance often goes hand-in-hand with proactive risk management strategies. Entities implement measures to minimize the likelihood and impact of potential losses, such as implementing safety protocols, training programs, and loss prevention initiatives.

Benefits of Self-Insurance

Self-insurance offers a range of advantages to organizations and, in some cases, individuals who choose to adopt this strategy. Here are some key benefits:

Cost Control

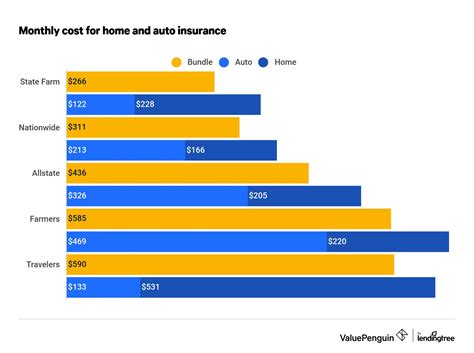

One of the primary advantages of self-insurance is the potential for significant cost savings. By assuming their own risks, entities can avoid paying premiums to external insurance companies. This can lead to substantial financial savings, especially for organizations with a good track record of low-risk operations.

Flexibility and Customization

Self-insurance allows entities to tailor their coverage to their specific needs and risk profiles. They have the flexibility to determine the types of risks they want to cover, the extent of coverage, and the associated deductibles or retentions. This customization ensures that the coverage aligns perfectly with the entity’s unique requirements.

Enhanced Risk Management

By self-insuring, entities take a more proactive approach to risk management. They gain a deeper understanding of their risks and can implement targeted strategies to mitigate those risks. This active involvement in risk management often leads to improved safety measures and a more efficient allocation of resources.

Improved Cash Flow

Self-insurance can provide entities with better control over their cash flow. Instead of paying regular insurance premiums, they can allocate funds to the self-insurance reserve as needed, which can be especially beneficial for entities with fluctuating cash flows or those seeking to optimize their financial planning.

Claim Management Efficiency

When an entity self-insures, it has direct control over the claims management process. This allows for more efficient handling of claims, as there is no need to wait for external insurance company approvals or bureaucratic processes. Quick and effective claim resolution can improve customer satisfaction and reduce administrative burdens.

Challenges and Considerations

While self-insurance offers numerous benefits, it also comes with certain challenges and considerations that entities must carefully evaluate before adopting this strategy.

Financial Risk

One of the primary concerns with self-insurance is the potential for large, unexpected losses. If an entity experiences a significant claim or a series of claims that exceed its self-insurance reserves, it may face financial strain or even insolvency. Proper risk assessment and adequate funding of reserves are critical to mitigating this risk.

Resource Requirements

Self-insurance requires dedicated resources for claims management, risk assessment, and ongoing monitoring. Entities must allocate personnel, time, and expertise to effectively handle these tasks. For smaller organizations, this can be a significant challenge, as it may require hiring additional staff or outsourcing certain functions.

Regulatory Compliance

Depending on the jurisdiction and the type of risks being self-insured, entities may need to comply with specific regulatory requirements. These regulations can vary widely and may include licensing, reporting, and reserve funding mandates. Staying informed about and adhering to these regulations is essential to avoid legal and financial penalties.

Limited Coverage

Self-insurance typically covers a limited range of risks, often those that are more predictable and manageable. Entities may still require traditional insurance coverage for catastrophic risks or highly specialized exposures. Understanding the limitations of self-insurance and maintaining a balanced risk management approach is crucial.

Real-World Examples of Self-Insurance

Self-insurance is a strategy utilized by a diverse range of entities, from large corporations to public entities and even some individuals. Here are a few real-world examples:

Large Corporations

Many multinational corporations with significant financial resources and a good understanding of their risk profiles choose to self-insure. For example, tech giants like Apple and Google have self-insured programs for various risks, including employee healthcare and workers’ compensation.

Public Entities

Government agencies, municipalities, and public schools often self-insure for certain risks. For instance, many school districts in the United States self-insure for property damage and liability claims, leveraging their financial stability and risk management expertise to provide coverage for their own assets and personnel.

Employee Welfare Programs

Some large employers, especially those with strong employee welfare programs, may self-insure for certain healthcare benefits. This allows them to offer comprehensive coverage while maintaining control over the benefits provided and the associated costs.

Future Implications and Trends

The concept of self-insurance continues to evolve, and its future implications are shaped by several key factors:

- Changing Risk Landscape: As industries evolve and new technologies emerge, the nature of risks also changes. Self-insurance strategies will need to adapt to address emerging risks, such as cybersecurity threats and environmental liabilities.

- Regulatory Environment: The regulatory landscape for self-insurance varies across jurisdictions. Future trends may involve increased regulation to ensure adequate protection for self-insured entities and their stakeholders.

- Advancements in Risk Management: Technological advancements and data analytics are revolutionizing risk management. Self-insurance strategies can benefit from these innovations, enabling more accurate risk assessments and improved claims management.

- Collaborative Models: Self-insurance may evolve to incorporate more collaborative models, where entities pool their resources and expertise to share risks and benefits. This approach can enhance risk management capabilities and provide cost efficiencies.

Conclusion

Self-insurance is a powerful tool in the risk management arsenal, offering entities the opportunity to take control of their financial destiny. By understanding the definition, mechanisms, benefits, and challenges of self-insurance, organizations can make informed decisions about whether this strategy aligns with their risk appetite and operational goals.

As the business landscape continues to evolve, self-insurance will likely play an increasingly important role, providing a flexible and cost-effective approach to managing risks. However, it is essential for entities to carefully assess their capabilities, resources, and risk profiles before embracing this strategy.

Whether it's a large corporation, a public entity, or an individual seeking greater control over their financial future, self-insurance offers a unique and empowering path to managing risks and ensuring long-term financial stability.

How does self-insurance differ from traditional insurance?

+Self-insurance differs from traditional insurance in that the entity assumes the financial responsibility for its own risks, while traditional insurance involves transferring that responsibility to an external insurance company in exchange for premiums.

Is self-insurance suitable for small businesses?

+While self-insurance can offer benefits to small businesses, it requires careful consideration. Small businesses may have limited resources and expertise for claims management and risk assessment. It is crucial to evaluate the risks and potential costs before adopting self-insurance.

What are the key factors to consider when deciding between self-insurance and traditional insurance?

+When deciding between self-insurance and traditional insurance, key factors include the entity’s risk profile, financial stability, resources for claims management, regulatory requirements, and the nature of the risks being insured. A comprehensive risk assessment is essential to make an informed decision.