Best Auto Home Insurance Companies

In the realm of financial protection, auto and home insurance are paramount, providing a safety net against unforeseen circumstances. With a plethora of insurance companies vying for your attention, choosing the right provider can be a daunting task. This article aims to shed light on some of the best auto and home insurance companies, offering a comprehensive guide to help you make an informed decision.

A Comprehensive Guide to Top Auto and Home Insurance Companies

Navigating the complex world of insurance can be challenging, but with the right knowledge, you can secure the best coverage for your needs. Here, we delve into the top performers in the auto and home insurance sector, evaluating their offerings, customer satisfaction, and financial stability.

Evaluating Auto Insurance Providers

When it comes to auto insurance, several factors come into play. These include the range of coverage options, competitive pricing, and a company’s reputation for claims handling and customer service. Let’s explore some of the industry leaders in this domain.

State Farm: A Trusted Name in Auto Insurance

State Farm has long been a household name in the insurance industry, offering a comprehensive range of auto insurance policies. With a focus on customer satisfaction, they provide customizable coverage plans to suit various needs. State Farm’s Excellent financial strength rating and A customer satisfaction score make it a reliable choice for many drivers.

| Coverage Options | Pricing |

|---|---|

| Comprehensive, Collision, Liability, Medical Payments, Uninsured/Underinsured Motorist Coverage | Competitive rates with discounts for good driving records and loyalty |

State Farm's Drive Safe & Save program rewards safe drivers with lower premiums, and their Steer Clear program offers discounts for young drivers who complete a qualifying driver education course.

Geico: Competitive Pricing and Digital Convenience

Geico, an acronym for Government Employees Insurance Company, has expanded its reach to offer affordable auto insurance to all. With a strong focus on digital convenience, Geico provides an easy-to-use online platform for policy management and claims filing. Their A+ Superior financial strength rating and A customer satisfaction score reflect their commitment to reliability.

| Key Features | Discounts |

|---|---|

| Emergency Roadside Assistance, Rental Car Coverage, Mechanical Breakdown Insurance | Military and federal employee discounts, good student discount, multi-policy discount |

Progressive: Personalized Coverage and Claims Satisfaction

Progressive Insurance is known for its personalized approach to auto insurance. They offer a wide range of coverage options and flexible payment plans, catering to various customer needs. With an A+ Superior financial strength rating and A customer satisfaction score, Progressive stands out for its claims satisfaction.

| Coverage Options | Unique Features |

|---|---|

| Liability, Collision, Comprehensive, Medical Payments, Uninsured/Underinsured Motorist Coverage, Rental Reimbursement | Name Your Price tool for customized coverage, Snapshot program for usage-based insurance rates |

Leading Home Insurance Companies

Home insurance is an essential component of financial planning, providing protection against various risks associated with homeownership. Let’s explore some of the top home insurance providers.

Allstate: Comprehensive Home Insurance Solutions

Allstate offers a comprehensive suite of home insurance products, designed to protect homeowners from a wide range of risks. With an A+ Superior financial strength rating and A customer satisfaction score, Allstate is a trusted name in the industry.

| Coverage Options | Unique Features |

|---|---|

| Dwelling Coverage, Personal Property Coverage, Liability Coverage, Additional Living Expenses | Claim Satisfaction Guarantee, Green Home Rebate, Identity Protection Coverage |

Liberty Mutual: Customizable Home Insurance Plans

Liberty Mutual provides customizable home insurance plans, allowing homeowners to tailor their coverage to their specific needs. With an A financial strength rating and A customer satisfaction score, Liberty Mutual is known for its personalized approach.

| Coverage Options | Discounts |

|---|---|

| Dwelling Coverage, Personal Property Coverage, Liability Coverage, Medical Payments to Others | Multi-policy discount, home security discount, new home discount |

Farmers Insurance: Community-Focused Home Insurance

Farmers Insurance is known for its community-focused approach to home insurance. They offer a range of coverage options, including specialized plans for unique homes and high-value properties. With an A financial strength rating and A customer satisfaction score, Farmers is a reliable choice for many homeowners.

| Coverage Options | Discounts |

|---|---|

| Dwelling Coverage, Personal Property Coverage, Liability Coverage, Additional Living Expenses, Identity Theft Coverage | Multi-policy discount, home security discount, mature homeowner discount |

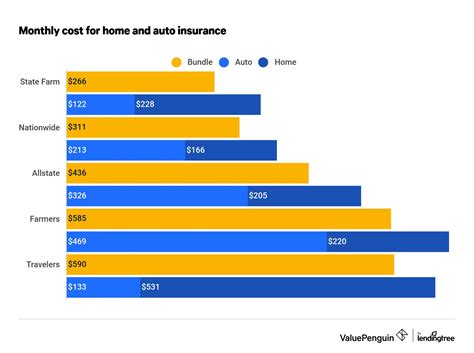

Comparative Analysis: Auto vs. Home Insurance

While auto and home insurance have distinct features, they share the common goal of providing financial protection. Here’s a comparative analysis of these two essential types of insurance.

| Feature | Auto Insurance | Home Insurance |

|---|---|---|

| Coverage Options | Liability, Collision, Comprehensive, Medical Payments, Uninsured/Underinsured Motorist | Dwelling Coverage, Personal Property Coverage, Liability Coverage, Additional Living Expenses |

| Financial Strength Ratings | State Farm: Excellent, Geico: A+ Superior, Progressive: A+ Superior | Allstate: A+ Superior, Liberty Mutual: A, Farmers: A |

| Customer Satisfaction Scores | State Farm: A, Geico: A, Progressive: A | Allstate: A, Liberty Mutual: A, Farmers: A |

Conclusion: Your Financial Safety Net

Choosing the right auto and home insurance provider is a crucial decision that can impact your financial security. With a range of reliable and reputable companies to choose from, you can tailor your coverage to your unique needs. Whether you’re a safe driver seeking affordable auto insurance or a homeowner looking for comprehensive protection, the companies outlined above offer a strong foundation for your financial safety net.

How do I choose the right auto insurance coverage for my needs?

+Consider your specific needs and budget. Evaluate the coverage options offered by different providers, such as liability, collision, and comprehensive coverage. Look for companies with a strong financial rating and good customer satisfaction scores. Also, consider any discounts or programs that can help lower your premiums, such as safe driver discounts or usage-based insurance programs.

What factors should I consider when choosing a home insurance policy?

+Evaluate the coverage limits and types offered by different providers, including dwelling coverage, personal property coverage, and liability coverage. Check for any additional coverages that may be important to you, such as identity theft protection or coverage for high-value items. Consider the company’s financial stability and customer satisfaction ratings. Also, look for discounts and programs that can help reduce your premiums, such as multi-policy discounts or home security discounts.

Are there any additional benefits or programs offered by these insurance companies?

+Yes, many insurance companies offer additional benefits and programs to enhance their customers’ experience. For instance, State Farm’s Drive Safe & Save program rewards safe drivers with lower premiums, while Geico’s Digital Garage provides personalized coverage recommendations. Progressive’s Snapshot program offers usage-based insurance rates, and Allstate’s Claim Satisfaction Guarantee ensures a positive claims experience. These are just a few examples of the innovative programs offered by these top insurance providers.