Average Price Of Auto Insurance Per Month

Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the globe. The cost of auto insurance, however, varies significantly based on numerous factors, including location, driving history, vehicle type, and coverage options. Understanding the average price of auto insurance per month is crucial for individuals seeking to budget for this necessary expense. This comprehensive analysis delves into the various determinants of auto insurance costs, offering insights into how these factors influence monthly premiums.

The Impact of Geographical Location

One of the most significant influences on auto insurance rates is the insured’s geographical location. Insurance providers assess the risk associated with a specific area, taking into account factors such as crime rates, traffic density, and the frequency of natural disasters. As a result, urban areas often have higher insurance premiums due to increased traffic congestion and the higher likelihood of accidents or theft.

For instance, in the United States, states like Michigan and California are known for their relatively high auto insurance rates. Michigan, in particular, has a unique no-fault system that contributes to higher average premiums. On the other hand, states like Ohio and Idaho tend to have lower insurance costs due to less dense populations and fewer severe weather events.

| State | Average Monthly Premium |

|---|---|

| Michigan | $250 |

| California | $180 |

| Ohio | $120 |

| Idaho | $110 |

Local Demographics and Auto Insurance Rates

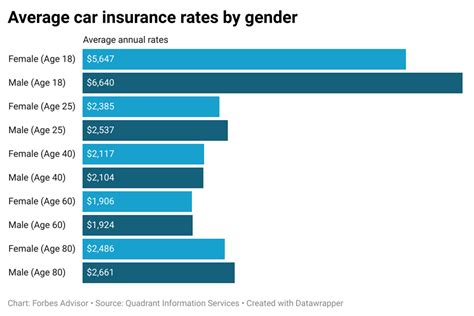

Within a state or region, local demographics also play a role in insurance pricing. Areas with a higher proportion of young drivers, for example, often have elevated insurance costs due to the higher accident risk associated with this demographic. Similarly, neighborhoods with higher crime rates may see increased insurance premiums to account for the elevated risk of vehicle theft or vandalism.

The Role of Driving History and Claims

An individual’s driving history is a critical factor in determining their auto insurance rates. Insurance providers scrutinize driving records to assess the risk associated with a particular driver. A clean driving record, free of accidents or traffic violations, is generally rewarded with lower insurance premiums.

On the other hand, drivers with a history of accidents or moving violations may face significantly higher insurance costs. This is because insurance companies view these individuals as higher-risk drivers, more likely to file claims in the future. The severity and frequency of these incidents also play a role, with more severe accidents or multiple violations leading to even higher insurance premiums.

The Impact of Claims Frequency

The frequency of insurance claims also influences the cost of auto insurance. Drivers who frequently file claims, even for minor incidents, are seen as a higher risk by insurance companies. As a result, these individuals may face increased insurance rates or even have difficulty finding an insurer willing to cover them.

Conversely, drivers who maintain a low claims frequency may be eligible for various discounts or rewards programs offered by insurance providers. These incentives aim to encourage safe driving habits and reward those who maintain a clean claims record.

Vehicle Type and Insurance Premiums

The type of vehicle being insured is another critical factor in determining insurance rates. Generally, more expensive vehicles, luxury cars, or those with powerful engines tend to have higher insurance costs. This is due to the increased cost of repairs and the higher likelihood of theft or vandalism associated with these vehicles.

Sports cars and high-performance vehicles, in particular, often carry higher insurance premiums due to their association with increased speeding and reckless driving. Conversely, smaller, more economical cars typically have lower insurance costs, as they are generally less expensive to repair and less likely to be targeted by thieves.

| Vehicle Type | Average Monthly Premium |

|---|---|

| Luxury Sedan | $200 |

| Economy Hatchback | $150 |

| Sports Car | $220 |

| SUV | $180 |

Vehicle Age and Value

The age and value of a vehicle also impact insurance rates. Older vehicles, especially those that are no longer being manufactured, may have reduced insurance costs due to their decreased market value and the lower likelihood of expensive repairs. On the other hand, newer vehicles, particularly those with advanced safety features or high-end specifications, often carry higher insurance premiums.

Coverage Options and Additional Factors

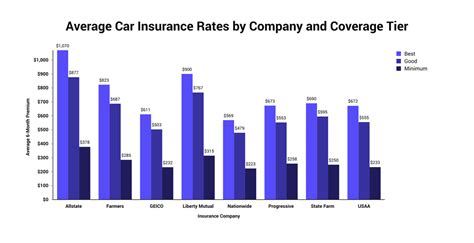

The level of coverage an individual chooses also significantly affects their monthly insurance premiums. Comprehensive coverage, which includes protection for a wide range of incidents such as theft, vandalism, and natural disasters, generally costs more than basic liability coverage, which only covers damage to other vehicles and property.

Additionally, drivers may opt for various add-ons or endorsements to their insurance policies, such as rental car coverage, roadside assistance, or gap insurance. These additional coverages can increase the overall cost of insurance but may provide valuable peace of mind and financial protection in specific situations.

Discounts and Bundling

Insurance providers often offer discounts to encourage safe driving practices and loyalty. These discounts can significantly reduce the cost of insurance and include options such as good student discounts, safe driver discounts, multi-policy discounts (for bundling auto insurance with other types of insurance), and loyalty discounts for long-term customers.

It's essential to research and understand the various discounts offered by insurance providers to ensure you're taking advantage of all the savings opportunities available to you.

Conclusion: Factors Influencing Auto Insurance Costs

The average price of auto insurance per month is influenced by a myriad of factors, including geographical location, driving history, vehicle type, and coverage options. Understanding these determinants is crucial for individuals seeking to manage their insurance costs effectively. By considering these factors and taking advantage of available discounts, drivers can make informed decisions to ensure they are adequately protected while keeping their insurance costs as low as possible.

Frequently Asked Questions

What is the average monthly cost of auto insurance in the United States?

+The average monthly cost of auto insurance in the U.S. varies greatly by state and can range from approximately 100 to 250. Factors such as location, driving history, and vehicle type significantly influence these rates.

Can I lower my auto insurance premiums if I have a poor driving record?

+Yes, there are several strategies to potentially lower your insurance premiums, even with a poor driving record. These include taking defensive driving courses, which may result in reduced points on your license and lower premiums, or opting for higher deductibles, which can reduce your monthly payments but increase the amount you pay out of pocket if you need to make a claim.

Are there any ways to save money on auto insurance without compromising coverage?

+Absolutely! Many insurance providers offer discounts for safe driving habits, multiple vehicles on the same policy, or bundling auto insurance with other types of insurance, such as home or renters insurance. Additionally, some providers offer usage-based insurance programs, where your driving behavior is monitored and safe driving habits can lead to lower premiums.

How do insurance companies determine the value of my vehicle for insurance purposes?

+Insurance companies typically use a combination of factors to determine the value of your vehicle, including its make, model, year, mileage, and condition. They may also consider the average cost of repairs for that particular vehicle and the likelihood of theft or damage.