Average Property Insurance

Property insurance is an essential aspect of financial planning for homeowners and renters alike. It provides protection against unforeseen events and ensures peace of mind. Understanding the average costs and factors influencing property insurance rates is crucial for making informed decisions. In this comprehensive guide, we delve into the world of property insurance, exploring its intricacies and providing valuable insights to help you navigate this complex landscape.

The Average Cost of Property Insurance: A Comprehensive Overview

Property insurance premiums vary widely across regions, property types, and individual circumstances. The average cost serves as a starting point to gauge the financial commitment required for adequate coverage. Let’s break down the key factors influencing these averages and provide a detailed analysis.

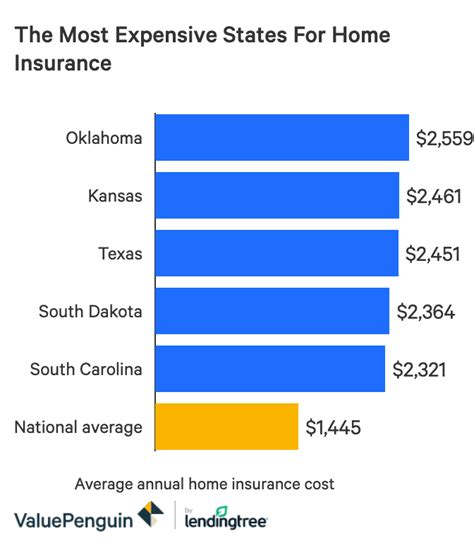

Regional Variations: Understanding Geographic Factors

The geographical location of your property significantly impacts insurance costs. Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, often experience higher premiums. For instance, coastal regions with frequent hurricane activity may have elevated insurance rates compared to inland areas. Additionally, crime rates and local construction costs can influence the average insurance premium in a given region.

| Region | Average Annual Premium |

|---|---|

| Urban Centers | $1,200 - $1,800 |

| Suburban Areas | $900 - $1,500 |

| Rural Communities | $700 - $1,200 |

Property Type and Age: Impact on Insurance Costs

The type and age of your property play a crucial role in determining insurance premiums. Older properties, especially those requiring extensive renovations or lacking modern safety features, may attract higher rates. Similarly, unique property types like historic homes or those with specialized construction may require specialized coverage, impacting the overall cost.

| Property Type | Average Annual Premium |

|---|---|

| Single-Family Home | $1,000 - $1,500 |

| Condominium | $800 - $1,200 |

| Apartment (Renter's Insurance) | $200 - $400 |

| Mobile Home | $700 - $1,000 |

Coverage Limits and Deductibles: Tailoring Your Policy

The level of coverage you choose directly affects your insurance premiums. Higher coverage limits for property damage and personal belongings will result in increased costs. Additionally, selecting a higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can reduce your premium. It’s essential to strike a balance between coverage and affordability to ensure adequate protection.

Claim History and Credit Score: Personal Factors in Play

Your insurance claim history and credit score can impact your premiums. A history of frequent claims may lead to higher rates, as it indicates a higher risk profile. Similarly, a poor credit score can result in increased premiums, as it may suggest a higher likelihood of filing claims. Maintaining a clean claim history and a good credit score can help keep your insurance costs manageable.

Bundling Policies: The Power of Multiple Coverages

Bundling multiple insurance policies, such as home and auto insurance, can lead to significant savings. Many insurance providers offer discounts when you combine policies, known as a “multi-policy discount.” This strategy not only simplifies your insurance management but also provides financial benefits. It’s worth exploring bundling options with your insurance provider to maximize savings.

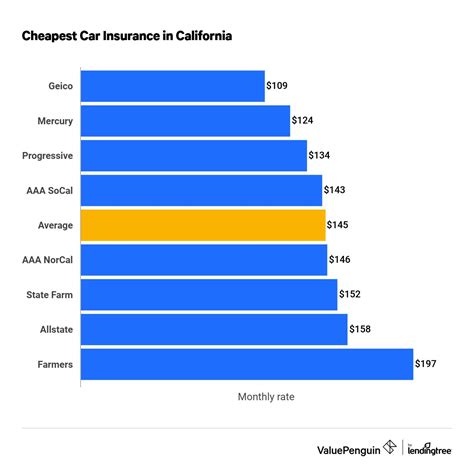

Comparing Quotes: Unlocking the Best Deals

Obtaining multiple quotes from different insurance providers is essential to finding the best deal. Each insurer has its own rating factors and pricing strategies, so comparing quotes can reveal significant variations. Online comparison tools and insurance brokers can streamline this process, providing a comprehensive view of available options.

Understanding Discounts: Maximizing Savings

Insurance providers offer various discounts to attract and retain customers. Common discounts include safety features discounts (for properties with smoke detectors, sprinkler systems, or security alarms), loyalty discounts (for long-term customers), and even occupational discounts (for certain professions). Understanding these discounts and meeting the criteria can significantly reduce your insurance costs.

The Impact of Deductibles: Striking a Balance

Deductibles play a crucial role in determining your insurance premium and out-of-pocket expenses. A higher deductible typically results in a lower premium, as you’re assuming more financial responsibility in the event of a claim. However, it’s essential to choose a deductible that aligns with your financial capabilities. Striking the right balance ensures you’re not overpaying for insurance or risking financial strain in the event of a claim.

Real-World Examples: Property Insurance in Action

To provide a clearer picture of property insurance costs, let’s explore some real-world scenarios. These examples showcase how different factors influence insurance premiums and highlight the importance of personalized coverage.

Scenario 1: Coastal Property in a High-Risk Zone

John, a homeowner in a coastal region prone to hurricanes, faces unique challenges. His property’s proximity to the ocean and the high risk of hurricane damage result in elevated insurance premiums. John’s annual premium is approximately $2,500, reflecting the higher risk associated with his location.

Scenario 2: Urban Condominium with Modern Safety Features

Emily, a condominium owner in an urban center, benefits from her property’s modern safety features. Her building’s state-of-the-art sprinkler system and smoke detectors contribute to a lower insurance premium. With an average annual premium of $950, Emily enjoys the peace of mind that comes with comprehensive coverage at a reasonable cost.

Scenario 3: Rural Mobile Home with Specialized Coverage

David, a mobile home owner in a rural area, requires specialized coverage due to the unique construction of his property. His insurance provider offers a tailored policy to address the specific risks associated with mobile homes. With an annual premium of $850, David has peace of mind knowing his home and belongings are adequately protected.

Navigating the Future: Trends and Innovations in Property Insurance

The property insurance industry is evolving, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of property insurance and the trends shaping the landscape.

Digital Transformation: The Rise of Insurtech

Insurtech, the fusion of insurance and technology, is revolutionizing the industry. Digital platforms and mobile apps are streamlining the insurance experience, making it more accessible and convenient. From online quote comparisons to digital policy management, insurtech is enhancing efficiency and customer satisfaction.

Telematics and Usage-Based Insurance: A New Paradigm

Telematics, the use of technology to track and analyze data, is transforming property insurance. Usage-based insurance models, where premiums are based on real-time data, are gaining traction. This approach rewards policyholders for responsible behavior, such as implementing safety measures or maintaining a claim-free history.

Artificial Intelligence and Risk Assessment: Precision Pricing

Artificial Intelligence (AI) is enhancing risk assessment and pricing accuracy in property insurance. AI algorithms analyze vast datasets to identify patterns and predict risks more precisely. This technology enables insurers to offer tailored premiums based on individual risk profiles, ensuring fair and accurate pricing.

Sustainability and Green Initiatives: A Focus on Environmental Impact

The property insurance industry is increasingly recognizing the importance of sustainability. Insurers are offering incentives for eco-friendly practices, such as solar panel installations or energy-efficient upgrades. By promoting sustainability, insurers not only reduce environmental impact but also provide policyholders with financial benefits.

Conclusion: Empowering Your Property Insurance Journey

Understanding the average cost of property insurance is just the beginning. By exploring the factors influencing premiums and staying informed about industry trends, you can make confident decisions about your coverage. Remember, property insurance is a vital investment in your financial security, and by tailoring your policy to your unique needs, you can ensure comprehensive protection without breaking the bank.

How often should I review my property insurance policy?

+It’s recommended to review your policy annually to ensure it aligns with your changing needs and circumstances. Life events such as home renovations, marriage, or adding valuable possessions may require adjustments to your coverage.

Can I negotiate my property insurance premium?

+While insurance premiums are based on calculated risk assessments, you can negotiate with your insurer by providing additional information or evidence that reduces your risk profile. For example, installing security systems or implementing fire safety measures may lead to premium reductions.

What factors can I control to reduce my insurance costs?

+You can take proactive measures to reduce your insurance costs. Maintaining a clean claim history, improving your credit score, and implementing safety features in your home are effective strategies. Additionally, regularly reviewing and comparing quotes can help you identify the most cost-effective options.