Average Yearly Auto Insurance Cost

Auto insurance is an essential financial safeguard for vehicle owners, protecting them from the potential financial burdens arising from accidents, theft, and other unforeseen events. The cost of this protection varies significantly, influenced by a multitude of factors, including the driver's age, driving record, location, and the type of vehicle insured. This article delves into the average yearly auto insurance cost, shedding light on the factors that impact it and offering strategies to navigate this essential expense effectively.

Understanding Average Yearly Auto Insurance Costs

The average yearly auto insurance cost in the United States is a complex and dynamic figure that varies widely depending on numerous factors. While it’s challenging to pinpoint an exact average, we can explore the key elements that contribute to this cost and provide a range based on comprehensive research and industry data.

According to the Insurance Information Institute, the average annual cost of car insurance in the U.S. is approximately $1,674 as of 2022. However, this figure is just a starting point, as insurance rates can range significantly, from a few hundred dollars to several thousand, based on individual circumstances.

Factors Influencing Auto Insurance Costs

- Driver’s Age and Experience: Younger drivers, particularly those under 25, often face higher insurance premiums due to their relative inexperience and the statistical risk they pose. As drivers age and gain more experience, insurance costs generally decrease.

- Driving Record: A clean driving record with no accidents or violations is a key factor in reducing insurance costs. On the other hand, a history of accidents or traffic violations can significantly increase insurance premiums.

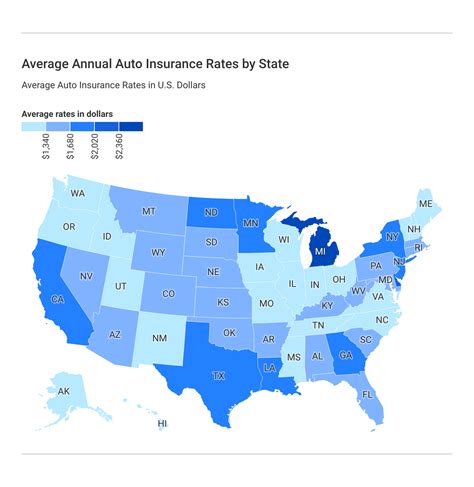

- Location: Insurance rates vary widely by state and even by city. Factors such as traffic density, crime rates, and the prevalence of natural disasters can influence insurance costs. For instance, densely populated urban areas often have higher insurance rates than rural areas.

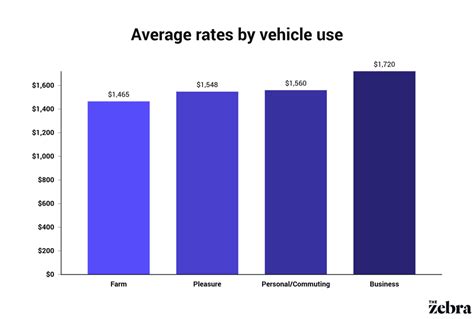

- Vehicle Type and Usage: The type of vehicle you drive and how you use it can impact insurance costs. High-performance cars, luxury vehicles, and SUVs often carry higher insurance premiums due to their repair and replacement costs. Additionally, the primary purpose of your vehicle (e.g., daily commute, business use, or pleasure driving) can affect your insurance rates.

- Coverage and Deductibles: The level of coverage you choose and your deductible amount play a significant role in your insurance costs. Higher coverage limits and lower deductibles generally result in higher premiums, while opting for lower coverage and higher deductibles can reduce your monthly payments.

Average Yearly Auto Insurance Costs by State

Insurance rates can vary significantly from one state to another due to differences in state regulations, traffic conditions, and the prevalence of accidents and claims. Here’s a glimpse at the average yearly auto insurance costs in some of the most populous states in the U.S.:

| State | Average Yearly Cost |

|---|---|

| California | $1,818 |

| Texas | $1,594 |

| New York | $1,426 |

| Florida | $2,214 |

| Illinois | $1,230 |

| Pennsylvania | $1,394 |

| Ohio | $1,082 |

These figures highlight the wide range of insurance costs across different states, emphasizing the importance of understanding the local insurance landscape.

Strategies to Reduce Auto Insurance Costs

While auto insurance is a necessary expense, there are strategies to mitigate its financial burden. Here are some effective approaches to consider:

- Shop Around and Compare Rates: Insurance companies use different methodologies to calculate premiums, so it’s beneficial to compare quotes from multiple insurers. Online tools and comparison websites can streamline this process, allowing you to find the best rates for your specific circumstances.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. Bundling can lead to significant savings, so it’s worth exploring this option.

- Safe Driving Practices: Maintaining a clean driving record is essential for keeping insurance costs down. Safe driving practices, such as avoiding accidents and traffic violations, can lead to lower premiums over time.

- Review Coverage Regularly: Insurance needs can change over time, so it’s important to periodically review your coverage to ensure you’re not overinsured or underinsured. Regularly reassessing your coverage can help you optimize your insurance expenses.

- Explore Discounts: Insurance companies offer a variety of discounts, including safe driver discounts, good student discounts, and discounts for completing defensive driving courses. Understanding the discounts available and meeting the criteria can lead to substantial savings.

The Future of Auto Insurance Costs

The auto insurance landscape is evolving rapidly, influenced by technological advancements, changing driving behaviors, and shifting regulatory environments. Here are some key trends and predictions that could impact average yearly auto insurance costs in the future:

Technological Innovations

The integration of technology into vehicles and the insurance industry is set to have a profound impact on insurance costs. Telematics devices, which monitor driving behavior and transmit data to insurance companies, are already being used to offer usage-based insurance. This allows insurers to offer personalized premiums based on actual driving habits, potentially benefiting safe drivers.

Additionally, the rise of autonomous vehicles could revolutionize auto insurance. While fully autonomous cars are still in development, their eventual widespread adoption could lead to a significant reduction in accidents, potentially lowering insurance costs for all drivers. However, the transition period as autonomous vehicles share the road with traditional cars could create a complex and uncertain insurance landscape.

Changing Driving Behaviors

The COVID-19 pandemic has accelerated trends in remote work and reduced commuting, leading to a significant drop in vehicle miles traveled. This shift in driving behavior could lead to lower accident rates and, consequently, lower insurance costs. However, the long-term impact of these changes is yet to be fully understood.

Regulatory Changes

State regulations play a critical role in determining insurance rates. Changes in state laws, such as modifications to minimum liability requirements or the introduction of no-fault insurance systems, can significantly impact insurance costs. Keeping abreast of these regulatory changes is essential for understanding future insurance trends.

Industry Competition

The insurance industry is highly competitive, with traditional insurers vying with digital-first disruptors. This competition can drive down prices and lead to more innovative insurance products. However, it can also lead to consolidation, which may impact the availability and cost of insurance in certain regions.

Economic Factors

Economic conditions, such as inflation and recession, can have a significant impact on insurance costs. During periods of economic downturn, insurance companies may face increased claims and reduced investment returns, leading to higher premiums. Conversely, a strong economy can lead to increased competition and more affordable insurance rates.

Conclusion

Understanding the average yearly auto insurance cost is essential for making informed decisions about your vehicle ownership. While the average cost provides a benchmark, your personal circumstances and the specific factors outlined above will ultimately determine your insurance expenses. By staying informed, comparing rates, and adopting safe driving practices, you can navigate the complexities of auto insurance and find the coverage that best suits your needs at a competitive price.

Frequently Asked Questions

How often should I review my auto insurance policy and coverage limits?

+

It’s recommended to review your auto insurance policy annually, or whenever you experience significant life changes such as getting married, buying a new vehicle, or moving to a new location. Regular reviews ensure your coverage remains adequate and up-to-date.

What are some common discounts offered by auto insurance companies, and how can I qualify for them?

+

Common discounts include safe driver discounts, good student discounts, multi-policy discounts (for bundling auto and home insurance), and loyalty discounts for long-term customers. To qualify for these discounts, you may need to maintain a clean driving record, keep a certain grade point average if you’re a student, or have multiple policies with the same insurer.

How do credit scores affect auto insurance rates, and is it legal for insurers to use credit-based insurance scores?

+

Credit scores can impact auto insurance rates because they are seen as an indicator of financial responsibility. Insurers often use credit-based insurance scores to assess the risk of insuring a driver. While it’s legal for insurers to use credit scores in most states, there are a few states that have banned or restricted this practice.

What is the average cost of auto insurance for teenagers, and are there ways to reduce their insurance premiums?

+

Teenagers typically pay the highest insurance premiums due to their lack of driving experience and the higher risk they pose. However, there are ways to reduce these costs, such as maintaining a good academic record (which may qualify for a good student discount), taking a defensive driving course, and bundling their policy with a parent’s policy.

What are some signs that you might be overpaying for auto insurance, and what steps can you take to find a better deal?

+

Signs of overpaying for auto insurance include consistently high premiums despite a clean driving record, not receiving any discounts, or having an insurer that doesn’t offer digital tools for policy management and claims processing. To find a better deal, shop around, compare quotes from multiple insurers, and consider switching providers if you find a more competitive rate.