Most Affordable Car Insurance In Florida

When it comes to finding the most affordable car insurance in Florida, there are several factors to consider. Florida is known for its unique insurance landscape, and understanding the market and your specific needs is crucial to securing the best deal. In this comprehensive guide, we'll delve into the world of car insurance in Florida, providing you with expert insights and strategies to navigate this complex but essential aspect of vehicle ownership.

Understanding the Florida Car Insurance Market

Florida’s car insurance market is distinct from many other states due to its no-fault insurance system and unique regulations. The state’s Personal Injury Protection (PIP) law requires all drivers to carry PIP coverage, which provides compensation for medical expenses and lost wages after an accident, regardless of fault. This system, while offering some benefits, also influences insurance rates and availability.

The cost of car insurance in Florida varies significantly based on several factors. These include your driving history, the type of vehicle you own, the coverage limits you choose, and even your location within the state. Understanding these variables is key to finding the most affordable option.

Key Factors Affecting Insurance Rates in Florida

Florida’s insurance landscape is influenced by a variety of factors, including:

- Driving History: Your driving record plays a significant role in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher costs.

- Vehicle Type: The make, model, and year of your vehicle can impact your insurance rates. Sports cars and luxury vehicles, for instance, often have higher insurance costs due to their higher repair costs and increased likelihood of theft.

- Coverage Limits: The level of coverage you choose directly affects your premium. Higher coverage limits generally result in higher costs, while lower limits may reduce your premium but leave you more exposed to financial risk.

- Location: Insurance rates can vary significantly between different cities and regions in Florida. Factors like the density of traffic, crime rates, and the frequency of natural disasters can influence insurance costs.

By considering these factors and understanding their impact, you can make more informed decisions when choosing car insurance in Florida.

Comparing Insurance Providers in Florida

Florida is home to numerous insurance providers, each offering unique policies and rates. To find the most affordable option, it’s essential to compare quotes from multiple insurers. Here’s a comparative analysis of some of the leading insurance providers in Florida:

State Farm

State Farm is one of the largest insurance providers in Florida and offers a range of car insurance policies. They are known for their comprehensive coverage options and competitive rates. State Farm’s policies typically include:

- Liability Coverage: Covers bodily injury and property damage to others in an accident you cause.

- Collision Coverage: Pays for repairs or replacement of your vehicle if it’s damaged in an accident.

- Comprehensive Coverage: Covers damage to your vehicle from non-accident events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Required in Florida, this coverage pays for medical expenses and lost wages after an accident, regardless of fault.

State Farm also offers additional coverages like rental car reimbursement and roadside assistance, providing a comprehensive insurance solution for Florida drivers.

Geico

Geico is another major player in the Florida car insurance market, known for its competitive rates and digital-first approach. Geico’s policies include:

- Bodily Injury Liability: Covers medical expenses and lost wages for others injured in an accident you cause.

- Property Damage Liability: Pays for damage to others’ property in an accident you cause.

- Collision Coverage: Covers repairs or replacement of your vehicle if it’s damaged in an accident.

- Comprehensive Coverage: Provides protection against non-accident related damages like theft, vandalism, or natural disasters.

Geico also offers optional coverages like Emergency Roadside Service, Rental Car Reimbursement, and Mechanical Breakdown Insurance, providing a customizable insurance experience for Florida drivers.

Progressive

Progressive is a leading insurance provider in Florida, offering a wide range of car insurance policies and innovative features. Their policies typically include:

- Liability Coverage: Covers bodily injury and property damage to others in an accident you cause.

- Collision Coverage: Pays for repairs or replacement of your vehicle if it’s damaged in an accident.

- Comprehensive Coverage: Covers damage to your vehicle from non-accident events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Required in Florida, this coverage pays for medical expenses and lost wages after an accident, regardless of fault.

Progressive also offers unique features like the Name Your Price® tool, which allows you to set your desired premium and find a policy that matches your budget. They also provide a Snapshot® program, which uses telematics to monitor your driving habits and offer discounts based on safe driving practices.

Strategies for Finding Affordable Car Insurance in Florida

To secure the most affordable car insurance in Florida, consider the following strategies:

Shop Around

Comparing quotes from multiple insurance providers is crucial. Each insurer has its own rating system and factors that influence premiums, so shopping around can reveal significant differences in rates. Online comparison tools can make this process easier and more efficient.

Understand Your Coverage Needs

Assess your coverage needs carefully. While it’s important to have adequate coverage, unnecessary add-ons can drive up your premium. Review your policy regularly and adjust your coverage as your needs change.

Take Advantage of Discounts

Many insurance providers offer discounts for various reasons. These may include discounts for safe driving, bundling multiple policies (e.g., car and home insurance), loyalty discounts, or even discounts for certain professions or memberships. Ask your insurer about the discounts they offer and see if you qualify.

Consider Higher Deductibles

Increasing your deductible (the amount you pay out of pocket before your insurance kicks in) can lower your premium. However, this strategy requires careful consideration, as a higher deductible means you’ll pay more out of pocket if you need to make a claim.

Maintain a Clean Driving Record

A clean driving record is one of the best ways to keep your insurance costs down. Avoid accidents and traffic violations, as these can significantly increase your premiums. If you’ve had a clean record for several years, you may be eligible for a safe driver discount.

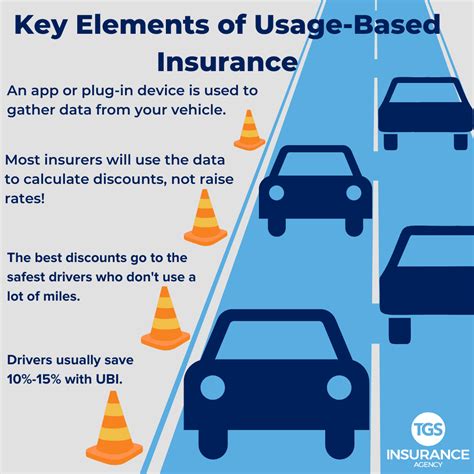

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses a device to track your driving habits. This data is then used to determine your premium. If you’re a safe and cautious driver, you may be able to save money with this type of insurance.

Performance Analysis and Real-World Examples

To illustrate the impact of these strategies, let’s consider a real-world example. John, a 35-year-old living in Miami, Florida, recently shopped for car insurance. He started by comparing quotes from three major insurance providers: State Farm, Geico, and Progressive.

| Insurance Provider | Annual Premium |

|---|---|

| State Farm | $1,200 |

| Geico | $1,150 |

| Progressive | $1,300 |

After comparing these quotes, John decided to explore additional strategies to further reduce his premium. He discovered that by increasing his deductible from $500 to $1,000, he could save an additional $100 per year with State Farm. Additionally, he qualified for a safe driver discount with Geico, which reduced his premium by $150 per year.

By combining these strategies, John was able to secure a significant reduction in his car insurance premium. This real-world example demonstrates the importance of shopping around, understanding your coverage needs, and taking advantage of available discounts to find the most affordable car insurance in Florida.

Future Implications and Industry Insights

The car insurance landscape in Florida is constantly evolving, and staying informed about industry trends and developments is crucial for making informed decisions. Here are some key future implications and industry insights to consider:

Technological Advancements

The insurance industry is embracing technological advancements, and this trend is likely to continue. Usage-based insurance, as mentioned earlier, is becoming increasingly popular. Additionally, advancements in artificial intelligence and machine learning are expected to enhance risk assessment and claim processing, potentially leading to more accurate pricing and faster claim resolutions.

Regulatory Changes

Florida’s insurance regulations are subject to change, and staying updated on any legislative or regulatory developments is essential. For instance, changes to the Personal Injury Protection (PIP) law or other mandatory coverage requirements could impact insurance rates and coverage options.

Market Competition

The car insurance market in Florida is highly competitive, and insurers are continually striving to offer the best value to customers. This competition can drive down prices and lead to innovative new products and services. Staying informed about new insurance providers entering the market and their unique offerings can be beneficial.

Consumer Education

As consumers become more knowledgeable about car insurance, they are better equipped to make informed choices. This shift in consumer behavior can influence the insurance market, potentially leading to more transparent pricing and improved customer service.

Frequently Asked Questions (FAQ)

How does Florida’s no-fault insurance system work, and how does it impact car insurance rates?

+

Florida’s no-fault insurance system requires all drivers to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses and lost wages after an accident, regardless of fault. While this system provides benefits like quicker access to medical care, it also influences insurance rates. Insurers factor in the cost of providing PIP coverage when setting premiums, which can lead to higher rates.

What are some common discounts offered by car insurance providers in Florida?

+

Common discounts offered by car insurance providers in Florida include safe driver discounts, multi-policy discounts (for bundling car insurance with other policies like home insurance), loyalty discounts, and discounts for certain professions or memberships. Some insurers also offer usage-based insurance discounts, where your premium is based on your actual driving behavior.

How can I get the most accurate car insurance quotes in Florida?

+

To get the most accurate car insurance quotes in Florida, provide as much detailed information as possible when requesting quotes. This includes your driving history, the make and model of your vehicle, the coverage limits you’re interested in, and any additional coverages you may want. Being thorough in your quote request will help insurers provide more accurate estimates.