House Insurance Deals

In the vast landscape of insurance coverage, finding the right home insurance policy is akin to navigating a complex maze. The options can be overwhelming, with numerous factors influencing the overall cost and level of protection provided. This guide aims to shed light on the essential aspects of home insurance, empowering you to make informed decisions and secure the best deals available.

Understanding the Basics of Home Insurance

Home insurance, often referred to as property insurance, is a contract that offers financial protection for your home and its contents. It safeguards you from potential losses arising from various events, including natural disasters, theft, and accidental damage. The coverage typically extends to the structure of your home, personal belongings, and even temporary living expenses should your residence become uninhabitable due to an insured event.

The primary goal of home insurance is to provide peace of mind and financial stability in the face of unforeseen circumstances. It acts as a safety net, ensuring that you can rebuild and replace essential items without incurring significant financial hardship.

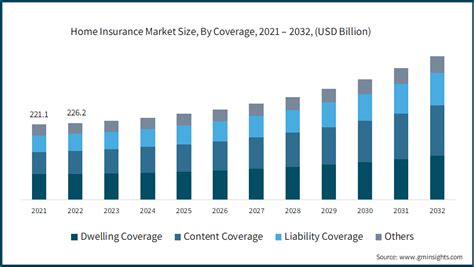

Key Components of a Home Insurance Policy

- Dwelling Coverage: This aspect of the policy covers the physical structure of your home, including the walls, roof, and permanent fixtures. It is typically the most expensive part of the policy, as it accounts for the majority of the home’s value.

- Personal Property Coverage: This covers your personal belongings, such as furniture, electronics, and clothing. The extent of coverage varies based on the policy and can be affected by factors like depreciation and specific exclusions.

- Liability Coverage: This protects you from financial losses arising from accidents or injuries that occur on your property. It covers legal fees and any compensation you may be required to pay to the injured party.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to an insured event, this coverage helps cover the costs of temporary housing and additional expenses until you can return to your home.

Factors Influencing Home Insurance Rates

The cost of home insurance can vary significantly, influenced by a multitude of factors. Understanding these factors is crucial in negotiating the best deals and ensuring adequate coverage.

Location and Natural Disasters

The geographical location of your home plays a significant role in determining insurance rates. Areas prone to natural disasters like hurricanes, earthquakes, or floods are typically associated with higher insurance premiums. Insurers consider the historical data of natural disasters in a specific area to assess the risk and set premiums accordingly.

For instance, homes located in hurricane-prone regions along the Atlantic coast or the Gulf of Mexico often face higher insurance costs. Similarly, areas with a high risk of earthquakes, such as California, may require specialized insurance policies with increased coverage and higher premiums.

Home Value and Construction Materials

The value of your home is a primary factor in calculating insurance rates. Higher-value homes generally attract higher premiums. Additionally, the construction materials used in your home can impact insurance costs. Homes built with materials that are resistant to fire, wind, or other natural disasters may qualify for lower rates.

Crime Rates and Security Measures

The crime rate in your neighborhood can affect insurance premiums. Areas with a higher incidence of theft or vandalism may lead to increased insurance costs. However, implementing robust security measures like alarm systems, reinforced doors, or surveillance cameras can mitigate these risks and potentially lower your insurance rates.

Previous Claims History

Your history of insurance claims can significantly impact future premiums. Frequent or large claims may cause insurers to view you as a higher risk, leading to increased rates or even non-renewal of your policy. Maintaining a clean claims history can be beneficial in securing better insurance deals.

Deductibles and Coverage Limits

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, as you’re assuming more financial responsibility. Conversely, a lower deductible provides greater financial protection but at a higher premium cost.

Coverage limits, on the other hand, define the maximum amount your insurer will pay for a covered loss. Opting for higher coverage limits can provide more comprehensive protection but will typically result in higher premiums.

| Factor | Impact on Insurance Rates |

|---|---|

| Location and Natural Disasters | Higher risk areas = higher premiums |

| Home Value and Construction Materials | Higher value homes = higher premiums; Fire/wind-resistant materials = lower premiums |

| Crime Rates and Security Measures | Higher crime rates = higher premiums; Robust security measures = lower premiums |

| Previous Claims History | Frequent/large claims = higher premiums; Clean claims history = better rates |

| Deductibles and Coverage Limits | Higher deductibles/lower coverage limits = lower premiums; Lower deductibles/higher coverage limits = higher premiums |

Securing the Best Home Insurance Deals

Finding the best home insurance deals requires a strategic approach. Here are some tips to help you navigate the process:

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurers. Online comparison tools can be a valuable resource, allowing you to quickly assess various options and find the best combination of coverage and price.

Bundle Your Policies

Consider bundling your home and auto insurance policies with the same insurer. Many insurance companies offer discounts for customers who combine multiple policies, making it a cost-effective option.

Improve Your Home’s Safety

Implementing safety measures in your home can not only protect your property but also reduce your insurance premiums. Invest in a monitored alarm system, install smoke and carbon monoxide detectors, and consider fire-resistant roofing materials. These enhancements can signal to insurers that your home is a lower risk, potentially leading to reduced premiums.

Review and Adjust Coverage Annually

Your insurance needs can change over time. Review your policy annually to ensure that your coverage aligns with your current circumstances. If you’ve made significant improvements to your home or acquired new, valuable possessions, you may need to adjust your coverage limits accordingly.

Consider Higher Deductibles

As mentioned earlier, choosing a higher deductible can lower your insurance premiums. However, it’s essential to select a deductible that you’re comfortable paying out of pocket in the event of a claim. A higher deductible may be more suitable for those with significant savings or an emergency fund.

Explore Discounts and Credits

Insurers often offer various discounts and credits to policyholders. These can include discounts for loyalty, mature homeowners, or for completing a home inventory. Additionally, some insurers provide credits for energy-efficient upgrades or for completing a defensive driving course. Explore these options to maximize your savings.

Navigating the Claims Process

Despite your best efforts to prevent them, accidents and losses can still occur. Knowing how to navigate the claims process is essential to ensure a smooth and efficient resolution.

Reporting a Claim

When a covered loss occurs, promptly report it to your insurance company. Most insurers provide 24⁄7 claims reporting, ensuring that you can initiate the process at any time. Be prepared to provide detailed information about the incident, including any photos or videos that can support your claim.

Understanding Your Coverage

Review your insurance policy to understand the specific terms and conditions of your coverage. This includes knowing your policy limits, deductibles, and any exclusions or limitations. Being well-informed can help you navigate the claims process more effectively and ensure that you receive the full benefits of your policy.

Working with Adjusters

Insurers typically assign a claims adjuster to handle your case. The adjuster’s role is to investigate your claim, assess the damage, and determine the amount of compensation you’re entitled to. Cooperate fully with the adjuster, providing all necessary information and documentation. If you have any concerns or questions, don’t hesitate to ask for clarification.

Resolving Disputes

In some cases, you may disagree with the adjuster’s assessment or the offered settlement. If this occurs, don’t hesitate to voice your concerns. Many insurers have dispute resolution processes in place to address such situations. You can also seek the assistance of an insurance advocate or an attorney to help negotiate a fair settlement.

The Future of Home Insurance

The insurance industry is constantly evolving, and home insurance is no exception. As technology advances, insurers are leveraging data analytics and machine learning to develop more precise risk assessment models. This shift towards data-driven insurance is expected to result in more accurate premiums and coverage options tailored to individual risks.

Additionally, the rise of smart home technology is presenting new opportunities for insurers to offer innovative coverage options. For instance, insurers may offer discounts to policyholders who install smart home devices that can prevent or mitigate losses, such as water leak detection systems or smart thermostats that can reduce the risk of fire.

The future of home insurance also holds the potential for more personalized policies. With the advent of on-demand insurance and usage-based models, policyholders may have the flexibility to customize their coverage based on their specific needs and circumstances. This could mean more control over premiums and coverage limits, allowing for a more tailored and cost-effective insurance experience.

What is the average cost of home insurance in the United States?

+

The average cost of home insurance in the U.S. varies widely depending on location, home value, and coverage limits. According to recent data, the national average premium for home insurance is around 1,300 per year. However, this can range from as low as 700 in some states to over $2,000 in others.

Are there any government programs to assist with home insurance costs for low-income individuals?

+

Yes, some states offer government-backed programs to help low-income individuals and families afford home insurance. These programs often provide discounted rates or even cover the entire cost of insurance for eligible applicants. It’s worth checking with your state’s insurance department to see if such programs are available in your area.

Can I cancel my home insurance policy at any time?

+

Yes, you have the right to cancel your home insurance policy at any time. However, keep in mind that there may be cancellation fees or penalties, especially if you cancel before the policy’s renewal date. It’s important to review your policy documents or contact your insurer to understand the cancellation process and any associated costs.

What is the difference between actual cash value and replacement cost coverage for personal property?

+

Actual cash value (ACV) coverage takes into account depreciation when settling a claim. This means that the insurer will pay the replacement cost of your damaged or stolen items minus any depreciation. On the other hand, replacement cost coverage pays the full cost of replacing your items without deducting for depreciation, providing more comprehensive protection.