Progressive Insurance Claims Number

Welcome to a comprehensive guide on Progressive Insurance's claims process. Progressive Insurance is a renowned name in the insurance industry, known for its innovative approaches and customer-centric services. This article aims to provide an in-depth exploration of Progressive's claims process, shedding light on its efficiency, technology integration, and customer experience.

Understanding Progressive Insurance’s Claims Process

Progressive Insurance has established a streamlined and efficient claims process, designed to offer quick and hassle-free assistance to policyholders. The company’s commitment to technological advancement has played a pivotal role in shaping its claims management system, ensuring a seamless experience for customers.

Reporting a Claim

Policyholders can initiate the claims process by reporting an incident through various channels. Progressive offers a user-friendly mobile app, allowing customers to report claims instantly with just a few taps. Additionally, the company’s website provides an intuitive online form, enabling policyholders to submit claims conveniently from any device.

For those who prefer a more traditional approach, Progressive also offers a dedicated claims hotline, available 24/7. Customers can reach out to experienced claims representatives who guide them through the process, offering personalized support and addressing any concerns.

| Claim Reporting Methods | Description |

|---|---|

| Mobile App | Quick and easy claim submission through the Progressive app. |

| Online Form | Web-based claim submission process accessible on any device. |

| Claims Hotline | 24/7 assistance and support from dedicated claims representatives. |

The Claims Journey: A Step-by-Step Guide

Once a claim is reported, Progressive’s efficient claims management system kicks into action. Here’s a detailed breakdown of the process:

- Claim Assessment: Progressive's claims team promptly reviews the reported incident, evaluating the nature and extent of the claim. This initial assessment helps determine the next steps and ensures a swift response.

- Communication and Updates: Policyholders are kept informed throughout the process. Progressive provides regular updates via email, text messages, or phone calls, keeping customers aware of the claim's progress and any required actions.

- Documentation and Evidence: Progressive may request additional documentation or evidence to support the claim. This could include photographs, videos, or other relevant materials. The company's app and online portal make it convenient for customers to submit such information digitally.

- Assessment of Liability: Progressive's claims team conducts a thorough investigation to determine liability. This involves analyzing the circumstances of the incident, reviewing relevant policies, and considering any applicable laws or regulations.

- Resolution and Settlement: Once liability is established, Progressive works towards a fair and prompt resolution. The company's claims adjusters collaborate with policyholders to reach a mutually agreeable settlement, ensuring a swift and satisfactory outcome.

Progressive’s Technological Edge: Enhancing the Claims Experience

Progressive Insurance has leveraged technology to revolutionize its claims process, offering policyholders a modern and efficient experience. The company’s innovative use of digital tools and platforms has simplified complex procedures, making insurance claims more accessible and less daunting.

Mobile App Integration

Progressive’s mobile app serves as a powerful tool for policyholders, offering a range of features that streamline the claims process. With the app, customers can:

- Report claims instantly, providing details and uploading necessary documents.

- Track the progress of their claim, receiving real-time updates and notifications.

- Access policy information, review coverage details, and manage their insurance profile.

- Connect with claims representatives through in-app messaging or video conferencing, ensuring personalized support.

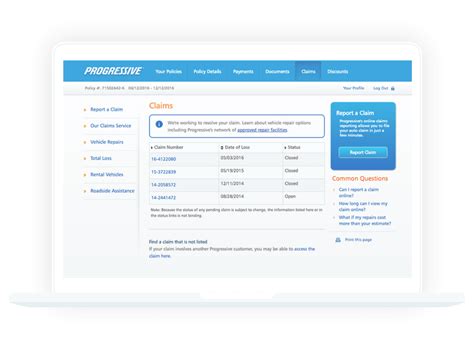

Online Claim Management

For those who prefer a web-based approach, Progressive’s online portal offers a comprehensive suite of tools. Policyholders can:

- Submit claims online, providing detailed information and supporting evidence.

- Receive automated updates and notifications, keeping them informed about the claim's status.

- Review claim history, access previous claim details, and track the progress of ongoing claims.

- Upload additional documents or evidence, ensuring a complete and accurate claim submission.

Advanced Claim Processing Technology

Behind the scenes, Progressive utilizes advanced claim processing technology to optimize its operations. The company’s innovative systems:

- Automate routine tasks, reducing processing time and minimizing errors.

- Integrate artificial intelligence and machine learning to analyze claims data, identify patterns, and enhance decision-making.

- Provide real-time analytics, enabling Progressive to monitor claim trends, identify potential issues, and continuously improve its processes.

- Ensure data security and privacy, protecting policyholder information through robust encryption and access control measures.

Customer Satisfaction and Progressive’s Commitment to Excellence

Progressive Insurance’s dedication to customer satisfaction is evident in its claims process. The company’s focus on efficiency, technology integration, and personalized support has earned it a reputation for excellence in the insurance industry.

Timely Claims Resolution

Progressive prioritizes timely resolution, understanding the urgency and impact of insurance claims on policyholders’ lives. The company’s efficient claims management system, coupled with its experienced claims team, ensures that claims are processed swiftly and fairly.

Personalized Customer Support

Progressive recognizes that every claim is unique and requires a personalized approach. The company’s claims representatives are trained to provide tailored support, addressing individual concerns and offering guidance throughout the process. Whether it’s answering questions, explaining complex procedures, or offering emotional support, Progressive’s team ensures a compassionate and understanding experience.

Customer Feedback and Continuous Improvement

Progressive actively seeks customer feedback to enhance its claims process. The company values input from policyholders, using it to identify areas for improvement and refine its services. By listening to customer experiences, Progressive can make data-driven decisions, ensuring that its claims management system remains customer-centric and responsive to evolving needs.

The Future of Progressive’s Claims Process

As the insurance industry continues to evolve, Progressive Insurance remains at the forefront of innovation. The company’s commitment to technological advancement and customer satisfaction positions it well for the future.

AI and Machine Learning Integration

Progressive is exploring the potential of AI and machine learning to further enhance its claims process. These technologies can automate complex tasks, analyze vast amounts of data, and provide insights that improve decision-making. By leveraging AI, Progressive aims to streamline its operations, reduce processing times, and offer even more personalized experiences to policyholders.

Digital Transformation and Accessibility

Progressive recognizes the importance of digital transformation in making insurance more accessible and convenient. The company continues to invest in its digital platforms, ensuring they remain user-friendly, secure, and accessible to all policyholders. By embracing digital innovation, Progressive aims to break down barriers and provide an inclusive insurance experience.

Collaborative Partnerships and Industry Innovation

Progressive actively engages with industry partners and collaborates on innovative solutions. By working together, Progressive can leverage shared expertise and resources, driving forward-thinking initiatives that benefit the entire insurance ecosystem. This collaborative approach ensures Progressive remains at the cutting edge of insurance technology and customer service.

How can I report a claim with Progressive Insurance?

+Progressive offers multiple channels for reporting claims, including their mobile app, online form, and 24⁄7 claims hotline. You can choose the method that suits you best and receive guidance and support throughout the process.

What documentation is required when filing a claim with Progressive?

+The specific documentation required may vary depending on the nature of your claim. However, generally, Progressive may request photographs, videos, or other relevant evidence to support your claim. It’s best to consult with a claims representative to understand the specific documentation needed for your situation.

How does Progressive’s advanced claim processing technology benefit policyholders?

+Progressive’s advanced claim processing technology automates routine tasks, reducing processing time and minimizing errors. It also integrates AI and machine learning to analyze data, identify patterns, and enhance decision-making. These technologies ensure a more efficient and accurate claims process, benefiting policyholders with faster resolutions and improved customer experiences.