Best And Cheapest Car Insurance

Finding the best and cheapest car insurance is a common goal for many drivers, as it not only ensures financial protection but also helps manage costs effectively. The insurance market is diverse, offering a range of policies tailored to different needs. This comprehensive guide will explore the essential factors to consider when searching for the best and most affordable car insurance, along with real-world examples and insights.

Understanding Your Insurance Needs

The first step in your journey towards the best and cheapest car insurance is to understand your specific needs. Every driver has unique circumstances, and recognizing these factors is crucial for making informed decisions. Consider the following aspects:

- Vehicle Type and Usage: Different vehicles and their usage patterns can impact insurance rates. For instance, a luxury sports car will generally cost more to insure than a standard sedan. Additionally, factors like the frequency of driving and the purpose (commuting, leisure, or business) can influence the type of coverage required.

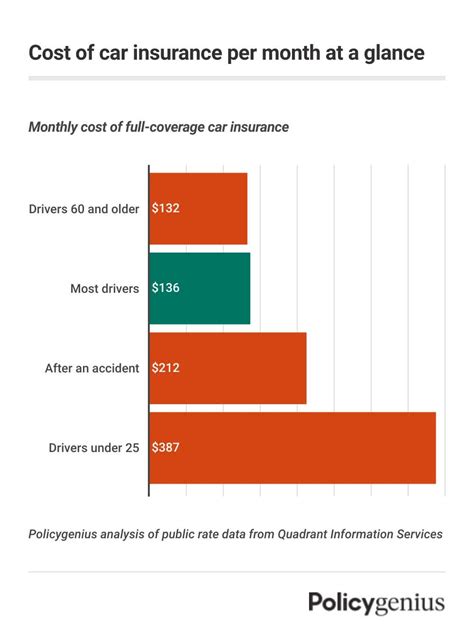

- Driving History: Your driving record is a significant determinant of insurance rates. A clean driving history with no accidents or traffic violations can lead to more favorable insurance rates. On the other hand, a history of accidents or moving violations may result in higher premiums.

- Location: The area where you reside and drive plays a vital role in insurance costs. Urban areas with higher population densities and traffic volumes often carry higher insurance premiums due to increased accident risks. Conversely, rural areas might offer more affordable rates.

- Personal Preferences: Consider your personal preferences and financial situation. Do you prefer comprehensive coverage, including collision and comprehensive insurance, or are you more inclined towards liability-only coverage to keep costs down? Understanding your risk tolerance and financial goals is essential.

Researching and Comparing Insurance Providers

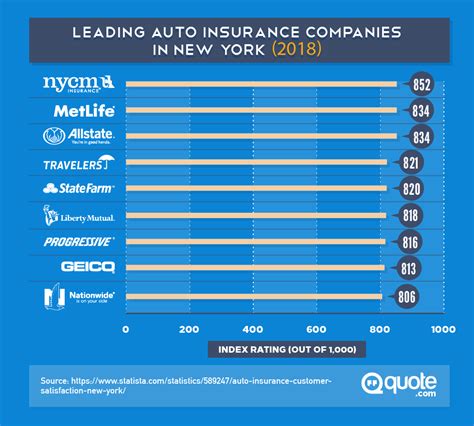

Once you have a clear understanding of your insurance needs, it’s time to explore the market and compare various insurance providers. This step is crucial to ensure you find the best value for your money.

Online Quotes and Comparison Tools

Utilize online platforms and comparison tools to obtain multiple quotes from different insurers. These tools allow you to input your details once and receive quotes from several providers, making the comparison process efficient. Here’s a step-by-step guide:

- Visit reputable online insurance comparison websites or use dedicated apps.

- Enter your personal and vehicle information, including make, model, and year.

- Select the desired coverage types and limits.

- Review the quotes provided, comparing prices and coverage details.

- Take note of any discounts or promotions offered by each insurer.

Some popular online insurance comparison platforms include InsuranceQuotes.com, Compare.com, and TheZebra.com. These platforms offer a user-friendly interface and provide quotes from a wide range of insurers, making it convenient to compare options.

Analyzing Quotes and Coverage Details

When comparing quotes, it’s essential to delve deeper into the coverage details to ensure you’re not only getting the best price but also the right level of protection. Here’s what to look for:

- Coverage Limits: Check the liability limits for bodily injury and property damage. Higher limits provide more protection but may cost more. Ensure the limits align with your needs and comfort level.

- Deductibles: Compare deductibles for collision and comprehensive coverage. A higher deductible can lower your premium, but it means you'll pay more out of pocket in the event of a claim. Choose a deductible that balances affordability and risk.

- Optional Coverages: Review additional coverages like rental car reimbursement, roadside assistance, or gap insurance. These can provide extra peace of mind but may increase your premium. Assess which optional coverages are worth the cost based on your personal circumstances.

- Discounts: Look for potential discounts offered by insurers. Common discounts include multi-policy discounts (bundling car and home insurance), good student discounts, safe driver discounts, and loyalty discounts for long-term customers.

Negotiating and Customizing Your Policy

After comparing quotes and understanding your coverage needs, it’s time to negotiate and customize your policy to achieve the best value. Here are some strategies to consider:

Bundling Policies

Bundling multiple insurance policies, such as car insurance with homeowners or renters insurance, can often lead to significant savings. Insurance companies typically offer multi-policy discounts to encourage customers to purchase more than one type of insurance from them. For instance, if you have both your car and home insurance with the same provider, you may qualify for a discount on both policies.

Adjusting Coverage Levels

Review your coverage levels and consider adjusting them to align with your current needs and budget. For example, if you have an older vehicle with a lower resale value, you might opt for liability-only coverage instead of comprehensive coverage. This can result in substantial savings while still providing adequate protection.

Shopping Around Regularly

Insurance rates can change over time, and shopping around annually or bi-annually can help you stay on top of the best deals. Regularly comparing quotes and reevaluating your coverage needs ensures you’re not overpaying for insurance. It’s also an opportunity to explore new insurers that may offer more competitive rates or additional benefits.

Exploring Telematics Programs

Telematics programs, also known as usage-based insurance, use technology to track your driving behavior and reward safe driving with lower premiums. These programs are particularly beneficial for young drivers or those with a less-than-perfect driving record. By agreeing to have your driving monitored, you may qualify for significant discounts if you maintain a safe driving record.

Real-World Examples of Affordable Insurance

To illustrate the impact of customization and negotiation, let’s look at a few real-world examples of drivers who found affordable car insurance through strategic choices:

Example 1: John’s Story

Situation: John, a 30-year-old driver with a clean driving record, wanted to lower his insurance costs.

Strategy: John decided to increase his deductible from 500 to 1,000, a move that reduced his annual premium by 150. Additionally, he switched to a liability-only policy for his older vehicle, saving him another 200 annually. By shopping around, he found an insurer offering a multi-policy discount, further reducing his premium by 100. These changes resulted in a total annual savings of 450.

Example 2: Sarah’s Experience

Situation: Sarah, a 22-year-old college student, was paying high premiums due to her age and limited driving experience.

Strategy: Sarah enrolled in a telematics program, allowing her insurer to monitor her driving behavior. By maintaining a safe driving record for six months, she qualified for a 20% discount on her premiums. Additionally, she negotiated with her insurer to remove collision coverage for her older car, which had a high deductible and was not financially feasible in the event of an accident. This adjustment saved her $300 annually.

Example 3: The Smith Family’s Approach

Situation: The Smith family, with two vehicles and a home, was seeking a more cost-effective insurance solution.

Strategy: The Smiths bundled their car and home insurance policies with the same insurer, taking advantage of a multi-policy discount. They also adjusted their coverage levels, opting for higher deductibles and eliminating certain optional coverages they deemed unnecessary. These changes resulted in a 15% reduction in their overall insurance costs.

Future Implications and Considerations

As you navigate the car insurance market, it’s essential to stay informed about emerging trends and potential changes that could impact your coverage and costs. Here are some key considerations for the future:

Autonomous Vehicles and Insurance

The rise of autonomous vehicles (AVs) is expected to revolutionize the insurance industry. As AV technology advances, insurance companies will need to adapt their policies to accommodate these new driving experiences. While AVs may reduce the number of accidents caused by human error, they also introduce new risks, such as software failures or cybersecurity threats. Stay updated on how insurers are preparing for this shift to ensure you’re covered appropriately.

Environmental and Climate Factors

Climate change and extreme weather events can impact insurance rates, particularly in areas prone to natural disasters like hurricanes, floods, or wildfires. As these risks become more prevalent, insurers may adjust their policies and premiums accordingly. Be mindful of your location’s vulnerability to such events and consider purchasing additional coverage, such as flood insurance, if necessary.

Advancements in Telematics and Data Analytics

The use of telematics and data analytics is expected to grow, offering insurers more detailed insights into driving behavior. This technology can help identify high-risk drivers and reward safe drivers with more accurate and personalized premiums. As these technologies evolve, insurers may offer even more tailored policies, potentially leading to cost savings for responsible drivers.

Regulatory Changes and Industry Innovations

Stay informed about any regulatory changes or industry innovations that could impact car insurance. For example, the introduction of electric vehicles (EVs) and the development of charging infrastructure may lead to new insurance products and pricing models. Additionally, changes in state regulations regarding insurance requirements or coverage mandates could affect your policy and costs.

Conclusion

Finding the best and cheapest car insurance requires a thoughtful approach that considers your unique needs, the market landscape, and emerging trends. By understanding your insurance requirements, researching and comparing providers, and negotiating customized policies, you can achieve significant savings without compromising on coverage. Stay vigilant about industry developments and periodically reassess your insurance needs to ensure you’re always getting the best value.

What are the key factors that influence car insurance rates?

+

Car insurance rates are influenced by various factors, including the type of vehicle, driving history, location, and personal preferences. Other factors such as age, gender, marital status, and credit score can also impact rates.

How often should I review and update my car insurance policy?

+

It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and up-to-date, and allows you to take advantage of any new discounts or policy adjustments.

Can I switch car insurance providers mid-policy term?

+

Yes, you can switch car insurance providers at any time. However, be aware of any cancellation fees or penalties associated with ending your current policy early. It’s important to carefully compare quotes and understand the terms and conditions of the new policy before making the switch.