Best Auto Insurance In Us

Choosing the best auto insurance provider is a crucial decision for any vehicle owner in the United States. With a vast array of insurance companies offering various coverage options, it can be challenging to determine which one aligns with your specific needs and provides the most comprehensive protection. This comprehensive guide will delve into the world of auto insurance, offering expert insights and valuable information to assist you in making an informed choice.

Understanding Auto Insurance

Auto insurance is a contractual agreement between a policyholder and an insurance company. In exchange for regular premium payments, the insurance provider promises to financially protect the policyholder in the event of an accident, theft, or other covered incidents. This protection can cover a range of expenses, including vehicle repairs, medical bills, and legal fees.

The primary goal of auto insurance is to provide financial security and peace of mind. It ensures that, should an unfortunate event occur, the policyholder is not left with a substantial financial burden. Different states have varying laws and regulations regarding mandatory insurance coverage, which we will explore further in this article.

Factors Influencing Auto Insurance Rates

The cost of auto insurance, often referred to as the premium, is influenced by several key factors. Understanding these factors is essential to evaluate the best insurance options available.

Driver Profile

Insurance companies assess a driver’s profile to determine the level of risk they pose. Factors such as age, gender, driving history, and credit score are considered. For instance, young drivers and those with a history of accidents or traffic violations may be classified as higher-risk, leading to higher insurance premiums.

Vehicle Details

The make, model, and year of your vehicle play a significant role in determining insurance rates. Some vehicles, especially those known for high-performance or luxury features, may be more expensive to insure. Additionally, the safety features and anti-theft systems installed in your car can impact your insurance costs.

Coverage Type and Limits

The type and amount of coverage you choose directly affect your premium. Common coverage types include liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. Each type offers specific benefits, and the limits you select (the maximum amount the insurer will pay for a covered claim) can significantly impact your premium.

Location and Usage

Where you live and how you use your vehicle also influence insurance rates. Areas with a higher incidence of accidents, theft, or natural disasters may have higher premiums. Similarly, if you use your vehicle for business purposes or frequently drive long distances, your insurance costs may increase.

Discounts and Bundling

Insurance companies often offer discounts to attract and retain customers. These discounts can be for various reasons, such as safe driving records, loyalty, multi-policy bundling (combining auto insurance with other policies like homeowners or renters insurance), or even for having certain safety features in your vehicle.

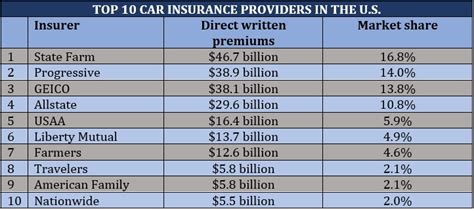

Top Auto Insurance Companies in the US

Now that we’ve explored the factors influencing auto insurance rates, let’s delve into some of the top auto insurance providers in the United States, along with their unique offerings and key advantages.

State Farm

About State Farm: State Farm is one of the largest insurance providers in the US, known for its extensive network of local agents. With a focus on personalized service, State Farm offers a range of insurance products, including auto, home, life, and health insurance.

Key Features:

- Comprehensive coverage options with flexible policies

- Excellent customer service with a dedicated agent system

- Discounts for safe driving, multiple policies, and accident-free records

- State Farm Bank provides financial services, including auto loans

Geico

About Geico: Geico, or Government Employees Insurance Company, is a well-known insurer that caters to a wide range of customers, including government employees and military personnel. Geico offers a digital-first approach to insurance, with a strong online presence and mobile app.

Key Features:

- Competitive rates and a wide range of coverage options

- User-friendly digital platform for managing policies and claims

- Discounts for safe driving, military affiliation, and bundling policies

- Emergency roadside assistance and rental car reimbursement

Progressive

About Progressive: Progressive is an innovative insurance provider known for its focus on technology and customer convenience. They offer a range of insurance products and are particularly popular for their auto insurance options.

Key Features:

- Customizable coverage options with a wide range of add-ons

- Snapshot program offers discounts based on driving behavior

- Online quote comparison tool for transparent pricing

- Discounts for safe driving, multiple policies, and loyalty

Allstate

About Allstate: Allstate is a leading insurance provider with a focus on providing comprehensive coverage and personalized service. They offer a wide range of insurance products, including auto, home, life, and business insurance.

Key Features:

- Flexible coverage options with a range of add-ons

- Accident forgiveness and safe driving bonuses

- Roadside assistance and rental car coverage

- Discounts for safe driving, loyalty, and bundling policies

USAA

About USAA: USAA is a highly regarded insurance provider that exclusively serves active military personnel, veterans, and their families. They offer a comprehensive range of insurance products tailored to the unique needs of military families.

Key Features:

- Competitive rates and comprehensive coverage

- Discounts for military affiliation and safe driving

- Strong focus on customer service and military support

- Online and mobile tools for easy policy management

Comparing Coverage and Pricing

When comparing auto insurance providers, it's essential to look beyond just the price. While cost is a significant factor, you should also consider the coverage provided, customer service, and the overall reputation of the insurance company.

Each insurance company offers different coverage options and may specialize in certain areas. For instance, some companies may offer more extensive rental car coverage or have a better claims process for specific types of incidents. It's crucial to understand your specific needs and prioritize the coverage that aligns with those needs.

Additionally, customer service and claims handling are vital aspects to consider. Look for insurance providers with a strong reputation for prompt and fair claims processing and excellent customer support. Online reviews and ratings can provide valuable insights into a company's customer service quality.

Additional Tips for Choosing Auto Insurance

Here are some additional tips to keep in mind when selecting an auto insurance provider:

- Compare quotes from multiple insurers to find the best value for your needs.

- Understand the state-specific insurance requirements to ensure you meet the minimum coverage standards.

- Consider bundling your auto insurance with other policies (like homeowners or renters insurance) to potentially save on premiums.

- Review your insurance needs regularly, especially if your circumstances change (e.g., marriage, purchasing a new vehicle, or moving to a new state).

- Explore discounts and ask your insurer about any applicable savings.

Conclusion

Choosing the best auto insurance provider is a critical decision that requires careful consideration of various factors. From understanding your specific needs to comparing coverage options and pricing, this guide has provided you with the tools to make an informed choice. Remember, the best auto insurance provider for you will offer a combination of comprehensive coverage, competitive pricing, and excellent customer service.

How do I know if I have adequate auto insurance coverage?

+To ensure you have adequate coverage, review your policy and consider your specific needs. Factors like the value of your vehicle, the likelihood of accidents or theft in your area, and your personal financial situation should all be taken into account. It’s generally recommended to have at least the minimum liability coverage required by your state, but additional coverage like collision and comprehensive can provide extra protection.

Can I switch auto insurance providers mid-policy term?

+Yes, you can typically switch auto insurance providers at any time. However, it’s important to understand the cancellation policies and any potential fees associated with canceling your current policy early. Additionally, ensure that your new policy is active before canceling the old one to avoid any lapses in coverage.

What factors influence the cost of auto insurance?

+The cost of auto insurance, or your premium, is influenced by various factors, including your age, driving record, the make and model of your vehicle, your location, and the type and amount of coverage you choose. Additionally, factors like credit score and the number of miles you drive annually can also impact your premium.