Cheapest Auto And Home Insurance

When it comes to finding the cheapest auto and home insurance options, many factors come into play. The cost of insurance policies can vary significantly depending on individual circumstances and the specific coverage needs of each person. In this comprehensive guide, we will delve into the world of auto and home insurance, exploring the factors that influence premiums, providing valuable tips to secure the most affordable coverage, and offering insights into the best practices for making informed decisions.

Understanding the Cost of Auto and Home Insurance

Auto and home insurance are essential protections for vehicle owners and homeowners alike. While the desire for affordable coverage is universal, the cost of these policies can vary based on a multitude of factors. By understanding these factors, individuals can make informed choices and potentially secure more cost-effective insurance plans.

Factors Influencing Auto Insurance Premiums

The price of auto insurance is influenced by a range of variables, including the following:

- Vehicle Type and Age: Insuring a luxury car or a sports vehicle will typically cost more than insuring a standard sedan or compact car. Additionally, newer vehicles often have higher insurance premiums due to their higher replacement costs.

- Driver’s Profile: Insurance providers assess the risk associated with each driver. Factors such as age, gender, driving history, and even marital status can impact premiums. Younger drivers, for instance, are often considered higher-risk and may face higher insurance costs.

- Location: The geographical location where the vehicle is primarily driven plays a significant role. Areas with higher crime rates or a history of frequent accidents may result in higher insurance premiums.

- Coverage Type and Limits: The type and extent of coverage chosen will directly affect the cost. Comprehensive and collision coverage, for example, provide broader protection but come at a higher price.

- Discounts and Bundling: Many insurance companies offer discounts for various reasons, such as safe driving records, multiple vehicles insured with the same provider, or bundling auto and home insurance policies together.

Factors Impacting Home Insurance Premiums

Similar to auto insurance, home insurance premiums are influenced by a combination of factors, including:

- Location and Property Type: The geographical location of the home and its construction type (e.g., single-family home, condominium, or apartment) can significantly impact insurance costs. Areas prone to natural disasters or with higher crime rates may result in higher premiums.

- Value of the Property: The replacement cost of the home and its contents is a crucial factor in determining insurance premiums. Higher-value properties typically require more extensive coverage and, consequently, higher premiums.

- Coverage Options and Deductibles: The level of coverage chosen, such as comprehensive or liability-only, will affect the overall cost. Additionally, selecting higher deductibles can lead to lower premiums, as the policyholder assumes more financial responsibility in the event of a claim.

- Discounts and Bundling: Bundling home and auto insurance policies with the same provider is a common way to save money. Many insurance companies offer discounts for this practice, as well as for other factors like installing security systems or being a loyal customer.

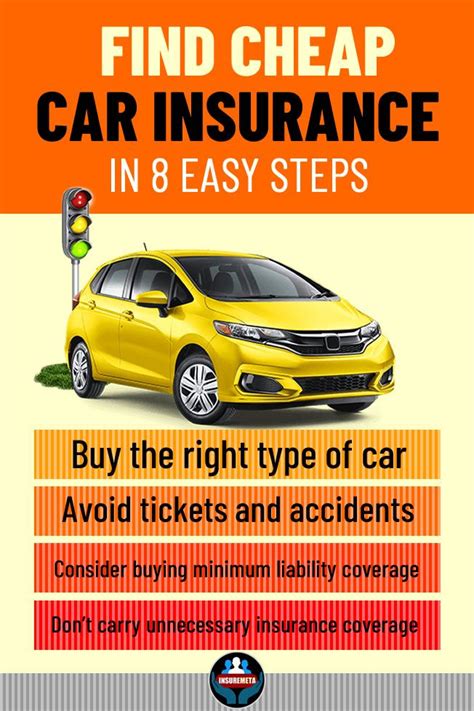

Tips for Securing the Cheapest Auto and Home Insurance

Now that we understand the factors influencing insurance premiums, let’s explore some practical tips to help you secure the cheapest auto and home insurance options:

Research and Compare Providers

The insurance market is highly competitive, and providers offer a wide range of coverage options and pricing structures. Take the time to research and compare multiple insurance companies. Online comparison tools and websites can be invaluable resources for gathering quotes and assessing the best deals available.

Understand Your Coverage Needs

Before seeking insurance quotes, take a moment to assess your specific coverage needs. Consider the type of coverage you require (e.g., liability-only, comprehensive, or collision for auto insurance) and the level of protection you desire for your home. By clearly defining your needs, you can ensure that you’re not overpaying for unnecessary coverage.

Shop Around for Discounts

Insurance companies often offer a variety of discounts to attract and retain customers. These discounts can significantly reduce your overall premiums. Common discounts include:

- Safe Driver Discounts: Reward drivers with clean driving records and no recent accidents or violations.

- Multi-Policy Discounts: Offered when you bundle your auto and home insurance policies with the same provider.

- Loyalty Discounts: Available for long-term customers who have maintained their policies without gaps or claims.

- Safety Feature Discounts: Recognize the use of safety features in your vehicle or home, such as anti-theft devices or security systems.

- Educational Discounts: Provided to individuals with certain educational backgrounds or professional affiliations.

Maintain a Good Credit Score

In many regions, insurance providers consider credit scores when calculating premiums. Maintaining a good credit score can potentially lead to lower insurance costs. By managing your credit responsibly and keeping a strong credit history, you may be able to access more favorable insurance rates.

Choose Higher Deductibles

Opting for higher deductibles can result in lower insurance premiums. This strategy is particularly effective for individuals with a strong financial foundation who are willing to assume more financial responsibility in the event of a claim. However, it’s essential to choose a deductible amount that you can comfortably afford.

Review and Adjust Your Coverage Regularly

Insurance needs can change over time. Regularly reviewing your coverage and making necessary adjustments can help ensure that you’re not overpaying for outdated or unnecessary coverage. As your circumstances evolve, whether through life changes or improvements to your home or vehicle, it’s crucial to reassess your insurance needs.

The Importance of Comprehensive Coverage

While securing the cheapest insurance is a common goal, it’s essential to strike a balance between affordability and adequate coverage. Opting for the lowest-cost option without considering your specific needs can leave you vulnerable in the event of an accident or disaster.

Comprehensive coverage provides a higher level of protection, ensuring that you're financially safeguarded against a wide range of potential risks. While it may come at a higher cost, comprehensive coverage can provide peace of mind and protect your assets in the long run.

Real-Life Example: The Benefits of Comprehensive Coverage

Imagine a scenario where a homeowner with a standard liability-only home insurance policy experiences a severe storm that damages their roof and causes water damage to their property. In this case, the homeowner may find that their policy does not provide sufficient coverage to repair the extensive damage.

On the other hand, a homeowner with comprehensive coverage would likely have their repairs covered, including the cost of fixing the roof and addressing water damage. This example highlights the importance of choosing a policy that aligns with your specific needs and provides adequate protection.

Conclusion: Balancing Cost and Coverage

Finding the cheapest auto and home insurance is a balancing act that requires careful consideration of your individual circumstances and coverage needs. While affordability is a critical factor, it’s equally important to ensure that your policies provide adequate protection for your assets and financial well-being.

By understanding the factors that influence insurance premiums, researching providers, and exploring available discounts, you can make informed decisions and secure insurance coverage that offers both value and peace of mind. Remember, the cheapest option may not always be the best option, and comprehensive coverage can provide the security you need in unexpected situations.

Frequently Asked Questions

How often should I review and adjust my insurance coverage?

+

It is recommended to review your insurance coverage annually or whenever significant life changes occur. This ensures that your policies remain up-to-date and aligned with your needs.

Can I switch insurance providers to save money?

+

Absolutely! Shopping around for insurance quotes and switching providers can often lead to significant savings. It’s important to compare multiple options and choose a provider that offers the best value for your specific needs.

Are there any online tools or resources to help me find the cheapest insurance options?

+

Yes, there are numerous online comparison websites and tools available that allow you to input your details and receive multiple insurance quotes from different providers. These resources can be invaluable in finding the most affordable options.

What should I consider when choosing between liability-only and comprehensive coverage for my auto insurance?

+

When deciding between liability-only and comprehensive coverage, consider your financial situation, the value of your vehicle, and your risk tolerance. Liability-only coverage is more affordable but provides limited protection, while comprehensive coverage offers broader protection but at a higher cost.

Can I negotiate insurance premiums with providers?

+

While insurance premiums are largely determined by standardized formulas, you can still negotiate with providers to some extent. Highlighting your good driving record, loyalty to the company, or any unique circumstances that might justify a lower rate can sometimes result in a more favorable outcome.