Best California Car Insurance

California is known for its sunny weather, diverse landscapes, and, of course, its bustling roads. With a population of over 39 million people and a vast network of highways and urban streets, finding the best car insurance can be a daunting task for residents. Car insurance is not only a legal requirement but also a financial safeguard for unexpected accidents and mishaps. In this comprehensive guide, we will delve into the world of California car insurance, exploring the factors that influence rates, the coverage options available, and most importantly, how to secure the best insurance policy tailored to your needs.

Understanding California Car Insurance

California has unique laws and regulations when it comes to car insurance, making it essential for residents to understand their coverage options. The state requires all drivers to carry a minimum level of liability insurance, which covers damages caused to others in an accident. This includes bodily injury liability and property damage liability. However, many drivers opt for additional coverage to protect themselves and their vehicles.

Required Coverage in California

California’s minimum liability coverage requirements are as follows:

- Bodily Injury Liability: 15,000 per person and 30,000 per accident.

- Property Damage Liability: $5,000 per accident.

While these minimums meet the legal requirements, they might not provide sufficient protection in the event of a serious accident. It is advisable to consider higher liability limits to ensure financial security.

Optional Coverage Options

In addition to liability coverage, California drivers have the option to choose from various additional coverages:

- Collision Coverage: Pays for damages to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Covers damages caused by non-collision events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if involved in an accident with a driver who has no or insufficient insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers after an accident, regardless of fault.

- Personal Injury Protection (PIP): Similar to medical payments coverage but includes broader coverage for medical and other related expenses.

Factors Influencing Car Insurance Rates in California

Car insurance rates in California can vary significantly based on numerous factors. Understanding these factors can help you make informed decisions when choosing an insurance provider and policy.

Driver’s Profile

Your driving history, age, gender, and marital status can impact your insurance rates. Young drivers, especially those under 25, often face higher premiums due to their perceived higher risk. Additionally, drivers with a history of accidents or traffic violations may be considered high-risk and pay higher rates.

Vehicle Details

The make, model, and year of your vehicle play a crucial role in determining insurance rates. Certain vehicles may have higher repair costs or be more prone to theft, which can influence your premium. Additionally, the usage of your vehicle, such as for personal or business purposes, can also impact your rates.

Location and Mileage

Where you live and drive can significantly affect your insurance rates. Urban areas with higher populations and traffic congestion often result in higher premiums. Furthermore, the number of miles you drive annually is also considered, as it directly relates to your risk of being involved in an accident.

Credit Score

In California, insurance companies are allowed to use your credit score as a factor when determining your insurance rates. A higher credit score can lead to lower premiums, as it is often associated with lower risk.

Finding the Best California Car Insurance

With so many insurance providers and coverage options available, finding the best car insurance in California can be a challenging task. Here are some steps to help you make an informed decision:

Research and Compare

Start by researching and comparing different insurance providers in California. Look for reputable companies with a strong financial standing and positive customer reviews. Compare their coverage options, policy features, and add-ons to ensure you find the best fit for your needs.

Understand Your Coverage Needs

Assess your specific coverage needs based on your driving habits, vehicle, and financial situation. Consider the minimum liability requirements, but also evaluate the benefits of additional coverages like collision and comprehensive insurance. Remember, the best policy is one that provides adequate protection without breaking the bank.

Get Multiple Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. Many insurance companies offer online quote tools, making it convenient to get an estimate quickly. Ensure you provide accurate and detailed information to get an accurate quote.

Review Policy Details

When comparing quotes, pay close attention to the policy details. Look beyond the premium and consider factors like deductibles, coverage limits, and any exclusions or limitations. Understanding these details will help you make an informed decision and avoid surprises later on.

Consider Bundling and Discounts

Many insurance providers offer discounts for bundling multiple policies, such as car insurance with home or renters insurance. Additionally, you may be eligible for discounts based on your driving history, vehicle safety features, or membership in certain organizations. Don’t hesitate to ask about available discounts when obtaining quotes.

Read Reviews and Seek Recommendations

Before finalizing your choice, read reviews from current and past customers of the insurance providers you are considering. Online review platforms and social media can provide valuable insights into the customer service and claim handling processes of different companies. Additionally, seek recommendations from friends, family, or trusted advisors who have had positive experiences with specific insurance providers.

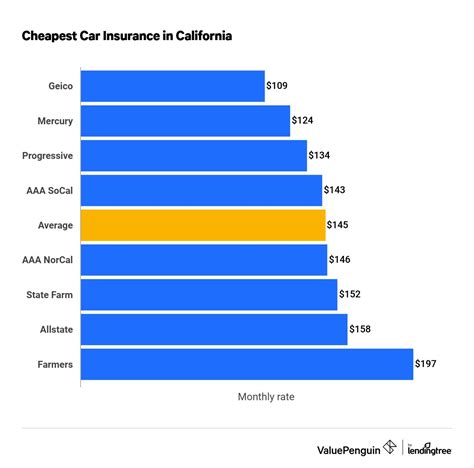

Top California Car Insurance Providers

To help you get started on your search for the best car insurance in California, here is a list of reputable insurance providers known for their competitive rates and comprehensive coverage options:

State Farm

State Farm is a well-established insurance provider with a strong presence in California. They offer a wide range of coverage options, including liability, collision, comprehensive, and additional add-ons like rental car coverage and roadside assistance. State Farm is known for its personalized approach and excellent customer service.

Geico

Geico, or Government Employees Insurance Company, is a popular choice for car insurance in California. They provide a user-friendly online platform for quotes and policy management, making it convenient for customers. Geico offers a variety of coverage options and is known for its competitive rates and discounts for safe driving and bundling.

Progressive

Progressive is another leading insurance provider that offers a wide range of coverage options and innovative features. They provide customized policies and allow customers to choose their coverage limits and deductibles. Progressive is known for its Name Your Price tool, which lets customers set their desired premium and see the corresponding coverage options.

Allstate

Allstate is a trusted insurance provider with a strong focus on customer service. They offer a comprehensive range of car insurance coverage options, including liability, collision, and comprehensive insurance. Allstate provides additional features like accident forgiveness and safe driving bonuses, making it a popular choice for many California drivers.

Esurance

Esurance is known for its digital-first approach, offering a seamless online experience for car insurance. They provide customizable policies and allow customers to manage their insurance online or through their mobile app. Esurance offers competitive rates and a variety of coverage options, making it a convenient choice for tech-savvy drivers.

Conclusion: Making an Informed Decision

Finding the best car insurance in California requires careful consideration of your specific needs, research, and comparison of different providers. By understanding the factors that influence insurance rates and exploring the coverage options available, you can make an informed decision and secure a policy that provides the right balance of protection and affordability. Remember to regularly review and update your insurance policy to ensure it continues to meet your changing needs.

What is the average cost of car insurance in California?

+The average cost of car insurance in California can vary depending on numerous factors. According to recent data, the average annual premium for a minimum liability policy in California is around 600 to 800. However, this can increase significantly with additional coverage options and based on individual risk factors.

Can I get car insurance without a license in California?

+While it is possible to purchase car insurance without a valid driver’s license, it may be challenging to find an insurance provider willing to offer coverage. Some insurance companies may require proof of a valid license or driving record to issue a policy. It is advisable to obtain a license before seeking car insurance.

How can I lower my car insurance rates in California?

+There are several ways to lower your car insurance rates in California. Some effective strategies include maintaining a clean driving record, increasing your credit score, choosing a higher deductible, and exploring discounts offered by insurance providers. Additionally, comparing quotes from multiple providers can help you find the most competitive rates.