Best Car Cheap Insurance

Finding the best car insurance at an affordable rate is a top priority for many vehicle owners. The good news is that there are various ways to secure cheap car insurance without compromising on coverage and protection. This comprehensive guide will explore the factors that influence insurance costs, strategies to lower premiums, and the best practices for choosing the right policy for your needs.

Understanding the Factors that Impact Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, and understanding these elements is crucial to finding the best rates. Here’s a breakdown of the key considerations:

Vehicle Type and Age

The type and age of your vehicle play a significant role in determining insurance premiums. Sports cars and high-performance vehicles often come with higher insurance costs due to their association with increased risk and higher repair expenses. Conversely, sedans and compact cars are generally more affordable to insure. Additionally, older vehicles tend to have lower insurance rates as they may have depreciated in value and pose less risk on the road.

Driving History and Record

Your driving history is a critical factor in insurance pricing. Insurers carefully examine your record for any signs of accidents, traffic violations, or claims. A clean driving record can lead to substantial discounts on your insurance premiums. On the other hand, a history of accidents or traffic violations may result in higher rates or even difficulty in finding coverage.

Coverage and Deductibles

The level of coverage you choose also impacts your insurance costs. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums. Conversely, liability-only coverage, which only covers damage to other vehicles, is often more affordable. Additionally, selecting a higher deductible can significantly reduce your insurance costs, as you’ll be responsible for a larger portion of any repair expenses.

Location and Usage

Your geographic location and how you use your vehicle also affect insurance rates. Insurance providers consider factors such as crime rates, traffic density, and the average cost of repairs in your area. Furthermore, the purpose for which you use your vehicle (e.g., commuting, business, or pleasure) can influence your insurance costs. If you drive fewer miles annually, you may be eligible for low-mileage discounts.

| Factor | Impact on Insurance Costs |

|---|---|

| Vehicle Type and Age | Sports cars and new vehicles often have higher premiums; older sedans and compact cars are more affordable. |

| Driving History | A clean record leads to discounts; accidents and violations can result in higher rates. |

| Coverage and Deductibles | Comprehensive and collision coverage are more expensive; higher deductibles can lower premiums. |

| Location and Usage | Urban areas with high crime and repair costs may have higher rates; low-mileage usage can qualify for discounts. |

Strategies to Find the Best Cheap Car Insurance

Now that we’ve examined the factors that influence car insurance costs, let’s explore some effective strategies to secure the best rates:

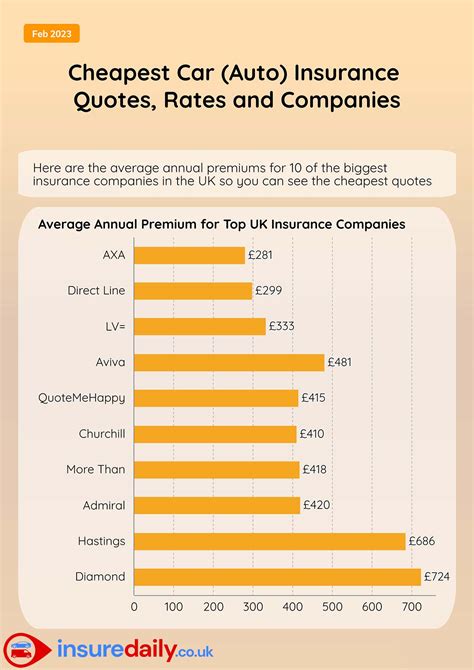

Shop Around and Compare Quotes

One of the most effective ways to find cheap car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, even for the same coverage. Utilize online comparison tools or directly request quotes from insurers to find the most competitive rates.

Choose the Right Coverage and Deductibles

Carefully consider the level of coverage you need. While comprehensive and collision coverage offer more protection, they also come with higher premiums. If you have an older vehicle or one with low monetary value, you may consider opting for liability-only coverage to keep costs down. Additionally, increasing your deductible can lower your premiums, but ensure that you’re comfortable with the financial responsibility in case of an accident.

Explore Discounts and Savings

Insurance providers offer a wide range of discounts to attract and retain customers. Some common discounts include:

- Safe Driver Discount: Reward for a clean driving record with no accidents or violations.

- Multi-Policy Discount: Offered when you bundle your car insurance with other policies, such as home or life insurance.

- Low-Mileage Discount: Available if you drive fewer miles annually, often determined by tracking devices or estimated mileage.

- Student Discount: Provided to students with good academic performance or enrolled in certain safety courses.

- Safe Car Discount: Given to owners of vehicles equipped with advanced safety features like airbags or anti-lock brakes.

Maintain a Good Driving Record

Your driving behavior significantly impacts your insurance costs. Avoid traffic violations and practice safe driving habits to maintain a clean record. This can lead to substantial discounts on your insurance premiums over time.

Consider Telematics or Usage-Based Insurance

Telematics insurance, also known as usage-based insurance, is a newer option that allows insurers to monitor your driving behavior in real-time. By installing a tracking device or using an app, insurers can assess your driving habits and offer personalized rates. This approach can be especially beneficial for safe drivers, as it provides an opportunity to prove their low-risk driving behavior and secure lower premiums.

Choosing the Right Cheap Car Insurance Provider

With a myriad of insurance providers offering cheap car insurance, selecting the right one can be daunting. Here are some key considerations to guide your decision:

Reputation and Financial Stability

Opt for an insurance provider with a solid reputation and strong financial stability. This ensures that the company will be able to honor your claims in the event of an accident or loss. Check independent ratings and reviews to assess the provider’s reliability and customer satisfaction.

Coverage Options and Customization

Different drivers have unique needs. Choose an insurer that offers a range of coverage options and allows for customization. This ensures that you can tailor your policy to your specific requirements without paying for unnecessary coverage.

Claims Handling and Customer Service

In the event of an accident or loss, you’ll want an insurer that handles claims efficiently and provides excellent customer service. Look for providers with a proven track record of prompt and fair claims processing. Additionally, consider the availability and accessibility of customer support, especially during non-business hours.

Technology and Digital Tools

In today’s digital age, many insurers offer convenient online or mobile tools for policy management, claims reporting, and communication. These tools can streamline the insurance process and provide added convenience. Consider insurers that provide user-friendly digital platforms and mobile apps for an enhanced customer experience.

Future Implications and Considerations

As the insurance landscape continues to evolve, it’s essential to stay informed about emerging trends and considerations:

Autonomous Vehicles and Safety Technology

The rise of autonomous vehicles and advanced safety technology is expected to have a significant impact on insurance rates. As these technologies become more prevalent and proven to reduce accidents, we can anticipate insurance providers adjusting their pricing models accordingly. This could lead to more affordable insurance rates for vehicles equipped with advanced safety features.

Telematics and Usage-Based Insurance

Telematics insurance, as mentioned earlier, is gaining popularity and could become a more mainstream option in the future. As more insurers adopt this approach, it may lead to a shift in the way insurance rates are determined. Safe drivers may benefit from lower premiums, while those with higher-risk driving behavior may face increased costs.

Regulation and Industry Changes

The insurance industry is subject to regulatory changes and market dynamics. Stay informed about any upcoming legislation or industry trends that could impact insurance rates and coverage options. Being aware of these changes can help you make more informed decisions about your insurance choices.

How can I get the best car insurance rates for my specific circumstances?

+To secure the best rates, it’s essential to shop around and compare quotes from multiple insurers. Additionally, consider your specific needs and circumstances. For instance, if you have a clean driving record, you may qualify for safe driver discounts. If you own an older vehicle, you might opt for liability-only coverage to keep costs down. Customizing your coverage and exploring discounts tailored to your situation can lead to significant savings.

What are some common mistakes to avoid when searching for cheap car insurance?

+One common mistake is assuming that the cheapest policy is always the best option. While cost is an important factor, it’s crucial to also consider the coverage provided and the insurer’s reputation for claims handling. Another mistake is failing to compare quotes from multiple providers, as rates can vary significantly. Additionally, neglecting to explore available discounts or opting for the first quote you receive can result in missed opportunities for savings.

How can I improve my chances of securing cheap car insurance in the long term?

+Maintaining a clean driving record is key to securing cheap car insurance over the long term. Avoid traffic violations and practice safe driving habits to keep your premiums low. Additionally, consider the long-term benefits of comprehensive and collision coverage. While these coverages may come with higher premiums, they provide valuable protection in the event of an accident or loss. Balancing your coverage needs with your budget can lead to sustainable savings in the long run.