Best Dental Insurance

Dental insurance plays a crucial role in maintaining optimal oral health and providing individuals with the necessary financial coverage for dental procedures. With a wide array of options available in the market, choosing the best dental insurance plan can be a daunting task. In this comprehensive guide, we will explore the key factors to consider, compare popular plans, and help you make an informed decision to ensure your smile stays healthy and bright.

Understanding Dental Insurance Plans

Dental insurance plans vary significantly in terms of coverage, premiums, and networks. Understanding the different types of plans and their unique features is essential for selecting the most suitable option. Here’s a breakdown of the primary types of dental insurance plans:

1. Indemnity Plans

Indemnity plans, often referred to as fee-for-service plans, provide the most flexibility when it comes to choosing dental care providers. With these plans, you can visit any dentist, including specialists, without restrictions. The insurance company will typically reimburse a percentage of the total cost of the treatment, with the remainder being your responsibility. Indemnity plans are ideal for those who prefer the freedom to choose their dental care providers and have a higher tolerance for out-of-pocket expenses.

2. Preferred Provider Organization (PPO) Plans

PPO plans offer a balance between flexibility and cost savings. These plans have a network of preferred dentists and specialists who have agreed to provide services at discounted rates. You can visit any dentist within the network without a referral, and your out-of-pocket costs will be lower compared to indemnity plans. However, if you choose to visit a dentist outside the network, you may incur higher expenses. PPO plans are a popular choice for individuals seeking a blend of flexibility and cost-effectiveness.

3. Health Maintenance Organization (HMO) Plans

HMO plans operate on a managed care model, where you must select a primary care dentist from within the plan’s network. This dentist will coordinate your dental care and provide referrals to specialists if needed. HMO plans typically have lower premiums and out-of-pocket costs compared to other plans, making them an attractive option for budget-conscious individuals. However, the trade-off is the limited choice of providers and the requirement for referrals, which can be a drawback for those who prefer more autonomy.

4. Dental Health Maintenance Organization (DHMOs) or Dental Care Organizations (DCOs)

DHMOs and DCOs are similar to HMOs but specifically cater to dental care. These plans have a network of dentists who provide services at predetermined rates, often with no out-of-pocket costs for basic procedures. DHMOs and DCOs are ideal for individuals seeking affordable dental care and are willing to work within a limited network of providers. The lack of out-of-pocket expenses can be particularly beneficial for those on a tight budget.

Key Factors to Consider When Choosing a Dental Insurance Plan

Selecting the best dental insurance plan involves careful consideration of various factors. Here are some crucial aspects to keep in mind:

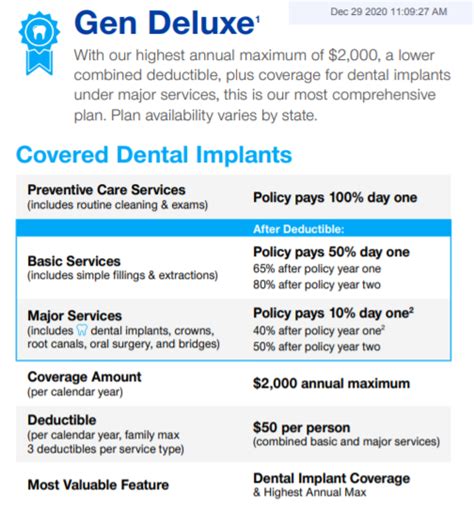

1. Coverage and Benefits

Examine the scope of coverage provided by different plans. Look for plans that offer comprehensive coverage for preventive care, such as regular check-ups, cleanings, and X-rays. Additionally, assess the extent of coverage for restorative procedures like fillings, root canals, and dental crowns. Consider your long-term dental needs and choose a plan that aligns with your anticipated dental requirements.

2. Network of Providers

The network of dentists and specialists covered by a plan is a significant consideration. Determine whether the plan offers an extensive network that includes dentists in your preferred location. If you have a specific dentist you prefer, ensure they are part of the plan’s network to avoid unexpected out-of-network costs. Additionally, consider whether the plan provides access to specialists, as some dental issues may require specialized care.

3. Premiums and Out-of-Pocket Costs

Dental insurance plans come with varying premium costs and out-of-pocket expenses. Assess your budget and determine the premium you can comfortably afford. Consider the plan’s deductibles, co-pays, and co-insurance rates, as these can significantly impact your overall dental care expenses. Remember that plans with lower premiums often have higher out-of-pocket costs, so strike a balance that suits your financial situation.

4. Waiting Periods and Pre-Existing Conditions

Most dental insurance plans have waiting periods for certain procedures, especially for major treatments like implants or orthodontics. Understand the waiting periods associated with different plans and consider how they align with your immediate and future dental needs. Additionally, be aware of any exclusions for pre-existing conditions, as some plans may not cover treatments related to conditions that existed before enrollment.

5. Additional Benefits and Perks

Some dental insurance plans offer additional benefits and perks that can enhance your overall dental care experience. These may include discounts on dental products, coverage for orthodontic treatments, or even vision care benefits. Evaluate these added advantages and determine whether they provide value and align with your specific needs.

Comparing Popular Dental Insurance Plans

To assist you in your search for the best dental insurance plan, let’s compare some popular options available in the market:

1. Delta Dental

Delta Dental is one of the leading dental insurance providers in the United States, offering a range of plans tailored to individual and family needs. Their plans typically include coverage for preventive care, basic procedures, and major treatments. Delta Dental’s extensive network of providers ensures easy access to dental care, making it a popular choice among individuals seeking comprehensive coverage.

2. Cigna Dental

Cigna Dental provides a variety of dental plans, including PPO and DHMO options. Their plans often emphasize preventive care and offer additional benefits like discounts on dental products and services. Cigna’s network includes a wide range of dentists and specialists, providing flexibility in choosing your dental care provider.

3. MetLife Dental

MetLife Dental offers a comprehensive suite of dental insurance plans, including PPO and indemnity options. Their plans focus on preventive care and provide coverage for a wide range of procedures. MetLife’s network is extensive, allowing members to choose from a diverse selection of dental care providers.

4. Aetna Dental

Aetna Dental provides a range of dental plans, including PPO and HMO options. Their plans are known for their competitive premiums and cost-effective coverage. Aetna’s network includes both general dentists and specialists, ensuring access to a comprehensive range of dental services.

5. United Concordia Dental

United Concordia Dental offers a variety of dental plans, including PPO, DHMO, and indemnity options. Their plans prioritize preventive care and provide coverage for various dental procedures. United Concordia’s network of providers is extensive, ensuring convenient access to dental care across different regions.

Choosing the Best Plan for Your Needs

When selecting the best dental insurance plan, it’s essential to consider your specific dental needs, budget, and preferences. Here are some tips to help you make an informed decision:

- Assess Your Dental Needs: Evaluate your current and anticipated dental requirements. If you have a history of complex dental issues, consider plans with more comprehensive coverage for major treatments. For individuals with good oral health, plans focused on preventive care and basic procedures may be sufficient.

- Compare Premiums and Out-of-Pocket Costs: Analyze the premiums and out-of-pocket expenses associated with different plans. Strike a balance between affordability and the coverage you require. Remember that plans with lower premiums may have higher deductibles and co-pays.

- Evaluate Network Options: Determine the importance of having a wide network of providers. If you prefer flexibility in choosing your dentist, PPO or indemnity plans may be more suitable. HMO and DHMO plans, on the other hand, offer cost savings but with a more limited network.

- Consider Additional Benefits: Look beyond basic coverage and consider plans that offer additional perks like discounts on dental products, orthodontic coverage, or vision care benefits. These added advantages can enhance your overall dental care experience.

- Read Reviews and Seek Recommendations: Research online reviews and seek recommendations from friends and family to gain insights into the experiences of others with different dental insurance plans. Real-life experiences can provide valuable information to help you make an informed choice.

Maximizing Your Dental Insurance Benefits

Once you’ve selected the best dental insurance plan for your needs, it’s essential to understand how to maximize your benefits. Here are some tips to make the most of your dental insurance coverage:

- Schedule Regular Check-Ups: Take advantage of your preventive care coverage by scheduling regular dental check-ups and cleanings. These visits can help identify potential issues early on and prevent more significant problems down the line.

- Utilize In-Network Providers: If your plan has a network of preferred providers, utilize them to take advantage of discounted rates and lower out-of-pocket costs. Check with your insurance company to confirm the network status of your preferred dentist before scheduling appointments.

- Understand Your Coverage Limits: Familiarize yourself with the coverage limits and exclusions of your plan. Be aware of any waiting periods for specific procedures and plan your dental treatments accordingly. Understanding your coverage limits will help you manage your expectations and financial responsibilities.

- Ask About Pre-Authorization: For major treatments or procedures, inquire about the process of pre-authorization. Some insurance companies require pre-authorization for certain procedures to ensure coverage. Understanding this process can help you navigate any potential hurdles and ensure smooth coverage.

- Keep Records and Receipts: Maintain a record of your dental visits, treatments, and receipts. This documentation can be useful for insurance claims and tax purposes, especially if you have out-of-pocket expenses that may be eligible for reimbursement or tax deductions.

The Future of Dental Insurance

The dental insurance industry is continually evolving to meet the changing needs of consumers. As technology advances and healthcare trends shift, we can expect to see innovative developments in dental insurance plans. Here are some potential future implications to consider:

1. Telehealth and Virtual Consultations

The rise of telehealth services has already made an impact on various healthcare sectors, and dental care is no exception. We can anticipate an increase in virtual consultations and remote dental assessments, offering convenient and accessible options for initial evaluations and follow-up care.

2. Integrating Technology for Dental Care

Technology will continue to play a significant role in dental care, with advancements in digital dentistry and dental imaging. Insurance plans may incorporate coverage for innovative technologies, such as 3D printing for dental restorations or advanced imaging techniques, to enhance the accuracy and efficiency of dental treatments.

3. Emphasis on Preventive Care

With a growing focus on preventive care and early intervention, insurance companies may place greater emphasis on promoting oral health through educational programs and incentives. This shift towards prevention can lead to more comprehensive coverage for preventive services and a reduction in out-of-pocket costs for individuals.

4. Personalized Dental Plans

The future may bring more personalized dental insurance plans tailored to individual needs and lifestyles. These plans could take into account factors such as genetic predispositions, dietary habits, and oral hygiene practices to offer customized coverage and preventive strategies.

5. Collaboration Between Dental and Medical Insurance

As the understanding of the connection between oral health and overall systemic health deepens, we may see a greater integration between dental and medical insurance plans. This collaboration could lead to more comprehensive coverage for dental treatments that impact overall health, such as periodontal disease management or oral cancer screenings.

How much does dental insurance typically cost?

+The cost of dental insurance can vary depending on various factors, including the type of plan, coverage, and location. On average, individual dental insurance plans can range from 30 to 50 per month, while family plans may cost around 100 to 200 per month. However, these prices can fluctuate based on the specific plan and insurance company.

What procedures are typically covered by dental insurance?

+Dental insurance plans generally cover a range of procedures, including preventive care such as cleanings, check-ups, and X-rays. Basic procedures like fillings and extractions are also typically covered. However, the extent of coverage for major treatments like root canals, crowns, and implants may vary depending on the plan and waiting periods.

Can I choose my own dentist with dental insurance?

+The ability to choose your own dentist depends on the type of dental insurance plan you have. Indemnity and PPO plans typically offer more flexibility in choosing providers, while HMO and DHMO plans have a limited network of dentists. It’s important to check the network status of your preferred dentist before selecting a plan to ensure they are covered.