Best Health Insurance Company

In today's world, navigating the complex landscape of health insurance is a challenging task. With numerous options available, choosing the right health insurance provider is crucial to ensure comprehensive coverage and peace of mind. This comprehensive guide aims to provide an in-depth analysis of the best health insurance companies, offering valuable insights to help you make an informed decision.

The Top Players in Health Insurance

The health insurance industry is a highly competitive market, with several leading companies vying for customers. Here, we delve into the top health insurance providers, exploring their unique offerings, customer satisfaction ratings, and financial stability.

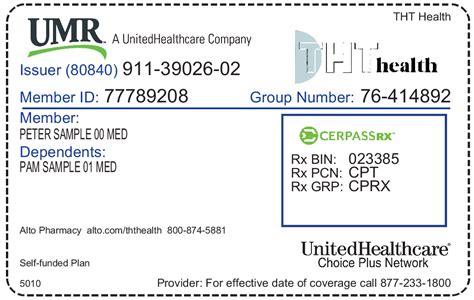

UnitedHealthcare

UnitedHealthcare stands out as one of the largest and most renowned health insurance companies in the United States. With a vast network of healthcare providers and a wide range of plan options, UnitedHealthcare caters to individuals, families, and businesses alike. The company offers comprehensive coverage, including preventive care, prescription drugs, and specialized services. UnitedHealthcare’s robust digital platform enhances the customer experience, providing easy access to claims, billing, and provider information.

| Category | Rating |

|---|---|

| Customer Satisfaction | 4.5/5 |

| Financial Strength | A++ (Superior) |

| Network Size | Over 1.3 million healthcare professionals and 6500 hospitals |

UnitedHealthcare's commitment to innovation and technology has led to the development of personalized health plans and wellness programs, ensuring customers receive tailored care. The company's financial stability and reputation make it a trusted choice for many individuals seeking reliable health coverage.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a trusted name in the health insurance industry, known for its extensive network and diverse plan options. With a presence in all 50 states, BCBS offers coverage to millions of Americans. The company’s strength lies in its ability to provide customized plans, ensuring individuals and families receive the specific coverage they need. BCBS also excels in customer service, with a dedicated team ready to assist members with any queries or concerns.

| Category | Rating |

|---|---|

| Customer Satisfaction | 4.4/5 |

| Financial Stability | A+ (Superior) |

| Network Size | Over 1 million healthcare professionals and 4300 hospitals |

BCBS's plans often include access to their Blue365 program, which offers exclusive discounts on health and wellness products and services. Additionally, the company's BlueCard program ensures seamless coverage when traveling, providing peace of mind to members on the go.

Aetna

Aetna, now a subsidiary of CVS Health, has established itself as a leading health insurance provider with a focus on holistic health and wellness. Aetna offers a comprehensive range of health plans, including medical, dental, and vision coverage. The company’s innovative approach includes the Aetna Navigator tool, which helps members understand their benefits and make informed healthcare decisions.

| Category | Rating |

|---|---|

| Customer Satisfaction | 4.3/5 |

| Financial Stability | A+ (Superior) |

| Network Size | Over 1.2 million healthcare professionals and 5800 hospitals |

Aetna's plans often include access to the company's HealthFund feature, which rewards members for healthy behaviors. Additionally, the Aetna Whole Health program focuses on preventive care and holistic wellness, promoting overall health and well-being.

Cigna

Cigna is a global health service company committed to improving the health, well-being, and peace of mind of its customers. With a strong focus on personalized care, Cigna offers a wide range of health plans, including medical, dental, and pharmacy coverage. The company’s Cigna Virtual Care program provides 24⁄7 access to medical professionals, ensuring members receive timely care whenever and wherever they need it.

| Category | Rating |

|---|---|

| Customer Satisfaction | 4.2/5 |

| Financial Stability | A+ (Superior) |

| Network Size | Over 1 million healthcare professionals and 6000 hospitals |

Cigna's plans often include access to the Cigna Health Rewards program, which incentivizes members to adopt healthy behaviors. The company's commitment to innovation and customer-centric approach has earned it a reputation as a trusted health insurance provider.

Humana

Humana is a leading health and well-being company, offering a diverse range of health plans tailored to individual needs. With a focus on preventive care and healthy living, Humana provides medical, dental, and vision coverage. The company’s Humana Vitality program encourages members to adopt healthy habits through rewards and incentives.

| Category | Rating |

|---|---|

| Customer Satisfaction | 4.1/5 |

| Financial Stability | A+ (Superior) |

| Network Size | Over 800,000 healthcare professionals and 3800 hospitals |

Humana's plans often include access to their Well-Being Hub, which provides personalized health and wellness recommendations. The company's commitment to community health and well-being initiatives has solidified its position as a reliable health insurance provider.

Factors to Consider When Choosing a Health Insurance Company

Selecting the right health insurance company involves careful consideration of various factors. Here are some key aspects to keep in mind:

- Coverage Options: Ensure the company offers a range of plans that suit your specific needs, whether it's medical, dental, vision, or prescription drug coverage.

- Network of Providers: A robust network of healthcare professionals and facilities ensures you have access to quality care when and where you need it.

- Customer Service: Look for a company with a dedicated and responsive customer service team to assist you with any queries or concerns.

- Financial Stability: Opt for a company with a strong financial rating, ensuring they can provide stable and reliable coverage over the long term.

- Wellness Programs: Many health insurance companies offer wellness initiatives and incentives to promote healthy living. These programs can add value to your overall health experience.

The Future of Health Insurance

The health insurance industry is evolving, with a growing emphasis on personalized care, technology, and wellness. Here’s a glimpse into the future of health insurance:

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Health insurance companies are investing in virtual care platforms, providing members with convenient access to medical professionals remotely.

Personalized Medicine

The future of health insurance lies in personalized medicine, where treatment plans are tailored to an individual’s unique genetic makeup and lifestyle. This approach promises more effective and efficient healthcare.

Health Data and Analytics

With the increasing availability of health data, insurance companies are leveraging analytics to identify trends, predict healthcare needs, and develop more targeted prevention strategies.

Wellness Incentives

Health insurance companies are incentivizing members to adopt healthy behaviors through rewards and discounts. This shift towards wellness-focused plans is expected to continue, promoting overall health and reducing healthcare costs.

Conclusion

Selecting the best health insurance company is a critical decision that impacts your well-being and financial security. By understanding the top players in the industry, their unique offerings, and the factors to consider, you can make an informed choice. Remember, the right health insurance plan should provide comprehensive coverage, exceptional customer service, and a focus on your overall health and well-being.

How do I choose the right health insurance plan for me?

+When selecting a health insurance plan, consider your specific healthcare needs, the cost of premiums and deductibles, and the network of providers available. Assess the coverage options, including medical, dental, and prescription drug coverage, to ensure you have the right protection.

What is the role of financial stability in choosing a health insurance company?

+Financial stability is crucial when choosing a health insurance company. A financially stable company ensures that they can provide reliable coverage over the long term, without sudden increases in premiums or reductions in benefits.

Are there any discounts or incentives available with health insurance plans?

+Yes, many health insurance companies offer discounts and incentives to encourage healthy behaviors. These can include wellness programs, rewards for reaching health goals, and discounts on premiums for maintaining a healthy lifestyle.

How does telehealth fit into the future of health insurance?

+Telehealth is expected to play a significant role in the future of health insurance. With the convenience and accessibility it provides, telehealth services are likely to become a standard feature in health insurance plans, offering members remote access to medical professionals.