Best House Insurance Rate

When it comes to safeguarding your home and ensuring peace of mind, finding the best house insurance rate is a crucial step. The process can be daunting, with numerous factors influencing the cost of coverage. In this comprehensive guide, we delve into the intricacies of house insurance, exploring the key aspects that impact rates and providing valuable insights to help you secure the most favorable policy for your unique circumstances.

Understanding House Insurance Rates

House insurance rates are determined by a combination of factors, each playing a significant role in assessing the level of risk associated with insuring your home. These factors are carefully considered by insurance providers to calculate the premium you’ll pay for coverage.

Risk Assessment Factors

Several critical elements contribute to the risk assessment process, influencing the overall house insurance rate. These factors include:

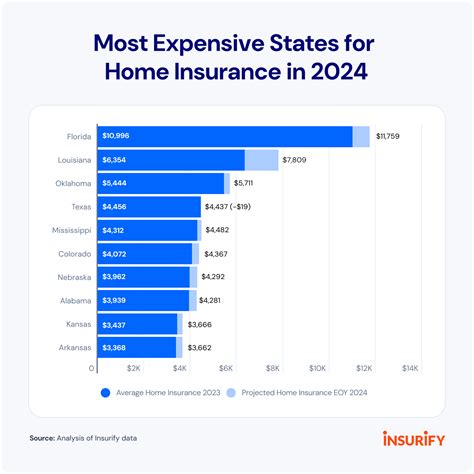

- Location: The geographical area where your home is situated plays a pivotal role. Areas prone to natural disasters, such as hurricanes, floods, or earthquakes, often result in higher insurance rates. Similarly, regions with a higher crime rate may also impact the cost of coverage.

- Home Value and Replacement Cost: The value of your home and the estimated cost to rebuild it in the event of a total loss are key considerations. Higher home values generally lead to increased insurance premiums.

- Construction Type and Age: The construction materials and methods used in building your home, along with its age, are important factors. Older homes or those built with certain materials may require more specialized coverage, impacting the insurance rate.

- Coverage Limits and Deductibles: The level of coverage you choose and the associated deductibles also affect the insurance rate. Higher coverage limits and lower deductibles typically result in higher premiums.

- Claim History: Your past claim history is a significant consideration. A history of frequent claims may lead to higher insurance rates or even non-renewal of your policy.

- Personal Information: Insurance providers often assess personal details such as your age, marital status, and occupation. Certain occupations or lifestyles may be perceived as higher risk, impacting insurance rates.

Comparing Insurance Providers

Securing the best house insurance rate often involves comparing multiple providers. Each insurance company uses its own formula to calculate rates, and exploring various options can lead to significant savings.

When comparing providers, consider factors such as:

- Coverage Options: Ensure that the providers offer the specific coverage you require, including standard coverage like fire, theft, and liability, as well as optional add-ons like flood or earthquake coverage.

- Reputation and Financial Stability: Opt for established insurance companies with a strong reputation and financial stability. This ensures that the provider will be able to pay out claims if needed.

- Customer Service and Claims Process: Evaluate the provider’s customer service reputation and the ease of the claims process. A provider with a good track record of prompt and fair claims handling is preferable.

- Discounts and Bundle Options: Many insurance companies offer discounts for various factors, such as bundling multiple insurance policies, installing security systems, or being claim-free for a certain period. Take advantage of these discounts to reduce your insurance rate.

Optimizing Your House Insurance Rate

While certain factors influencing insurance rates are beyond your control, there are strategies you can employ to optimize your rate and secure the best possible coverage.

Improving Your Home’s Risk Profile

By taking proactive measures to improve your home’s risk profile, you can potentially reduce your insurance rate. Consider the following steps:

- Upgrade Security Features: Installing a security system, reinforcing doors and windows, and adding motion-activated lighting can deter potential thieves and reduce the risk of break-ins. Many insurance providers offer discounts for such upgrades.

- Address Structural Weaknesses: If your home has structural weaknesses or outdated features, such as old electrical wiring or plumbing, addressing these issues can reduce the risk of accidents and lower your insurance rate.

- Maintain Your Home: Regular maintenance and timely repairs are essential. Keeping your home in good condition not only improves its value but also reduces the risk of unexpected damage, which can lead to insurance claims.

- Consider Renovations: Certain renovations, such as adding a fire sprinkler system or reinforcing your roof, can significantly reduce the risk of catastrophic damage and result in lower insurance rates.

Bundling Insurance Policies

Bundling your insurance policies with the same provider is a common strategy to save money. Many insurance companies offer multi-policy discounts when you combine your home and auto insurance or add other types of coverage, such as life or health insurance.

By bundling your policies, you can often receive a significant discount on your overall insurance premiums, making it a cost-effective way to manage your insurance needs.

Increasing Your Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can result in a lower insurance rate. This strategy works best for individuals who can afford to pay a higher deductible in the event of a claim.

However, it’s important to strike a balance and ensure that the increased deductible is still manageable in the event of an unexpected claim. Assess your financial situation and choose a deductible that aligns with your ability to pay.

Special Considerations for Unique Circumstances

For individuals with unique circumstances or specific needs, finding the best house insurance rate may require additional considerations.

High-Value Homes

If you own a high-value home, standard insurance policies may not provide sufficient coverage. In such cases, specialized high-value home insurance policies are available, designed to offer comprehensive coverage tailored to your specific needs.

These policies often include additional coverage for high-end finishes, valuable personal property, and unique structural features. Work with an insurance broker who specializes in high-value homes to ensure you receive the appropriate level of coverage.

Renters Insurance

For individuals renting a home or apartment, renters insurance is essential to protect your personal belongings and liability. Renters insurance typically covers the cost of replacing your belongings in the event of a covered loss, such as fire or theft, and provides liability protection if someone is injured in your rental unit.

When choosing renters insurance, consider factors such as the value of your personal belongings, the level of liability coverage you require, and any additional coverage options, such as personal property floater policies for high-value items.

Older Homes

Older homes often require specialized insurance coverage due to their unique construction and potential vulnerabilities. When insuring an older home, consider the following:

- Additional Structural Coverage: Older homes may have specific structural issues, such as outdated wiring or plumbing, that require additional coverage. Ensure your policy includes provisions for these potential risks.

- Replacement Cost Coverage: For older homes, it’s crucial to have replacement cost coverage, which ensures that you’ll receive the full cost to rebuild your home in the event of a total loss. Actual cash value policies, which deduct depreciation, may not provide sufficient coverage.

- Consider an Umbrella Policy: An umbrella policy provides additional liability coverage beyond your standard home insurance policy. This can be especially valuable for older homes, as they may have higher liability risks due to aging infrastructure or potential hidden hazards.

The Future of House Insurance Rates

The house insurance industry is constantly evolving, and advancements in technology and data analytics are shaping the future of insurance rates. Here are some key trends to watch:

Telematics and Usage-Based Insurance

Usage-based insurance, also known as telematics, is gaining traction in the house insurance industry. This innovative approach to pricing insurance policies is based on real-time data collected from sensors or devices installed in your home.

By monitoring factors such as energy usage, water flow, and even the opening and closing of doors and windows, insurance providers can gain insights into your home’s risk profile and offer more accurate and personalized insurance rates.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the insurance industry by enabling more accurate risk assessment and fraud detection. These technologies analyze vast amounts of data, including historical claims data and real-time information, to identify patterns and make more informed decisions.

By leveraging AI and machine learning, insurance providers can offer more precise insurance rates, tailored to individual circumstances, and detect potential fraud more effectively.

Blockchain Technology

Blockchain technology is revolutionizing the insurance industry by enhancing transparency, security, and efficiency in insurance transactions. By leveraging blockchain, insurance providers can streamline the claims process, reduce administrative costs, and improve data accuracy.

Additionally, blockchain can facilitate the secure sharing of data between insurance providers, brokers, and customers, leading to more efficient risk assessment and potentially lower insurance rates.

Conclusion: Securing the Best House Insurance Rate

Finding the best house insurance rate is a critical step in protecting your home and financial well-being. By understanding the factors that influence insurance rates, comparing providers, and implementing strategies to optimize your risk profile, you can secure the most favorable coverage for your unique circumstances.

As the insurance industry continues to evolve with advancements in technology and data analytics, staying informed about emerging trends and innovations will empower you to make the best decisions for your insurance needs.

How often should I review my house insurance policy and rates?

+It’s recommended to review your house insurance policy and rates annually. This allows you to stay up-to-date with any changes in your home’s value, coverage needs, and market rates. Additionally, reviewing your policy regularly ensures that you have the appropriate level of coverage and can take advantage of any discounts or promotions offered by your insurance provider.

What factors can I control to potentially lower my insurance rate?

+While some factors influencing insurance rates are beyond your control, there are several steps you can take to potentially lower your rate. These include improving your home’s security features, addressing structural weaknesses, maintaining your home regularly, and considering renovations that reduce the risk of damage. Additionally, increasing your deductible and bundling insurance policies can result in cost savings.

How can I ensure I have sufficient coverage for my high-value home?

+If you own a high-value home, it’s essential to work with an insurance broker who specializes in high-value homes. They can guide you in obtaining a specialized policy that provides comprehensive coverage for your unique needs. This may include additional coverage for high-end finishes, valuable personal property, and unique structural features.

What is the difference between replacement cost coverage and actual cash value coverage?

+Replacement cost coverage provides the full cost to rebuild your home in the event of a total loss, regardless of depreciation. This type of coverage is particularly important for older homes or those with unique features. In contrast, actual cash value coverage deducts depreciation from the replacement cost, resulting in a lower payout.