State Farm Car Insurance Texas

In the vast state of Texas, where cars rule the roads and diversity thrives, choosing the right car insurance provider is paramount. Enter State Farm, a name synonymous with reliability and trust. This article delves deep into the world of State Farm car insurance in Texas, exploring its offerings, benefits, and why it might be the perfect fit for your vehicular needs.

State Farm’s Tailored Coverage in Texas

State Farm understands that Texas drivers have unique requirements, and thus, it offers a comprehensive range of coverage options tailored to meet these specific needs. Whether you’re navigating the bustling streets of Houston, cruising along the coastal roads of Galveston, or exploring the wide-open spaces of West Texas, State Farm has you covered.

Comprehensive Coverage

State Farm’s comprehensive car insurance policy in Texas provides extensive protection, including coverage for damage caused by accidents, vandalism, natural disasters, and more. With this policy, you can rest assured that your vehicle is safeguarded against a wide array of potential mishaps.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you financially if you're at fault in an accident, covering bodily injury and property damage costs. |

| Collision Coverage | Covers repair or replacement costs for your vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Provides protection against theft, vandalism, natural disasters, and other non-collision-related incidents. |

| Medical Payments Coverage | Helps cover medical expenses for you and your passengers after an accident, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects you if an at-fault driver doesn't have sufficient insurance to cover your damages. |

Customized Policies

One of the standout features of State Farm’s car insurance is its ability to customize policies to fit individual needs. Whether you’re a student, a senior citizen, a business owner, or a family driver, State Farm offers tailored coverage options and discounts to ensure you’re getting the most value for your insurance dollar.

- Students: State Farm recognizes the financial constraints of students and offers discounts for good grades and low mileage.

- Senior Citizens: Older drivers can benefit from State Farm's mature driver discounts and accident forgiveness programs.

- Business Owners: State Farm understands the unique needs of business owners and offers commercial auto insurance policies tailored to protect business vehicles.

- Families: State Farm's multi-car and multi-policy discounts can significantly reduce insurance costs for families with multiple vehicles.

The Benefits of Choosing State Farm in Texas

State Farm’s reputation as a trusted insurance provider is well-earned, and there are numerous advantages to choosing them for your car insurance needs in Texas.

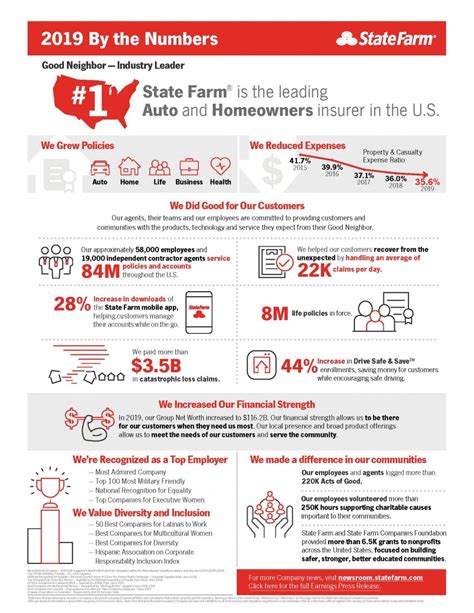

Financial Strength and Stability

State Farm is renowned for its financial strength and stability, consistently ranking among the top insurance companies in the nation. This means they have the resources to pay out claims quickly and efficiently, providing peace of mind during challenging times.

Excellent Customer Service

State Farm’s customer service is widely acclaimed. Their agents are known for their expertise, responsiveness, and dedication to ensuring customers understand their coverage and feel valued. Whether you need assistance with a claim, have questions about your policy, or are seeking advice on coverage options, State Farm’s agents are ready to help.

Digital Convenience and Innovation

In today’s digital age, State Farm embraces innovation to enhance the customer experience. Their mobile app and online platform offer convenience and efficiency, allowing you to manage your policy, file claims, and access important documents anytime, anywhere. Additionally, State Farm’s innovative use of technology, such as their Drive Safe & Save program, can help you save on insurance costs by tracking and rewarding safe driving habits.

Community Involvement and Support

State Farm is deeply committed to the communities it serves. Through various initiatives and sponsorships, State Farm actively supports local events, charities, and educational programs. This dedication to community involvement reflects the company’s values and reinforces its position as a trusted partner in the lives of Texas residents.

Conclusion: Why State Farm is a Smart Choice for Texas Drivers

When it comes to car insurance in Texas, State Farm stands out as a reliable and customer-centric provider. With its comprehensive coverage options, tailored policies, and a commitment to financial strength and community involvement, State Farm offers Texas drivers peace of mind and value. From the bustling cities to the wide-open rural landscapes, State Farm is there to protect what matters most.

How does State Farm’s pricing compare to other providers in Texas?

+

State Farm’s pricing is competitive and often offers excellent value for the coverage provided. However, insurance rates can vary based on individual circumstances and the specific coverage chosen. It’s always recommended to obtain quotes from multiple providers to find the best fit for your needs.

What are the key benefits of State Farm’s Drive Safe & Save program?

+

The Drive Safe & Save program rewards safe driving habits with potential discounts on insurance premiums. By installing a small device that tracks driving behavior, State Farm can offer personalized rates based on safe driving practices. This program encourages safer driving and can lead to significant savings over time.

How does State Farm handle claims in Texas?

+

State Farm is known for its efficient and responsive claims process. With a dedicated team of claims professionals, they work diligently to ensure claims are handled promptly and fairly. Customers can file claims online, via the mobile app, or by phone, and State Farm provides regular updates throughout the claims process.