Free Insurance Qoute

Insurance is an essential aspect of financial planning and risk management, offering peace of mind and protection for individuals and businesses alike. In today's dynamic and often unpredictable world, having the right insurance coverage is crucial. However, navigating the complex web of insurance options and providers can be daunting. This comprehensive guide aims to demystify the process of obtaining free insurance quotes, providing you with the knowledge and tools to make informed decisions about your insurance needs.

Understanding the Need for Insurance Quotes

Insurance quotes are like a personalized roadmap to financial security. They provide a detailed overview of the costs and coverage options available for various insurance types, helping you assess and compare different policies. By obtaining multiple quotes, you can ensure you’re getting the best value for your insurance dollar.

Whether you're seeking coverage for your home, vehicle, health, or business, insurance quotes are a vital step in the process. They empower you to make informed choices, ensuring you're adequately protected without overspending.

The Benefits of Free Insurance Quotes

Opting for free insurance quotes offers a range of advantages that can significantly enhance your insurance experience.

Cost Comparison

Free quotes allow you to compare prices and coverage across multiple insurance providers. This transparency ensures you can find the most competitive rates, saving you money in the long run.

Customized Coverage

Insurance quotes are tailored to your specific needs. Whether you require comprehensive car insurance, homeowners insurance with specific add-ons, or health insurance that covers your unique medical requirements, quotes provide a detailed breakdown of the coverage options available to you.

Time Efficiency

Obtaining free insurance quotes online or through brokers can be a quick and efficient process. You can gather multiple quotes in a matter of minutes, saving you the time and effort of researching and contacting individual insurance companies.

Expert Guidance

When working with insurance brokers or agents, they can provide expert advice and insights based on your quote comparisons. They can help you understand the fine print, recommend the best policies for your needs, and even negotiate better rates on your behalf.

How to Get Free Insurance Quotes

Securing free insurance quotes is a straightforward process, whether you prefer the convenience of online platforms or the personalized touch of working with a broker.

Online Insurance Quote Platforms

Numerous online platforms offer free insurance quotes for a wide range of insurance types. These platforms typically provide a simple form where you input your details, and they generate quotes from multiple insurance providers based on your information.

Some popular online insurance quote platforms include:

- PolicyGenius: Offers quotes for life, home, renters, and auto insurance.

- Insurify: Provides quotes for auto, home, and renters insurance, as well as coverage for classic cars and ridesharing.

- Compare.com: Specializes in auto insurance quotes, comparing rates from top providers.

- HealthMarkets: Focuses on health insurance, offering quotes for individual and family plans.

- ValuePenguin: Provides quotes for auto, home, renters, life, and health insurance, with a strong emphasis on data-driven comparisons.

When using online platforms, ensure you provide accurate and detailed information to receive the most precise quotes.

Working with Insurance Brokers

Insurance brokers are licensed professionals who work with multiple insurance companies to find the best coverage for their clients. They can provide personalized guidance and advice, helping you navigate the complex world of insurance.

To work with an insurance broker, you can:

- Research and identify reputable brokers in your area or online.

- Contact them and provide details about your insurance needs.

- Discuss your budget, coverage requirements, and any specific concerns.

- The broker will then obtain quotes from various insurance providers and present them to you.

- Review the quotes, ask questions, and make an informed decision.

Working with a broker ensures you have an advocate who understands your unique needs and can negotiate on your behalf.

Factors Affecting Insurance Quotes

Insurance quotes are influenced by a variety of factors, and understanding these can help you obtain the most accurate and beneficial quotes.

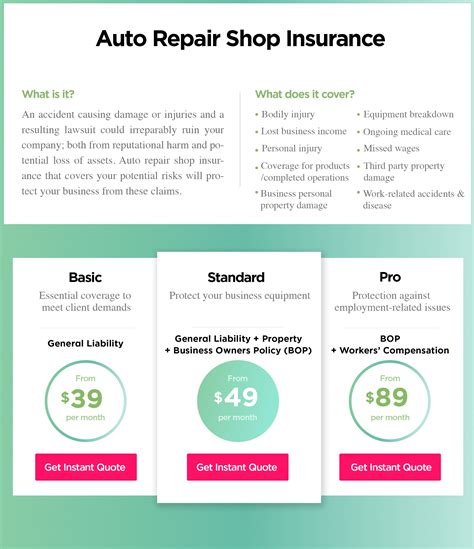

Insurance Type

Different types of insurance, such as auto, home, health, or life insurance, have distinct coverage options and cost structures. The specific type of insurance you’re seeking will significantly impact your quote.

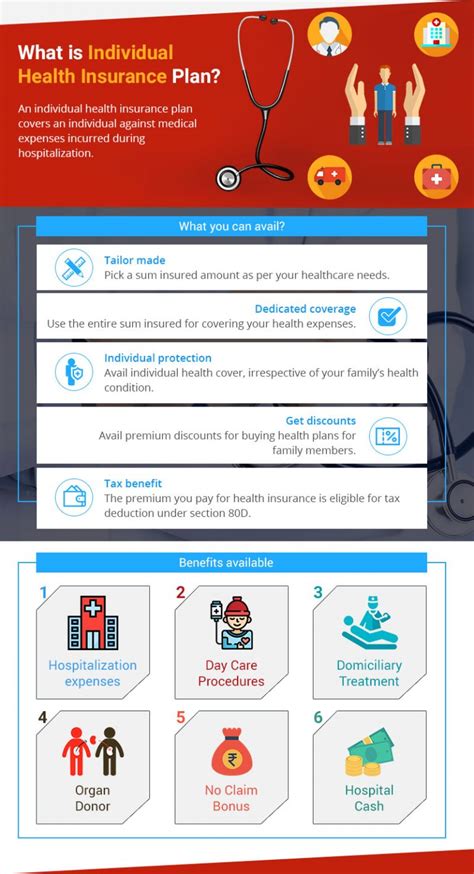

Coverage Options

The level of coverage you require will affect your insurance quote. For example, in auto insurance, you may choose between liability-only coverage or comprehensive coverage that includes collision and comprehensive protection. Similarly, in health insurance, you can opt for higher or lower deductibles and copays.

Location

Your geographic location plays a significant role in insurance quotes. Insurance providers consider factors like crime rates, weather conditions, and local regulations when determining rates.

Personal Factors

Your personal circumstances and demographics can impact your insurance quotes. For instance, your age, gender, driving record, credit score, and health history can all influence the quotes you receive.

| Factor | Impact on Quotes |

|---|---|

| Age | Younger individuals may pay higher premiums for auto and health insurance. |

| Gender | Insurance rates may vary based on gender, especially for auto insurance. |

| Driving Record | A clean driving record can lead to lower auto insurance premiums. |

| Credit Score | A higher credit score is often associated with lower insurance rates. |

| Health History | Pre-existing health conditions may impact health insurance quotes. |

Tips for Obtaining the Best Insurance Quotes

To ensure you get the most advantageous insurance quotes, consider the following tips:

Compare Multiple Quotes

Don’t settle for the first quote you receive. Compare quotes from at least three to five insurance providers to find the best rates and coverage.

Understand Your Coverage Needs

Before seeking quotes, take the time to understand your specific insurance needs. This will help you ask the right questions and make informed decisions.

Consider Bundling Policies

If you require multiple types of insurance, such as auto and home insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for bundling, which can significantly reduce your overall costs.

Explore Discounts

Insurance providers often offer a variety of discounts, such as safe driver discounts, loyalty discounts, or discounts for certain occupations or affiliations. Ask your insurance broker or agent about available discounts and ensure you’re taking advantage of all applicable ones.

Review Your Policy Regularly

Insurance needs and circumstances can change over time. Regularly review your insurance policies and quotes to ensure they still meet your requirements. You may find better deals or discover new discounts that weren’t available when you initially obtained your policy.

Common Misconceptions about Insurance Quotes

There are several misconceptions surrounding insurance quotes that can lead to confusion or misconceptions. Let’s address some of these:

Misconception: Insurance Quotes Are Final

Insurance quotes are estimates based on the information you provide. They are not binding contracts. The actual premium and coverage may vary once you apply for the policy and the insurance company conducts its own assessment.

Misconception: Quotes Are Always Accurate

While insurance quotes aim to be accurate, they may not always reflect the final cost. Factors like changes in your personal circumstances or the insurance company’s assessment can affect the actual premium.

Misconception: All Insurance Companies Offer the Same Coverage

Insurance providers offer different coverage options and benefits. It’s essential to review the fine print and compare policies to ensure you’re getting the coverage that best suits your needs.

Future Trends in Insurance Quotes

The insurance industry is continuously evolving, and technology is playing a significant role in shaping the future of insurance quotes.

Digital Transformation

The shift towards digital insurance platforms and online quote generation is expected to continue. This trend offers increased convenience and efficiency for consumers, allowing them to obtain quotes and manage their policies entirely online.

Data-Driven Quotes

Insurance companies are leveraging advanced analytics and data science to generate more accurate and personalized quotes. By analyzing vast amounts of data, they can better understand individual risk profiles and offer tailored coverage options.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are being utilized to streamline the insurance quote process. These technologies can automate tasks, improve accuracy, and provide real-time quotes based on individual risk assessments.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by enhancing security, transparency, and efficiency in insurance transactions, including quote generation and policy management.

Conclusion

Obtaining free insurance quotes is a crucial step in securing the right coverage for your needs. By understanding the process, factors influencing quotes, and the benefits of comparison shopping, you can make informed decisions about your insurance. Whether you choose to work with a broker or utilize online platforms, the key is to gather multiple quotes, compare options, and seek expert guidance when needed. Stay informed, and you’ll be well on your way to achieving the financial security and peace of mind that insurance provides.

Can I obtain free insurance quotes without providing personal information?

+No, insurance quotes are typically generated based on personal details and circumstances. While you may find generic quote estimates online, accurate and personalized quotes require some level of personal information.

Are insurance quotes binding?

+No, insurance quotes are not binding. They are estimates of what your insurance policy might cost based on the information you provide. The actual premium and coverage may differ once you apply for the policy.

How often should I review my insurance quotes and policies?

+It’s recommended to review your insurance quotes and policies annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not overpaying for unnecessary coverage.