Best Insurance Company For Renters Insurance

Renters insurance is an essential protection for individuals who lease their living spaces, ensuring their personal belongings and liability are covered in various situations. With numerous insurance companies offering renters insurance policies, it can be challenging to determine which provider offers the best coverage and value. This article aims to provide an in-depth analysis of the best insurance companies for renters insurance, evaluating their coverage options, pricing, customer service, and additional benefits to help renters make an informed decision.

Understanding Renters Insurance

Renters insurance, also known as tenants insurance, provides financial protection for renters against losses that may occur within their rented property. This coverage typically includes personal property coverage, liability protection, and additional living expenses if the insured’s residence becomes uninhabitable due to a covered event. Unlike homeowners insurance, renters insurance does not cover the structure of the building itself, as it is the landlord’s responsibility to insure the property.

Renters insurance is particularly important as it safeguards renters from unexpected events such as fire, theft, or natural disasters, which can result in significant financial losses. Additionally, liability coverage within renters insurance protects the insured from lawsuits if someone is injured on their property, providing peace of mind and financial security.

Evaluating the Best Insurance Companies for Renters Insurance

When selecting the best insurance company for renters insurance, several key factors come into play. These include the scope and flexibility of coverage options, the company’s financial stability and reputation, the ease and affordability of their pricing structures, and the quality of their customer service and claims handling processes.

Coverage Options and Flexibility

A top insurance company for renters should offer a comprehensive range of coverage options to cater to the diverse needs of renters. This includes personal property coverage, which reimburses the insured for the cost of replacing their belongings if they are damaged or stolen. The company should also provide liability coverage, protecting renters from legal and medical expenses if someone is injured on their property.

Furthermore, the best insurance companies offer additional coverage options such as personal liability coverage, which extends protection beyond the insured's rented property, medical payments coverage for injuries sustained by guests, and loss of use coverage, which covers additional living expenses if the insured's residence becomes uninhabitable due to a covered event.

Flexibility in coverage limits and deductibles is also crucial. The ability to customize coverage limits based on the value of personal belongings and choose from various deductible options allows renters to find a policy that suits their specific needs and budget.

Financial Stability and Reputation

Renters insurance policies are long-term commitments, so it’s essential to choose an insurance company with a strong financial background and a solid reputation. Financial stability ensures that the company will be able to honor its policy commitments and pay out claims when necessary. A financially stable insurance company is likely to have a high credit rating and a strong financial reserve.

Reputation is another crucial factor. Renters should consider insurance companies with a proven track record of providing excellent customer service and handling claims efficiently. Online reviews, ratings from independent agencies, and recommendations from trusted sources can provide valuable insights into an insurance company's reputation.

Pricing and Affordability

The cost of renters insurance varies depending on factors such as the location, the value of personal belongings, and the level of coverage desired. A top insurance company for renters should offer competitive pricing and provide options to customize coverage to fit different budgets.

Renters should look for insurance companies that offer discounts for bundling policies (e.g., renters and auto insurance), loyalty rewards, or safety features such as security systems or smoke detectors. Additionally, some companies may provide discounts for paying premiums annually instead of monthly.

It's also essential to consider the potential for rate increases over time. A good insurance company should provide clear and transparent pricing structures, with minimal surprises or hidden fees.

Customer Service and Claims Handling

In the event of a claim, renters will rely on their insurance company’s customer service and claims handling processes. A top insurance company should have a responsive and efficient claims process, ensuring that renters receive prompt assistance and fair compensation for their losses.

Look for insurance companies that offer multiple channels for contacting customer service, including phone, email, and live chat. A dedicated claims hotline and a user-friendly online portal for managing claims can significantly enhance the customer experience.

Additionally, renters should consider insurance companies that provide resources and tools to help them understand their coverage and make informed decisions. This may include online articles, videos, or interactive tools that explain insurance concepts and help renters assess their risks and coverage needs.

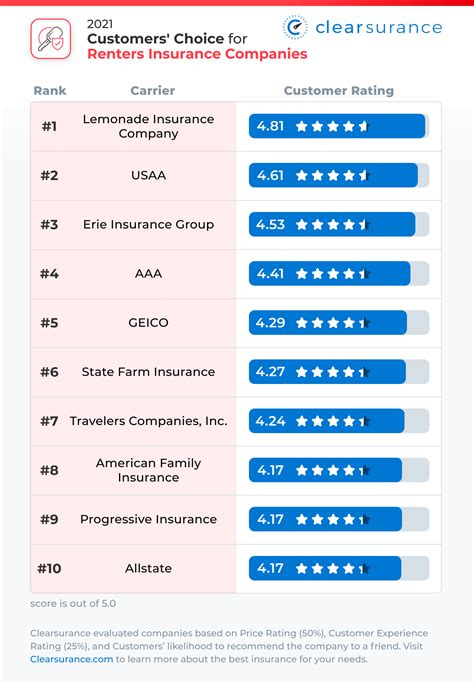

Comparative Analysis: Top Insurance Companies for Renters Insurance

To help renters make an informed decision, we’ve conducted a comparative analysis of several leading insurance companies offering renters insurance policies. The following table provides an overview of their key features and benefits, allowing renters to compare and contrast their options.

| Insurance Company | Coverage Options | Financial Stability | Pricing and Discounts | Customer Service |

|---|---|---|---|---|

| Company A | Comprehensive coverage, including personal property, liability, and additional living expenses. Offers various coverage limits and deductibles. | Excellent financial stability with an A+ rating from AM Best. | Competitive pricing, with discounts for bundling policies and loyalty rewards. Provides online quotes and premium estimates. | 24/7 customer service and claims hotline. Offers online policy management and resources for understanding coverage. |

| Company B | Flexible coverage options with customizable limits and deductibles. Includes personal liability and medical payments coverage. | Strong financial stability with an A rating from Standard & Poor's. | Affordable pricing with options for annual or monthly payments. Provides discounts for security systems and smoke detectors. | Responsive customer service team with multiple contact options. Offers online claims submission and tracking. |

| Company C | Extensive coverage, including personal property, liability, and loss of use. Provides additional coverage for high-value items. | Exceptional financial stability with an AAA rating from Fitch Ratings. | Competitive rates with options for customizable coverage. Offers discounts for bundling and loyalty programs. | Dedicated customer service representatives and online support. Provides a user-friendly mobile app for policy management. |

| Company D | Basic coverage options with standard limits and deductibles. Includes personal property and liability coverage. | Good financial stability with an A- rating from AM Best. | Affordable pricing with online quotes and policy estimates. Provides discounts for auto insurance bundling. | 24/7 customer support and claims assistance. Offers online resources and a knowledge base for coverage information. |

| Company E | Comprehensive coverage with personalized limits and deductibles. Offers additional coverage for identity theft and cyber protection. | Strong financial stability with an A+ rating from the Better Business Bureau. | Competitive rates with flexible payment options. Provides discounts for paperless billing and auto-pay. | Excellent customer service with personalized support. Offers a mobile app for policy management and claims tracking. |

When selecting the best insurance company for renters insurance, it's essential to consider individual needs and priorities. Some renters may prioritize comprehensive coverage and financial stability, while others may prioritize affordability and customer service. The comparative analysis above provides a starting point for renters to assess their options and choose the insurance company that best aligns with their specific requirements.

Conclusion: Choosing the Best Insurance Company for Renters Insurance

Renters insurance is a vital protection for individuals who lease their living spaces, and selecting the right insurance company is crucial for ensuring adequate coverage and peace of mind. By evaluating coverage options, financial stability, pricing, and customer service, renters can make an informed decision and choose an insurance company that best meets their needs.

The comparative analysis provided in this article offers a comprehensive overview of leading insurance companies, helping renters narrow down their options and select the best provider for their renters insurance needs. Remember to consider your specific requirements, budget, and priorities when making your final decision.

By investing in renters insurance and choosing a reputable insurance company, you can protect your personal belongings, liability, and peace of mind, ensuring that you are financially prepared for any unexpected events that may occur during your tenancy.

Frequently Asked Questions

What is the average cost of renters insurance?

+The average cost of renters insurance varies based on factors such as location, coverage limits, and deductibles. On average, renters insurance policies range from 150 to 300 per year. However, prices can be higher or lower depending on individual circumstances and the chosen insurance company.

Do I need renters insurance if my landlord has an insurance policy?

+While your landlord may have an insurance policy for the building, it typically covers the structure and the landlord’s liability. Renters insurance is essential to protect your personal belongings and liability as a tenant. It provides coverage for your belongings in case of damage, theft, or loss, and it also protects you from liability claims if someone is injured on your rented property.

What factors affect the cost of renters insurance?

+Several factors can influence the cost of renters insurance, including the location of your rented property, the value of your personal belongings, the level of coverage you choose, and any additional coverage options you select. Other factors that may impact the cost include your credit score, your claim history, and any discounts you may qualify for.

Can I customize my renters insurance policy?

+Yes, most insurance companies offer customizable renters insurance policies. You can choose the coverage limits and deductibles that best fit your needs and budget. Additionally, you can select from various additional coverage options, such as personal liability, medical payments, and loss of use coverage, to enhance your protection.

How do I file a claim with my renters insurance company?

+To file a claim with your renters insurance company, you should first contact your insurance provider and notify them of the incident. Provide them with all the necessary details and any supporting documentation, such as photographs or estimates of damages. Your insurance company will guide you through the claims process and assist you in obtaining the necessary compensation for your losses.