Best Mortgage Insurance

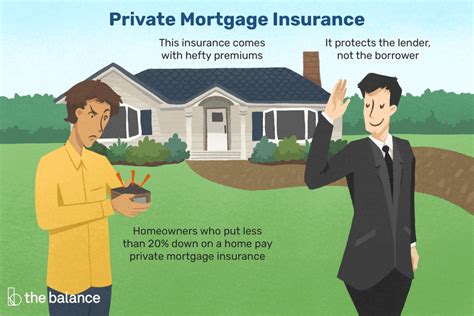

Mortgage insurance, also known as mortgage default insurance, is an essential component of homeownership for many prospective buyers. It protects the lender in the event of a borrower's default on their mortgage payments, providing a safety net and enabling individuals with smaller down payments to secure home loans. Choosing the best mortgage insurance involves careful consideration of various factors, including cost, coverage, and the specific needs of the borrower.

Understanding Mortgage Insurance

Mortgage insurance is a vital aspect of the home buying process, particularly for those who cannot afford a traditional 20% down payment. In Canada, mortgage insurance is mandatory for any mortgage with a down payment of less than 20% of the property’s purchase price. This insurance safeguards lenders from potential losses if a borrower defaults on their mortgage, ensuring that the lender can recover the outstanding balance.

The primary purpose of mortgage insurance is to facilitate homeownership for individuals who may not meet the traditional financial criteria. By providing this insurance, lenders can offer more flexible mortgage terms, allowing borrowers to enter the property market with smaller down payments. This has been a significant driver of homeownership rates, particularly among first-time buyers.

Factors to Consider When Choosing Mortgage Insurance

Selecting the best mortgage insurance involves a careful evaluation of various factors. While cost is often a primary consideration, it’s important to balance this with the coverage provided and the specific needs of the borrower. Here are some key factors to consider:

Cost of Mortgage Insurance

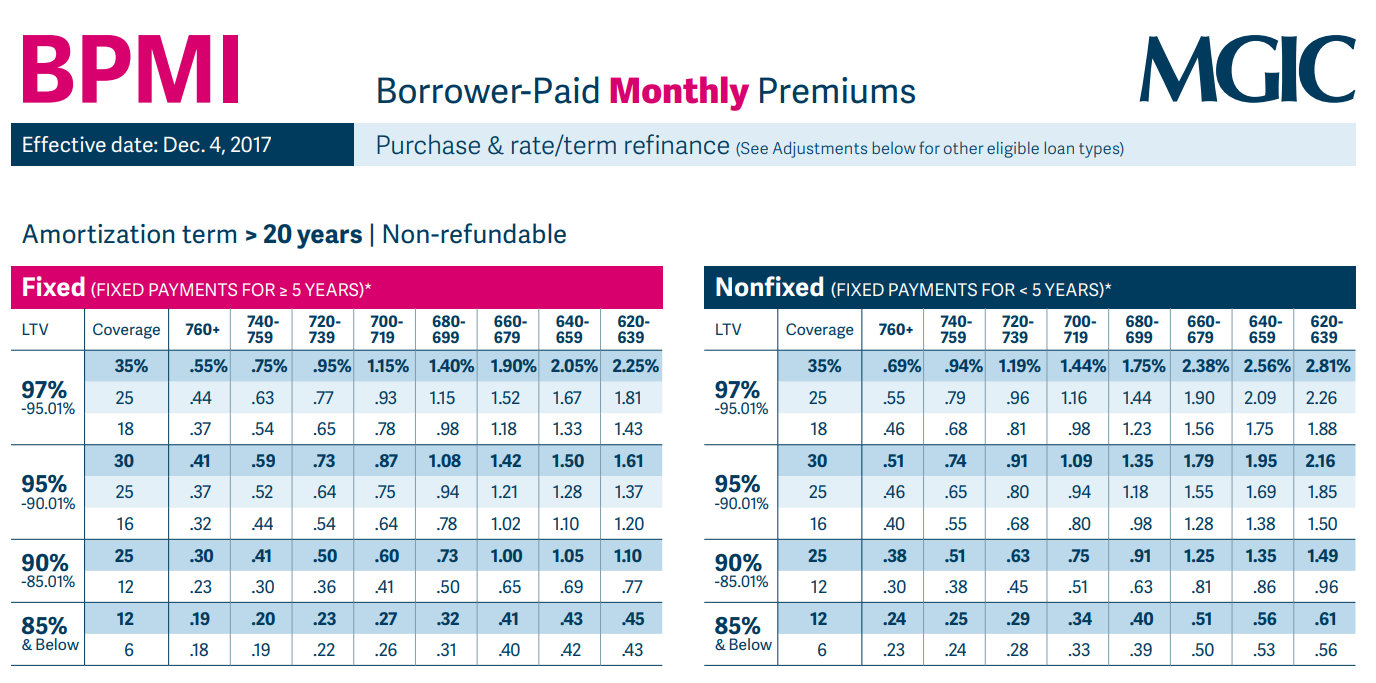

The cost of mortgage insurance is typically calculated as a percentage of the loan amount. This premium is added to the mortgage balance, increasing the overall cost of the loan. However, it’s important to note that this cost is non-refundable and is not tax-deductible.

The exact cost of mortgage insurance can vary depending on several factors, including the borrower's credit score, the loan-to-value ratio (LTV), and the mortgage term. In general, borrowers with higher credit scores and lower LTV ratios can expect to pay lower premiums. Additionally, shorter mortgage terms may result in lower insurance costs.

| Credit Score | Loan-to-Value Ratio (LTV) | Mortgage Term | Estimated Premium |

|---|---|---|---|

| Excellent (760+) | 80% | 5 years | 0.60% - 0.85% |

| Good (700-759) | 85% | 10 years | 0.90% - 1.25% |

| Average (680-699) | 90% | 15 years | 1.25% - 1.50% |

The table above provides a general estimate of mortgage insurance premiums based on different credit scores, LTV ratios, and mortgage terms. It's important to note that these figures are subject to change and may vary between insurance providers.

Coverage and Benefits

When evaluating mortgage insurance, it’s crucial to understand the coverage it provides. Mortgage insurance typically covers the lender in the event of borrower default, but it’s essential to review the specific terms and conditions to ensure the coverage meets your needs.

Some mortgage insurance policies may offer additional benefits, such as the ability to port the insurance to a new mortgage if you sell your home and purchase another. This can save you the cost of reapplying for insurance and potentially reduce your overall expenses. Additionally, certain policies may offer flexibility in terms of prepayment or early renewal, providing greater control over your mortgage.

Reputable Insurance Providers

Choosing a reputable and reliable insurance provider is crucial when selecting mortgage insurance. Here are some of the top providers in the market:

- Canada Mortgage and Housing Corporation (CMHC): As a Crown corporation, CMHC is the largest provider of mortgage insurance in Canada. They offer competitive rates and a range of insurance products tailored to different borrower needs.

- Genworth Canada: Genworth is another leading provider of mortgage insurance, known for its comprehensive coverage and flexible options. They offer a range of insurance plans, including those designed for self-employed individuals.

- Canada Guaranty: Canada Guaranty is a private mortgage insurer that provides insurance for residential and commercial mortgages. They are known for their innovative products and competitive rates.

Evaluating the Best Mortgage Insurance

When it comes to choosing the best mortgage insurance, it’s important to consider your individual needs and circumstances. Here are some key factors to evaluate:

Your Financial Situation

Assess your financial situation and determine how much you can afford to spend on mortgage insurance. Consider your income, expenses, and savings to ensure you choose a policy that fits within your budget.

Loan-to-Value Ratio

The loan-to-value ratio (LTV) is a critical factor in determining your mortgage insurance premium. A lower LTV ratio typically results in a lower premium. If you have the means, consider increasing your down payment to reduce your LTV ratio and, consequently, your insurance costs.

Mortgage Term and Amortization

The term of your mortgage and the amortization period can also impact your insurance costs. Shorter mortgage terms and amortization periods may result in lower insurance premiums. Evaluate your financial goals and preferences to determine the right term and amortization for your situation.

Flexibility and Portability

Consider the flexibility and portability of the mortgage insurance policy. If you plan to sell your home and purchase another in the future, a portable policy can save you the cost and hassle of reapplying for insurance. Additionally, policies that offer flexibility in terms of prepayment or early renewal can provide greater control over your mortgage and potentially reduce overall costs.

Comparative Analysis: Top Mortgage Insurance Providers

To help you make an informed decision, let’s take a closer look at some of the top mortgage insurance providers in Canada and compare their offerings.

CMHC: Canada Mortgage and Housing Corporation

CMHC is the largest and most well-known mortgage insurer in Canada. They offer a range of insurance products, including standard mortgage insurance, self-employed mortgage insurance, and rental property mortgage insurance.

CMHC's standard mortgage insurance provides coverage for borrowers with down payments of less than 20% of the purchase price. The premium is calculated as a percentage of the mortgage amount and is added to the mortgage balance. CMHC offers competitive rates and is known for its reliability and extensive experience in the market.

Genworth Canada

Genworth Canada is another leading mortgage insurer, offering a range of insurance products tailored to different borrower needs. They provide standard mortgage insurance, as well as specialized insurance for self-employed individuals and those with unique financial circumstances.

Genworth's standard mortgage insurance covers borrowers with down payments of less than 20%, similar to CMHC. The premium is calculated based on the loan-to-value ratio and is added to the mortgage balance. Genworth is known for its flexibility and innovative products, making it a popular choice among borrowers.

Canada Guaranty

Canada Guaranty is a private mortgage insurer that provides insurance for both residential and commercial mortgages. They offer a range of insurance products, including standard mortgage insurance, self-employed mortgage insurance, and portfolio insurance.

Canada Guaranty's standard mortgage insurance covers borrowers with down payments of less than 20% and provides competitive rates. Their portfolio insurance is designed for mortgage professionals and offers flexibility in terms of coverage and pricing. Canada Guaranty is known for its personalized approach and excellent customer service.

Performance Analysis and Case Studies

To further illustrate the impact of mortgage insurance, let’s explore some real-life case studies and analyze the performance of different insurance providers.

Case Study 1: John’s Mortgage Journey

John, a first-time homebuyer, had a down payment of 10% for his dream home. He opted for mortgage insurance with CMHC to secure a mortgage with a 90% loan-to-value ratio. The insurance premium added approximately 1% to his mortgage balance, resulting in a slightly higher monthly payment.

Over the course of 5 years, John diligently made his mortgage payments and maintained a good credit score. As a result, he was able to renew his mortgage with a lower insurance premium, saving him money in the long run. John's experience highlights the importance of maintaining a good credit score and exploring opportunities for early renewal.

Case Study 2: Sarah’s Self-Employment

Sarah, a self-employed entrepreneur, wanted to purchase a home but faced challenges due to her unique income structure. She chose Genworth Canada’s self-employed mortgage insurance, which allowed her to provide alternative income verification. This specialized insurance product enabled Sarah to secure a mortgage and achieve her goal of homeownership.

Sarah's experience demonstrates the value of choosing an insurance provider that offers specialized products tailored to specific borrower needs. Genworth's self-employed mortgage insurance provided Sarah with the flexibility and support she needed to navigate the challenges of self-employment and secure a mortgage.

Case Study 3: Mike’s Portfolio Mortgage

Mike, a seasoned investor, had a portfolio of rental properties and wanted to expand his real estate holdings. He opted for Canada Guaranty’s portfolio insurance, which provided coverage for his entire portfolio of mortgages. This insurance product offered him flexibility in terms of coverage and pricing, allowing him to manage his mortgage portfolio effectively.

Mike's experience showcases the benefits of portfolio insurance for investors and real estate professionals. Canada Guaranty's portfolio insurance provided Mike with the necessary coverage and support to grow his real estate portfolio, while also offering personalized pricing and flexible terms.

Future Implications and Industry Insights

As the housing market continues to evolve, the role of mortgage insurance remains crucial. Here are some key industry insights and future implications to consider:

Changing Market Dynamics

The housing market is subject to fluctuations and changing dynamics. Mortgage insurance providers must adapt to these changes and offer flexible products that cater to the diverse needs of borrowers. As the market evolves, insurance providers will need to innovate and provide solutions that address emerging challenges and opportunities.

Technological Advancements

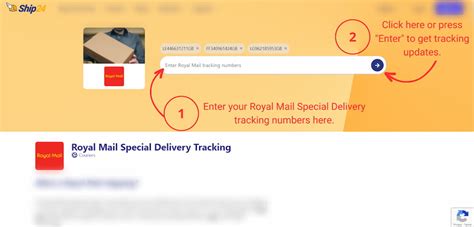

The digital age has brought about significant technological advancements in the mortgage industry. Mortgage insurance providers are leveraging technology to streamline processes, enhance customer experience, and improve efficiency. Online application platforms, digital verification tools, and data analytics are transforming the way mortgage insurance is delivered and managed.

Regulatory Environment

The mortgage insurance industry is subject to strict regulations and oversight. Insurance providers must comply with various regulatory requirements to ensure the stability and integrity of the market. As regulations evolve, insurance providers will need to adapt their products and practices to meet these changing standards.

Industry Collaboration

Collaboration between mortgage lenders, brokers, and insurance providers is becoming increasingly important. By working together, these industry stakeholders can provide more comprehensive solutions to borrowers, ensuring a smoother and more efficient home buying process. Collaboration can lead to improved customer experience, streamlined processes, and enhanced market stability.

How much does mortgage insurance typically cost?

+The cost of mortgage insurance can vary depending on factors such as credit score, loan-to-value ratio, and mortgage term. Generally, borrowers with higher credit scores and lower LTV ratios can expect to pay lower premiums. For example, a borrower with an excellent credit score and a 20% down payment may pay around 0.60% - 0.85% of the loan amount as a premium. However, these figures can vary, and it’s best to consult with a mortgage professional for an accurate estimate.

Is mortgage insurance required for all mortgages?

+In Canada, mortgage insurance is mandatory for any mortgage with a down payment of less than 20% of the property’s purchase price. This requirement ensures that lenders are protected in the event of borrower default. However, it’s important to note that there are exceptions for certain types of mortgages, such as those backed by the federal government or insured by the National Housing Act.

Can I cancel my mortgage insurance once I have it?

+Once you have mortgage insurance, it is typically non-cancelable. The insurance premium is added to your mortgage balance and remains in place until the mortgage is paid off or refinanced. However, if you increase your down payment to 20% or more, you may be eligible to have the insurance removed. It’s important to consult with your lender or insurance provider to understand your specific options.