Insurance Cheapest Quote

Securing the most affordable insurance quote is a common goal for many individuals and businesses, as it can significantly impact their financial well-being and overall expenses. In today's competitive insurance market, finding the cheapest quote often involves a thorough understanding of the factors that influence rates, an exploration of different insurance providers, and a strategic approach to policy selection. This article aims to provide a comprehensive guide to help readers navigate the complex world of insurance, offering insights and strategies to secure the most cost-effective coverage.

Understanding the Landscape: Key Factors Influencing Insurance Rates

The cost of insurance premiums is determined by a multitude of factors, each playing a unique role in shaping the overall price. These factors can be broadly categorized into personal or business-related characteristics, the type of insurance coverage, and external market influences.

Personal and Business Characteristics

For individuals, insurance rates are often influenced by age, gender, marital status, and driving or health records. Younger individuals, particularly those under 25, tend to pay higher premiums due to their perceived higher risk of accidents or health issues. Gender can also impact rates, with some insurers charging different premiums for men and women based on historical data and statistical trends. Marital status may result in lower rates, as married individuals are often seen as more stable and responsible. Driving records, including any past accidents or traffic violations, significantly affect auto insurance rates, with a clean record often leading to more affordable premiums.

Similarly, for businesses, insurance rates are influenced by factors such as the industry, size, and location. High-risk industries like construction or manufacturing often incur higher premiums due to the increased likelihood of accidents or property damage. The size of a business can also impact rates, with larger companies often benefiting from economies of scale and negotiating better rates. Location is another critical factor, as areas with higher crime rates or natural disaster risks may result in increased premiums.

Type of Insurance Coverage

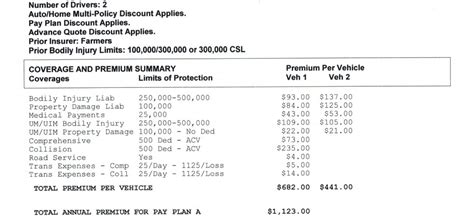

The type of insurance coverage sought is another significant determinant of rates. Different types of insurance, such as auto, home, health, or life insurance, carry varying levels of risk and cost. For instance, auto insurance typically covers liability, collision, and comprehensive coverage, with the specific coverage and deductibles chosen impacting the premium. Home insurance, on the other hand, covers structures, personal belongings, and liability, with the value of the home and its contents, as well as the level of coverage desired, affecting the premium.

External Market Influences

External market factors also play a role in determining insurance rates. These can include economic conditions, inflation rates, and the overall state of the insurance market. During economic downturns or periods of high inflation, insurance rates may increase as insurers seek to mitigate financial losses. The competitive landscape of the insurance market can also influence rates, with more competitive markets often resulting in lower premiums as insurers strive to attract customers.

Exploring Insurance Providers: A Comparison of Top Companies

With a basic understanding of the factors influencing insurance rates, the next step is to explore the insurance market and compare providers. This section will delve into a comparative analysis of some of the top insurance companies, highlighting their unique offerings, customer service, and, most importantly, their pricing.

Company A: A Leading Provider of Comprehensive Coverage

Company A is a well-established insurance provider known for its comprehensive range of insurance products. They offer auto, home, health, and life insurance policies, catering to a diverse range of customer needs. One of their key strengths is their personalized approach to insurance, where customers can tailor their policies to suit their specific requirements. This flexibility often results in more affordable premiums, as customers only pay for the coverage they need.

In terms of pricing, Company A's rates are highly competitive. They offer a range of discounts, including multi-policy discounts, safe driver discounts, and loyalty rewards. Their online quoting tool provides customers with an instant estimate, allowing for quick comparisons and easy policy selection. Additionally, Company A is known for its excellent customer service, with a dedicated team of agents available to assist customers throughout the policy selection and claims process.

Company B: A Specialist in Customized Insurance Solutions

Company B is a specialist insurance provider, focusing on offering customized insurance solutions to meet the unique needs of their customers. They understand that every individual or business has different insurance requirements and, therefore, provide highly tailored policies. This level of customization often results in more affordable premiums, as customers can opt for coverage that precisely matches their risks and needs.

In terms of pricing, Company B offers competitive rates, particularly for customers who are considered low-risk. They provide discounts for multiple policies, safe practices (such as installing security systems or taking defensive driving courses), and loyalty. Additionally, Company B is known for its innovative use of technology, with an easy-to-use online platform that allows customers to manage their policies and quickly obtain quotes.

Company C: A Pioneer in Digital Insurance Services

Company C is a relatively new entrant in the insurance market, but it has quickly gained recognition for its innovative digital insurance services. They offer a fully digital insurance experience, from policy procurement to claims management, making the process fast, efficient, and cost-effective. Their online platform allows customers to compare policies, obtain quotes, and purchase coverage in just a few clicks.

In terms of pricing, Company C's digital approach has allowed them to offer highly competitive rates. They leverage advanced algorithms and risk assessment tools to provide accurate quotes, often resulting in lower premiums. Additionally, they offer a range of discounts, including multi-policy discounts, referral bonuses, and discounts for customers who use their mobile app for policy management.

Strategies for Securing the Cheapest Insurance Quote

Now that we have explored the key factors influencing insurance rates and compared some top insurance providers, it’s time to delve into specific strategies that can help secure the cheapest insurance quote. These strategies involve a combination of research, negotiation, and leveraging the power of technology.

Research and Compare

The first step in securing the cheapest insurance quote is thorough research and comparison. Utilize online resources, insurance comparison websites, and reviews to gather information about different insurance providers and their offerings. Compare not only the prices but also the coverage, discounts, and customer service ratings. This comprehensive approach ensures that you are not only getting the best price but also the best value for your money.

Negotiate and Bundle

Negotiation is a powerful tool when it comes to securing affordable insurance rates. Many insurance providers are open to negotiating rates, particularly if you have a strong risk profile or a long history with the company. You can also consider bundling multiple insurance policies with the same provider, as this often results in significant discounts. For instance, if you have auto and home insurance with the same company, you may be eligible for a multi-policy discount, which can substantially reduce your overall premium.

Leverage Technology

In today’s digital age, technology plays a crucial role in securing the cheapest insurance quote. Utilize online quoting tools, which are often faster and more accurate than traditional methods. These tools allow you to quickly compare rates from multiple providers, ensuring that you are getting the best deal. Additionally, consider using mobile apps for policy management, as many insurance providers offer discounts for customers who use these apps.

Optimize Your Risk Profile

Your risk profile is a significant factor in determining your insurance rates. Taking steps to optimize your risk profile can lead to substantial savings. For instance, if you are an individual, maintaining a clean driving record, installing safety features in your vehicle, or improving your health can result in lower premiums. For businesses, implementing robust safety measures, maintaining a strong financial position, and investing in employee training can all contribute to a reduced risk profile and, consequently, lower insurance rates.

Review and Update Regularly

Insurance rates and policies can change over time, so it’s important to regularly review and update your coverage. This ensures that you are always getting the best value and the most affordable rates. Set reminders to review your policies annually, or whenever your circumstances change, such as moving to a new location, changing jobs, or adding a family member to your policy. By staying proactive, you can ensure that your insurance coverage remains both comprehensive and cost-effective.

Future Implications: Trends Shaping the Insurance Industry

As we look ahead, several trends are shaping the insurance industry, influencing both rates and the overall insurance landscape. Understanding these trends can provide valuable insights into the future of insurance and how individuals and businesses can adapt to secure the most affordable coverage.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology that allows vehicles to communicate with insurers, is rapidly gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, leverages telematics to track driving behavior and offer more precise insurance rates. This technology provides insurers with real-time data on driving habits, such as miles driven, speed, and braking patterns, allowing them to offer more accurate and personalized premiums.

The rise of telematics and usage-based insurance is expected to revolutionize the auto insurance market, as it provides a more accurate assessment of risk. For individuals, this means the potential for lower premiums if they exhibit safe driving behaviors. However, it also means that risky driving habits may result in higher premiums. Therefore, individuals looking to secure the cheapest insurance quote should consider adopting safer driving practices to take advantage of this emerging trend.

Increased Use of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry by enabling more efficient risk assessment and underwriting processes. These technologies analyze vast amounts of data, including historical claims data, demographic information, and even social media activity, to predict future risks and tailor insurance rates accordingly. AI and ML are also being used to streamline the claims process, making it faster and more efficient for customers.

The increased use of AI and ML in the insurance industry is expected to lead to more accurate and fair pricing. Insurers will be able to better understand and manage risks, which can result in more competitive premiums for customers. Additionally, these technologies can enhance customer service, providing more personalized and efficient support. Therefore, as these technologies continue to evolve, individuals and businesses can expect more tailored and affordable insurance options.

The Impact of Digital Transformation

Digital transformation is reshaping the insurance industry, with more insurers moving their services online and adopting digital tools and platforms. This shift is making insurance more accessible, efficient, and cost-effective. Online quoting tools, digital policy management, and mobile apps are just a few examples of how digital transformation is enhancing the insurance experience.

The impact of digital transformation is expected to continue, with insurers further leveraging technology to streamline processes and improve customer service. This digital shift can lead to more competitive pricing, as insurers are able to reduce operational costs and pass these savings on to customers. Additionally, the increased use of digital tools can provide customers with more control over their insurance, allowing them to easily manage their policies and obtain quotes, which can lead to more informed decisions and potentially cheaper insurance.

Conclusion: A Comprehensive Approach to Affordable Insurance

Securing the cheapest insurance quote requires a comprehensive approach that involves understanding the factors influencing rates, exploring the insurance market, and implementing strategic tactics. By researching and comparing providers, negotiating and bundling policies, leveraging technology, optimizing risk profiles, and staying updated with the latest industry trends, individuals and businesses can secure the most affordable insurance coverage.

As the insurance industry continues to evolve, staying informed about emerging trends and technologies is crucial. The rise of telematics, the increased use of AI and ML, and the ongoing digital transformation are shaping the future of insurance, offering more tailored and cost-effective solutions. By adapting to these changes and taking advantage of the opportunities they present, individuals and businesses can ensure they are getting the best value for their insurance dollar.

How often should I review my insurance policies to ensure I am getting the best rates?

+It is recommended to review your insurance policies at least once a year, or whenever your personal or business circumstances change significantly. This ensures that your coverage remains up-to-date and that you are not overpaying for unnecessary coverage.

What are some common discounts offered by insurance providers that can help lower my premiums?

+Common discounts include multi-policy discounts (when you bundle multiple types of insurance with the same provider), safe driver discounts (for individuals with a clean driving record), loyalty discounts (for long-term customers), and discounts for specific safety features or practices (such as installing security systems or taking defensive driving courses).

How can I optimize my risk profile to potentially lower my insurance rates?

+For individuals, this could involve maintaining a clean driving record, improving health habits, and installing safety features in your home or vehicle. For businesses, it may mean implementing robust safety measures, maintaining a strong financial position, and investing in employee training to reduce workplace accidents.