Insurance Prices Cars

Insurance is an essential aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. However, the cost of insuring a car can vary significantly depending on numerous factors. Understanding these variables is crucial for car owners, as it allows them to make informed decisions and potentially save on insurance expenses.

The Complex Factors Influencing Insurance Prices for Cars

The price of car insurance is not a straightforward calculation. It is influenced by a multitude of factors, each contributing to the overall premium. These factors can be broadly categorized into three main groups: the vehicle itself, the driver’s profile, and external influences.

Vehicle-Specific Factors

The make, model, and year of a vehicle play a significant role in determining insurance costs. Generally, newer cars with advanced safety features are considered less risky and may result in lower insurance premiums. On the other hand, sports cars, high-performance vehicles, and certain luxury brands are often associated with higher premiums due to their increased likelihood of theft or costly repairs.

| Vehicle Category | Insurance Premium Impact |

|---|---|

| Economy Cars | Lower premiums due to lower replacement and repair costs. |

| Sports Cars | Higher premiums due to increased performance and theft risks. |

| Luxury Brands | Elevated premiums because of higher replacement and repair expenses. |

Additionally, the primary use of the vehicle can also affect insurance costs. A car primarily used for business purposes or as a commercial vehicle may attract higher premiums compared to a personal vehicle. This is because commercial vehicles are typically driven more frequently and are exposed to different types of risks.

Driver’s Profile and History

The driver’s personal details and driving history are significant factors in insurance pricing. Younger drivers, particularly those under the age of 25, often face higher insurance premiums due to their lack of driving experience. Statistically, younger drivers are more likely to be involved in accidents, which can drive up insurance costs for this demographic.

Conversely, mature drivers with a long, clean driving record can often enjoy lower insurance rates. Insurance companies view these drivers as less risky, as they have demonstrated safe driving habits over an extended period.

| Driver's Profile | Insurance Premium Impact |

|---|---|

| Young Drivers | Higher premiums due to increased accident risks. |

| Mature Drivers | Lower premiums if they have a long, clean driving record. |

| Drivers with Violations | Elevated premiums for those with speeding tickets or other violations. |

The number of years a driver has been licensed also influences insurance costs. New drivers, even those over the age of 25, may pay higher premiums until they have established a proven track record of safe driving.

External Factors and Circumstances

Beyond the vehicle and driver’s profile, external factors also significantly impact insurance premiums. The location where the vehicle is primarily garaged can affect insurance costs. Areas with higher crime rates or a history of frequent natural disasters may result in increased insurance premiums, as the risk of theft or damage is perceived to be higher.

The purpose for which the vehicle is used also comes into play. Commuting to work or using the vehicle for business purposes may attract different insurance rates compared to primarily using the car for leisure. Insurance companies assess the level of risk associated with different types of driving and adjust premiums accordingly.

Furthermore, the insurance company itself and the type of coverage chosen can greatly influence the overall premium. Different insurance providers offer varying rates and coverage options, and it's essential to shop around to find the best deal. The level of coverage selected, such as comprehensive, collision, or liability-only, will also impact the cost.

The Impact of Technological Advancements on Insurance Prices

The automotive industry is undergoing rapid technological advancements, and these innovations are also shaping the insurance landscape. One notable development is the increasing popularity of self-driving or autonomous vehicles. While these vehicles are designed to enhance safety, their complex technology can lead to higher repair costs, which may result in elevated insurance premiums.

Additionally, the rise of telematics and usage-based insurance is transforming the way insurance premiums are calculated. Telematics devices installed in vehicles can track driving behavior, such as speed, acceleration, and mileage. This data is then used to tailor insurance premiums to the individual driver's habits. Drivers who exhibit safe driving behaviors may qualify for discounts, while those with riskier driving patterns may face higher premiums.

The Role of Advanced Safety Features

Many modern vehicles are equipped with advanced safety features, such as lane departure warning systems, automatic emergency braking, and adaptive cruise control. These features are designed to prevent accidents and mitigate the severity of collisions. As a result, vehicles with such safety technologies may be eligible for insurance discounts, as they are perceived as less risky.

| Safety Feature | Potential Insurance Discount |

|---|---|

| Lane Departure Warning | Up to 5% discount on liability coverage. |

| Automatic Emergency Braking | Potential savings of 10-15% on collision coverage. |

| Adaptive Cruise Control | May qualify for discounts on comprehensive coverage. |

However, it's important to note that while these safety features can lead to insurance discounts, they also contribute to the overall cost of the vehicle. Therefore, the net effect on insurance premiums can vary depending on the specific features and the insurance provider's policies.

Strategies for Managing Insurance Costs

For car owners looking to manage their insurance costs, there are several strategies that can be employed. One of the most effective methods is to shop around and compare quotes from multiple insurance providers. Different companies may offer varying rates and coverage options, so it’s beneficial to explore these differences to find the most cost-effective policy.

Additionally, taking advantage of discounts can significantly reduce insurance premiums. Many insurance companies offer discounts for a variety of reasons, such as good student discounts, safe driver discounts, and loyalty discounts for long-term customers. Understanding the available discounts and ensuring eligibility can lead to substantial savings.

Another strategy is to increase the deductible. A deductible is the amount the policyholder pays out of pocket before the insurance coverage kicks in. By opting for a higher deductible, car owners can reduce their insurance premiums. However, it's important to choose a deductible amount that is affordable and won't cause financial strain in the event of an accident.

The Importance of Safe Driving Habits

Maintaining a clean driving record is crucial for managing insurance costs. Insurance companies closely monitor driving behavior and history, and a clean record can lead to lower premiums. Avoiding traffic violations, such as speeding tickets or driving under the influence, is essential to keep insurance costs down.

Furthermore, adopting safe driving habits can not only reduce the risk of accidents but also potentially lower insurance premiums. This includes practicing defensive driving, avoiding aggressive maneuvers, and regularly maintaining the vehicle to ensure optimal performance and safety.

Future Outlook and Emerging Trends

Looking ahead, the insurance industry is likely to continue adapting to the changing landscape of the automotive sector. As self-driving and autonomous vehicles become more prevalent, insurance companies will need to adjust their risk assessment models and premium structures accordingly. Additionally, the increasing use of telematics and data-driven insurance models will likely become the norm, further personalizing insurance rates based on individual driving behaviors.

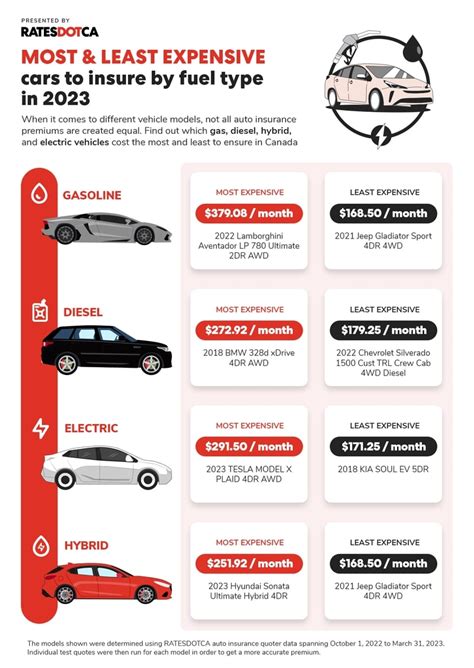

Furthermore, the focus on sustainability and electric vehicles (EVs) is expected to influence insurance pricing. EVs, while generally considered safer due to their lack of internal combustion engines, may face unique challenges in terms of repair and replacement costs. As the EV market matures, insurance providers will need to develop specific policies and pricing structures to accommodate these vehicles.

Frequently Asked Questions

How do insurance companies determine the cost of car insurance premiums?

+Insurance companies use a combination of factors to calculate car insurance premiums. These include the make, model, and year of the vehicle, the driver’s age, driving record, and location. Additionally, the type of coverage chosen and the insurance company’s policies play a role in determining the premium.

Can I negotiate car insurance prices with insurance companies?

+While insurance companies typically set their rates based on various factors, it is possible to negotiate or shop around for better deals. Comparing quotes from multiple providers can help identify more competitive rates. Additionally, discussing your specific needs and circumstances with an insurance agent may lead to tailored coverage options and potential discounts.

What are some common discounts available for car insurance policies?

+Common discounts for car insurance policies include good student discounts for young drivers with good academic records, safe driver discounts for those with clean driving records, and loyalty discounts for long-term customers. Additionally, having multiple vehicles insured with the same provider or bundling home and auto insurance policies can often result in discounts.

How does the use of telematics impact car insurance prices?

+Telematics devices track driving behavior, such as speed and acceleration. This data is used to assess the risk associated with a driver’s habits. Drivers who exhibit safe driving behaviors may qualify for discounts, while those with riskier driving patterns may face higher premiums. Usage-based insurance policies, which utilize telematics, offer a more personalized approach to insurance pricing.

Are there any emerging trends in car insurance that car owners should be aware of?

+One emerging trend is the increasing adoption of self-driving and autonomous vehicles. As these vehicles become more common, insurance companies will need to adapt their risk assessment models. Additionally, the focus on sustainability and the rise of electric vehicles may lead to specific insurance policies and pricing structures for these environmentally friendly cars.