Least Expensive Car Insurance Companies

Finding the least expensive car insurance can be a challenging task, as the cost of insurance varies greatly depending on numerous factors, including the insurer, your location, the type of vehicle, and your personal profile. However, there are certain companies that are known for offering competitive rates and affordable coverage options. In this comprehensive guide, we will explore some of the least expensive car insurance companies, their unique features, and the factors that contribute to their affordability. By understanding these companies and their offerings, you can make an informed decision to secure the best value for your insurance needs.

Exploring the Least Expensive Car Insurance Companies

When it comes to finding the most affordable car insurance, several companies stand out for their commitment to providing cost-effective coverage without compromising on quality. Let’s delve into some of these insurers and uncover the secrets behind their competitive pricing.

Geico: A Leader in Affordable Insurance

Geico, one of the largest insurance providers in the United States, has earned its reputation as a leader in affordable car insurance. With a strong focus on digital innovation and a vast network of agents, Geico offers a seamless and convenient experience for policyholders. Here’s a closer look at what makes Geico a top choice for budget-conscious drivers:

- Discounts Galore: Geico is renowned for its extensive range of discounts, making it easier for policyholders to save on their premiums. These discounts include multi-policy, good student, military, and even a discount for federal employees.

- Online Convenience: Geico’s online platform is highly user-friendly, allowing customers to manage their policies, make payments, and file claims with just a few clicks. This digital approach helps keep costs low and provides a hassle-free experience.

- Excellent Claims Process: Geico consistently receives high marks for its efficient and customer-centric claims process. With a dedicated team and a focus on quick resolutions, Geico ensures that policyholders can get back on the road promptly after an accident.

By combining competitive rates with a robust suite of discounts and a streamlined digital experience, Geico has solidified its position as one of the least expensive car insurance companies in the market.

State Farm: A Trusted Name with Affordable Options

State Farm, a well-established insurance provider with a rich history, offers a wide range of coverage options and is known for its competitive pricing. Here’s why State Farm often makes it onto the list of the least expensive car insurance companies:

- Local Agent Support: State Farm prides itself on its network of local agents who provide personalized guidance and support. This human touch can be especially beneficial for those who prefer face-to-face interactions and expert advice when choosing the right coverage.

- Flexible Payment Plans: State Farm understands the importance of financial flexibility and offers various payment options, including monthly, quarterly, or even annual plans. This adaptability ensures that policyholders can choose a payment schedule that aligns with their budget.

- Discounts for Loyalty: State Farm rewards loyal customers with discounts. Policyholders who maintain their coverage with State Farm for an extended period can enjoy reduced premiums, making it an attractive option for long-term planning.

State Farm’s commitment to providing affordable coverage, combined with its focus on customer service and loyalty rewards, makes it a top contender for those seeking the least expensive car insurance.

Progressive: A Pioneer in Online Insurance

Progressive, a pioneer in the digital insurance space, has revolutionized the way customers interact with their insurance provider. Here’s how Progressive has established itself as a go-to option for budget-conscious drivers:

- Name Your Price Tool: Progressive’s innovative “Name Your Price” tool allows customers to set their desired price range for insurance coverage. This unique feature empowers customers to take control of their budget and find the coverage that fits their needs.

- Snapshot Program: The Snapshot program is Progressive’s innovative approach to personalized pricing. By installing a small device in your vehicle, Progressive can analyze your driving habits and offer discounts based on safe driving practices. This data-driven approach rewards responsible drivers with lower premiums.

- Discounts for Bundling: Progressive encourages policyholders to bundle their insurance policies, such as combining auto and home insurance. By doing so, customers can enjoy significant savings, making Progressive an attractive option for those with multiple insurance needs.

With its focus on technology, personalized pricing, and bundling discounts, Progressive has solidified its position as one of the least expensive car insurance companies, offering both affordability and convenience.

Factors Influencing Car Insurance Costs

While the least expensive car insurance companies offer competitive rates, it’s essential to understand the factors that influence insurance costs. These factors can vary based on individual circumstances and location. Let’s explore some key elements that impact insurance premiums:

Location-Specific Factors

Insurance rates can vary significantly based on where you live. Factors such as population density, traffic congestion, and the incidence of accidents and thefts in your area can influence premiums. Urban areas often have higher insurance costs due to increased risk factors.

Additionally, state-specific laws and regulations can impact insurance rates. For instance, states with no-fault insurance laws typically have higher premiums, as they require insurers to provide more comprehensive coverage.

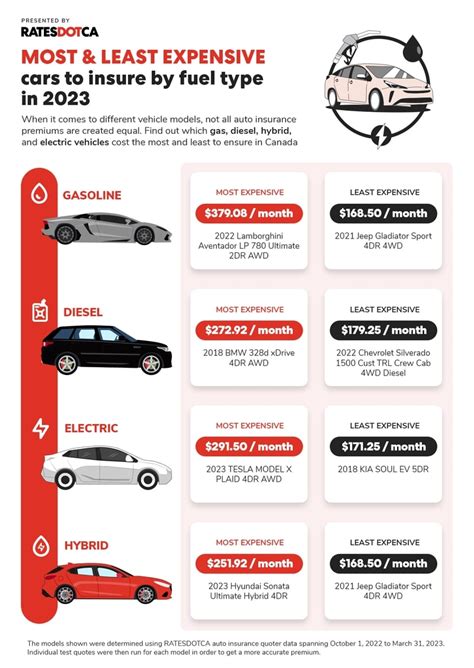

Vehicle Type and Usage

The type of vehicle you drive and how you use it can significantly affect your insurance costs. High-performance sports cars and luxury vehicles often come with higher insurance premiums due to their value and potential for higher repair costs.

Similarly, vehicles used for commercial purposes or those driven frequently may attract higher premiums. Insurers consider factors like annual mileage and the purpose of vehicle usage when determining rates.

Personal Profile and Driving History

Your personal profile, including age, gender, and marital status, can influence insurance costs. Young drivers, for instance, are often considered higher-risk and may face higher premiums. Additionally, your driving history plays a crucial role. A clean driving record with no accidents or violations can lead to more affordable insurance rates.

Coverage Options and Add-ons

The level of coverage you choose and any additional add-ons can impact your insurance costs. Comprehensive and collision coverage, for instance, provide broader protection but come at a higher cost. On the other hand, opting for higher deductibles can lower your premiums.

Optional add-ons like rental car reimbursement, roadside assistance, or gap insurance can also affect the overall cost of your policy.

Tips for Finding the Least Expensive Car Insurance

While the least expensive car insurance companies offer attractive rates, there are additional steps you can take to further reduce your insurance costs. Here are some valuable tips to consider:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shopping around and comparing quotes from multiple insurers is essential to finding the best deal. Online comparison tools can simplify this process, allowing you to quickly assess various options.

Bundle Your Insurance Policies

Many insurance companies offer discounts when you bundle multiple policies with them. Consider combining your auto insurance with other types of insurance, such as home or renters insurance, to take advantage of these savings.

Review Your Coverage Regularly

Insurance needs can change over time. Regularly reviewing your coverage and making necessary adjustments can help you maintain an optimal balance between affordability and adequate protection. Consider your current lifestyle, vehicle usage, and any life changes that may impact your insurance requirements.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep your insurance costs low. Avoid traffic violations and accidents, as these can lead to increased premiums. Safe driving not only keeps you and others on the road safe but also rewards you with more affordable insurance.

Conclusion: Making Informed Choices

Finding the least expensive car insurance is not just about identifying the cheapest provider; it’s about making informed choices that balance affordability with the coverage you need. By understanding the factors that influence insurance costs and exploring the unique offerings of the least expensive car insurance companies, you can make a well-rounded decision.

Remember, the right insurance provider should not only offer competitive rates but also provide excellent customer service, a seamless claims process, and personalized coverage options. Take the time to research, compare, and assess your options to ensure you find the best value for your insurance needs.

How can I get the best car insurance rates for my situation?

+To get the best car insurance rates, shop around and compare quotes from multiple insurers. Consider your specific needs and choose a policy that offers adequate coverage at an affordable price. Additionally, maintain a clean driving record, bundle policies for discounts, and regularly review your coverage to ensure it aligns with your changing circumstances.

What factors influence the cost of car insurance?

+The cost of car insurance is influenced by various factors, including your location, vehicle type, driving history, age, and the level of coverage you choose. Additionally, state-specific laws and regulations can impact insurance rates. It’s important to understand these factors to make informed decisions about your insurance coverage.

Are there any ways to lower my car insurance premiums?

+Yes, there are several ways to lower your car insurance premiums. Shop around for the best rates, bundle your policies with the same insurer for discounts, maintain a clean driving record, and consider increasing your deductible. Regularly reviewing your coverage and making necessary adjustments can also help you save money.