What Is Universal Life Insurance And How Does It Work

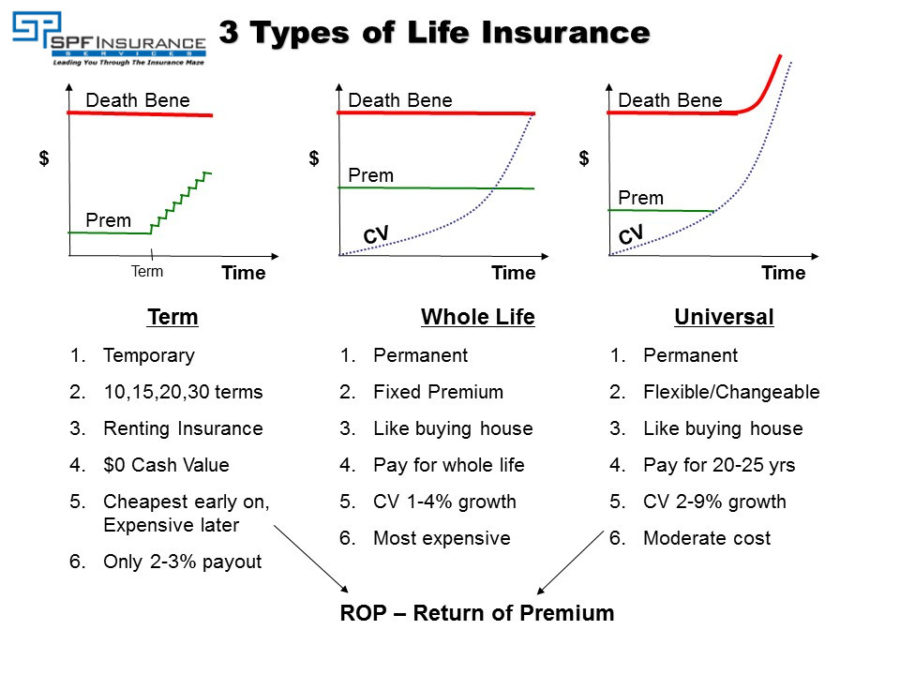

Universal life insurance is a flexible and customizable form of permanent life insurance that offers policyholders a wide range of options and benefits. Unlike term life insurance, which provides coverage for a specific period, universal life insurance is designed to offer lifelong protection while also providing a cash value component that can be accessed and utilized by the policyholder.

This type of insurance policy has gained popularity due to its adaptability and the potential for both financial security and investment growth. Understanding how universal life insurance works is crucial for individuals seeking comprehensive financial planning and long-term protection for their loved ones.

The Basics of Universal Life Insurance

Universal life insurance, often referred to as UL, is a versatile life insurance policy that combines death benefit coverage with a savings component. This unique feature allows policyholders to build cash value within their policy, which can be used for various financial purposes.

The cash value accumulates over time, and policyholders have the flexibility to adjust their premiums and death benefits as their financial situation and needs change. This adaptability is a key advantage of universal life insurance, as it enables individuals to tailor their coverage to their specific circumstances.

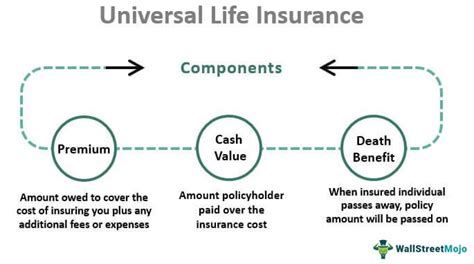

Key Components of Universal Life Insurance:

- Death Benefit: Similar to traditional life insurance, universal life insurance provides a death benefit to the beneficiaries upon the insured individual’s passing. This benefit is a guaranteed financial sum that can help cover funeral expenses, outstanding debts, and provide long-term financial support for the loved ones left behind.

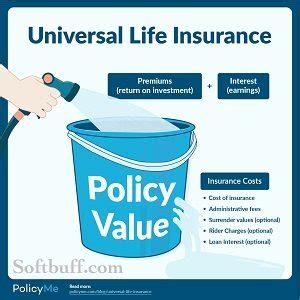

- Cash Value Accumulation: One of the distinctive features of universal life insurance is the cash value account. A portion of the premiums paid goes towards building this cash value, which earns interest over time. Policyholders can access this cash value through loans or withdrawals, subject to certain conditions and potential fees.

- Premium Flexibility: Universal life insurance policies offer policyholders the ability to adjust their premium payments. They can choose to pay a fixed premium amount or vary the payments based on their financial situation. This flexibility is particularly beneficial for individuals with fluctuating income levels.

- Investment Options: Many universal life insurance policies provide the option to invest a portion of the cash value in various investment vehicles, such as mutual funds or stock market indices. These investment choices can potentially enhance the growth of the policy’s cash value, but they also carry investment risks.

How Universal Life Insurance Works

Universal life insurance operates through a combination of premium payments, cash value accumulation, and policy charges. The policyholder pays premiums, which are then allocated to cover the cost of insurance (COI) and administrative fees, with the remaining amount contributing to the cash value.

The cost of insurance is determined by various factors, including the insured's age, health status, and life expectancy. Administrative fees cover the expenses associated with managing the policy, such as processing transactions and maintaining records.

The cash value grows over time, and policyholders can choose to invest a portion of it to potentially increase its value. However, it's important to note that investing carries risks, and the policyholder bears the responsibility for any investment losses.

Policyholders have the option to access their cash value through withdrawals or loans. Withdrawals reduce the death benefit and cash value, while loans must be repaid with interest. Both withdrawals and loans may have tax implications, so it's essential to consult with a financial advisor before making any decisions.

Policy Flexibility and Adjustments:

One of the significant advantages of universal life insurance is its flexibility. Policyholders can make adjustments to their coverage as their needs and circumstances change. They can increase or decrease the death benefit, adjust premium payments, or modify the investment strategy for their cash value.

For instance, if an individual experiences a financial hardship, they may choose to reduce their premium payments temporarily. On the other hand, during periods of financial stability, they can increase their premiums to accelerate cash value growth or maximize the death benefit.

| Policy Feature | Description |

|---|---|

| Death Benefit | Provides financial support to beneficiaries upon the insured's passing. |

| Cash Value Accumulation | Builds a cash value account that earns interest and can be accessed through loans or withdrawals. |

| Premium Flexibility | Allows policyholders to adjust premium payments based on their financial situation. |

| Investment Options | Offers the opportunity to invest a portion of the cash value for potential growth. |

Advantages and Considerations of Universal Life Insurance

Universal life insurance offers several advantages, making it a popular choice for those seeking comprehensive financial planning. Here are some key benefits and considerations to keep in mind:

Advantages:

- Lifetime Coverage: Universal life insurance provides lifelong protection, ensuring that your loved ones are financially secured even if you live a long life.

- Cash Value Accumulation: The ability to build cash value within the policy offers a potential source of funds for various financial needs, such as retirement planning or emergency expenses.

- Premium Flexibility: Policyholders can adjust their premium payments to align with their financial situation, providing greater control over their insurance coverage.

- Investment Opportunities: The investment component of universal life insurance allows for potential growth of the cash value, although it’s essential to carefully consider the associated risks.

- Policy Customization: Universal life insurance policies can be tailored to individual needs, making it a flexible option for those with unique financial circumstances.

Considerations:

- Cost: Universal life insurance policies often have higher premiums compared to term life insurance. It’s important to assess your financial situation and determine if the long-term benefits outweigh the initial costs.

- Investment Risk: The investment component of universal life insurance carries market risks. Policyholders should carefully evaluate their risk tolerance and consider seeking professional advice.

- Tax Implications: Withdrawals and loans from the cash value may have tax consequences. Understanding the tax implications is crucial when utilizing the cash value for financial purposes.

- Policy Management: Universal life insurance policies require active management and regular reviews to ensure they align with your changing financial goals and needs.

Conclusion

Universal life insurance is a powerful financial tool that offers both protection and potential investment growth. By understanding the key components, flexibility, and advantages of this insurance policy, individuals can make informed decisions to secure their financial future and provide long-term security for their loved ones.

Can I change the death benefit amount in a universal life insurance policy?

+Yes, one of the advantages of universal life insurance is its flexibility. Policyholders can adjust the death benefit amount to meet their changing needs. However, increasing the death benefit may require additional premium payments or impact the cash value growth.

Are there any tax benefits associated with universal life insurance?

+Universal life insurance policies offer certain tax advantages. The cash value growth within the policy is typically tax-deferred, meaning it accumulates without immediate tax implications. However, tax laws can vary, so it’s advisable to consult with a tax professional for detailed guidance.

What happens if I stop paying premiums on my universal life insurance policy?

+If you cease paying premiums on your universal life insurance policy, the policy may enter a grace period, allowing you a limited time to make the missed payment. If the grace period expires without payment, the policy may lapse, and you may lose both the death benefit and the cash value accumulated.