Best Rate Car Insurance

Car insurance is a crucial aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. While many insurance providers offer similar coverage options, the rates can vary significantly. In this comprehensive guide, we will delve into the world of car insurance, exploring the factors that influence rates and strategies to find the best deals.

Understanding Car Insurance Rates

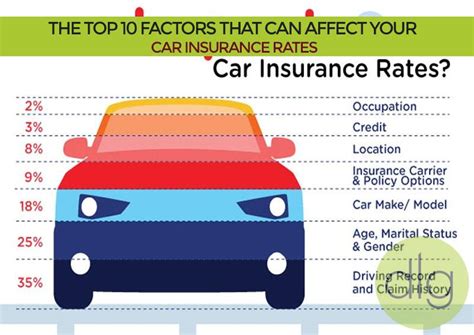

Car insurance rates are determined by a complex interplay of various factors, each contributing to the overall cost of coverage. Insurance companies use these factors to assess the risk associated with insuring a particular vehicle and driver. Here’s a breakdown of the key elements that influence car insurance rates:

1. Vehicle Factors

The type of car you drive plays a significant role in determining insurance rates. Insurance companies consider factors such as the make, model, and year of the vehicle. For instance, sports cars and luxury vehicles often attract higher premiums due to their expensive repair costs and higher risk of theft.

Additionally, the safety features of a car can impact insurance rates. Vehicles equipped with advanced safety technologies, such as lane departure warning systems and collision avoidance features, may be eligible for discounts. These features reduce the likelihood of accidents and subsequent insurance claims.

| Vehicle Safety Feature | Discount Potential |

|---|---|

| Anti-Lock Brakes | Up to 5% |

| Airbags | Up to 30% |

| Adaptive Cruise Control | Up to 10% |

| Collision Avoidance Systems | Up to 20% |

2. Driver Factors

The driver’s profile is a critical factor in insurance rate calculations. Insurance companies assess a driver’s risk based on their age, gender, driving history, and location. Young drivers, especially males, often face higher premiums due to their higher propensity for accidents and risky driving behaviors.

Driving history is another crucial factor. A clean driving record with no accidents or traffic violations can lead to significant discounts. Conversely, a history of accidents or moving violations can result in higher insurance rates.

Location also plays a role, as insurance companies consider regional factors such as crime rates, traffic congestion, and the likelihood of natural disasters. Drivers residing in areas with higher accident rates or frequent thefts may face higher insurance premiums.

3. Coverage and Deductibles

The level of coverage and the chosen deductibles can significantly impact insurance rates. Comprehensive and collision coverage, which provide protection for damage to the insured vehicle, generally cost more than liability-only coverage. Higher deductibles, which represent the amount the policyholder pays out of pocket before insurance coverage kicks in, can lead to lower premiums.

Insurance companies offer various coverage options, allowing policyholders to tailor their policies to their needs and budget. It’s essential to strike a balance between adequate coverage and affordable rates.

4. Discounts and Special Programs

Insurance companies often provide discounts and special programs to attract and retain customers. These discounts can substantially reduce insurance rates and are worth exploring. Some common discounts include:

- Multi-Policy Discounts: Bundling car insurance with other policies, such as homeowners or renters insurance, can result in significant savings.

- Good Student Discount: Students with a certain GPA or academic standing may be eligible for discounts, encouraging academic excellence.

- Safe Driver Discounts: Maintaining a clean driving record over a specified period can lead to lower rates.

- Telematics Discounts: Some insurance companies offer programs that monitor driving behavior through telematics devices. Safe driving habits can result in reduced premiums.

Strategies for Finding the Best Car Insurance Rates

Now that we understand the factors influencing car insurance rates, let’s explore some strategies to find the best deals and save money on coverage:

1. Compare Multiple Quotes

Obtaining multiple quotes from different insurance providers is essential to finding the best rates. Each company uses its own formula to calculate rates, so comparing quotes can reveal significant differences. Online comparison tools and insurance brokers can streamline the process, making it easier to find competitive rates.

2. Bundle Policies

Bundling multiple insurance policies, such as car insurance with homeowners or renters insurance, can lead to substantial savings. Insurance companies often offer multi-policy discounts, recognizing the convenience and loyalty of customers who choose them as their primary insurer.

3. Explore Discount Opportunities

As mentioned earlier, insurance companies offer various discounts. Take the time to research and understand the discounts available to you. From safe driver programs to good student discounts, there are numerous ways to reduce your insurance premiums.

Additionally, consider the safety features of your vehicle. If your car has advanced safety technologies, inform your insurance provider. You may be eligible for discounts that can significantly lower your insurance costs.

4. Maintain a Clean Driving Record

A clean driving record is crucial for obtaining affordable car insurance. Avoid accidents and traffic violations, as they can significantly increase your insurance rates. If you have a history of accidents or violations, consider taking defensive driving courses. Many insurance companies offer discounts for completing such courses, recognizing the commitment to safer driving.

5. Choose the Right Coverage

It’s essential to strike a balance between adequate coverage and affordable rates. Evaluate your needs and choose a coverage level that provides sufficient protection without breaking the bank. Consider your financial situation and the potential costs associated with accidents or repairs. Opting for higher deductibles can lower your premiums, but ensure you have the financial means to cover the deductible in case of a claim.

6. Shop Around Regularly

Insurance rates can change over time, and new providers may offer better deals. It’s beneficial to shop around regularly, at least once a year, to ensure you’re still getting the best rates. Insurance companies frequently update their rates and introduce new discounts, so staying informed can lead to significant savings.

Case Study: Finding the Best Rate

Let’s explore a real-life example to illustrate the process of finding the best car insurance rate. Meet Sarah, a 30-year-old professional with a clean driving record and a reliable sedan.

Sarah’s current insurance policy has served her well, but she’s curious if she can find better rates. She decides to explore her options and follows these steps:

- Research and Compare: Sarah begins by researching insurance providers in her area. She uses online comparison tools and seeks recommendations from friends and family. She gathers quotes from several reputable companies, ensuring she has a comprehensive understanding of the market.

- Explore Discounts: Sarah reviews the discounts offered by each insurance provider. She discovers that her current provider doesn’t offer a multi-policy discount, so she considers switching to a company that does. Additionally, she learns about a safe driver discount and decides to inquire about it.

- Bundle Policies: Sarah already has homeowners insurance, so she explores the possibility of bundling it with her car insurance. She finds that by doing so, she can save a significant amount on her overall insurance premiums.

- Negotiate and Switch: Armed with the knowledge of competitive rates and discounts, Sarah negotiates with her current insurance provider. She presents the quotes she obtained and discusses the potential savings from bundling policies. Her current provider matches the rates, and she decides to stay with them, benefiting from the convenience of a single insurer.

By following these steps, Sarah successfully secured a better car insurance rate while maintaining her loyalty to a trusted provider. Her experience highlights the importance of researching, comparing, and leveraging discounts to find the best deals.

Conclusion: Empowering Drivers to Save

Car insurance is an essential aspect of responsible vehicle ownership, providing financial protection and peace of mind. By understanding the factors that influence insurance rates and employing strategic approaches, drivers can find the best deals and save money on their coverage. From comparing multiple quotes to exploring discounts and maintaining a clean driving record, there are numerous ways to reduce insurance costs.

Remember, car insurance is a vital investment, and finding the right coverage at an affordable rate is crucial. By staying informed, shopping around, and taking advantage of available discounts, drivers can make informed decisions and ensure they are adequately protected without breaking the bank.

How often should I review my car insurance policy and rates?

+It’s recommended to review your car insurance policy and rates at least once a year. Insurance rates can change, and new discounts may become available. By regularly reviewing your policy, you can ensure you’re still getting the best value and take advantage of any updates or improvements in the market.

Can I negotiate my car insurance rates with my provider?

+Yes, you can negotiate your car insurance rates with your provider. Many insurance companies are open to discussions and may be willing to match or beat competitors’ rates to retain your business. Gather quotes from other providers and present them to your insurer to initiate negotiations.

What factors can I control to lower my car insurance rates?

+There are several factors within your control that can influence your car insurance rates. Maintaining a clean driving record, avoiding accidents and traffic violations, and completing defensive driving courses can lead to lower premiums. Additionally, choosing a vehicle with advanced safety features and exploring available discounts can significantly impact your insurance costs.