Best Texas Insurance Rates

When it comes to insurance, finding the best rates is a top priority for many individuals and businesses alike. Texas, known for its diverse landscapes and vibrant communities, offers a wide range of insurance options. This article aims to explore the factors that influence insurance rates in the Lone Star State and guide you towards securing the most advantageous coverage.

Understanding Insurance Rates in Texas

Insurance rates in Texas are determined by a complex interplay of various factors, each playing a significant role in the final cost of coverage. From personal circumstances to geographic location, these elements can greatly impact the premiums you pay. Let’s delve into the key factors that shape insurance rates in the state.

Personal Factors: A Unique Profile

Your personal circumstances are a crucial determinant of insurance rates. Age, gender, marital status, and even credit score can influence the cost of your coverage. For instance, younger individuals often pay higher premiums due to their perceived higher risk of accidents. Similarly, individuals with a poor credit history may face higher rates as credit scores are often used as an indicator of responsibility.

Additionally, your driving record plays a pivotal role. A clean driving history can lead to significant discounts, while multiple violations or accidents can result in higher premiums. Insurance companies carefully assess these factors to gauge the level of risk associated with insuring you.

| Personal Factor | Impact on Rates |

|---|---|

| Age | Younger drivers often pay more due to higher risk |

| Gender | Insurance rates can vary based on gender |

| Marital Status | Married individuals may enjoy lower rates |

| Credit Score | A lower credit score can result in higher premiums |

| Driving Record | Clean record leads to discounts; violations increase rates |

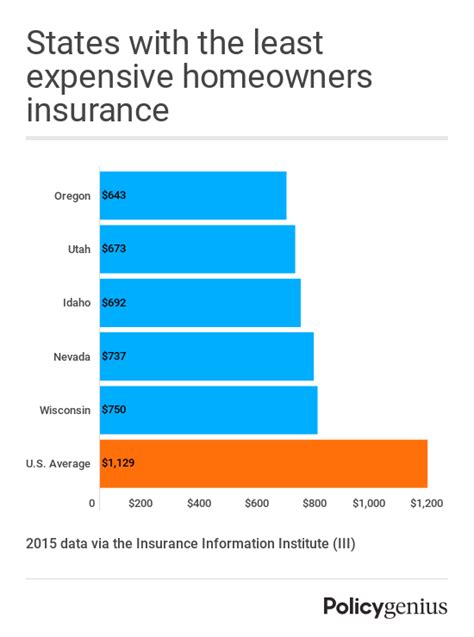

The Role of Geographic Location

Where you live in Texas can significantly impact your insurance rates. Certain areas may be more prone to natural disasters, such as hurricanes or tornadoes, which can increase the risk and, consequently, the cost of insurance. Additionally, crime rates and traffic congestion can also influence rates. For instance, areas with higher theft rates may result in higher comprehensive insurance premiums.

The density of the population can also play a role. Urban areas often experience higher rates of accidents and claims, leading to increased premiums. In contrast, rural areas may offer more affordable rates due to lower traffic volumes and a reduced risk of accidents.

Vehicle Factors: Make, Model, and Usage

The type of vehicle you drive and how you use it can greatly affect your insurance rates. More expensive vehicles generally have higher premiums due to the cost of repairs and replacement parts. Sports cars and luxury vehicles, known for their performance and higher accident risks, often command higher insurance rates.

The frequency and purpose of your vehicle usage also matter. If you primarily use your vehicle for work or long-distance commuting, you may face higher rates due to the increased mileage and potential exposure to risks. Conversely, if you only use your vehicle occasionally or for pleasure, you may be eligible for lower rates.

| Vehicle Factor | Impact on Rates |

|---|---|

| Vehicle Type | Expensive or high-performance vehicles cost more to insure |

| Usage | Frequent driving for work or commuting may result in higher rates |

| Mileage | Higher mileage can increase insurance costs |

Insurance Company and Policy Type

The insurance company you choose and the type of policy you opt for can significantly influence your rates. Different insurance providers offer varying levels of coverage and pricing structures. It’s essential to shop around and compare quotes from multiple companies to find the best deal that suits your needs.

The type of policy you select also plays a role. Comprehensive policies, which offer broader coverage, tend to be more expensive than basic liability-only policies. However, the level of coverage you require will depend on your personal circumstances and the value of your assets.

Discounts and Bundling

Insurance companies often offer a range of discounts to attract and retain customers. These discounts can significantly reduce your insurance rates. Common discounts include those for safe driving records, multi-policy bundling (insuring multiple vehicles or combining auto and home insurance), and loyalty discounts for long-term customers.

Additionally, certain safety features on your vehicle can qualify you for discounts. Anti-theft devices, advanced driver assistance systems, and other safety enhancements may lower your insurance rates as they reduce the risk of accidents and claims.

Securing the Best Insurance Rates in Texas

Now that we’ve explored the key factors influencing insurance rates in Texas, let’s delve into some practical strategies to help you secure the best deals.

Shop Around and Compare Quotes

One of the most effective ways to find the best insurance rates is to compare quotes from multiple providers. Each insurance company has its own rating system and pricing structure, so shopping around can reveal significant variations in premiums. Online comparison tools and insurance brokers can be invaluable resources for this task.

When comparing quotes, ensure you're comparing like-for-like policies. Different providers may offer varying levels of coverage, so it's crucial to understand the exact terms and conditions of each policy to make an accurate comparison.

Understand Your Coverage Needs

Determining the right level of coverage is essential to getting the best insurance rates. While it may be tempting to opt for the cheapest policy, it’s important to ensure you have adequate coverage to protect your assets and meet legal requirements.

Consider your personal circumstances and the value of your assets. Do you own a home or valuable possessions that need to be insured? Are there specific risks in your area that you need to mitigate? Assessing your coverage needs will help you find the right balance between cost and protection.

Explore Discounts and Bundle Policies

As mentioned earlier, insurance companies offer a range of discounts that can significantly reduce your premiums. Take the time to understand the discounts available and ensure you’re taking advantage of them. Safe driving records, loyalty programs, and multi-policy bundling are some of the most common ways to save.

Bundling your policies, such as combining auto and home insurance, can lead to substantial savings. Many insurance companies offer bundled discounts, so it's worth exploring this option to reduce your overall insurance costs.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance rates. A clean driving history can lead to significant discounts, while violations and accidents can result in higher premiums. It’s essential to drive safely and responsibly to maintain a positive record.

If you have a history of violations or accidents, consider taking defensive driving courses or other programs that can help improve your driving skills and reduce your insurance costs. Many insurance companies offer discounts for completing these courses.

Consider Telematics Insurance

Telematics insurance, also known as usage-based insurance, is an innovative approach that uses technology to monitor your driving behavior and reward safe driving habits. By installing a small device in your vehicle or using a smartphone app, insurance companies can track your driving patterns, including speed, acceleration, and mileage.

Telematics insurance can be a great option for safe drivers, as it allows you to demonstrate your responsible driving habits and potentially receive significant discounts. However, it's important to understand that your driving behavior will be closely monitored, and any risky driving could result in higher premiums.

Regularly Review and Adjust Your Policy

Insurance needs can change over time, so it’s essential to regularly review your policy and ensure it still meets your requirements. Life events such as marriage, buying a home, or starting a family can significantly impact your insurance needs. Regular policy reviews will help you stay adequately covered and identify opportunities to reduce your premiums.

Additionally, insurance rates can fluctuate, and you may find better deals as you renew your policy. By regularly comparing quotes and shopping around, you can ensure you're getting the most competitive rates available.

Conclusion: Navigating Insurance Rates in Texas

Securing the best insurance rates in Texas involves understanding the key factors that influence premiums and taking proactive steps to find the most advantageous coverage. From personal circumstances to geographic location and vehicle factors, each element plays a role in determining your insurance costs.

By shopping around, comparing quotes, and understanding your coverage needs, you can make informed decisions to secure the best insurance rates. Additionally, exploring discounts, maintaining a clean driving record, and considering innovative options like telematics insurance can further enhance your savings.

Remember, insurance is a vital aspect of financial protection, and finding the right coverage at the best rates is essential to your overall financial well-being. With the right approach and a thorough understanding of the factors at play, you can navigate the insurance landscape in Texas with confidence and secure the coverage you need at a price that suits your budget.

How do I find the best auto insurance rates in Texas?

+To find the best auto insurance rates in Texas, compare quotes from multiple providers, assess your coverage needs, and explore discounts. Shopping around is crucial, as rates can vary significantly between companies. Additionally, consider bundling policies and maintaining a clean driving record to qualify for lower premiums.

What factors influence home insurance rates in Texas?

+Home insurance rates in Texas are influenced by factors such as the location and construction of your home, the value of your possessions, and the level of coverage you require. Natural disaster risks, crime rates, and the age and condition of your home can also impact premiums. Shopping around and comparing quotes is essential to finding the best rates.

Are there any discounts available for health insurance in Texas?

+Yes, there are various discounts available for health insurance in Texas. These may include discounts for healthy lifestyles, such as non-smoker or fitness program discounts. Some insurance companies also offer discounts for maintaining a healthy weight or participating in wellness programs. Additionally, bundling health insurance with other policies can lead to savings.

Can I reduce my insurance rates by improving my credit score?

+Improving your credit score can indeed lead to lower insurance rates. Many insurance companies use credit-based insurance scores to assess risk, and a higher credit score may result in more favorable premiums. However, the impact of credit score on insurance rates can vary, and it’s important to note that other factors, such as driving record and claims history, also play a significant role.