Best Type Of Life Insurance

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. With various types of life insurance policies available, it can be challenging to determine which one is the best fit for your specific needs. This comprehensive guide aims to explore the different life insurance options, their unique features, and how they can benefit you and your family.

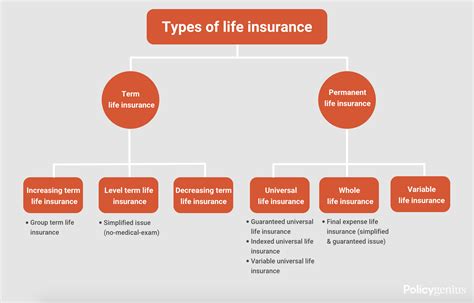

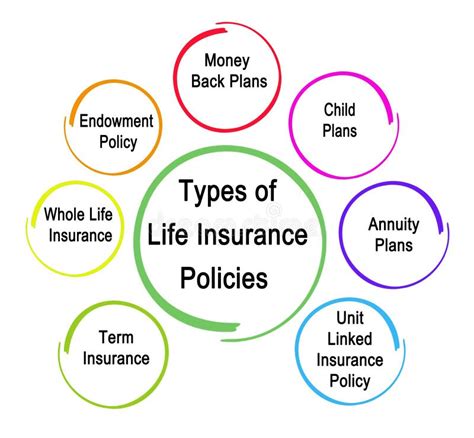

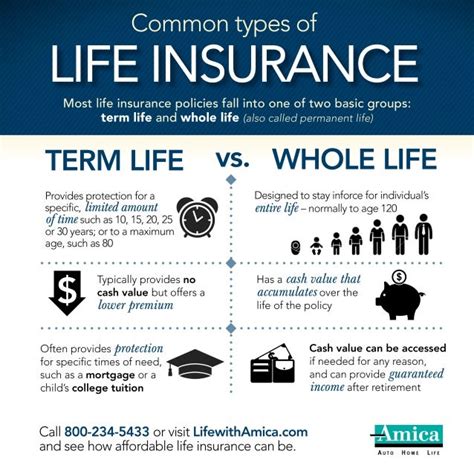

Understanding the Basics: Types of Life Insurance

The world of life insurance offers a range of options, each designed to cater to distinct financial goals and life stages. Let’s delve into the primary types of life insurance policies and their key characteristics.

Term Life Insurance

Term life insurance is a straightforward and affordable option, providing coverage for a specific period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a tax-free lump sum. Here’s a breakdown of its key features:

- Affordability: Term life insurance is known for its low premiums, making it an accessible choice for many.

- Coverage Period: The policy’s term is fixed, and it does not build cash value.

- Flexibility: You can choose the coverage amount and term length to suit your needs.

- No Investment Component: This type of insurance is purely for protection, without any investment aspect.

Whole Life Insurance

Whole life insurance, often referred to as permanent life insurance, provides coverage for the policyholder’s entire life, as long as premiums are paid. It combines a death benefit with a cash value component, offering a range of benefits:

- Lifetime Coverage: The policy remains active as long as premiums are paid, providing lifelong peace of mind.

- Cash Value Accumulation: A portion of the premiums goes into a cash value account, which earns interest over time.

- Tax Advantages: The cash value grows tax-deferred, and withdrawals or loans against the cash value may be tax-free.

- Fixed Premiums: Premium payments remain consistent throughout the policy.

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance option that offers more control over premiums and death benefits. It provides the policyholder with the freedom to adjust their premiums and death benefit amounts, subject to certain limits:

- Flexibility: You can adjust your premiums and death benefit amounts based on your needs and financial situation.

- Cash Value: Similar to whole life insurance, universal life policies have a cash value component that grows tax-deferred.

- Premium Payment Options: You can choose to pay premiums regularly or make a single premium payment.

- Coverage Duration: The policy remains active as long as there are sufficient funds in the cash value account to cover the cost of insurance.

Indexed Universal Life Insurance

Indexed universal life insurance is a variation of universal life insurance that ties the policy’s cash value growth to a stock market index, typically the S&P 500. This type of policy offers the potential for higher returns while providing protection against market downturns:

- Index-Linked Growth: The cash value grows based on the performance of the chosen index, offering the potential for higher returns.

- Protection from Market Risk: If the index performs poorly, the policy’s cash value is still guaranteed to grow at a minimum rate.

- Flexible Premiums: Like universal life insurance, you can adjust your premiums and death benefit amounts.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a specialized policy designed for individuals who may have difficulty obtaining traditional life insurance due to health or age-related factors. It offers simplified underwriting and guaranteed acceptance:

- Guaranteed Acceptance: No medical exam or health questions are required, ensuring coverage for everyone.

- Limited Coverage: The policy typically has lower coverage amounts and higher premiums compared to traditional life insurance.

- Two-Year Waiting Period: There is often a two-year waiting period before the full death benefit is paid out. If the policyholder passes away during this period, only the premiums paid plus interest are paid out.

Choosing the Right Policy: Factors to Consider

Selecting the best life insurance policy involves evaluating your unique circumstances and financial goals. Here are some key factors to consider when making your decision:

Your Financial Goals

Assess your financial objectives. Do you want to provide financial security for your family in the event of your untimely death? Are you looking to cover specific expenses, such as mortgage payments or your children’s education? Understanding your financial goals will help narrow down the most suitable policy type.

Coverage Amount and Term

Determine the amount of coverage you need to meet your financial obligations. Consider your outstanding debts, such as mortgages or loans, as well as the financial needs of your dependents. Additionally, decide on the term length that aligns with your life stage and financial planning.

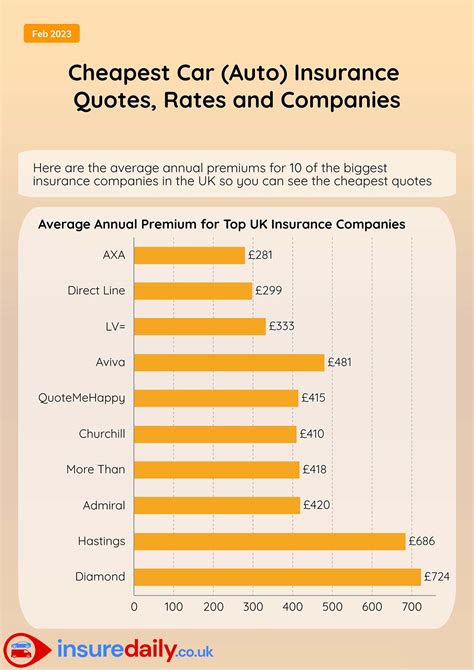

Budget and Premium Payments

Evaluate your budget and the affordability of the premiums. Term life insurance typically offers the most cost-effective option, while permanent life insurance policies may require higher premium payments. Assess your financial situation and choose a policy that aligns with your budget.

Health and Lifestyle Factors

Your health and lifestyle can impact the type of policy you qualify for and the premiums you pay. If you have pre-existing health conditions or engage in high-risk activities, certain policies may be more accessible or offer better rates. It’s essential to disclose all relevant information to ensure accurate coverage and premium rates.

Investment vs. Protection

Consider whether you prioritize the investment component of a policy or are solely focused on protection. Whole life and universal life insurance policies offer both death benefits and cash value accumulation, providing a savings element. Term life insurance, on the other hand, is purely for protection and does not build cash value.

Benefits and Drawbacks: A Comparative Analysis

Each type of life insurance policy comes with its own set of advantages and potential drawbacks. Let’s explore a comparative analysis to help you make an informed decision.

| Policy Type | Pros | Cons |

|---|---|---|

| Term Life Insurance |

|

|

| Whole Life Insurance |

|

|

| Universal Life Insurance |

|

|

| Indexed Universal Life Insurance |

|

|

| Guaranteed Issue Life Insurance |

|

|

Real-Life Examples and Success Stories

Let’s explore some real-life scenarios to illustrate how different life insurance policies have benefited individuals and their families.

Scenario 1: Young Family with Term Life Insurance

John and Emily, a young couple with two children, opted for term life insurance. With a 20-year term and a coverage amount of $500,000 each, they ensured their family’s financial stability in the event of their untimely death. The affordable premiums allowed them to protect their family without straining their budget.

Scenario 2: Business Owner with Whole Life Insurance

Sarah, a successful business owner, chose whole life insurance to provide financial security for her family and business. With a $1 million coverage amount, she ensured her family’s financial well-being and used the policy’s cash value to fund her business ventures, taking advantage of the tax-deferred growth.

Scenario 3: High-Net-Worth Individual with Universal Life Insurance

Michael, a high-net-worth individual, selected universal life insurance for its flexibility. He adjusted his premiums and coverage amounts as his financial situation changed, ensuring his policy remained aligned with his needs. The cash value accumulation allowed him to build wealth and pass it on to his heirs tax-free.

Scenario 4: Senior Citizen with Guaranteed Issue Life Insurance

Linda, a senior citizen with health concerns, chose guaranteed issue life insurance to provide peace of mind for her family. With no medical exam required, she secured a $25,000 policy to cover her final expenses and leave a small legacy for her loved ones.

Expert Insights and Recommendations

Life insurance is an essential tool for financial planning, and choosing the right policy can provide invaluable protection for you and your loved ones. By understanding the different types of life insurance and their unique features, you can make a well-informed decision that aligns with your financial goals and life stage.

Frequently Asked Questions

What is the average cost of life insurance?

+The cost of life insurance varies based on several factors, including your age, health, lifestyle, and the type of policy you choose. On average, term life insurance premiums range from 20 to 30 per month for a $500,000 policy for a healthy individual in their 30s. Whole life and universal life insurance policies typically have higher premiums due to their lifetime coverage and cash value accumulation.

Can I switch from term life insurance to a permanent policy later on?

+Yes, you can convert your term life insurance policy to a permanent policy, such as whole life or universal life, within a certain timeframe specified in your policy contract. This option allows you to maintain coverage and potentially take advantage of the investment benefits of permanent life insurance.

How do I choose the right coverage amount for my life insurance policy?

+Determining the right coverage amount involves assessing your financial obligations and the needs of your dependents. Consider factors such as outstanding debts, mortgage payments, children’s education expenses, and any other financial goals you want to achieve. A financial advisor can help you calculate the appropriate coverage amount based on your unique circumstances.

What happens if I miss a premium payment for my life insurance policy?

+Missing a premium payment can have different consequences depending on the type of policy you have. For term life insurance, missing a payment may result in the policy lapsing, and you will need to reapply for coverage. Whole life and universal life policies often have a grace period of 30-60 days, allowing you to make the missed payment without any penalties. If you consistently miss payments, the policy may lapse or be converted to a reduced paid-up policy.

Can I borrow money from the cash value of my life insurance policy?

+Yes, you can borrow money from the cash value of whole life or universal life insurance policies. This is known as taking a policy loan. The loan amount is typically limited to the cash value of the policy, and it accrues interest. Keep in mind that if the loan is not repaid, the policy’s death benefit will be reduced by the outstanding loan amount plus interest.