State Farms Insurance

Welcome to an in-depth exploration of one of America's leading insurance providers, State Farm Insurance. With a rich history spanning over a century, State Farm has established itself as a trusted name in the industry, offering a comprehensive range of insurance products and services. This article delves into the company's origins, its evolution, and the key factors that have contributed to its success, while also examining its current market position and future prospects.

A Legacy of Innovation: The State Farm Story

State Farm Insurance was founded in 1922 by George J. Mecherle, an innovative agriculturalist-turned-insurance entrepreneur. Mecherle’s vision was to create an insurance company that prioritized the needs of policyholders, offering affordable and accessible coverage. The company’s early success was built on the foundation of providing auto insurance to farmers and rural residents, a demographic often overlooked by other insurers.

Over the decades, State Farm has grown exponentially, expanding its product offerings to include not just auto insurance, but also homeowners, life, health, and business insurance. The company's commitment to innovation has been a driving force, with State Farm often leading the industry in adopting new technologies and business practices. This commitment has resulted in numerous industry firsts, such as the introduction of drive-in claims service in the 1940s and the launch of one of the first successful television advertising campaigns in the insurance industry.

A Pioneer in Customer Service

State Farm’s dedication to customer service is legendary. The company was one of the first to establish a national network of local agents, providing personalized service and expertise to policyholders. This model, which has since become an industry standard, allowed State Farm to build strong relationships with its customers, ensuring their loyalty and trust.

State Farm's agents are not just sales representatives; they are trusted advisors, providing guidance and support to policyholders throughout their insurance journey. This approach has not only contributed to the company's success but has also set a high bar for customer service in the insurance industry.

Financial Strength and Stability

State Farm’s financial strength and stability are cornerstone aspects of its success. The company has consistently maintained an A++ rating from AM Best, the highest possible rating, which reflects its strong financial position and ability to meet its obligations to policyholders.

This financial stability has allowed State Farm to weather economic downturns and market fluctuations, ensuring the continued protection of its policyholders. Additionally, it has enabled the company to invest in research and development, technology, and employee training, further solidifying its position as an industry leader.

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A++ (Superior) |

| Standard & Poor's | AA- (Very Strong) |

| Moody's | Aa2 (High Quality) |

The State Farm Product Suite: Comprehensive Coverage

State Farm offers a comprehensive range of insurance products to meet the diverse needs of its customers. Here’s a glimpse into its product portfolio:

Auto Insurance

State Farm’s auto insurance is a cornerstone of its business, offering a wide range of coverage options tailored to individual needs. From liability and collision coverage to comprehensive and gap insurance, State Farm provides protection for a variety of vehicles, including cars, motorcycles, and RVs. The company’s Drive Safe & Save™ program also rewards safe drivers with discounts, further incentivizing responsible driving habits.

Homeowners Insurance

State Farm’s homeowners insurance policies provide protection for one of the most significant investments many individuals make: their homes. The company offers various coverage options, including protection for the structure of the home, personal belongings, and liability. State Farm also provides optional endorsements for additional coverage, such as water backup and identity restoration.

Life Insurance

State Farm’s life insurance products offer policyholders and their families financial security and peace of mind. The company provides term life insurance, which offers coverage for a specified period, as well as permanent life insurance, which provides lifelong coverage and builds cash value. State Farm’s life insurance policies can be tailored to meet individual needs, whether it’s covering final expenses, providing income replacement, or building a legacy.

Health Insurance

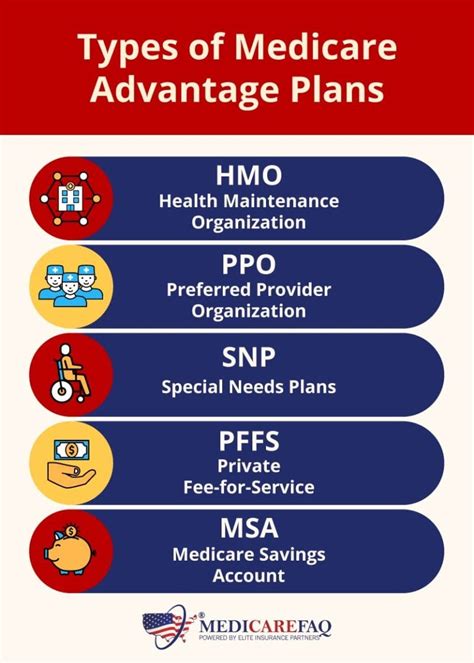

State Farm’s health insurance offerings include a range of medical and supplemental health plans. The company provides major medical insurance, which covers the cost of medical care, as well as supplemental plans like accident, critical illness, and hospital indemnity insurance. These plans can help fill gaps in traditional health insurance coverage, providing additional financial protection during times of illness or injury.

Business Insurance

State Farm’s business insurance solutions are designed to protect small businesses and startups. The company offers a range of coverage options, including general liability insurance to protect against third-party claims, property insurance to cover business assets, and workers’ compensation insurance to provide medical benefits and wage replacement to employees injured on the job. State Farm’s business insurance policies can be customized to meet the unique needs of different industries and businesses.

Technology and Innovation: Driving the Future

State Farm continues to lead the industry in adopting new technologies and innovative business practices. The company’s digital transformation efforts have been significant, with a focus on enhancing the customer experience and streamlining processes.

Digital Platforms and Tools

State Farm has invested heavily in developing robust digital platforms and tools to serve its customers better. The State Farm® Mobile app, for instance, allows policyholders to manage their insurance needs on the go, from paying bills and viewing policy details to reporting claims and accessing digital ID cards. The app also features a range of innovative tools, such as the Digital Discount Center, which provides personalized discounts and savings opportunities.

Additionally, State Farm has implemented a range of online and digital tools for its agents, empowering them to better serve their clients. These tools include online quoting and policy management systems, as well as digital claim management platforms, ensuring efficient and effective service delivery.

Data Analytics and AI

State Farm has embraced data analytics and artificial intelligence (AI) to improve its operations and customer experience. The company uses advanced analytics to identify trends, optimize pricing, and improve underwriting accuracy. AI-powered chatbots and virtual assistants have also been implemented to provide 24⁄7 support to policyholders, answering common questions and guiding them through simple tasks.

Collaborations and Partnerships

State Farm has a history of collaborating with other industry leaders and startups to innovate and improve its services. The company has partnered with ride-sharing platforms like Lyft and Uber to offer specialized insurance coverage for drivers, as well as with technology companies to develop advanced driver assistance systems (ADAS) and autonomous vehicle technologies.

The State Farm Difference: A Commitment to Community

Beyond its insurance offerings and technological advancements, State Farm has a strong commitment to community involvement and social responsibility. The company’s culture of giving back is deeply rooted in its values and is a significant aspect of its corporate social responsibility (CSR) initiatives.

Community Engagement

State Farm actively supports and engages with the communities it serves. The company’s agents and employees regularly participate in local volunteer initiatives, supporting a wide range of causes, from education and youth development to disaster relief and environmental conservation. State Farm also sponsors numerous community events and programs, further strengthening its connections with local communities.

Philanthropic Initiatives

State Farm’s philanthropic efforts are extensive, with a focus on education, youth development, and disaster relief. The company’s signature philanthropic program, State Farm Neighborhood of Good®, provides grants and sponsorships to local organizations and initiatives that align with its core values. Through this program, State Farm has supported countless community projects, empowering individuals and transforming communities.

Environmental Sustainability

State Farm is committed to environmental sustainability and has implemented various initiatives to reduce its environmental footprint. The company has set ambitious goals to achieve carbon neutrality and has made significant strides in reducing waste, conserving energy, and promoting sustainable practices across its operations. State Farm’s commitment to sustainability extends to its products and services, with a focus on offering eco-friendly options and supporting green initiatives.

The Future of State Farm: Navigating Industry Trends

As the insurance industry continues to evolve, State Farm is well-positioned to navigate emerging trends and challenges. The company’s commitment to innovation, technological advancement, and community engagement will continue to drive its success in the years to come.

The Rise of Insurtech

The emergence of insurtech startups and technologies is reshaping the insurance landscape. State Farm has embraced this trend, partnering with insurtech companies and developing its own innovative solutions. The company’s focus on digital transformation and data analytics positions it well to capitalize on the opportunities presented by insurtech, enhancing its efficiency, customer experience, and overall competitiveness.

Climate Change and Catastrophic Events

The increasing frequency and severity of natural disasters and catastrophic events due to climate change present significant challenges for the insurance industry. State Farm, with its strong financial position and commitment to sustainability, is well-equipped to navigate these challenges. The company’s focus on resilience and adaptation, coupled with its community engagement initiatives, will help it continue to protect its policyholders and support the communities it serves.

The Future of Work and Remote Operations

The shift towards remote work and digital operations, accelerated by the COVID-19 pandemic, has had a significant impact on the insurance industry. State Farm has successfully adapted to this new reality, implementing robust remote work policies and digital collaboration tools. The company’s focus on employee well-being and digital transformation ensures it remains agile and responsive to changing work dynamics, positioning it for long-term success.

Industry Consolidation and Competition

The insurance industry is experiencing consolidation, with larger carriers acquiring smaller players to gain market share and economies of scale. State Farm, with its strong brand recognition, financial strength, and comprehensive product suite, is well-positioned to compete in this consolidating market. The company’s focus on innovation, customer service, and community involvement will continue to set it apart and drive its success in the face of increasing competition.

How does State Farm compare to other major insurance providers in terms of financial strength and stability?

+State Farm’s financial strength and stability are among the highest in the industry. With an A++ rating from AM Best, it surpasses many of its competitors in terms of financial security and ability to meet its obligations. This rating, combined with State Farm’s robust financial position and commitment to innovation, sets it apart as a leader in the insurance market.

What makes State Farm’s customer service stand out compared to other insurance companies?

+State Farm’s commitment to customer service is legendary. The company’s network of local agents provides personalized advice and support, building strong relationships with policyholders. This approach, combined with State Farm’s focus on innovation and digital transformation, ensures an exceptional customer experience that sets it apart from competitors.

How does State Farm innovate to stay ahead in the rapidly changing insurance industry?

+State Farm embraces innovation through its digital transformation initiatives, data analytics, and partnerships with insurtech companies. The company’s focus on enhancing the customer experience, streamlining processes, and leveraging technology ensures it remains competitive and well-positioned to capitalize on emerging industry trends.

What is State Farm’s approach to environmental sustainability and corporate social responsibility (CSR)?

+State Farm is committed to environmental sustainability and CSR. The company has set ambitious goals for carbon neutrality and has implemented various initiatives to reduce its environmental footprint. State Farm’s philanthropic efforts, focused on education, youth development, and disaster relief, further demonstrate its commitment to making a positive impact on the communities it serves.