Best Us Health Insurance

Navigating the complex world of health insurance in the United States can be daunting, but finding the best coverage for your needs is crucial. With a myriad of options available, it's essential to understand the key factors that determine the quality and suitability of a health insurance plan. In this comprehensive guide, we will delve into the critical aspects of selecting the best US health insurance, providing you with the knowledge to make an informed decision.

Understanding Your Health Insurance Needs

The first step in choosing the best health insurance is recognizing your unique healthcare requirements. Factors such as your age, current health status, family size, and anticipated medical needs play a significant role in determining the most suitable plan. For instance, a young, healthy individual may prioritize affordability and basic coverage, while a family with older members might require more comprehensive benefits and specialized care options.

Assessing Coverage Options

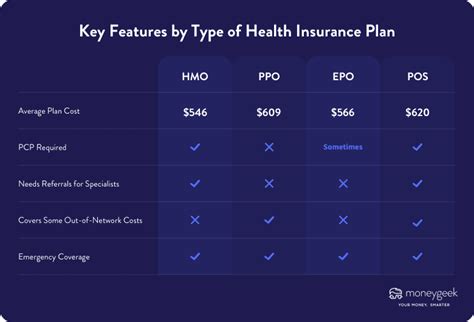

Health insurance plans offer a range of coverage options, each with its own set of advantages and limitations. Common types include:

- HMO (Health Maintenance Organization) plans typically provide comprehensive coverage but may restrict your choice of healthcare providers to those within the network.

- PPO (Preferred Provider Organization) plans offer more flexibility in provider choice but often come with higher costs.

- POS (Point of Service) plans combine features of both HMO and PPO plans, allowing you to choose between in-network and out-of-network providers.

- EPO (Exclusive Provider Organization) plans are similar to PPO plans but typically do not cover out-of-network care, except in emergencies.

Understanding these plan types and their specific coverage details is crucial in making an informed decision.

Evaluating Plan Costs

The cost of health insurance is a significant consideration. Factors such as premiums, deductibles, copayments, and out-of-pocket maximums can vary widely between plans. It's essential to analyze these costs in relation to your expected healthcare needs to find a plan that offers the best value.

| Cost Component | Description |

|---|---|

| Premium | The amount you pay monthly to maintain your insurance coverage. |

| Deductible | The amount you must pay out of pocket before your insurance starts covering costs. |

| Copayment | A fixed amount you pay for specific services, such as doctor visits or prescriptions. |

| Out-of-Pocket Maximum | The maximum amount you'll pay in a year for covered services before your insurance covers 100% of costs. |

Key Factors in Choosing the Best Health Insurance

When evaluating health insurance plans, several critical factors come into play. These include:

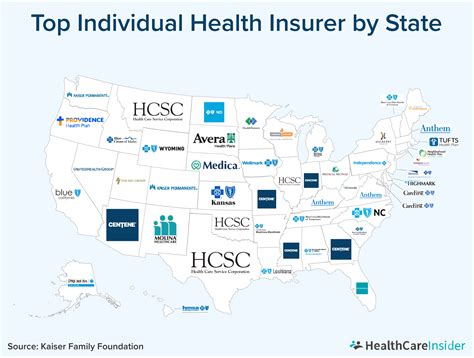

Network of Providers

The network of healthcare providers affiliated with your insurance plan is a crucial consideration. Ensure that your preferred doctors, specialists, and hospitals are included in the plan's network to avoid unexpected out-of-network charges. Some plans also offer out-of-state coverage, which can be beneficial for those who travel frequently.

Prescription Drug Coverage

Prescription medications can be costly, so understanding your plan's drug coverage is essential. Check for any limitations on brand-name or specialty drugs, and ensure that your required medications are covered under the plan.

Preventive Care Benefits

Preventive care services, such as annual check-ups, screenings, and vaccinations, are vital to maintaining good health. Look for plans that cover these services at no or low cost to you, as they can significantly reduce your long-term healthcare expenses.

Specialty Care and Chronic Condition Management

If you have specific healthcare needs, such as ongoing treatment for a chronic condition or regular access to specialized care, ensure that the plan provides adequate coverage for these services. Some plans offer specialized programs or discounts for managing chronic conditions.

Customer Service and Claims Processing

The quality of customer service and claims processing can significantly impact your experience with a health insurance provider. Look for plans with a reputation for timely and efficient handling of claims, as well as responsive and knowledgeable customer support.

Researching and Comparing Health Insurance Plans

With a clear understanding of your needs and the critical factors to consider, it's time to research and compare different health insurance plans. Utilize online tools, insurance brokers, or healthcare marketplaces to explore your options. Compare plans based on coverage, costs, and other key factors to narrow down your choices.

Utilizing Online Tools and Resources

Numerous online platforms and government websites provide tools to help you compare health insurance plans. These resources often offer detailed information on coverage, costs, and provider networks, making it easier to evaluate and choose the best plan for your needs.

Working with Insurance Brokers

Insurance brokers can be a valuable resource in navigating the complex world of health insurance. They can provide personalized advice, help you understand the nuances of different plans, and guide you through the enrollment process. Brokers often have access to a wide range of plans and can negotiate better rates on your behalf.

Exploring Healthcare Marketplaces

Healthcare marketplaces, such as the federal and state-based marketplaces established under the Affordable Care Act (ACA), offer a centralized platform to compare and enroll in health insurance plans. These marketplaces often provide additional resources and support, making it easier to find and choose the right plan.

Enrolling in the Best Health Insurance Plan

Once you've researched and compared your options, it's time to enroll in the best health insurance plan for your needs. The enrollment process typically involves providing personal and health-related information, selecting your plan, and paying your first premium. It's essential to ensure that all your details are accurate and up-to-date to avoid any delays or issues with your coverage.

Understanding Enrollment Periods

Health insurance plans typically have specific enrollment periods, during which you can sign up for coverage. These periods vary depending on the type of plan and your individual circumstances. For instance, the annual Open Enrollment Period for individual and family plans under the ACA runs from November 1st to December 15th in most states. Outside of these periods, you may only be able to enroll if you qualify for a Special Enrollment Period due to a qualifying life event, such as marriage, birth of a child, or loss of other coverage.

Completing the Enrollment Process

The enrollment process usually involves filling out an application, either online or through paper forms. You'll need to provide personal information, such as your name, address, and date of birth, as well as details about your income, family size, and any existing health conditions. It's crucial to be accurate and honest in your application to avoid issues with your coverage.

Payment and Confirmation

Once you've completed the enrollment application, you'll need to pay your first premium to activate your coverage. This payment can often be made online or by mail. After your payment is processed, you should receive confirmation of your enrollment, including details about your coverage start date and any necessary next steps.

Maximizing Your Health Insurance Benefits

Now that you've enrolled in the best health insurance plan for your needs, it's important to understand how to make the most of your coverage. This involves staying informed about your benefits, utilizing preventive care services, and managing your healthcare costs effectively.

Understanding Your Coverage and Benefits

Take the time to thoroughly review your insurance plan's summary of benefits and coverage. This document outlines what's covered, any limitations or exclusions, and the specific costs associated with different services. Understanding your coverage ensures that you're prepared for any potential healthcare needs and can make informed decisions about your care.

Utilizing Preventive Care Services

Preventive care services, such as annual check-ups, screenings, and immunizations, are often covered at no or low cost under your health insurance plan. These services can help identify potential health issues early on, allowing for more effective treatment and management. By taking advantage of these services, you can maintain good health and potentially avoid more costly medical interventions down the line.

Managing Healthcare Costs

While having health insurance provides peace of mind and financial protection, it's still important to manage your healthcare costs effectively. This includes understanding your plan's cost-sharing arrangements, such as deductibles and copayments, and making informed choices about your healthcare providers and treatments. Shopping around for competitive prices and negotiating medical bills can also help reduce your out-of-pocket expenses.

FAQ

What is the best health insurance plan for me?

+The "best" health insurance plan for you depends on your unique needs and circumstances. Factors such as your age, health status, family size, and anticipated medical needs play a significant role in determining the most suitable plan. It's crucial to assess your specific requirements and compare different plans based on coverage, costs, and other key factors to find the plan that offers the best value for your situation.

How can I find affordable health insurance?

+Finding affordable health insurance involves researching and comparing different plans based on their costs. Consider factors such as premiums, deductibles, copayments, and out-of-pocket maximums. Lower premiums often come with higher deductibles and out-of-pocket costs, so it's essential to evaluate the overall cost of the plan, not just the monthly premium. You can also explore options for government-subsidized plans, such as those available through the Affordable Care Act (ACA) marketplaces, which offer financial assistance based on your income.

What should I look for in a health insurance plan's network of providers?

+When evaluating a health insurance plan's network of providers, it's crucial to ensure that your preferred doctors, specialists, and hospitals are included. This helps avoid unexpected out-of-network charges. Also, consider whether the plan offers out-of-state coverage, which can be beneficial if you travel frequently. Some plans provide online tools or directories to help you search for in-network providers in your area.

How do I enroll in a health insurance plan?

+Enrolling in a health insurance plan typically involves completing an application, either online or through paper forms. You'll need to provide personal and health-related information, select your plan, and pay your first premium. It's essential to ensure that all your details are accurate and up-to-date to avoid any delays or issues with your coverage. Enrollment periods vary depending on the type of plan and your individual circumstances, so be sure to understand the specific enrollment period for your chosen plan.

Choosing the best US health insurance is a critical decision that impacts your healthcare access and financial well-being. By understanding your needs, researching and comparing plans, and enrolling in the right coverage, you can ensure that you have the protection and support you need to maintain good health. Remember to stay informed about your benefits, utilize preventive care services, and manage your healthcare costs effectively to maximize the value of your health insurance.