Insurance Agency License Lookup

When it comes to insurance, trust and transparency are paramount. Ensuring that you are dealing with licensed and reputable insurance agencies is essential for safeguarding your financial interests. This comprehensive guide aims to empower you with the knowledge and tools to conduct a thorough Insurance Agency License Lookup, enabling you to make informed decisions about your insurance needs.

Unveiling the Importance of Insurance Agency Licensing

In the world of insurance, licensing serves as a crucial safeguard for consumers. Licensed insurance agencies adhere to strict regulations, ensuring they operate ethically and in the best interests of their clients. Here’s a deeper dive into why license verification matters:

Legal Compliance and Consumer Protection

Insurance licensing is a regulatory process designed to uphold legal standards and protect consumers. Licensed agencies are held accountable for their actions, ensuring they provide accurate information, transparent policies, and fair practices. This protection is particularly vital in complex insurance matters, where a single mistake can have significant financial implications.

Expertise and Professionalism

A license serves as a stamp of approval, indicating that an agency has met the necessary educational and training requirements. Licensed agents are equipped with the knowledge to guide clients through the intricate world of insurance, offering tailored solutions that meet their specific needs. This expertise is invaluable when navigating the complexities of insurance coverage.

Financial Stability and Trustworthiness

License verification also extends to the financial health of insurance agencies. Regulatory bodies scrutinize an agency’s financial stability, ensuring they can honor their commitments and pay out claims. This level of financial scrutiny instills confidence in clients, assuring them that their investments are secure.

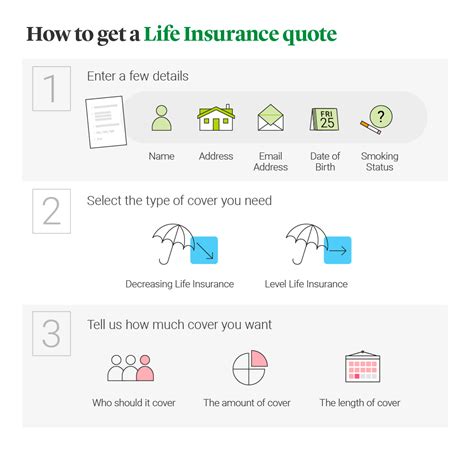

How to Conduct a Comprehensive Insurance Agency License Lookup

Performing an Insurance Agency License Lookup is a straightforward process that can be done online or through official government channels. Here’s a step-by-step guide to help you verify the legitimacy and credentials of any insurance agency:

Step 1: Utilize Online Resources

Many states and countries provide online platforms or databases where you can search for licensed insurance agencies. These resources often include detailed information about an agency’s license status, the types of insurance they are authorized to sell, and any disciplinary actions taken against them. Here are some popular online resources:

- National Association of Insurance Commissioners (NAIC): The NAIC maintains a database of licensed insurance companies across the United States. You can search by company name, state, or license number.

- State Insurance Departments: Each state in the U.S. has its own insurance department or regulatory body. These departments often provide online license lookup tools. For instance, the California Department of Insurance offers a comprehensive search feature.

- Insurance Company Websites: Reputable insurance companies typically display their licenses and credentials prominently on their websites. Look for pages dedicated to "About Us," "Licenses," or "Regulatory Information."

- Third-Party Verification Sites: Some third-party websites offer insurance license verification services. While these sites can be helpful, always cross-reference the information with official government sources.

Step 2: Contact the Insurance Agency Directly

If you’re unable to find the information you need online, or if you want to verify the details personally, contacting the insurance agency directly is an option. Here’s how:

- Call the agency's customer service number and ask to speak to a licensed agent. Explain that you're interested in their services but want to verify their license status first.

- Politely request their license number and the state or regulatory body that issued the license. Reputable agencies should be open and transparent about this information.

- Take note of the agent's name and any other relevant details during the call. This can be useful if you need to file a complaint or report any discrepancies.

Step 3: Cross-Reference with Official Sources

To ensure accuracy, always cross-reference the information provided by the insurance agency with official sources. This step is crucial to verify that the agency is providing truthful and up-to-date information.

- Use the license number and state provided by the agency to conduct a search on the official state insurance department's website or the NAIC database.

- If the agency is indeed licensed, you should find matching details in the official records. Any discrepancies could indicate a potential red flag.

Step 4: Check for Disciplinary Actions

Even if an insurance agency is licensed, it’s essential to check for any disciplinary actions or complaints against them. This step ensures that you’re not only dealing with a legitimate agency but also one with a clean track record.

- Most state insurance department websites have a dedicated section for consumer complaints and disciplinary actions. Search for the agency's name to see if any red flags have been raised.

- Additionally, the NAIC maintains a Market Conduct Annual Report, which provides insights into the performance and compliance of insurance companies. While this report is not publicly available, you can request it from your state insurance department.

Step 5: Consider Additional Credentials and Ratings

While a license is a crucial indicator of an agency’s legitimacy, it’s not the only factor to consider. Reputable insurance agencies often go beyond the basic licensing requirements to earn additional credentials and ratings.

- Designations: Many insurance professionals pursue advanced certifications and designations to enhance their expertise. Look for designations like Chartered Property Casualty Underwriter (CPCU), Certified Insurance Counselor (CIC), or Associate in Personal Insurance (API). These credentials indicate a higher level of knowledge and commitment to the industry.

- Company Ratings: Reputable insurance companies are often rated by independent agencies that assess their financial strength and stability. Look for ratings from established agencies like A.M. Best, Standard & Poor's, or Moody's. A strong rating indicates the company's ability to pay out claims and honor its commitments.

Real-World Scenarios: Navigating License Verification

Let’s explore a couple of real-world scenarios to illustrate the importance and process of Insurance Agency License Lookup:

Scenario 1: Choosing an Auto Insurance Provider

You’re in the market for auto insurance and have narrowed down your options to a few reputable agencies. Before making a decision, you decide to conduct a license lookup to ensure you’re dealing with legitimate and trustworthy providers.

Step 1: Visit the NAIC website and use their Company Search tool. Enter the names of the agencies you're considering and review their license details. Verify that the licenses are active and valid for the types of insurance you require.

Step 2: Cross-reference the license information with the official state insurance department websites. This ensures that the licenses are up-to-date and haven't expired or been revoked.

Step 3: Check for any consumer complaints or disciplinary actions against the agencies. This information is often available on state insurance department websites or through the NAIC's Market Conduct Annual Report.

By following these steps, you can make an informed decision about which auto insurance provider to choose, ensuring your peace of mind and financial protection.

Scenario 2: Verifying a Health Insurance Broker

You’ve been referred to a health insurance broker by a trusted friend, but you want to verify their credentials and license status before proceeding.

Step 1: Contact the broker directly and politely request their license number and the state or regulatory body that issued the license. A reputable broker should be transparent and provide this information readily.

Step 2: Use the license number to search on the official state insurance department's website. Verify that the license is active and valid for selling health insurance in your state.

Step 3: Take the extra step of checking for any disciplinary actions or complaints against the broker. This information is often publicly available on state insurance department websites or through the NAIC's Market Conduct Annual Report.

By verifying the broker's license and checking for any red flags, you can proceed with confidence, knowing that you're working with a legitimate and trustworthy health insurance professional.

Future Trends and Innovations in Insurance Licensing

As the insurance industry evolves, so too do the methods and technologies used for license verification. Here are some emerging trends and innovations that are shaping the future of Insurance Agency License Lookup:

Blockchain Technology for License Verification

Blockchain, the technology that underpins cryptocurrencies like Bitcoin, is being explored as a secure and transparent way to verify insurance licenses. By storing license information on a decentralized blockchain network, license data can be made tamper-proof and instantly verifiable. This technology has the potential to revolutionize the way license lookups are conducted, making the process faster, more secure, and more accessible.

Artificial Intelligence (AI) for Automated Verification

AI-powered tools are being developed to automate the process of insurance license verification. These tools can quickly scan and analyze large volumes of data, such as insurance agency websites and government databases, to extract and verify license information. AI-driven license verification not only saves time but also reduces the risk of human error, making the process more efficient and accurate.

Mobile Apps for On-the-Go Verification

With the increasing reliance on mobile devices, insurance agencies and regulatory bodies are developing mobile apps to make license verification more accessible and convenient. These apps allow users to quickly scan QR codes or enter license numbers to verify an agency’s credentials instantly. Mobile apps not only enhance the user experience but also promote transparency and accountability in the insurance industry.

Enhanced Data Sharing and Collaboration

The insurance industry is moving towards greater data sharing and collaboration between regulatory bodies and insurance agencies. By sharing license data and maintaining a centralized database, license verification can become more efficient and accurate. This collaborative approach streamlines the process for both consumers and insurance professionals, making it easier to verify licenses across multiple jurisdictions.

Continued Focus on Consumer Protection

As the insurance industry evolves, the emphasis on consumer protection remains a top priority. Regulatory bodies and insurance agencies are continually working to enhance license verification processes to ensure that consumers are protected from fraudulent or unlicensed practices. This ongoing commitment to consumer protection is vital to maintaining trust and confidence in the insurance industry.

Conclusion

Conducting an Insurance Agency License Lookup is a critical step in safeguarding your financial interests and ensuring you’re dealing with reputable and licensed insurance agencies. By utilizing online resources, contacting agencies directly, and cross-referencing information with official sources, you can verify the legitimacy and credentials of any insurance provider. Remember, a licensed agency is not only compliant with regulations but also committed to providing expert guidance and financial protection. Stay informed, and don’t hesitate to verify before you trust.

FAQ

How often should I verify the license of my insurance agency?

+

It’s generally recommended to verify your insurance agency’s license status annually or whenever you’re considering significant changes to your insurance coverage. This ensures that your agency remains licensed and compliant with regulations.

What should I do if I find an insurance agency with a suspended or revoked license?

+

If you discover that an insurance agency’s license has been suspended or revoked, it’s crucial to cease any business dealings with them immediately. Contact your state insurance department to report the agency and seek guidance on next steps. Additionally, consider filing a complaint with the Better Business Bureau (BBB) to help protect other consumers.

Are there any free resources for checking insurance agency licenses?

+

Yes, many state insurance departments and the National Association of Insurance Commissioners (NAIC) provide free online resources for checking insurance agency licenses. These platforms allow you to search by company name, license number, or state to verify the legitimacy of an agency.