Biggest Insurance Companies In The Us

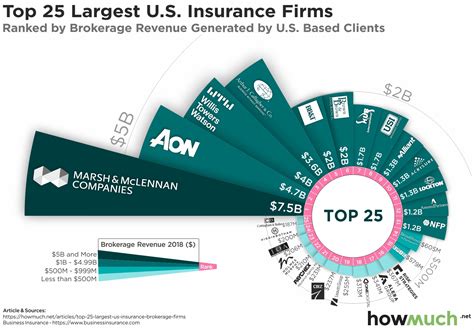

The insurance industry is a cornerstone of financial stability and risk management in the United States, offering protection and peace of mind to individuals, businesses, and communities across the nation. With a vast array of insurance providers, the market is highly competitive, and certain companies have emerged as leaders, commanding significant market share and influence.

This article delves into the realm of the biggest insurance companies in the US, exploring their financial might, market presence, and the strategies that have propelled them to the top. By analyzing these industry giants, we gain insights into the dynamics of the insurance sector and the key factors that contribute to their success.

Market Leaders: Unraveling the Top Insurance Companies

The US insurance landscape is dominated by a handful of major players, each with a unique approach to serving the diverse needs of American consumers. These companies have built their reputations on a foundation of financial strength, innovative products, and a commitment to customer satisfaction.

One of the most prominent names in the industry is State Farm, which boasts an extensive network of local agents and a strong focus on personal lines insurance, including auto, home, and life coverage. State Farm's ability to provide tailored solutions and its emphasis on community involvement have solidified its position as a market leader.

Another powerhouse in the industry is Berkshire Hathaway, a conglomerate led by the legendary investor Warren Buffett. Berkshire Hathaway's insurance arm includes subsidiaries like GEICO, which has revolutionized the auto insurance space with its direct-to-consumer model and competitive rates. The company's diverse portfolio and strategic acquisitions have made it a force to be reckoned with.

Allstate, with its iconic slogan "You're in good hands," has established itself as a trusted provider of a wide range of insurance products. Allstate's innovative digital tools and its commitment to customer education have earned it a loyal customer base.

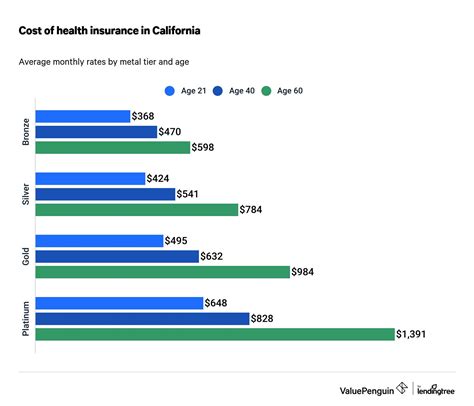

In the realm of health insurance, UnitedHealth Group stands tall. As one of the largest healthcare providers in the US, UnitedHealth Group offers a comprehensive suite of health plans, catering to individuals, families, and employers. Its focus on preventive care and wellness initiatives has contributed to its success.

Financial Strength and Stability

The biggest insurance companies in the US are characterized by their financial prowess and stability. These organizations have built robust balance sheets, allowing them to weather economic storms and fulfill their obligations to policyholders. Their financial strength is a key factor in attracting customers and maintaining their trust.

For instance, Travelers, a leading provider of commercial insurance, has consistently demonstrated strong financial performance. Its diverse product offerings and risk management expertise have positioned it as a go-to insurer for businesses seeking comprehensive coverage.

Progressive, another prominent player, has made its mark in the auto insurance market with its focus on innovation and technology. Progressive's commitment to data-driven decision-making and its use of advanced analytics have contributed to its financial success and customer satisfaction.

| Company | Revenue (Billions) | Market Share |

|---|---|---|

| State Farm | $77.8 | 15.5% |

| Berkshire Hathaway | $74.9 | 14.9% |

| UnitedHealth Group | $266.4 | 13.1% |

| Allstate | $40.8 | 7.9% |

| Travelers | $32.9 | 6.4% |

State Farm’s Community Focus

State Farm’s success can be attributed, in part, to its strong community presence. The company’s network of local agents allows it to provide personalized service and build relationships with customers. This approach has not only boosted customer loyalty but has also contributed to the company’s growth, especially in the personal lines insurance market.

Berkshire Hathaway’s Conglomerate Power

Berkshire Hathaway’s dominance in the insurance industry is a result of its diverse portfolio and strategic acquisitions. By owning subsidiaries like GEICO and other insurance companies, Berkshire Hathaway has been able to offer a wide range of products and reach a broader customer base. This conglomerate structure has allowed it to leverage synergies and maintain a competitive edge.

Innovation and Technology

In an increasingly digital world, the biggest insurance companies have embraced innovation and technology to enhance their operations and customer experience. From streamlined online quoting and policy management to the use of data analytics for risk assessment, these companies are leveraging technology to stay ahead of the curve.

Take, for example, Liberty Mutual, which has invested heavily in digital transformation. Its online platforms and mobile apps have made it easier for customers to manage their policies and access services. Additionally, Liberty Mutual's use of predictive analytics has improved its risk assessment capabilities, enabling it to offer more accurate and competitive pricing.

Similarly, Farmers Insurance has embraced technology to enhance its customer engagement. Its digital tools and mobile apps allow policyholders to file claims, access policy information, and even receive real-time assistance. Farmers' focus on technology has not only improved customer satisfaction but has also helped streamline its internal processes.

Progressive’s Data-Driven Approach

Progressive’s success in the auto insurance market can be attributed to its data-driven approach. The company utilizes advanced analytics to understand customer behavior and pricing dynamics. This allows it to offer personalized quotes and competitive rates, attracting price-conscious consumers. Progressive’s use of technology has not only improved its underwriting accuracy but has also contributed to its reputation as an innovative insurer.

Impact on the Industry and Future Prospects

The presence of these industry giants has a significant impact on the overall insurance landscape in the US. Their financial strength and market influence often set the tone for industry trends and regulatory changes. Additionally, their innovative approaches and technological advancements have raised the bar for all players in the market.

Looking ahead, the biggest insurance companies in the US are well-positioned to continue their dominance. With a focus on financial stability, innovation, and customer-centric strategies, these organizations are poised to adapt to changing market dynamics and emerging risks. Their ability to leverage technology and data analytics will likely remain a key differentiator, ensuring their continued success and relevance in the years to come.

What sets the biggest insurance companies apart from smaller providers?

+The biggest insurance companies in the US are distinguished by their financial strength, extensive market presence, and innovative approaches to serving customers. Their ability to offer a wide range of products, coupled with their focus on financial stability and customer satisfaction, sets them apart from smaller providers.

How do these companies maintain their market leadership?

+Market leaders in the insurance industry maintain their position through a combination of financial strength, innovative products, and a commitment to customer service. They invest in technology, data analytics, and community engagement to stay ahead of the curve and meet the evolving needs of their customers.

What role do these companies play in the overall insurance landscape?

+The biggest insurance companies in the US have a significant impact on the industry. They set industry standards, influence regulatory changes, and drive innovation. Their financial stability and market influence ensure that they remain key players in shaping the future of insurance in the country.