Blue Shield Health Insurance Plans

Blue Shield Health Insurance is a prominent player in the healthcare industry, offering a comprehensive range of health insurance plans to individuals, families, and businesses across the United States. With a focus on providing accessible and affordable healthcare solutions, Blue Shield has become a trusted name in the market, catering to the diverse needs of its policyholders.

In this expert-reviewed article, we delve deep into the world of Blue Shield Health Insurance Plans, exploring their unique features, benefits, and the value they bring to policyholders. From understanding the different plan options to navigating the claims process, we aim to provide a comprehensive guide to help you make informed decisions about your healthcare coverage.

Understanding Blue Shield Health Insurance Plans

Blue Shield Health Insurance offers a diverse portfolio of plans, designed to cater to the varying healthcare needs and preferences of its customers. These plans can be broadly categorized into the following types:

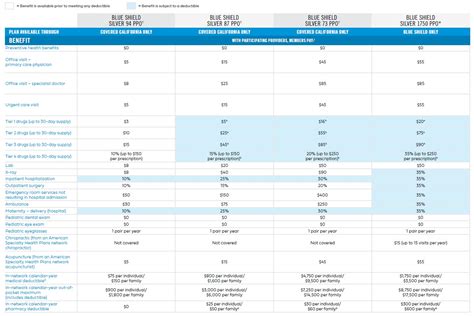

- Individual and Family Plans: Tailored for individuals and families, these plans offer comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. Blue Shield provides a range of options, allowing individuals to choose the level of coverage and cost-sharing that aligns with their needs and budget.

- Group Health Plans: Blue Shield also extends its services to businesses, offering group health insurance plans that provide employees and their families with access to quality healthcare. These plans are designed to promote employee well-being and can be customized to meet the specific needs of the employer and their workforce.

- Medicare Advantage Plans: For individuals aged 65 and older, Blue Shield offers Medicare Advantage plans, which are an alternative to original Medicare. These plans bundle Part A (hospital insurance) and Part B (medical insurance) coverage, often including additional benefits like prescription drug coverage and vision/dental care.

- Medicaid Health Plans: Blue Shield partners with state Medicaid programs to provide health coverage to eligible low-income individuals and families. These plans offer essential health benefits, ensuring access to necessary medical services for those who qualify.

- Student Health Plans: Recognizing the unique healthcare needs of students, Blue Shield offers specialized health plans for college and university students. These plans provide coverage for a range of medical services, helping students focus on their education without worrying about unexpected healthcare costs.

Key Features and Benefits of Blue Shield Health Insurance Plans

Blue Shield Health Insurance Plans are renowned for their extensive network of healthcare providers, ensuring policyholders have access to quality medical care when and where they need it. The plans also offer a range of additional benefits, including:

- Preventive Care Coverage: Blue Shield places a strong emphasis on preventive healthcare, covering a wide range of preventive services such as annual physical exams, immunizations, and cancer screenings. By promoting early detection and prevention, these plans contribute to the overall well-being of policyholders.

- Prescription Drug Coverage: Many Blue Shield plans include prescription drug coverage, helping policyholders manage the cost of essential medications. The plans often feature a comprehensive formulary, ensuring access to a wide range of prescription drugs at affordable prices.

- Mental Health and Substance Abuse Coverage: Recognizing the importance of mental health, Blue Shield plans typically cover a range of mental health services, including therapy, counseling, and substance abuse treatment. This coverage aims to provide policyholders with the support they need to maintain their mental well-being.

- Maternity and Newborn Care: For families expecting a new addition, Blue Shield offers comprehensive maternity and newborn care coverage. This includes prenatal care, delivery, and postpartum services, ensuring mothers and newborns receive the necessary medical attention during this critical period.

- Dental and Vision Care: Blue Shield understands the importance of oral and eye health, which is why many of its plans include optional dental and vision care coverage. These benefits ensure policyholders can access affordable dental and vision services, promoting overall health and well-being.

Choosing the Right Blue Shield Health Insurance Plan

Selecting the right health insurance plan is a critical decision, and Blue Shield offers a range of options to suit different needs. When choosing a Blue Shield plan, consider the following factors:

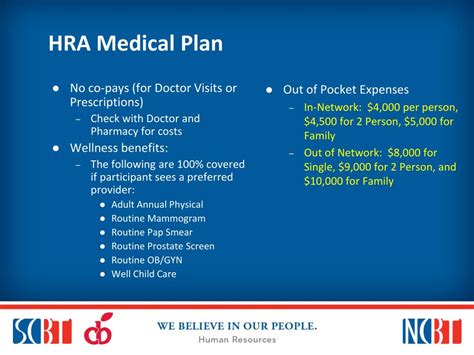

- Coverage Needs: Assess your healthcare needs and the needs of your family. Consider factors such as chronic conditions, prescription drug requirements, and any specialized medical services you may require. Choose a plan that provides comprehensive coverage for these specific needs.

- Premium Costs: Evaluate the monthly premium costs associated with different plans. While a lower premium may be tempting, it's essential to balance this with the plan's deductible, copayments, and out-of-pocket maximums. Understanding these costs can help you make an informed decision.

- Provider Network: Ensure that the plan's provider network includes your preferred doctors, hospitals, and specialists. A robust network ensures you have access to quality healthcare services without incurring additional costs.

- Additional Benefits: Look for plans that offer the additional benefits you value, such as prescription drug coverage, dental and vision care, or mental health services. These benefits can significantly enhance your overall healthcare experience.

- Plan Flexibility: Consider the flexibility of the plan, including options for adding dependents, changing coverage levels, or switching to a different plan during open enrollment periods. Flexibility can be crucial in accommodating life changes or evolving healthcare needs.

Navigating the Blue Shield Claims Process

Understanding how to navigate the claims process is essential for maximizing the benefits of your Blue Shield Health Insurance Plan. Here's a step-by-step guide to help you through the process:

- Review Your Plan's Coverage: Before submitting a claim, ensure that the service or treatment you received is covered by your plan. Refer to your plan's summary of benefits or contact Blue Shield's customer support for clarification.

- Obtain the Necessary Documentation: When receiving medical services, ensure you obtain itemized bills, receipts, and any other relevant documentation. These will be required when submitting your claim.

- Submit Your Claim: Blue Shield offers multiple ways to submit claims, including online through their secure portal, by mail, or through their mobile app. Choose the method that works best for you and ensure you include all necessary documentation.

- Track Your Claim: After submitting your claim, you can track its progress through Blue Shield's online portal or by contacting their customer support team. This allows you to stay informed about the status of your claim and address any potential delays.

- Understand Your Explanation of Benefits (EOB): Once your claim is processed, Blue Shield will send you an Explanation of Benefits (EOB) detailing the services covered, the amount paid, and any remaining balance. Review this document carefully to understand your financial responsibility.

- Pay Any Remaining Balances: If your EOB indicates a remaining balance, you'll need to pay this amount to your healthcare provider. Blue Shield may provide payment options or guidance on how to settle the balance.

Blue Shield's Commitment to Customer Service

Blue Shield Health Insurance understands the importance of providing exceptional customer service to its policyholders. The company prides itself on its dedicated customer support teams, who are available to assist with any inquiries or concerns. Whether you need help choosing a plan, understanding your coverage, or navigating the claims process, Blue Shield's customer service representatives are ready to provide personalized assistance.

Additionally, Blue Shield offers a range of online tools and resources to empower policyholders. These include secure online portals for managing your plan, accessing digital copies of your insurance card, and submitting claims. The company's website also provides valuable educational content, helping policyholders make informed decisions about their healthcare and insurance coverage.

The Future of Blue Shield Health Insurance Plans

As the healthcare landscape continues to evolve, Blue Shield Health Insurance remains committed to innovation and adaptation. The company is continually exploring new ways to enhance its plans, improve customer experiences, and deliver accessible, affordable healthcare solutions.

One area of focus for Blue Shield is the integration of digital health technologies. By leveraging telehealth services and digital health platforms, Blue Shield aims to improve access to healthcare services, especially in remote or underserved areas. This digital transformation also enables more efficient claim processing and enhances overall customer satisfaction.

Additionally, Blue Shield is dedicated to promoting health and wellness among its policyholders. The company offers a range of wellness programs and incentives, encouraging policyholders to adopt healthy lifestyles and take proactive steps to maintain their well-being. By focusing on prevention and early intervention, Blue Shield aims to reduce the incidence of chronic diseases and improve the overall health of its policyholders.

As Blue Shield continues to adapt and innovate, its health insurance plans are poised to remain a trusted and reliable choice for individuals, families, and businesses seeking comprehensive healthcare coverage. With a focus on accessibility, affordability, and customer satisfaction, Blue Shield is well-positioned to meet the evolving needs of its policyholders in the years to come.

Conclusion

In conclusion, Blue Shield Health Insurance Plans offer a comprehensive and accessible approach to healthcare coverage. With a diverse range of plan options, extensive provider networks, and a commitment to customer service, Blue Shield provides peace of mind to its policyholders. As the company continues to innovate and adapt to the changing healthcare landscape, its plans will undoubtedly remain a top choice for those seeking quality, affordable healthcare solutions.

How do I choose the right Blue Shield Health Insurance Plan for my needs?

+When selecting a Blue Shield plan, consider your healthcare needs, budget, and preferences. Evaluate the coverage offered, premium costs, provider network, and additional benefits. Assess your specific healthcare requirements, such as prescription drug needs, mental health services, or maternity care, and choose a plan that aligns with your priorities.

What are the key differences between Blue Shield’s individual and family plans?

+Blue Shield’s individual plans are tailored for single individuals, while family plans are designed to cover the healthcare needs of an entire family unit. Family plans typically offer more comprehensive coverage and may include additional benefits such as maternity care or dependent coverage. Consider your family’s healthcare needs and choose a plan that provides adequate coverage for all members.

How can I access Blue Shield’s provider network information?

+Blue Shield provides access to its provider network information through its website. You can search for doctors, hospitals, and specialists within your plan’s network, ensuring you receive in-network benefits when seeking healthcare services. Additionally, Blue Shield’s customer support team can assist you in finding providers that meet your specific needs.

What happens if I need to file a claim with Blue Shield?

+If you need to file a claim with Blue Shield, start by reviewing your plan’s coverage and obtaining the necessary documentation, such as itemized bills and receipts. Submit your claim through Blue Shield’s online portal, by mail, or via their mobile app. Track the progress of your claim and understand your Explanation of Benefits (EOB) to ensure you’re aware of any remaining balances.