Business Insurance For Online Business

In today's digital age, more and more entrepreneurs are venturing into the world of online business, establishing their presence and finding success in the vast digital landscape. However, with the unique challenges and risks that come with running an online enterprise, it is crucial for business owners to safeguard their operations and assets. This is where business insurance steps in, providing a safety net to protect online businesses from various potential liabilities and unforeseen events.

Business insurance for online businesses is a vital component of any comprehensive risk management strategy. It offers protection against a range of risks, from data breaches and cyber attacks to legal liabilities and property damage. In this comprehensive guide, we will delve into the world of business insurance for online ventures, exploring the key considerations, coverage options, and best practices to ensure that your online business remains resilient and well-protected.

Understanding the Risks: A Primer for Online Business Owners

Running an online business presents a unique set of risks that are distinct from traditional brick-and-mortar operations. Understanding these risks is the first step towards developing an effective insurance strategy. Here are some of the key challenges that online businesses face:

Cyber Security Threats

In the digital realm, cyber security is a critical concern. Online businesses are vulnerable to a range of cyber attacks, including hacking, malware, phishing, and data breaches. These threats can result in significant financial losses, damage to reputation, and legal liabilities.

| Threat | Impact |

|---|---|

| Data Breach | Loss of sensitive customer information, financial and legal consequences |

| Malware Infection | Disruption of business operations, potential data loss |

| Phishing Attacks | Fraudulent activities, identity theft, and financial loss |

Legal Liabilities

Online businesses are subject to a multitude of regulations and laws, and non-compliance can lead to significant legal consequences. Additionally, product or service-related issues, such as defective products or inadequate services, can result in customer lawsuits.

E-commerce and Online Sales Risks

For online businesses engaged in e-commerce, there are specific risks to consider. These include issues with online payment systems, fraud, and the potential for disputes over products or services.

Data Loss and System Failures

Relying heavily on digital systems and data, online businesses face the risk of data loss or system failures. This can disrupt operations and result in financial losses.

Reputation Management

In the online world, a business’s reputation is crucial. Negative reviews, online scams, or public relations crises can have a significant impact on an online business’s success and longevity.

Tailoring Insurance Coverage for Online Businesses

Given the unique risks associated with online businesses, it is essential to tailor insurance coverage to address these specific concerns. Here are some key coverage options to consider:

Cyber Liability Insurance

Cyber liability insurance is designed to protect online businesses from the financial consequences of cyber attacks and data breaches. This coverage can include expenses related to legal fees, data recovery, and customer notification. It is a critical component of any online business’s insurance portfolio.

Professional Liability Insurance (E&O)

Professional liability insurance, also known as Errors and Omissions (E&O) insurance, protects online businesses from claims arising from professional services. This coverage is especially relevant for businesses that provide advice or services, such as consulting, web design, or content creation.

Product Liability Insurance

For online businesses that sell physical products, product liability insurance is essential. This coverage protects against claims arising from defective products, product recalls, or bodily injury caused by a product.

Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) is a package of insurance coverages tailored to the needs of small and medium-sized businesses. It typically includes property insurance, liability insurance, and business interruption insurance. BOPs can be customized to include specific coverages relevant to online businesses, such as cyber liability.

Commercial Property Insurance

Even if an online business operates primarily online, physical assets such as computers, servers, and office equipment are still vulnerable to damage or theft. Commercial property insurance can provide coverage for these assets.

Business Interruption Insurance

Business interruption insurance is designed to protect online businesses from the financial losses resulting from a disruption to normal operations. This could include coverage for lost income due to a cyber attack or other covered event.

Best Practices for Online Business Insurance

When it comes to insuring your online business, there are several best practices to follow to ensure you have the right coverage and a smooth claims process.

Conduct a Comprehensive Risk Assessment

Before purchasing insurance, conduct a thorough risk assessment of your online business. Identify the specific risks your business faces and prioritize them based on likelihood and potential impact. This will help you determine the most appropriate insurance coverage for your needs.

Work with a Specialist Broker

Consider working with an insurance broker who specializes in online businesses or has experience with cyber risks. They can provide expert advice and guide you through the complex world of cyber insurance.

Understand Your Coverage Limits

Review your insurance policies carefully to understand the coverage limits and exclusions. Ensure that the limits are sufficient to cover potential losses and that you are aware of any situations that are not covered.

Regularly Review and Update Your Policies

The digital landscape is constantly evolving, and so are the risks associated with online businesses. Regularly review your insurance policies to ensure they align with your business’s current needs and risks. Update your coverage as necessary to maintain adequate protection.

Implement Robust Security Measures

While insurance is crucial, it is also important to take proactive steps to mitigate risks. Implement robust security measures, such as firewalls, antivirus software, and regular security audits, to minimize the likelihood of cyber attacks and data breaches.

Maintain Accurate and Up-to-Date Records

Keep detailed records of your business operations, including client contracts, invoices, and financial records. This will streamline the claims process and provide evidence of your business’s operations and losses in the event of a claim.

Case Study: Successful Online Business Insurance Claims

Let’s explore a real-world example of how business insurance can provide critical support to online businesses. Consider the case of “WebTech Solutions,” an online web design and development agency.

The Scenario

WebTech Solutions experienced a devastating cyber attack that resulted in the loss of critical client data and the disruption of their web hosting services. The attack not only affected their own operations but also impacted their clients’ websites and online businesses.

The Insurance Response

WebTech Solutions had taken the proactive step of purchasing comprehensive cyber liability insurance. This coverage provided the following benefits:

- Data Recovery and Restoration: The insurance policy covered the costs associated with recovering and restoring lost data, ensuring that WebTech Solutions could get their own operations back on track and assist their clients in doing the same.

- Legal Fees and Regulatory Fines: The policy included coverage for legal expenses and any regulatory fines that might be imposed as a result of the data breach. This protected WebTech Solutions from significant financial burdens.

- Business Interruption: The insurance policy provided coverage for lost income during the period of disruption caused by the cyber attack. This allowed WebTech Solutions to continue paying employees and maintaining their business operations.

- Public Relations and Crisis Management: The insurance company provided expert support in managing the public relations fallout from the attack, helping WebTech Solutions maintain their reputation and rebuild trust with clients.

By having the right insurance coverage in place, WebTech Solutions was able to navigate this challenging situation with minimal financial loss and maintain the trust of their clients. This case study highlights the critical role that business insurance plays in protecting online businesses from the unique risks they face.

The Future of Insurance for Online Businesses

As the digital landscape continues to evolve, so too will the insurance industry’s approach to protecting online businesses. Here are some trends and developments to watch for in the future of online business insurance:

Increased Focus on Cyber Risks

With the ever-growing threat of cyber attacks, insurance companies are likely to place a greater emphasis on cyber risk management and offer more comprehensive cyber liability insurance policies. This will include coverage for emerging risks, such as ransomware attacks and social engineering scams.

Integration of AI and Machine Learning

The use of AI and machine learning in insurance is expected to grow, allowing for more accurate risk assessment and underwriting. This technology can also assist in fraud detection and claims management, improving the overall efficiency of the insurance process.

Partnerships and Collaboration

Insurance companies may partner with cybersecurity firms and other technology providers to offer more integrated solutions for online businesses. This could include bundled insurance and cybersecurity services, providing a more holistic approach to risk management.

Flexibility and Customization

Insurance policies for online businesses are likely to become more flexible and customizable, allowing business owners to tailor their coverage to their specific needs and risks. This could include the ability to add or remove coverages as their business evolves.

Enhanced Data Protection

With the implementation of data protection regulations such as GDPR and CCPA, insurance companies are likely to offer more robust data protection coverage, helping online businesses navigate the complex landscape of data privacy and security.

Emphasis on Education and Prevention

In addition to providing insurance coverage, insurance companies may place a greater focus on educating online businesses about cyber risks and best practices for prevention. This could include providing resources and training to help businesses mitigate risks and avoid potential losses.

FAQ

What are the most common risks faced by online businesses, and how can insurance help mitigate them?

+

Online businesses face various risks, including cyber attacks, data breaches, legal liabilities, and e-commerce-related issues. Insurance provides financial protection against these risks, covering costs related to data recovery, legal fees, and business interruption. It also offers support for crisis management and reputation protection.

How much does business insurance for online businesses typically cost?

+

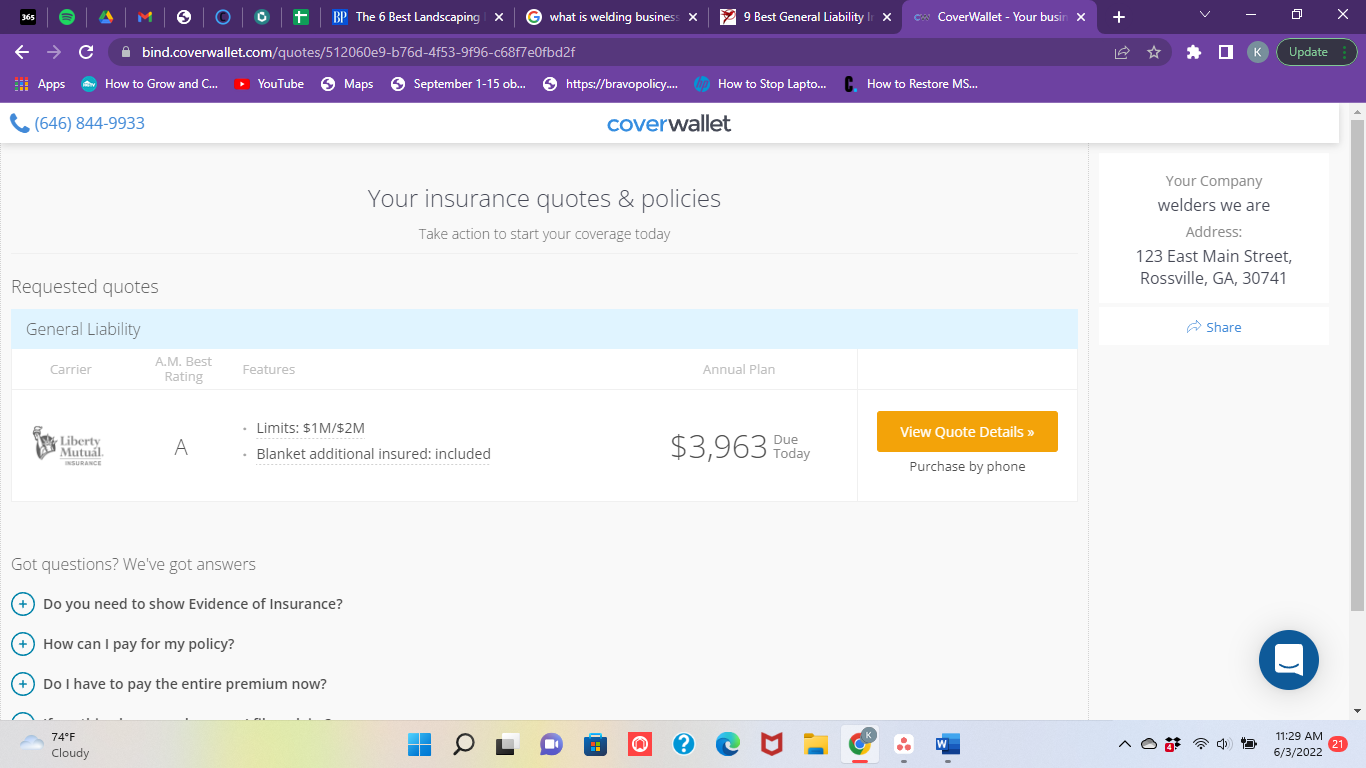

The cost of business insurance for online businesses can vary widely depending on factors such as the size and nature of the business, the specific coverages required, and the provider. It’s best to obtain quotes from multiple insurers to find the most suitable coverage at a competitive price.

Are there any specific types of insurance that online businesses should prioritize over others?

+

Cyber liability insurance is a critical coverage for online businesses due to the high risk of cyber attacks and data breaches. Additionally, professional liability insurance and product liability insurance are essential for businesses providing services or selling products online.

How can online businesses ensure they have adequate insurance coverage?

+

To ensure adequate coverage, online businesses should conduct a comprehensive risk assessment, work with a specialist broker, and regularly review and update their insurance policies. It’s also important to understand coverage limits and exclusions to avoid any gaps in protection.