Business Insurance The Hartford

Business insurance is an essential aspect of running a successful and protected enterprise. It acts as a safety net, ensuring that companies can navigate various risks and unforeseen circumstances without compromising their financial stability. The Hartford, a renowned insurance provider, has established itself as a trusted partner for businesses across different industries. In this comprehensive guide, we will delve into the world of business insurance, focusing on The Hartford's offerings, and explore how it can safeguard your enterprise effectively.

Understanding Business Insurance: A Comprehensive Overview

Business insurance, often referred to as commercial insurance, is a broad term encompassing various policies designed to protect businesses from potential losses and liabilities. It serves as a crucial tool for risk management, allowing entrepreneurs and business owners to focus on their core operations with peace of mind.

The scope of business insurance is vast, covering a wide range of potential risks, including property damage, liability claims, cyber attacks, and employee-related issues. By tailoring insurance policies to their specific needs, businesses can mitigate financial risks and ensure continuity in the face of adversity.

Let's take a closer look at some of the key aspects of business insurance and how it safeguards different facets of your enterprise.

Protecting Your Business Assets

One of the primary functions of business insurance is to safeguard your physical assets. This includes your commercial property, such as office buildings, warehouses, and equipment. In the event of natural disasters, fires, or theft, a comprehensive property insurance policy can provide the necessary coverage to repair or replace damaged assets.

| Coverage Type | Description |

|---|---|

| Building Coverage | Protects the structure of your commercial property. |

| Business Personal Property | Covers furniture, equipment, and inventory. |

| Loss of Income | Provides financial support during business interruption. |

Liability Protection

Liability insurance is a crucial component of business insurance, as it safeguards your company against claims arising from accidents, injuries, or property damage caused by your products or services. This protection extends to legal defense costs and any settlements or judgments resulting from such claims.

- Product Liability: Covers claims related to defective products.

- Professional Liability: Protects against negligence claims for professional services.

- General Liability: Provides broad coverage for various liability risks.

Managing Employee Risks

Employee-related risks are an inevitable part of running a business. Business insurance offers solutions to manage these risks, ensuring a safe and healthy work environment.

- Workers' Compensation: Provides benefits to employees injured on the job.

- Employment Practices Liability: Protects against claims of discrimination or harassment.

- Group Health Insurance: Offers comprehensive healthcare coverage to employees.

The Hartford: A Trusted Partner for Business Insurance

The Hartford, with its rich history and expertise in the insurance industry, has become a go-to provider for businesses seeking comprehensive protection. Founded in 1810, The Hartford has consistently demonstrated its commitment to helping businesses thrive by offering tailored insurance solutions and exceptional customer service.

The Hartford’s Business Insurance Solutions

The Hartford’s business insurance offerings are designed to cater to a diverse range of industries and business sizes. Whether you own a small startup or a large corporation, The Hartford can provide customized insurance plans to address your unique needs.

Commercial Property Insurance

The Hartford’s commercial property insurance policies offer flexible coverage options, ensuring your business assets are adequately protected. From office buildings to specialized equipment, they provide tailored solutions to match your specific requirements.

Liability Coverage

With a wide array of liability insurance options, The Hartford ensures your business is shielded from various claims and legal actions. Their policies cover product liability, professional liability, and general liability, providing the necessary peace of mind to focus on business growth.

Employee Benefits and Protection

The Hartford understands the importance of employee well-being and offers a comprehensive suite of employee benefits and protection plans. From workers’ compensation to group health insurance, they ensure your employees are taken care of, fostering a positive and secure work environment.

The Benefits of Choosing The Hartford

Opting for The Hartford as your business insurance provider comes with a multitude of advantages. Their reputation for reliability and customer satisfaction is well-established, making them a trusted partner for businesses across the nation.

- Customized Solutions: The Hartford offers personalized insurance plans tailored to your business needs.

- Financial Stability: With a strong financial background, The Hartford provides stability and peace of mind.

- Excellent Customer Service: Their dedicated team ensures prompt and efficient support.

- Industry Expertise: Over two centuries of experience have made The Hartford an expert in the field.

Real-World Case Studies: The Impact of Business Insurance

To illustrate the significance of business insurance, let’s explore a few real-world scenarios where The Hartford’s policies made a tangible difference.

Case Study 1: Natural Disaster Recovery

A small business owner in Florida, Ms. Smith, had invested her life savings into her boutique clothing store. When Hurricane Emma struck, she feared the worst. However, with The Hartford’s commercial property insurance, she was able to quickly recover from the storm’s damage. The insurance covered the repairs, allowing her to reopen her store within a matter of weeks.

Case Study 2: Product Liability Claim

Mr. Johnson, a manufacturer of innovative kitchen appliances, faced a challenging situation when a customer claimed that one of his products caused an accident. The Hartford’s product liability insurance stepped in, covering the legal fees and any potential settlement, saving Mr. Johnson’s business from financial ruin.

Case Study 3: Employee Well-being

At Tech Solutions Inc., employee health and safety are top priorities. By partnering with The Hartford, they were able to provide comprehensive group health insurance and workers’ compensation plans. This not only improved employee satisfaction but also reduced absenteeism, leading to increased productivity.

The Future of Business Insurance: Trends and Innovations

As the business landscape evolves, so does the world of insurance. The Hartford is at the forefront of innovation, constantly adapting to meet the changing needs of businesses.

Emerging Trends in Business Insurance

With the rise of technology and new business models, The Hartford is embracing the following trends to provide cutting-edge insurance solutions:

- Cyber Insurance: Protecting businesses from the growing threat of cyber attacks and data breaches.

- Business Interruption Insurance: Covering revenue losses during unforeseen events, ensuring business continuity.

- Environmental Liability: Addressing the increasing environmental concerns and risks associated with business operations.

The Hartford’s Commitment to Innovation

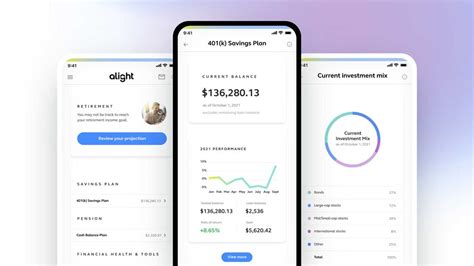

The Hartford’s dedication to innovation is evident in their recent initiatives. They have invested in developing advanced risk management tools and digital platforms to enhance the insurance experience for businesses.

One notable innovation is their AI-powered risk assessment tool, which uses machine learning to analyze a business's unique risks and provide tailored insurance recommendations. This ensures that businesses receive the most appropriate coverage, minimizing potential gaps in their insurance plans.

FAQs

What is the process for filing a business insurance claim with The Hartford?

+

Filing a claim with The Hartford is straightforward. You can initiate the process by contacting their dedicated claims department via phone or online. Their team will guide you through the necessary steps, ensuring a smooth and efficient claims experience.

Can small businesses afford The Hartford’s insurance policies?

+

Absolutely! The Hartford understands the unique challenges faced by small businesses. They offer flexible payment options and customizable policies to ensure that small businesses can access the protection they need without straining their finances.

Does The Hartford provide insurance for specific industries with unique risks?

+

Yes, The Hartford specializes in providing insurance solutions for a wide range of industries, including construction, healthcare, technology, and more. They have expertise in understanding the specific risks associated with each industry and tailor their policies accordingly.

How does The Hartford ensure customer satisfaction and prompt claim processing?

+

The Hartford prioritizes customer satisfaction by investing in a dedicated and knowledgeable customer service team. They utilize advanced technology and streamlined processes to ensure timely claim processing, minimizing any disruptions to your business.

Are there any discounts or incentives for businesses that choose The Hartford’s insurance plans?

+

Indeed, The Hartford offers a variety of discounts and incentives to encourage businesses to choose their insurance plans. These may include multi-policy discounts, loyalty rewards, and even safety training programs that can reduce insurance costs over time.

In a dynamic business environment, where risks can arise unexpectedly, business insurance serves as a vital safeguard. The Hartford, with its extensive experience and commitment to innovation, stands as a reliable partner, ensuring businesses can thrive and overcome challenges with confidence. By choosing The Hartford, you’re not just investing in insurance; you’re investing in the future success and resilience of your enterprise.