Calculate Homeowners Insurance

Understanding the process of calculating homeowners insurance premiums is crucial for homeowners, as it ensures adequate coverage for their properties and helps them make informed decisions about their insurance policies. This article delves into the intricate factors that insurance companies consider when determining homeowners insurance rates, offering a comprehensive guide to help individuals navigate this complex financial aspect of homeownership.

The Complexities of Homeowners Insurance Calculation

The cost of homeowners insurance is not a one-size-fits-all figure. It is a highly individualized process that takes into account a multitude of factors, each contributing to the overall premium. These factors can be broadly categorized into the following sections:

1. Home Value and Location

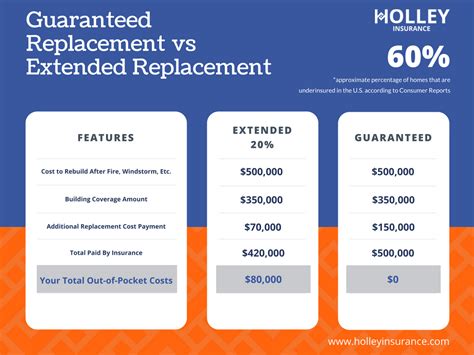

The value of your home is a primary determinant in insurance calculations. Insurance companies assess the replacement cost, which is the amount it would take to rebuild your home in the event of a total loss. This consideration ensures that, in the worst-case scenario, your home can be rebuilt to its original condition. Location also plays a pivotal role. Areas prone to natural disasters like hurricanes, floods, or earthquakes carry higher insurance premiums due to the increased risk of claims.

| Location Risk Factor | Premium Impact |

|---|---|

| High-Risk Zones (e.g., Coastal Areas) | Significant Increase |

| Moderate-Risk Zones | Mild to Moderate Increase |

| Low-Risk Zones | Minimal Impact |

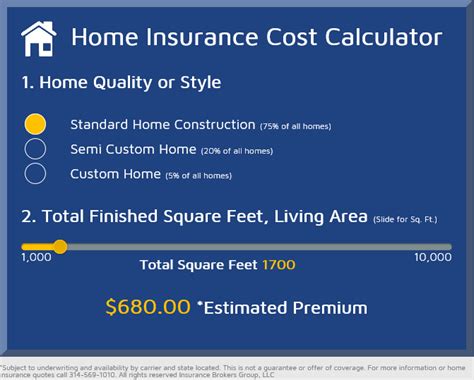

2. Construction and Age of the Property

The construction materials and age of your home are critical factors. Homes built with fire-resistant materials or those that comply with modern building codes often enjoy lower premiums. Similarly, older homes may require more extensive (and expensive) repairs, which can drive up insurance costs.

3. Coverage Options and Deductibles

The level of coverage you choose significantly influences your premium. Higher coverage limits generally result in higher premiums. Additionally, the deductible you select can make a difference. A higher deductible means you pay more out-of-pocket before insurance kicks in, but it can lead to lower premiums.

| Coverage Type | Premium Impact |

|---|---|

| Replacement Cost Coverage | May Increase Premium |

| Actual Cash Value Coverage | Often More Affordable |

4. Claims History and Credit Score

Your insurance claims history is a key consideration for insurers. Frequent claims can lead to higher premiums or even policy cancellations. Similarly, a good credit score is often rewarded with lower premiums, as it indicates a lower risk of non-payment.

5. Additional Factors

Several other factors can influence your premium, including the presence of security systems, the number of stories in your home, and even your profession. Some insurers offer discounts for multiple policies (e.g., bundling home and auto insurance) or for certain professions (e.g., teachers or military personnel).

The Role of Technology in Homeowners Insurance Calculations

In recent years, the insurance industry has embraced technological advancements to enhance the accuracy and efficiency of homeowners insurance calculations. Advanced algorithms and data analytics have enabled insurers to better assess risk profiles, resulting in more tailored and precise premium quotes.

1. Geospatial Data and Risk Assessment

Geospatial technologies, such as GIS (Geographic Information System), play a crucial role in evaluating risk. Insurers can use these tools to map out areas susceptible to natural disasters, assess the proximity of homes to fire stations or other emergency services, and even analyze crime rates in specific neighborhoods. This data-driven approach allows for more accurate risk assessments and, consequently, more precise premium calculations.

2. Digital Home Inspections

Traditionally, home inspections were conducted in person by insurance adjusters. However, with the advent of technology, digital home inspections have become a viable alternative. Policyholders can now use their smartphones or tablets to provide detailed information about their homes, including the condition of roofs, the presence of fire hazards, and the functionality of security systems. This not only saves time and resources for both parties but also ensures a more accurate assessment of the home’s risk profile.

3. Smart Home Integration

The integration of smart home technologies has opened up new avenues for risk assessment and premium calculations. Smart home devices, such as smoke detectors, security cameras, and water leak sensors, can provide real-time data to insurers, allowing them to monitor and assess risk more accurately. For instance, a smart smoke detector that alerts the homeowner and the insurance company about a potential fire risk can help mitigate potential losses and influence premium calculations.

4. Telematics and Usage-Based Insurance

Telematics, the technology that enables the transmission of data from a vehicle to a remote location, has also found its way into homeowners insurance. Usage-based insurance, also known as pay-as-you-go insurance, allows insurers to monitor and assess risk based on actual usage. For example, smart water meters can provide data on water usage, helping insurers understand the risk of water damage and adjust premiums accordingly.

5. Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling techniques enable insurers to identify patterns and trends in insurance claims, allowing for more accurate risk assessment and premium calculations. By analyzing historical data and combining it with real-time data from smart home devices and other sources, insurers can develop sophisticated models that predict the likelihood of future claims and adjust premiums accordingly.

Tips for Reducing Homeowners Insurance Premiums

While the calculation of homeowners insurance premiums is largely based on factors beyond your control, there are strategies you can employ to potentially reduce your premium:

- Review your coverage regularly and adjust it to reflect any changes in your home's value or your personal circumstances.

- Consider increasing your deductible. A higher deductible means you'll pay more out-of-pocket if you need to file a claim, but it can lead to lower premiums.

- Invest in home improvements that can reduce the risk of claims. This might include installing fire-resistant roofing, adding security systems, or making your home more energy-efficient.

- Shop around and compare quotes from different insurers. Each company uses its own formula to calculate premiums, so you might find better rates with a different provider.

- Take advantage of any discounts you may be eligible for, such as those for having a monitored security system, being claim-free for a certain period, or bundling your home and auto insurance policies.

The Future of Homeowners Insurance Calculations

The landscape of homeowners insurance is continually evolving, driven by advancements in technology and changing risk factors. As we move forward, we can expect to see further integration of technology in risk assessment and premium calculations. This includes the continued development and refinement of geospatial technologies, digital home inspections, smart home integration, and telematics.

Additionally, the use of big data and artificial intelligence will likely play an increasingly significant role in homeowners insurance calculations. By analyzing vast amounts of data and employing sophisticated algorithms, insurers will be able to make more accurate predictions about future claims and adjust premiums accordingly. This data-driven approach will enable insurers to offer more tailored and competitive policies, benefiting both insurers and policyholders.

Furthermore, the rise of parametric insurance, a type of insurance that pays out based on predefined parameters rather than the actual loss, is worth noting. This innovative approach, which is particularly useful in cases of natural disasters, can provide swift payouts to policyholders, helping them recover more quickly. As parametric insurance gains traction, it could potentially influence the way premiums are calculated and paid out, offering a more efficient and effective solution for both insurers and homeowners.

In conclusion, understanding the factors that influence homeowners insurance calculations is essential for making informed decisions about your insurance coverage. By staying informed about the latest advancements in the insurance industry and taking proactive measures to reduce risk, you can potentially lower your premiums and ensure you have adequate coverage for your home and possessions.

What are the typical coverage limits for homeowners insurance policies?

+Coverage limits can vary widely depending on the value of your home and your personal belongings. Most policies offer a range of coverage limits, with the option to customize based on your specific needs. It’s important to review your coverage limits regularly to ensure they align with the current value of your home and possessions.

How often should I review my homeowners insurance policy?

+It’s recommended to review your policy annually or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains up-to-date and provides adequate protection.

Can I negotiate my homeowners insurance premium?

+While insurance premiums are largely determined by the insurer’s assessment of risk, you can negotiate certain aspects of your policy, such as coverage limits or deductibles. Additionally, shopping around and comparing quotes from different insurers can often lead to better rates.