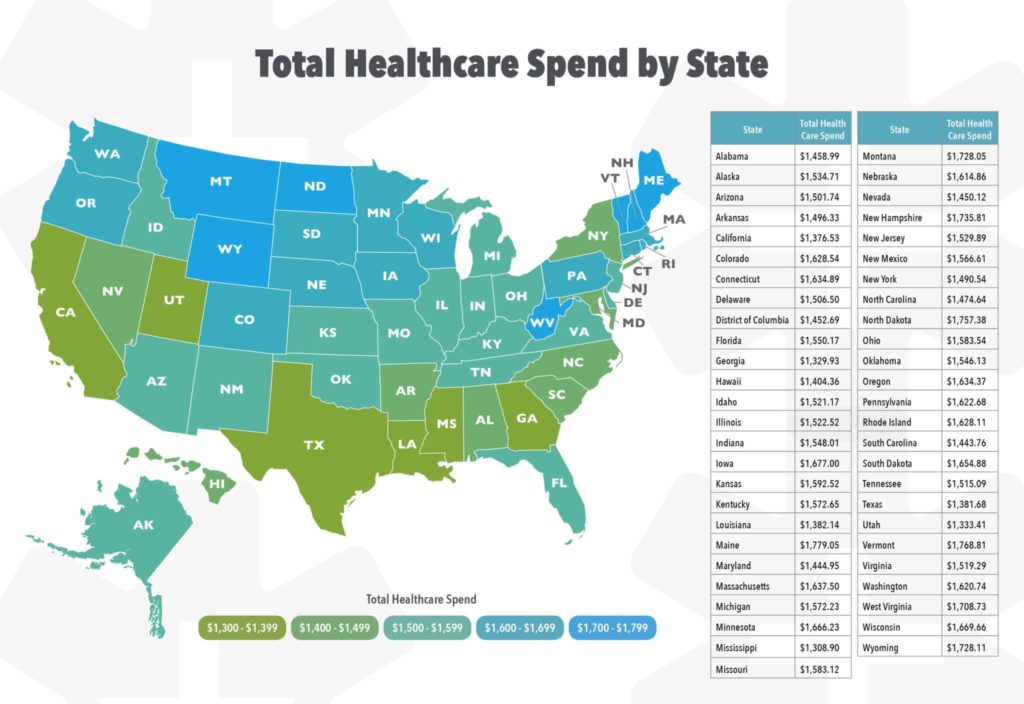

California Average Health Insurance Cost

Understanding the average health insurance costs in California is crucial for individuals and families seeking affordable healthcare coverage. The state's diverse demographics and varying insurance plans make it essential to explore the specifics of health insurance expenses. This article delves into the intricacies of health insurance costs in California, providing an in-depth analysis of factors influencing prices and offering insights into finding the best coverage options.

California’s Health Insurance Landscape

California is renowned for its robust healthcare system, offering a wide range of insurance plans to cater to diverse needs. From major medical plans to short-term and supplemental insurance, the state provides extensive coverage options. A significant portion of Californians receive health insurance through their employers, benefiting from group plans that often come with lower premiums. However, for those purchasing insurance individually, costs can vary significantly based on factors like age, location, and the specific plan chosen.

Average Health Insurance Costs in California

The average health insurance cost in California for individuals and families can fluctuate based on various factors. According to recent data, the average monthly premium for a benchmark silver plan in California is approximately $650. This benchmark plan serves as a reference point, helping individuals understand the typical cost of a standard plan. However, it’s important to note that actual costs can differ considerably based on individual circumstances and the chosen coverage level.

Individual Plans

For individuals purchasing health insurance in California, the average monthly premium can range from 400 to 800, depending on factors such as age, location, and the specific plan’s coverage. Younger individuals might expect lower premiums, while older adults might face higher costs. Additionally, plans with more comprehensive coverage will generally have higher premiums compared to basic plans.

| Age Group | Average Monthly Premium |

|---|---|

| 18-24 | $450 |

| 25-34 | $500 |

| 35-44 | $550 |

| 45-54 | $600 |

| 55-64 | $650 |

It's important to note that these averages are just a guide, and actual costs can vary based on individual circumstances and the chosen plan's coverage.

Family Plans

When it comes to family health insurance plans in California, the average monthly premium can range from 1,200 to 2,000. These plans provide coverage for the entire family, including spouses and dependent children. The cost of family plans is influenced by factors such as the number of family members, their ages, and the chosen plan’s coverage level.

| Family Size | Average Monthly Premium |

|---|---|

| 2-Person Family | $1,300 |

| 3-Person Family | $1,500 |

| 4-Person Family | $1,700 |

| 5+ Person Family | $2,000 |

Factors Influencing Health Insurance Costs

Several key factors contribute to the variation in health insurance costs in California. Understanding these factors can help individuals make informed decisions when selecting a health insurance plan.

Age

Age is a significant factor in determining health insurance costs. Younger individuals tend to have lower premiums as they generally require fewer medical services and have a lower risk of developing serious health conditions. As individuals age, their health insurance premiums typically increase due to an elevated risk of health issues.

Location

The cost of health insurance can vary significantly based on an individual’s location within California. Urban areas like Los Angeles and San Francisco often have higher insurance costs due to the concentration of healthcare facilities and providers, leading to increased demand and potentially higher prices. Conversely, rural areas might offer more affordable insurance options due to a lower cost of living and fewer healthcare resources.

Coverage Level

The level of coverage chosen by an individual or family significantly impacts insurance costs. Plans with higher coverage levels, such as platinum or gold plans, offer more comprehensive benefits but come with higher premiums. On the other hand, bronze or silver plans, while more affordable, may have higher out-of-pocket costs and provide less extensive coverage.

Deductibles and Out-of-Pocket Costs

Health insurance plans with lower deductibles and out-of-pocket costs generally have higher premiums. Conversely, plans with higher deductibles and out-of-pocket expenses may have lower monthly premiums but require individuals to pay more when accessing healthcare services.

Provider Network

The choice of a provider network can also affect insurance costs. Plans with a narrower provider network, often referred to as HMO plans, tend to have lower premiums as they limit coverage to specific healthcare providers. On the other hand, PPO plans, which offer a more extensive provider network, may have higher premiums but provide more flexibility in choosing healthcare providers.

Finding Affordable Health Insurance in California

Despite the potential variability in health insurance costs, there are strategies to find affordable coverage in California. Here are some tips to consider:

- Compare Plans: Research and compare different health insurance plans to find the one that best fits your needs and budget. Online tools and resources can help you evaluate various options and understand their coverage and costs.

- Explore Government Programs: California offers various government-funded health insurance programs, such as Medi-Cal and Covered California. These programs provide affordable coverage options for eligible individuals and families.

- Employer-Sponsored Plans: If you're employed, explore the health insurance options offered by your employer. Group plans often provide more affordable coverage compared to individual plans.

- Consider Short-Term Plans: Short-term health insurance plans can be a cost-effective option for those between jobs or seeking temporary coverage. However, it's important to note that these plans often have limited coverage and may not be suitable for long-term needs.

- Shop During Open Enrollment: California's health insurance marketplace, Covered California, typically has an open enrollment period where individuals can enroll in or switch health insurance plans. Shopping during this period ensures access to a wide range of options and allows for a comprehensive comparison of plans.

Conclusion

Understanding the average health insurance costs in California is a critical step towards securing affordable and comprehensive healthcare coverage. By considering factors like age, location, and coverage level, individuals and families can make informed decisions when selecting a health insurance plan. Remember, the key to finding the best coverage is thorough research, comparison, and seeking professional advice when needed. With the right approach, navigating California’s health insurance landscape can lead to cost-effective and beneficial coverage options.

What is the difference between HMO and PPO health insurance plans in California?

+HMO (Health Maintenance Organization) plans typically have a narrower network of healthcare providers and require you to choose a primary care physician who coordinates your care. These plans often have lower premiums but may limit your choice of specialists and require prior authorization for certain services. On the other hand, PPO (Preferred Provider Organization) plans offer a more extensive network of providers and allow you to visit any healthcare professional without a referral. PPO plans usually have higher premiums but provide more flexibility in choosing healthcare providers.

Are there any government subsidies available for health insurance in California?

+Yes, California offers various government subsidies to help individuals and families afford health insurance. Through programs like Medi-Cal and Covered California, eligible individuals can receive financial assistance to reduce their monthly premiums and out-of-pocket costs. It’s recommended to check your eligibility and explore these programs to potentially reduce your health insurance expenses.

Can I switch health insurance plans outside of the open enrollment period in California?

+In certain circumstances, you may be able to switch health insurance plans outside of the open enrollment period in California. These circumstances typically include a change in life events, such as marriage, divorce, birth of a child, or loss of other health coverage. It’s important to check the specific guidelines and eligibility requirements for these special enrollment periods to ensure a smooth transition.