Social Security Insurance Disability

Social Security Insurance (SSI) Disability is a vital program within the United States that provides financial support to individuals who are unable to work due to severe medical conditions. This article aims to delve into the intricacies of SSI Disability, exploring its purpose, eligibility criteria, application process, and the benefits it offers to those in need. By understanding the ins and outs of this program, we can shed light on a crucial safety net for Americans facing disability-related challenges.

Understanding SSI Disability: An Overview

SSI Disability, officially known as Supplemental Security Income (SSI), is a federal program administered by the Social Security Administration (SSA). Its primary objective is to assist individuals with limited income and resources who are either aged 65 or older, blind, or disabled. The program ensures that these individuals can meet their basic needs and maintain a certain quality of life despite their physical or mental limitations.

The SSI Disability program is distinct from Social Security Disability Insurance (SSDI), which is another crucial component of the SSA's disability benefits system. SSDI is designed for individuals who have worked and paid into the Social Security system through payroll taxes. In contrast, SSI Disability is a means-tested program, meaning it considers an individual's financial situation, including their income and assets, to determine eligibility.

SSI Disability offers a range of benefits, including monthly cash payments, access to Medicaid for healthcare coverage, and in some cases, additional state-level benefits. These benefits aim to provide a financial safety net, ensuring that individuals with severe disabilities can afford their daily living expenses and receive the medical care they require.

Eligibility Criteria: Who Qualifies for SSI Disability?

Meeting the eligibility criteria for SSI Disability is a multi-faceted process. The SSA evaluates applicants based on various factors, including their medical condition, income, and resources.

Medical Requirements

To qualify for SSI Disability, an individual must have a severe medical condition that meets the SSA’s definition of disability. This includes conditions that significantly limit one’s ability to perform basic work activities and are expected to last for at least 12 months or result in death. The SSA maintains a Blue Book, which lists specific medical conditions and their corresponding criteria for disability determination. Some common conditions that may qualify include:

- Musculoskeletal disorders like severe arthritis or degenerative disc disease.

- Neurological disorders such as multiple sclerosis or Parkinson's disease.

- Mental disorders, including severe depression, bipolar disorder, or schizophrenia.

- Cardiovascular issues like heart failure or chronic heart disease.

- Respiratory illnesses such as chronic obstructive pulmonary disease (COPD) or asthma.

It's important to note that not all severe medical conditions automatically qualify for SSI Disability. The SSA's determination is based on a comprehensive evaluation of the applicant's medical records, including doctor's notes, test results, and treatment history.

Financial Considerations

In addition to the medical criteria, SSI Disability also imposes financial limits. Applicants must have limited income and resources to qualify. The SSA sets specific income and asset limits, which vary depending on the applicant’s living situation (whether they live alone or with others) and their state of residence.

Income limits typically consider an individual's earned income (from work) and unearned income (such as Social Security benefits, pensions, or investment earnings). The SSA has established income thresholds, and applicants must fall below these limits to be considered financially eligible.

Resource limits, on the other hand, refer to an individual's assets, such as cash, bank accounts, real estate, and personal property. The SSA has specific rules regarding which assets are countable and which are exempt. For example, an individual's primary residence and certain types of personal property, like household goods and vehicles, are typically exempt from the resource limits.

Additional Factors

Beyond the medical and financial considerations, there are a few other factors that can impact an individual’s eligibility for SSI Disability:

- Citizenship and immigration status: Only U.S. citizens and certain non-citizens can qualify for SSI Disability.

- Work history: While SSI Disability is not based on work credits like SSDI, having a work history can sometimes impact an applicant's eligibility, especially if they have recently worked and earned a substantial income.

- Drug and alcohol abuse: Individuals who are disabled due to drug or alcohol abuse may face additional hurdles in qualifying for SSI Disability.

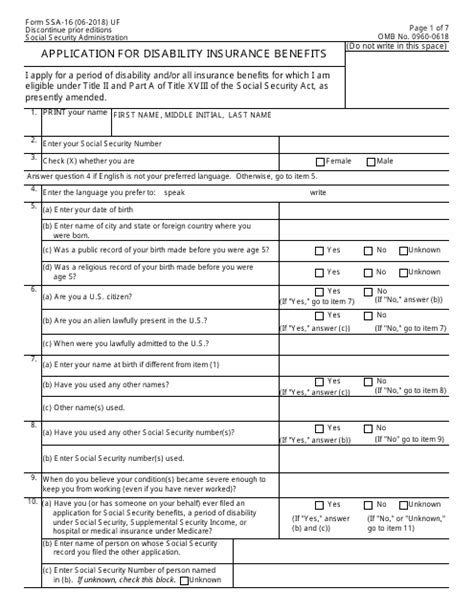

The Application Process: How to Apply for SSI Disability

Navigating the application process for SSI Disability can be complex, but with the right information and preparation, it becomes more manageable. Here’s a step-by-step guide to help you through the process.

Step 1: Determine Eligibility

Before applying, it’s crucial to assess whether you meet the basic eligibility criteria. Review the medical and financial requirements outlined above and ensure you have the necessary documentation to support your claim. This may include medical records, doctor’s statements, and financial records.

Step 2: Gather Documentation

The SSA requires extensive documentation to support your application. Here’s a checklist of some of the key documents you’ll need:

- Proof of identity (e.g., birth certificate, driver's license)

- Social Security number

- Medical records and test results

- Prescription medications and dosage information

- Financial records, including tax returns, bank statements, and investment statements

- Proof of residence and citizenship/immigration status

It's important to note that the SSA may request additional documentation as your application progresses. Be prepared to provide any necessary information promptly.

Step 3: Apply Online or In-Person

The SSA offers two primary ways to apply for SSI Disability:

- Online Application: You can apply for SSI Disability online through the SSA's website. This method is convenient and allows you to track the status of your application easily. However, it may not be suitable for individuals with complex medical or financial situations, as it requires self-reporting of information.

- In-Person Application: If you prefer personal assistance or have a complex case, you can apply in person at your local SSA office. This option allows you to receive guidance and support from SSA representatives, ensuring that your application is complete and accurate.

Step 4: Initial Determination

Once you’ve submitted your application, the SSA will review your case. This process can take several months, as the agency carefully evaluates your medical and financial information. If your application is approved, you will begin receiving SSI Disability benefits, including monthly payments and access to Medicaid (or in some cases, Medicare) for healthcare coverage.

Step 5: Ongoing Eligibility

SSI Disability benefits are not permanent. The SSA periodically reviews recipients’ cases to ensure continued eligibility. These reviews typically occur every few years and involve updating your medical and financial information. It’s important to keep the SSA informed of any changes in your condition, income, or resources to maintain your eligibility.

Benefits of SSI Disability: What to Expect

SSI Disability offers a range of benefits to assist individuals with severe disabilities in meeting their basic needs and accessing essential services.

Monthly Cash Payments

The primary benefit of SSI Disability is the monthly cash payment. The amount of this payment depends on various factors, including your living situation and whether you have other sources of income. In 2023, the maximum federal SSI payment is 841 per month for an individual and 1,261 per month for a couple. However, some states provide additional SSI supplements, increasing the total benefit amount.

Medicaid Coverage

SSI Disability recipients are automatically eligible for Medicaid, the federal-state healthcare program for low-income individuals. Medicaid provides comprehensive healthcare coverage, including doctor visits, hospital stays, prescription medications, and more. This benefit is particularly crucial for individuals with severe disabilities, as it ensures they can access the medical care they need without financial strain.

State-Level Benefits

In addition to federal SSI benefits, some states offer their own disability-related programs or provide additional benefits to SSI recipients. These can include supplemental payments, assistance with housing or utility costs, and access to specialized services for individuals with disabilities. It’s important to research and understand the specific benefits available in your state.

Work Incentives

The SSA recognizes that some SSI Disability recipients may want to work despite their disabilities. To encourage and support these individuals, the agency offers various work incentives. These incentives allow recipients to earn income without losing their SSI benefits or Medicaid coverage. For example, the Earned Income Exclusion allows recipients to exclude a portion of their earned income from their SSI calculation, enabling them to work and save without immediately impacting their benefits.

Challenges and Future Implications

While SSI Disability is a vital program for individuals with severe disabilities, it is not without its challenges. One of the primary concerns is the lengthy and complex application process, which can be daunting for those already facing significant health challenges. Additionally, the financial eligibility criteria can be restrictive, excluding some individuals who may have limited income but also substantial assets, such as a home or vehicle.

Looking to the future, there are ongoing efforts to improve and streamline the SSI Disability program. The SSA is continuously working to enhance its technology and processes to make the application and determination process more efficient. Additionally, advocacy groups and policymakers are pushing for changes to the financial eligibility criteria to ensure that more individuals with disabilities can access the support they need.

Furthermore, as the population ages and the prevalence of certain disabilities increases, the demand for SSI Disability benefits is likely to grow. This highlights the need for sustainable funding and resource allocation to ensure the program can meet the needs of a growing number of beneficiaries.

Conclusion: A Lifeline for Americans with Disabilities

SSI Disability serves as a critical safety net for Americans facing severe disabilities. By providing financial support and access to healthcare, the program enables individuals to maintain their independence and quality of life despite their physical or mental limitations. While the application process can be challenging, the benefits it offers are invaluable for those in need.

As we continue to advocate for the rights and well-being of individuals with disabilities, the SSI Disability program remains a cornerstone of support, ensuring that no one is left behind due to their medical conditions.

Can I qualify for SSI Disability if I have a part-time job?

+Yes, it is possible to qualify for SSI Disability while working part-time. The SSA offers work incentives that allow recipients to earn income without immediately losing their benefits. These incentives, such as the Earned Income Exclusion, ensure that individuals can work and still receive the support they need.

How often does the SSA review my SSI Disability case?

+The SSA typically reviews SSI Disability cases every few years to ensure continued eligibility. This review process involves updating your medical and financial information. It’s important to promptly provide any requested information to maintain your benefits.

Are there any assets that are exempt from the SSI resource limits?

+Yes, certain assets are exempt from the SSI resource limits. These typically include your primary residence, household goods, and a vehicle (with certain value limits). Additionally, some types of personal property, such as burial plots or life insurance policies, are also exempt.