Car Insurance In Fl

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind for drivers. In the state of Florida, known for its vibrant culture, beautiful beaches, and unique road systems, understanding the ins and outs of car insurance is essential. Florida's insurance regulations and market dynamics present a complex landscape, requiring drivers to make informed choices to ensure adequate coverage. This comprehensive guide will delve into the intricacies of car insurance in Florida, offering valuable insights and expert advice to help residents navigate the state's insurance requirements and options.

The Landscape of Car Insurance in Florida

Florida is a distinctive state when it comes to car insurance, with a unique set of regulations and market characteristics. The Sunshine State is home to a diverse range of drivers, from young, tech-savvy millennials to seasoned retirees, each with their own insurance needs and preferences. Understanding the specific requirements and options available in Florida is key to making informed decisions and securing the best coverage.

Florida's No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each driver's insurance company is responsible for covering their own policyholder's damages and injuries up to a certain limit. This system is designed to expedite the claims process and reduce the number of minor lawsuits. However, it also means that drivers must carry specific types of coverage to comply with state law.

| Insurance Coverage Type | Minimum Requirement in Florida |

|---|---|

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability | $10,000 |

The Personal Injury Protection (PIP) coverage is a cornerstone of Florida's no-fault system, providing financial support for medical bills, lost wages, and other related expenses after an accident. Meanwhile, Property Damage Liability coverage ensures that the policyholder can cover the costs of damage to others' property in an at-fault accident.

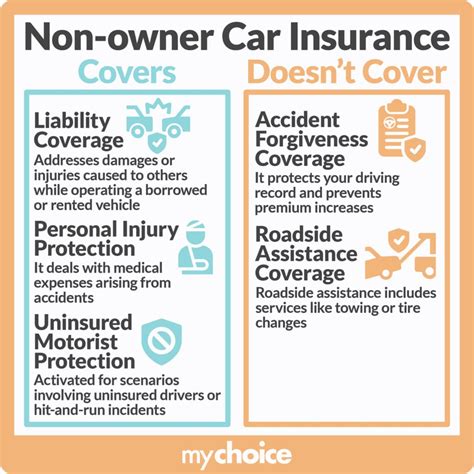

Additional Coverage Options

While the no-fault system mandates certain coverage types, Florida drivers have the flexibility to choose additional coverage options to enhance their protection. Here are some common add-ons:

- Bodily Injury Liability: Covers the costs of injuries caused to others in an at-fault accident.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if an at-fault driver lacks sufficient insurance coverage.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, or natural disasters.

- Collision Coverage: Covers the cost of repairs or replacement for your vehicle after an accident, regardless of fault.

- Medical Payments Coverage: Offers additional medical expense coverage beyond the PIP limits.

Factors Influencing Insurance Premiums

Insurance premiums in Florida are influenced by a multitude of factors, including personal characteristics, driving history, and vehicle details. Here are some key elements that impact insurance costs:

- Age and Gender: Younger drivers, especially males, often face higher premiums due to statistical risk factors.

- Driving Record: A clean driving record with no recent accidents or violations can lead to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle can significantly impact insurance rates. Sports cars and luxury vehicles tend to have higher premiums.

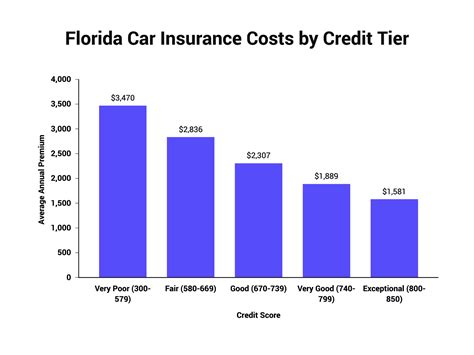

- Credit History: In Florida, insurance companies are allowed to consider credit scores when determining premiums. A good credit score can lead to lower rates.

- Coverage and Deductibles: Choosing higher coverage limits and accepting higher deductibles can influence the overall premium.

Comparing Car Insurance Providers in Florida

Florida's insurance market is highly competitive, with numerous providers offering a wide range of policies. When comparing car insurance options, it's essential to consider not just the price but also the quality of coverage and the provider's reputation. Here's a comparative analysis of some leading insurance companies in Florida:

State Farm

State Farm is a well-established insurance provider with a strong presence in Florida. They offer a comprehensive range of insurance products, including auto, home, and life insurance. State Farm is known for its competitive pricing and excellent customer service. Their policies often include additional perks like roadside assistance and rental car coverage.

Geico

Geico is a popular choice among Florida drivers, thanks to its efficient online platform and competitive rates. Geico provides a wide range of coverage options, including comprehensive and collision coverage, as well as specialty policies for classic cars and motorcycles. Their online resources and mobile app make it easy to manage policies and file claims.

Progressive

Progressive is another major player in Florida's insurance market, offering a variety of insurance products and innovative features. Progressive is known for its Name Your Price tool, which allows customers to set their desired price range and then suggests coverage options to meet their budget. They also provide unique add-ons like pet injury coverage and gap insurance.

Allstate

Allstate offers a comprehensive suite of insurance products, including auto, home, and life insurance. They are known for their innovative features like Drivewise, which rewards safe driving habits with discounts. Allstate also provides a range of coverage options, including accident forgiveness and rental car reimbursement.

USAA

USAA is a unique insurance provider, exclusively serving active military personnel, veterans, and their families. They are renowned for their excellent customer service and comprehensive coverage options. USAA offers competitive rates and additional perks like discounts for safe driving and loyalty.

Tips for Choosing the Right Car Insurance in Florida

Selecting the right car insurance policy in Florida involves a careful evaluation of your specific needs and circumstances. Here are some expert tips to guide you through the process:

- Understand Your Coverage Needs: Assess your personal risk factors and choose coverage that aligns with your needs. Consider factors like your driving record, the value of your vehicle, and your financial situation.

- Compare Multiple Providers: Don't settle for the first quote you receive. Compare rates and coverage options from multiple providers to ensure you're getting the best value.

- Consider Bundling Policies: Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance. This can be a cost-effective way to secure comprehensive coverage.

- Review Your Policy Regularly: Insurance needs can change over time. Regularly review your policy to ensure it still meets your requirements, and don't hesitate to make adjustments as necessary.

- Explore Discounts: Insurance providers often offer a variety of discounts, such as safe driver discounts, multi-policy discounts, and loyalty rewards. Take advantage of these savings to lower your premiums.

Future Trends in Florida's Car Insurance Market

The car insurance landscape in Florida is constantly evolving, influenced by technological advancements, changing consumer preferences, and regulatory shifts. Here are some key trends to watch in the coming years:

Telematics and Usage-Based Insurance

Telematics technology, which uses data from sensors and GPS to monitor driving behavior, is gaining traction in Florida's insurance market. Usage-based insurance policies, which offer personalized premiums based on real-time driving data, are expected to become more prevalent. This shift could incentivize safer driving habits and provide more accurate pricing for policyholders.

Increased Focus on Digital Platforms

Insurance providers are investing heavily in digital platforms and mobile apps to enhance the customer experience. From policy management to claim filing, these digital tools are making insurance processes more efficient and accessible. Florida drivers can expect continued improvements in online and mobile services, making it easier to manage their insurance needs.

Expanding Coverage Options

As the automotive industry evolves, with the rise of electric and autonomous vehicles, insurance providers are likely to introduce new coverage options. This could include specialized policies for electric cars and liability coverage for autonomous driving systems. Florida drivers can anticipate a broader range of coverage choices to align with the changing automotive landscape.

Regulation and Compliance

Florida's insurance regulations are subject to ongoing updates and revisions. Stay informed about any changes to the state's insurance laws and how they might impact your coverage. Compliance with these regulations is crucial to avoid legal issues and ensure you have the necessary protection.

Frequently Asked Questions (FAQ)

What is the average cost of car insurance in Florida?

+

The average cost of car insurance in Florida varies depending on several factors, including the driver’s age, driving record, vehicle type, and coverage limits. According to recent data, the average annual premium in Florida is around $1,700, but this can range significantly based on individual circumstances.

Can I get car insurance without a driver’s license in Florida?

+

No, you must have a valid driver’s license to obtain car insurance in Florida. Insurance providers require proof of a valid license as part of the application process.

What happens if I get into an accident with an uninsured driver in Florida?

+

If you have uninsured motorist coverage, your insurance company will cover the damages and injuries caused by the uninsured driver up to your policy limits. This coverage is highly recommended in Florida to protect against financial losses in such situations.

How can I lower my car insurance premiums in Florida?

+

There are several strategies to reduce your car insurance premiums in Florida. These include maintaining a clean driving record, increasing your deductibles, exploring discounts (e.g., safe driver discounts, multi-policy discounts), and shopping around for competitive rates.

What should I do if I’m involved in a car accident in Florida?

+

If you’re involved in a car accident in Florida, the first step is to ensure the safety of yourself and others involved. Call 911 if necessary. Exchange insurance information with the other driver(s) and take photos of the accident scene. Notify your insurance company as soon as possible to initiate the claims process.