Non Automobile Owners Insurance

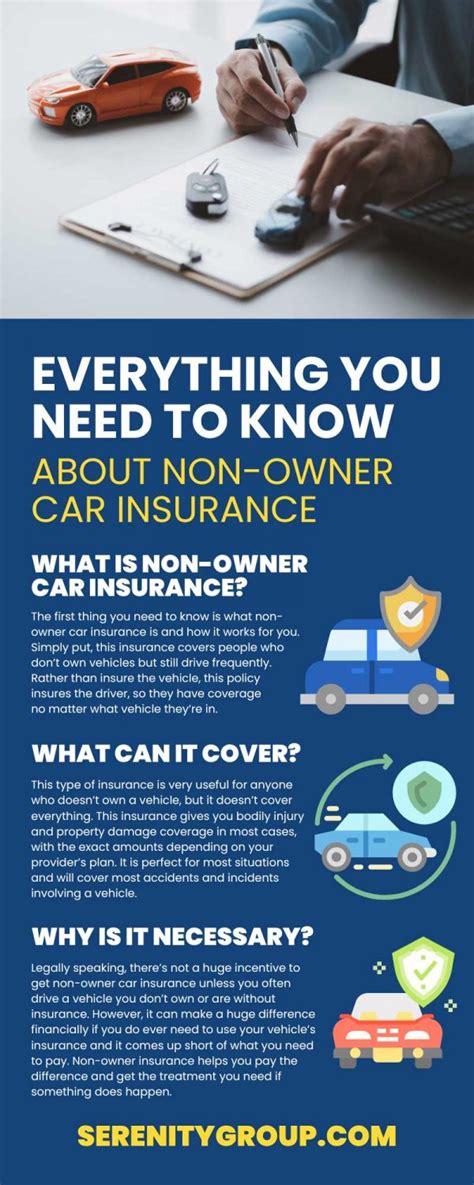

In today's world, insurance is an essential aspect of financial planning, offering protection and peace of mind against various uncertainties. While automobile insurance is a common type of coverage, it is not the only option available. For individuals who do not own automobiles, non-automobile owners insurance provides an alternative solution to safeguard their assets and manage potential risks.

Non-automobile owners insurance, often referred to as renters insurance or personal liability insurance, caters to a diverse range of individuals. From renters and homeowners to those who prefer alternative modes of transportation, this type of insurance offers comprehensive coverage tailored to specific needs. By understanding the benefits and features of non-automobile owners insurance, individuals can make informed decisions to protect their financial well-being.

Understanding Non-Automobile Owners Insurance

Non-automobile owners insurance is a specialized form of coverage designed to protect individuals and their assets from various risks. Unlike traditional automobile insurance, which primarily focuses on vehicles, this type of insurance broadens its scope to cover a wide array of potential liabilities and losses.

One of the key advantages of non-automobile owners insurance is its flexibility. It can be customized to meet the unique needs of different individuals. For instance, renters can opt for policies that cover their personal belongings, providing protection against theft, damage, or loss. Additionally, homeowners without automobiles can secure their properties and personal liability, ensuring they are financially prepared for unexpected incidents.

Key Components of Non-Automobile Owners Insurance

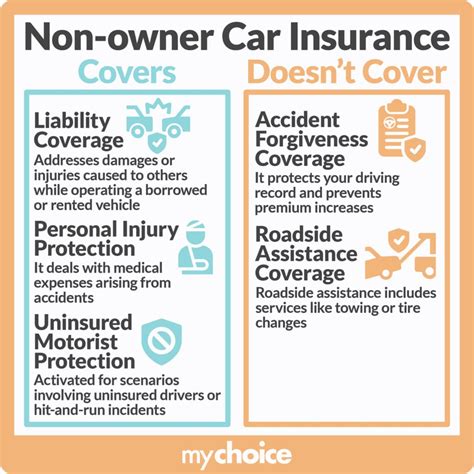

Non-automobile owners insurance typically consists of several essential components, each offering specific coverage and benefits. These components can vary depending on the provider and the policy chosen, but here are some common elements:

- Personal Property Coverage: This aspect of the policy provides protection for an individual's personal belongings, such as furniture, electronics, clothing, and jewelry. It covers losses due to theft, fire, vandalism, or natural disasters.

- Liability Coverage: Liability insurance is a crucial component, as it safeguards the policyholder against legal claims and financial responsibilities arising from accidental injuries or property damage caused to others. It covers medical expenses, legal fees, and settlements.

- Medical Payments Coverage: In the event of an accident or injury on the policyholder's property, this coverage provides financial assistance for the medical expenses of the injured party, regardless of fault.

- Additional Living Expenses: If a covered loss renders the policyholder's residence uninhabitable, this coverage helps cover the additional costs of temporary housing and other related expenses during the repair or rebuilding process.

- Personal Injury Protection: Personal injury protection covers non-physical damages, such as defamation, invasion of privacy, or libel, providing legal defense and financial support.

The Benefits of Non-Automobile Owners Insurance

Opting for non-automobile owners insurance offers a range of benefits that extend beyond the protection of personal belongings. Here are some key advantages:

Peace of Mind and Financial Security

Non-automobile owners insurance provides individuals with a sense of security and peace of mind. Knowing that their assets and liabilities are protected, they can navigate life's uncertainties with confidence. In the event of a covered loss, the insurance policy ensures financial stability and assists in recovering from unforeseen circumstances.

Tailored Coverage for Specific Needs

One of the significant advantages of non-automobile owners insurance is its ability to be customized. Whether an individual is a renter, homeowner, or prefers alternative transportation, the policy can be tailored to their unique circumstances. This customization ensures that the coverage meets their specific requirements, providing a comprehensive safety net.

Protection Against Unexpected Incidents

Life is full of surprises, and non-automobile owners insurance steps in to mitigate the financial impact of unexpected incidents. From natural disasters to accidental injuries, the policy covers a wide range of scenarios, ensuring that individuals are not left vulnerable or financially strained in the face of unforeseen events.

Affordable and Accessible

Non-automobile owners insurance is often more affordable than traditional automobile insurance, making it an accessible option for individuals with varying financial situations. With competitive rates and flexible payment plans, this type of insurance is within reach for many, providing essential protection without breaking the bank.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of non-automobile owners insurance, let's explore a few real-world scenarios:

Case Study: Rental Property Protection

Imagine a renter, Jane, who lives in a bustling city. Despite her careful precautions, her apartment becomes a target for burglars. Thanks to her non-automobile owners insurance policy, which includes personal property coverage, Jane receives compensation for the stolen items, helping her replace her belongings and move on from the traumatic experience.

Liability Protection: A Homeowner's Story

John, a proud homeowner, hosts a neighborhood barbecue. Unfortunately, a guest trips and injures themselves on his property. John's non-automobile owners insurance policy, with its liability coverage, steps in to cover the guest's medical expenses and potential legal fees, preventing John from facing significant financial burdens.

Additional Living Expenses: A Temporary Displacement

Sarah, a recent college graduate, rents an apartment. Due to a severe storm, her building sustains significant damage, rendering it unsafe to inhabit. With her non-automobile owners insurance policy, Sarah receives assistance for her temporary housing expenses, ensuring she has a roof over her head while her apartment undergoes repairs.

Comparative Analysis: Non-Automobile Owners vs. Automobile Insurance

While non-automobile owners insurance offers comprehensive coverage, it is essential to understand how it differs from traditional automobile insurance. Here's a comparative analysis to provide a clearer picture:

| Aspect | Non-Automobile Owners Insurance | Automobile Insurance |

|---|---|---|

| Primary Coverage | Personal property, liability, and additional living expenses | Vehicle protection, liability, and medical payments |

| Cost | Generally more affordable, depending on coverage and location | Varies based on vehicle type, usage, and location |

| Target Audience | Renters, homeowners, and individuals without automobiles | Vehicle owners and drivers |

| Flexibility | Highly customizable to meet specific needs | Offered in standard and customized packages |

Future Implications and Expert Insights

As the insurance landscape continues to evolve, non-automobile owners insurance is poised to play an increasingly vital role. With changing lifestyles, growing urban populations, and a shift towards alternative transportation, the demand for this type of insurance is expected to rise.

💡 Industry experts predict that non-automobile owners insurance will become a critical component of financial planning, especially for millennials and Generation Z, who are more likely to rent and opt for sustainable transportation options. The flexibility and affordability of these policies will make them an attractive choice for this demographic.

Furthermore, as awareness about the importance of insurance grows, individuals will seek comprehensive coverage to protect their assets and manage risks effectively. Non-automobile owners insurance provides an excellent opportunity for insurers to cater to a diverse range of consumers, offering tailored solutions to meet their unique needs.

Conclusion

Non-automobile owners insurance is a valuable tool for individuals looking to protect their financial well-being. By understanding the various components and benefits of this type of insurance, individuals can make informed decisions to safeguard their assets and manage potential liabilities. With its flexibility, affordability, and comprehensive coverage, non-automobile owners insurance offers a reliable safety net for a wide range of individuals.

Frequently Asked Questions

Can I customize my non-automobile owners insurance policy to include specific coverage for my unique needs?

+Absolutely! One of the key advantages of non-automobile owners insurance is its flexibility. You can work with your insurance provider to tailor the policy to your specific requirements. Whether you want higher coverage limits for personal property or additional liability protection, your insurer can help create a customized plan that suits your needs.

<div class="faq-item">

<div class="faq-question">

<h3>How does non-automobile owners insurance compare in terms of cost to other types of insurance, such as automobile insurance or health insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Non-automobile owners insurance is generally more affordable than automobile insurance, as it does not involve the high costs associated with vehicle coverage. However, the cost can vary depending on factors such as the level of coverage you choose, your location, and any additional endorsements or riders you add to your policy. When compared to health insurance, non-automobile owners insurance typically covers a broader range of potential risks but may have lower coverage limits.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any discounts or incentives available for non-automobile owners insurance policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, many insurance providers offer discounts and incentives for non-automobile owners insurance policies. Some common discounts include multi-policy discounts (if you bundle your non-auto insurance with other policies like homeowners or renters insurance), loyalty discounts for long-term customers, and even discounts for specific occupations or membership in certain organizations. It's always a good idea to inquire about available discounts when shopping for insurance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I consider when choosing a non-automobile owners insurance provider?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When selecting a non-automobile owners insurance provider, it's essential to consider factors such as their financial stability, customer service reputation, and the range of coverage options they offer. Look for providers with a strong financial rating, as this indicates their ability to pay out claims. Read reviews and seek recommendations to gauge customer satisfaction. Additionally, compare the coverage options and premiums offered by different providers to find the best fit for your needs and budget.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can non-automobile owners insurance be combined with other types of insurance for additional protection?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! Many insurance providers offer the option to bundle different types of insurance policies, such as combining non-automobile owners insurance with homeowners or renters insurance. Bundling policies can often result in significant discounts and provide a more comprehensive level of protection. By combining policies, you can ensure that all your assets and liabilities are covered under one insurance provider, making it more convenient and cost-effective.</p>

</div>

</div>