How To Use Gap Insurance

Gap insurance is an essential coverage option for vehicle owners, providing financial protection in scenarios where the outstanding loan or lease balance exceeds the actual cash value of the vehicle. This insurance policy is particularly valuable in situations such as total vehicle loss due to accidents, theft, or natural disasters, as it ensures you're not left with a large financial burden. Understanding how gap insurance works and when to use it is crucial for anyone looking to safeguard their finances and maintain peace of mind when it comes to vehicle ownership.

Understanding Gap Insurance

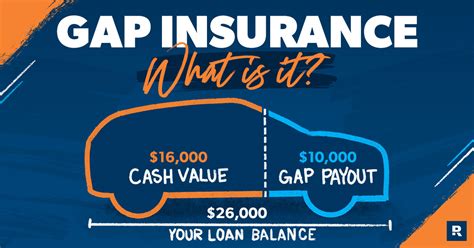

Gap insurance, often referred to as Guaranteed Asset Protection, is an add-on policy designed to cover the difference between the value of your vehicle and the amount you still owe on it. This coverage is especially beneficial during the early years of a car loan or lease, when the vehicle's value typically depreciates faster than the loan balance is paid off.

Imagine purchasing a new car for $30,000 and taking out a loan for the full amount. After a year, your car's value might drop to $25,000, but you still owe $28,000 on your loan. In this scenario, if your car is totaled in an accident, standard insurance will only cover the current value of the vehicle ($25,000), leaving you with a significant gap of $3,000 to cover out of pocket.

This is where gap insurance steps in. With this coverage, the insurance provider will pay the difference between the vehicle's actual cash value and the outstanding loan or lease balance, ensuring you're not left with a financial shortfall.

When to Use Gap Insurance

Gap insurance is most beneficial during the following scenarios:

- New Vehicle Purchases: If you've just bought a new car, especially a costly one, gap insurance is crucial as vehicles depreciate rapidly during the first few years of ownership.

- Leasing a Vehicle: Leasing often involves higher monthly payments and a lower resale value, making gap insurance a prudent choice to protect your finances.

- High-Loan-to-Value Ratios: If you've financed a significant portion of your vehicle's value or have a low down payment, gap insurance can provide peace of mind by covering potential shortfalls.

- After an Accident: In the unfortunate event of a total loss accident, gap insurance ensures you're not stuck with a large bill, allowing you to walk away without financial strain.

How to Obtain Gap Insurance

Gap insurance can be purchased from various sources, including:

- Vehicle Dealers: Many car dealerships offer gap insurance as an add-on when you purchase a new vehicle. However, it's essential to review the terms and conditions carefully.

- Insurance Providers: Your regular auto insurance company may offer gap coverage as an optional add-on to your existing policy.

- Third-Party Insurers: Specialized insurance companies provide gap insurance policies that can be tailored to your specific needs.

Factors to Consider When Choosing Gap Insurance

When selecting a gap insurance policy, keep these factors in mind:

- Policy Limits: Ensure the policy covers the full amount of your loan or lease balance. Some policies may have limitations or deductibles.

- Coverage Period: Gap insurance is typically valid for the duration of your loan or lease. However, some policies may offer shorter coverage periods, so choose one that aligns with your needs.

- Additional Benefits: Look for policies that offer extra benefits like rental car coverage or waivers for late payments.

- Cost: Compare prices and features from different providers to find the best value for your money.

Using Gap Insurance: Step-by-Step Guide

Here's a simple guide on how to use gap insurance:

- Purchase Gap Insurance: Acquire a gap insurance policy from a reputable provider. Ensure you understand the terms and conditions of the policy.

- Keep the Policy Details Handy: Store your gap insurance policy documents in a safe place, along with your other important vehicle-related paperwork.

- Notify Your Insurer in Case of an Incident: In the event of a total loss, theft, or write-off, promptly inform your gap insurance provider and follow their claims process.

- Submit a Claim: Provide all the necessary documentation, including police reports, repair estimates, and any other relevant information.

- Wait for Claim Approval: The insurance provider will assess your claim and, if approved, pay out the difference between your vehicle's value and your outstanding loan or lease balance.

Gap insurance is a valuable tool to protect your finances when it comes to vehicle ownership. By understanding its benefits and how to obtain and use it, you can ensure that you're fully covered in case of unforeseen circumstances.

Gap Insurance: Frequently Asked Questions

Can I purchase gap insurance at any time during my loan or lease period?

+Yes, you can typically purchase gap insurance at any point during your loan or lease period. However, it’s advisable to buy it as soon as possible, especially if your vehicle is new or has high depreciation rates.

Is gap insurance mandatory for all vehicle owners?

+No, gap insurance is not mandatory. It’s an optional coverage that provides additional financial protection. However, it’s highly recommended, especially if you have a high-value vehicle or a substantial loan balance.

What happens if my gap insurance claim is denied?

+If your gap insurance claim is denied, the insurance provider will provide reasons for the denial. You can review the policy terms and conditions to understand the grounds for denial and potentially appeal the decision. It’s crucial to thoroughly understand the coverage limitations before purchasing a policy.

Can I cancel my gap insurance policy if I no longer need it?

+Yes, you can cancel your gap insurance policy at any time. However, it’s essential to understand the cancellation process and any potential fees involved. Canceling your policy may also impact your vehicle loan or lease terms, so it’s advisable to consult with your lender or leasing company before making any decisions.