What Is Life Insurance Cash Value

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their loved ones. One of the key aspects of life insurance policies is the concept of cash value, which adds an extra layer of flexibility and potential benefits to policyholders. In this comprehensive guide, we will delve into the world of life insurance cash value, exploring its nature, how it works, its advantages, and its role in overall financial planning.

Understanding Life Insurance Cash Value

Life insurance cash value refers to the portion of a policyholder’s premium that is not used immediately to purchase insurance coverage. Instead, this money is invested by the insurance company, generating earnings over time. The cash value accumulates within the policy, serving as a savings component that can be accessed by the policyholder during their lifetime.

The idea behind cash value life insurance is to offer policyholders a combination of death benefit protection and a potential financial asset. While the primary purpose of life insurance is to provide financial support to beneficiaries in the event of the policyholder's passing, the cash value aspect allows individuals to build savings within the policy, which can be utilized for various purposes during their lifetime.

How Does Life Insurance Cash Value Work?

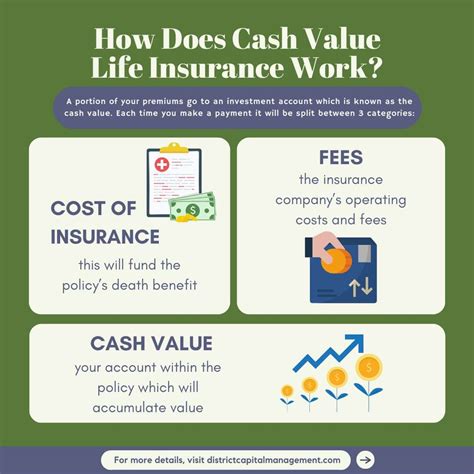

The operation of life insurance cash value involves a complex interplay of premiums, investment returns, and policy design. When a policyholder purchases a life insurance policy with a cash value component, a portion of their premium payments goes towards the insurance coverage, while the remaining amount is allocated to the cash value account.

The insurance company invests this cash value in a range of financial instruments, such as stocks, bonds, and money market funds. The earnings generated from these investments are then added to the cash value account, which grows over time. The growth rate of the cash value depends on various factors, including the policy's design, the performance of the underlying investments, and the overall economic environment.

Policyholders can typically access their cash value through a variety of means. One common method is through policy loans, where the policyholder borrows against the cash value, repaying the loan with interest over time. Alternatively, policyholders can surrender their policy and receive the cash value as a lump sum, although this may have tax implications and result in the termination of the insurance coverage.

Advantages of Life Insurance Cash Value

Life insurance cash value offers several advantages to policyholders, making it an attractive option for those seeking financial security and flexibility:

Long-Term Savings

The cash value component of a life insurance policy provides a dedicated savings vehicle that accumulates over time. Policyholders can use this savings to achieve various financial goals, such as funding retirement, paying for their children’s education, or covering unexpected expenses.

Policy Loans and Flexibility

One of the significant benefits of life insurance cash value is the ability to access funds through policy loans. These loans allow policyholders to borrow against their cash value without incurring credit checks or providing collateral. The loan amount is typically repaid with interest, and the policy continues to accumulate cash value, ensuring the death benefit remains intact.

Tax Advantages

Life insurance cash value policies often offer tax advantages. The growth of cash value within the policy is generally tax-deferred, meaning the earnings are not taxed until the policyholder accesses the funds. Additionally, policy loans are considered non-taxable events, providing further tax benefits.

Estate Planning

Life insurance cash value can play a crucial role in estate planning. The death benefit, combined with the cash value accumulation, can provide a substantial financial legacy for beneficiaries. The cash value can be used to cover estate taxes, pay off debts, or fund charitable donations, ensuring the policyholder’s financial goals are realized even after their passing.

Guaranteed Death Benefit

Despite the focus on cash value, it’s essential to remember that life insurance policies primarily provide a death benefit. The cash value component does not impact the policy’s primary purpose of offering financial protection to beneficiaries in the event of the policyholder’s untimely demise.

Performance and Growth

The performance and growth of life insurance cash value can vary based on several factors. Insurance companies offer different types of policies, each with its investment strategy and potential returns. While some policies may offer higher growth potential, they may also come with higher risk.

Policyholders should carefully consider their financial goals, risk tolerance, and time horizon when selecting a life insurance policy with a cash value component. Consulting with a financial advisor or insurance professional can help individuals make informed decisions based on their unique circumstances.

Types of Life Insurance with Cash Value

There are several types of life insurance policies that offer a cash value component. Understanding the differences between these policies is crucial for policyholders to make the right choice:

Whole Life Insurance

Whole life insurance is a permanent insurance policy that provides coverage for the policyholder’s entire life. It offers a guaranteed cash value accumulation, meaning the policyholder knows exactly how much their cash value will grow over time. Whole life policies typically have higher premiums but provide stable and predictable growth.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life policies. Policyholders can adjust their premium payments and death benefit amounts within certain limits. The cash value in universal life insurance policies is invested in a separate account, and the policyholder can choose the level of risk they are comfortable with, ranging from conservative to aggressive investment strategies.

Variable Life Insurance

Variable life insurance policies allow policyholders to invest their cash value in a variety of investment options, such as mutual funds. The growth of the cash value depends on the performance of the chosen investments. While variable life insurance offers higher growth potential, it also carries more risk compared to whole or universal life policies.

Indexed Universal Life Insurance

Indexed universal life insurance combines the flexibility of universal life policies with the potential for higher returns. The cash value is linked to a stock market index, such as the S&P 500, allowing policyholders to benefit from market growth while limiting downside risk. Indexed universal life policies offer a balance between growth potential and stability.

Considerations and Risks

While life insurance cash value provides numerous benefits, it’s essential to consider certain risks and potential drawbacks:

Cost

Life insurance policies with a cash value component generally have higher premiums compared to term life insurance policies. Policyholders should carefully evaluate their financial situation and long-term goals to determine if the additional cost is justified by the benefits they seek.

Investment Risk

The cash value of life insurance policies is subject to investment risk. If the underlying investments perform poorly, the cash value may not grow as expected, or it may even decline. Policyholders should be aware of the potential risks associated with the investment strategy chosen by the insurance company.

Policy Lapses

If a policyholder fails to make premium payments, the policy may lapse, resulting in the loss of both the death benefit and the accumulated cash value. It’s crucial to ensure timely premium payments to maintain the policy’s benefits.

Tax Implications

While life insurance cash value offers tax advantages, there are potential tax implications when accessing the funds. Policy loans and surrenders may trigger taxable events, and policyholders should consult with tax professionals to understand the tax consequences.

Real-World Examples and Success Stories

To illustrate the impact and benefits of life insurance cash value, let’s explore a few real-world examples:

Retirement Funding

John, a 55-year-old business owner, purchased a whole life insurance policy with a cash value component 20 years ago. Over the years, the cash value accumulated, and John used it to supplement his retirement income. The tax-deferred growth of the cash value allowed him to maintain a comfortable lifestyle during his retirement years.

Education Expenses

Sarah, a single mother, wanted to ensure her children’s education was financially secure. She opted for a universal life insurance policy with a cash value component. As her children grew, Sarah accessed the cash value through policy loans to cover their college tuition fees, ensuring they could pursue their educational goals without financial strain.

Business Succession Planning

Michael, a successful entrepreneur, wanted to ensure a smooth transition of his business to his children upon his retirement. He utilized the cash value of his whole life insurance policy to fund the buy-sell agreement, providing the necessary capital to purchase his share of the business and facilitate a seamless succession plan.

Conclusion

Life insurance cash value is a powerful tool that adds a layer of financial flexibility and security to policyholders’ lives. By understanding the nature of cash value, how it works, and its potential advantages, individuals can make informed decisions when selecting a life insurance policy. Whether it’s for long-term savings, accessing funds through policy loans, or leaving a substantial legacy, life insurance cash value can be a valuable asset in overall financial planning.

How does life insurance cash value accumulate over time?

+Life insurance cash value accumulates through the investment of a portion of the policyholder’s premium payments. The insurance company invests this money in various financial instruments, and the earnings generated are added to the cash value account, allowing it to grow over time.

Can I access my life insurance cash value during my lifetime?

+Yes, policyholders can typically access their life insurance cash value through policy loans or policy surrenders. Policy loans allow borrowing against the cash value without affecting the death benefit, while surrenders provide a lump-sum payment but may have tax implications.

What are the tax implications of life insurance cash value?

+Life insurance cash value offers tax advantages, as the growth within the policy is generally tax-deferred. Policy loans are non-taxable events. However, policy surrenders and accessing the cash value may trigger taxable events, and it’s advisable to consult with tax professionals for guidance.

How do I choose the right life insurance policy with cash value?

+When selecting a life insurance policy with cash value, consider your financial goals, risk tolerance, and time horizon. Consult with financial and insurance professionals to understand the different policy types, such as whole life, universal life, variable life, and indexed universal life, and choose the one that aligns with your specific needs and circumstances.

Can I use life insurance cash value for estate planning?

+Absolutely! Life insurance cash value can be a valuable tool for estate planning. The death benefit, combined with the accumulated cash value, can provide a substantial financial legacy for beneficiaries. It can be used to cover estate taxes, pay off debts, or fund charitable donations, ensuring your financial goals are realized after your passing.