Progressive Insurance Car

Introduction: A Journey Towards Comprehensive Auto Coverage

In the intricate landscape of vehicle ownership, one of the most pivotal decisions you’ll make is selecting the right auto insurance provider. Progressive Insurance, a powerhouse in the industry, has been a trusted name for decades, offering a comprehensive suite of policies tailored to meet the diverse needs of drivers across the United States. This article delves into the heart of Progressive’s offerings, exploring how their car insurance policies provide not just financial security but also a sense of confidence and peace of mind for policyholders.

From understanding the unique features and benefits of Progressive’s car insurance to exploring real-world examples of how their policies have made a difference, this comprehensive guide aims to be your trusted resource. By the end, you’ll have a clearer picture of why Progressive Insurance is a leading choice for millions of drivers, and how their services can enhance your driving experience and protect you from unforeseen events.

Understanding Progressive Car Insurance: A Comprehensive Overview

Progressive Insurance’s car insurance policies are designed to offer a robust blend of coverage options, catering to the varied needs of their vast customer base. Here’s a detailed breakdown of the key components that make Progressive’s auto insurance stand out:

1. Comprehensive Coverage Options:

Liability Coverage: This foundational aspect of any auto insurance policy covers bodily injury and property damage you may cause to others in an accident. Progressive offers flexible limits, allowing policyholders to customize their coverage to fit their needs and budget.

Collision Coverage: Progressive’s collision coverage helps policyholders cover the costs of repairing or replacing their vehicle in the event of an accident, regardless of fault. With Progressive, you can choose from various deductibles to find the right balance between coverage and cost.

Comprehensive Coverage: Beyond collision, Progressive’s comprehensive coverage protects against damage from events like theft, vandalism, fire, and natural disasters. This essential coverage ensures that your vehicle is protected from a wide range of potential hazards.

2. Unique Policy Features:

Snapshot: Progressive’s innovative Snapshot program uses a small device plugged into your vehicle’s diagnostic port to track your driving habits. Based on your driving behavior, you could be eligible for discounts, offering a personalized approach to insurance rates.

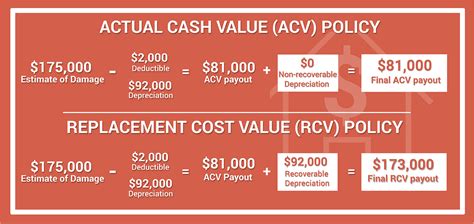

Gap Coverage: This coverage is especially beneficial for new car owners. It ensures that if your car is totaled or stolen, Progressive will pay the difference between what you owe on your loan or lease and the actual cash value of your vehicle, providing added financial security.

Roadside Assistance: Progressive’s roadside assistance program provides 24⁄7 help for common issues like flat tires, dead batteries, or running out of gas. This service ensures that you’re never stranded and adds a layer of convenience to your driving experience.

3. Customer-Centric Approach:

Online and Mobile Tools: Progressive understands the importance of digital convenience. Their online platform and mobile app allow policyholders to manage their policies, file claims, and access important documents with ease.

Claims Process: Progressive’s claims process is renowned for its efficiency. With a dedicated claims team, policyholders can expect swift and fair resolution, often with the option to begin the process online or via the Progressive app.

Customer Service: Progressive’s customer service is a key differentiator. With a focus on education and transparency, their representatives guide policyholders through the complexities of insurance, ensuring a thorough understanding of their coverage.

Real-World Impact: Progressive Car Insurance in Action

To truly grasp the value of Progressive’s car insurance policies, let’s explore a few real-life scenarios where their comprehensive coverage made a significant difference:

Case Study 1: Collision Coverage in Action

Scenario: John, a loyal Progressive customer, was involved in a rear-end collision while commuting to work. His vehicle, a 2018 sedan, sustained significant damage to the rear bumper and trunk.

Progressive’s Response: With Progressive’s collision coverage, John was able to have his vehicle repaired at a trusted body shop of his choice. Progressive’s claims adjuster provided a detailed estimate, ensuring all repairs were covered, and John’s car was back on the road within a week.

Case Study 2: Comprehensive Coverage for Natural Disasters

Scenario: In the wake of a severe thunderstorm, Sarah, a Progressive policyholder, discovered her vehicle had sustained hail damage, with dents across the roof and hood.

Progressive’s Response: Progressive’s comprehensive coverage stepped in, covering the costs of repairing the hail damage. With a preferred repair shop network, Sarah was able to have her vehicle repaired quickly, minimizing the impact of the storm on her daily life.

Case Study 3: Snapshot Program Success

Scenario: David, a cautious driver, signed up for Progressive’s Snapshot program. Over the course of 30 days, the Snapshot device tracked his driving habits, including his adherence to speed limits and braking patterns.

Progressive’s Reward: David’s driving habits earned him a substantial discount on his Progressive car insurance policy. By demonstrating safe driving practices, David not only saved money but also gained a deeper understanding of his driving behavior, reinforcing his commitment to safety.

Performance Analysis: Progressive’s Track Record

Progressive Insurance’s performance over the years has been a testament to their commitment to customer satisfaction and financial stability. Here’s a glimpse into their key performance indicators:

Financial Strength: Progressive maintains a strong financial position, with an A+ rating from A.M. Best, a leading insurance rating agency. This rating reflects their ability to meet their financial obligations and provide stable coverage for their policyholders.

Customer Satisfaction: Progressive consistently ranks highly in customer satisfaction surveys, with a focus on providing clear and concise policy information, efficient claims handling, and personalized customer support.

Claims Handling: Progressive’s claims process is renowned for its efficiency and fairness. With a network of experienced claims adjusters and a dedicated claims team, they ensure a swift and stress-free experience for policyholders.

Conclusion: A Trusted Partner for Your Driving Journey

Progressive Insurance’s car insurance policies are a testament to their commitment to providing comprehensive coverage, innovative features, and a customer-centric approach. With a focus on education, transparency, and financial stability, Progressive has earned the trust of millions of drivers across the United States.

As you navigate the world of auto insurance, remember that Progressive Insurance is not just a provider but a partner, dedicated to ensuring your peace of mind and financial protection on the road. Whether you’re a cautious driver looking to save with Snapshot or a new car owner seeking the security of gap coverage, Progressive has the tools and expertise to meet your unique needs.

FAQ: Progressive Car Insurance

What are the average monthly premiums for Progressive’s car insurance policies?

+

Progressive’s car insurance premiums vary based on factors like the policyholder’s location, driving record, and coverage limits. On average, policyholders can expect to pay between 100 and 200 per month for comprehensive coverage. However, with Progressive’s Snapshot program and other discounts, many customers are able to reduce their premiums significantly.

How does Progressive’s Snapshot program work, and what kind of discounts can I expect?

+

The Snapshot program uses a small device to monitor your driving habits, including speed, braking, and time of day. Based on your driving behavior, you could be eligible for discounts of up to 30% on your car insurance policy. The more safely you drive, the more you can save.

What additional coverage options does Progressive offer, and how can they benefit me?

+

Progressive offers a range of additional coverage options, including rental car reimbursement, roadside assistance, and custom parts and equipment coverage. These add-ons can provide extra protection and convenience, ensuring you’re covered for a wide range of situations.