Is The Irs About Insurance

The Internal Revenue Service (IRS) is a vital government agency in the United States responsible for tax administration and revenue collection. While the IRS plays a crucial role in the nation's financial system, its relationship with insurance is often misunderstood and raises several important questions. This article aims to provide a comprehensive analysis of the IRS's involvement with insurance, shedding light on its role, regulations, and implications for individuals and businesses.

Understanding the IRS and Its Mandate

The IRS, established in 1862, is a federal agency under the Department of the Treasury. Its primary function is to enforce tax laws, collect taxes, and ensure compliance with the Internal Revenue Code (IRC). The agency’s mandate is wide-ranging, covering individual and corporate taxes, estate taxes, employment taxes, and a host of other financial obligations.

The IRS's role extends beyond simple tax collection. It also provides taxpayer assistance, offers various tax incentives and credits, and enforces tax regulations to maintain fairness and equity in the tax system. The agency's activities are guided by a complex set of laws and regulations, ensuring that tax administration is conducted efficiently and effectively.

The Intersection of IRS and Insurance

The relationship between the IRS and insurance is multifaceted and often complex. While the IRS does not directly provide insurance services, its regulations and policies have significant implications for the insurance industry and those who purchase insurance products.

Insurance Premiums and Tax Deductibility

One of the key areas where the IRS intersects with insurance is in the deductibility of insurance premiums. The IRS allows individuals and businesses to deduct certain insurance expenses from their taxable income, providing a tax benefit for those who purchase insurance coverage. This includes health insurance premiums, certain types of life insurance, and business-related insurance policies.

| Insurance Type | Deductibility |

|---|---|

| Health Insurance | Premiums for self, spouse, and dependents are generally deductible as a medical expense. |

| Life Insurance | Premiums for term life insurance are not deductible, but premiums for permanent life insurance with a cash value component may be partially deductible. |

| Business Insurance | Insurance premiums related to business operations, such as property, liability, and professional indemnity insurance, are generally deductible as business expenses. |

For instance, individuals who itemize their deductions on their tax returns can claim health insurance premiums as a medical expense. Similarly, businesses can deduct insurance premiums as a cost of doing business, which can significantly reduce their taxable income.

Taxation of Insurance Proceeds

The IRS also plays a role in the taxation of insurance proceeds. While the majority of insurance payouts are not taxable, certain types of insurance proceeds are subject to tax. This is particularly relevant for life insurance policies and certain types of health insurance plans.

| Insurance Type | Taxation |

|---|---|

| Life Insurance | Proceeds from life insurance policies are generally tax-free to the beneficiary, but may be taxable if the policy was owned by the insured for estate planning purposes. |

| Health Insurance | Health insurance reimbursements are generally not taxable, but certain employer-provided health benefits may be subject to tax if they exceed specified thresholds. |

For example, life insurance proceeds paid to a beneficiary are typically tax-free, as they are considered a death benefit. However, if the policy was owned by the insured as part of an estate plan, the proceeds may be taxable as part of the insured's estate.

IRS Audits and Insurance Records

The IRS may also request insurance records during an audit. This is particularly relevant for businesses, as insurance policies and claims can impact a company’s financial statements and tax liabilities. For instance, insurance proceeds received for a casualty loss may need to be reported to the IRS and may impact the tax treatment of the loss.

Insurance Companies and IRS Regulations

Insurance companies themselves are subject to various IRS regulations. They must comply with tax laws and report their income and expenses accurately. Additionally, insurance companies often provide tax-advantaged products, such as annuities and certain types of retirement plans, which are subject to specific IRS rules and regulations.

Implications for Individuals and Businesses

The IRS’s involvement with insurance has several implications for individuals and businesses. For individuals, understanding the tax deductibility of insurance premiums can help maximize tax savings. Additionally, knowing the tax treatment of insurance proceeds can ensure proper reporting and compliance with tax laws.

For businesses, the IRS's regulations on insurance impact both their financial reporting and tax liabilities. Accurate reporting of insurance expenses and proceeds is crucial for maintaining compliance and avoiding penalties. Furthermore, businesses should be aware of the tax advantages offered by certain insurance products, such as retirement plans and annuities, to optimize their tax strategies.

Conclusion

The relationship between the IRS and insurance is complex but crucial for individuals and businesses to understand. By navigating the IRS’s regulations and guidelines, taxpayers can make informed decisions about insurance coverage and tax planning. The IRS’s role in tax administration and its intersection with insurance highlight the importance of tax compliance and the potential tax benefits associated with insurance products.

Can I Deduct All Insurance Premiums from My Taxes?

+No, not all insurance premiums are deductible. The deductibility depends on the type of insurance and its purpose. For instance, health insurance premiums for yourself, spouse, and dependents are generally deductible, while life insurance premiums are not deductible unless they are part of an estate plan.

Are Insurance Proceeds Always Tax-Free?

+In most cases, insurance proceeds are tax-free, particularly for life insurance and health insurance. However, there are exceptions. For example, life insurance proceeds may be taxable if the policy was owned by the insured for estate planning purposes. It’s essential to understand the specific rules for each type of insurance to ensure proper tax treatment.

How Do I Report Insurance Proceeds to the IRS?

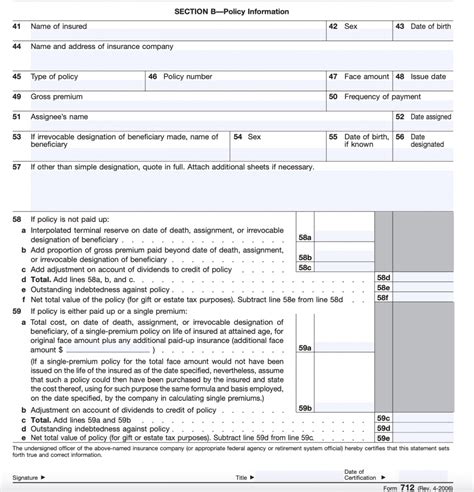

+The reporting requirements depend on the type of insurance and the nature of the proceeds. For life insurance proceeds, they are typically reported on Form 1040 as part of the tax return. For health insurance reimbursements, they are generally not reported separately but may impact other deductions or credits. It’s advisable to consult a tax professional for specific guidance.