California Insurance Car

The world of automotive insurance is a complex and ever-evolving landscape, and it's especially crucial to navigate when you're a driver in the bustling state of California. With its diverse roads, varied weather conditions, and unique laws, California presents a distinct set of challenges and opportunities when it comes to insuring your vehicle. In this comprehensive guide, we'll delve deep into the intricacies of California car insurance, offering expert insights, real-world examples, and valuable tips to ensure you're fully equipped to make informed decisions about your coverage.

Understanding the Basics of California Car Insurance

California, known for its progressive mindset and robust legal framework, sets the bar high for automotive insurance standards. The state’s insurance laws are designed to protect drivers, passengers, and pedestrians alike, ensuring that everyone on the road is adequately covered in the event of an accident. Understanding these laws and the resulting insurance requirements is the first step towards becoming a savvy California driver.

Mandatory Insurance Coverage in California

California operates under a financial responsibility law, which mandates that all drivers maintain minimum levels of liability insurance. This includes bodily injury liability coverage of at least 15,000 per person and 30,000 per accident, as well as property damage liability coverage of at least $5,000. These minimums are designed to cover basic expenses in the event of an at-fault accident, but they may not be sufficient for more severe incidents. It’s essential to carefully consider your specific needs and risks when determining the appropriate level of coverage.

| Liability Coverage | Minimum Requirement (California) |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

Additional Coverage Options

Beyond the mandatory liability coverage, California drivers have a range of optional insurance coverages to choose from. These include:

- Collision Coverage: Pays for damage to your vehicle if you're in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, weather damage, and animal collisions.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who doesn't have sufficient insurance.

- Medical Payments Coverage: Helps cover the cost of medical treatment for you and your passengers after an accident, regardless of fault.

- Personal Injury Protection (PIP): Provides additional medical and living expense coverage, often more comprehensive than Medical Payments.

Factors Influencing California Car Insurance Rates

The cost of car insurance in California can vary significantly based on a multitude of factors. Understanding these variables can help you make informed decisions about your coverage and potentially save on your premiums.

Vehicle-Related Factors

The type of vehicle you drive can have a substantial impact on your insurance rates. Sports cars, luxury vehicles, and certain models with high theft rates may cost more to insure due to their increased risk of accidents or theft. Additionally, the age and condition of your vehicle can also play a role, with newer, well-maintained cars often attracting lower premiums.

Driver-Related Factors

Your driving history is a significant determinant of your insurance rates. A clean driving record with no accidents or moving violations will generally result in lower premiums. Conversely, a history of accidents, especially those where you were at fault, can lead to higher rates. Your age, gender, and marital status can also influence your rates, with younger drivers and males typically facing higher premiums.

Location-Based Factors

The area where you live and typically drive plays a critical role in determining your insurance rates. Urban areas with high traffic density and a higher incidence of accidents and thefts tend to have higher insurance rates. Similarly, areas with a history of severe weather events, like hurricanes or floods, may also see higher premiums.

Usage-Based Factors

How you use your vehicle can also impact your insurance rates. If you drive long distances regularly or use your vehicle for business purposes, your rates may be higher. Conversely, if you primarily use your car for pleasure and drive relatively few miles annually, you may be eligible for low-mileage discounts.

Navigating California’s Unique Insurance Landscape

California’s insurance market is diverse and competitive, offering a wide range of coverage options and pricing structures. Understanding how to navigate this landscape can help you secure the best coverage at the most competitive rates.

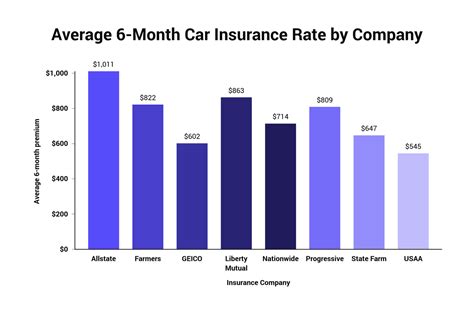

Comparing Insurance Providers

California is home to numerous insurance providers, both large national carriers and smaller, regional companies. It’s essential to compare quotes from multiple providers to ensure you’re getting the best deal. Online quote tools can be a convenient way to quickly compare rates, but be sure to also explore the specific coverage offerings and policy terms of each provider.

Understanding Policy Terms

When comparing policies, pay close attention to the specific terms and conditions. While the price is an important factor, the level of coverage and the policy’s fine print can be even more crucial. Look for policies that offer comprehensive coverage with clear, straightforward language and minimal exclusions or limitations.

Leveraging Discounts

Many insurance providers offer a variety of discounts that can significantly reduce your premiums. Common discounts include those for safe driving, multiple vehicles, bundling home and auto insurance, and loyalty rewards. Some providers also offer discounts for specific professions or membership in certain organizations. Be sure to inquire about all available discounts when obtaining quotes.

Understanding No-Fault Insurance

California operates under a tort system for auto insurance, which means that fault is determined in an accident and the at-fault driver’s insurance is responsible for damages. However, Personal Injury Protection (PIP) coverage, which is optional in California, provides a level of no-fault coverage for medical expenses and lost wages after an accident.

Future of California Car Insurance: Trends and Innovations

The automotive insurance landscape in California is continually evolving, driven by technological advancements, changing consumer behaviors, and shifting regulatory environments. Staying abreast of these trends can help drivers make more informed decisions about their coverage and potentially benefit from new opportunities.

Telematics and Usage-Based Insurance

Telematics devices, which track driving behavior and transmit data to insurance providers, are gaining popularity in the insurance industry. These devices can offer personalized insurance rates based on your actual driving habits, potentially rewarding safe drivers with lower premiums. While this technology is still in its early stages, it’s expected to play a more significant role in the future of automotive insurance.

Digital Transformation

The insurance industry is undergoing a digital transformation, with an increasing emphasis on online platforms, mobile apps, and digital tools. This shift offers greater convenience and efficiency for consumers, allowing for easier policy management, claims processing, and real-time updates. It also enables more personalized insurance products tailored to individual needs and risks.

Environmental and Sustainability Considerations

With California’s focus on environmental sustainability and its leadership in electric vehicle (EV) adoption, the insurance industry is beginning to offer specialized coverage for EVs. These policies often provide enhanced benefits, such as roadside assistance tailored to EVs and coverage for charging station damage. As the EV market continues to grow, we can expect to see more innovative insurance products designed specifically for electric and hybrid vehicles.

Connected Car Technologies

The integration of advanced technologies in modern vehicles, such as advanced driver-assistance systems (ADAS) and connected car features, is transforming the automotive landscape. These technologies have the potential to significantly reduce accident rates and improve road safety. As a result, insurance providers are beginning to offer discounts for vehicles equipped with these safety features, recognizing their role in mitigating risk.

Conclusion: Making Informed Choices for Your California Car Insurance

Navigating the complex world of California car insurance requires a deep understanding of the state’s unique laws and regulations, as well as the various factors that influence insurance rates. By comprehending the basics of automotive insurance, the specific requirements in California, and the trends shaping the future of the industry, you can make informed decisions about your coverage. Remember to regularly review and update your insurance policy to ensure it continues to meet your needs and takes advantage of any available discounts or advancements in coverage options.

What is the average cost of car insurance in California?

+The average cost of car insurance in California varies depending on several factors, including the driver’s age, driving history, location, and the type of coverage chosen. As of [most recent data], the average annual premium for minimum liability coverage in California was around 700, while full coverage policies averaged closer to 2,000. However, these figures can vary significantly based on individual circumstances.

Are there any discounts available for California car insurance?

+Yes, many insurance providers offer a range of discounts to California drivers. Common discounts include those for safe driving, multiple vehicles, bundling home and auto insurance, and loyalty rewards. Some providers also offer discounts for specific professions or membership in certain organizations. It’s always a good idea to inquire about available discounts when obtaining quotes.

How do I choose the right insurance provider for my needs in California?

+Choosing the right insurance provider involves a combination of factors. Start by comparing quotes from multiple providers to find competitive rates. Then, carefully review the specific coverage offerings and policy terms to ensure they align with your needs. Consider the provider’s reputation, customer service record, and any additional perks or benefits they offer. Finally, don’t hesitate to reach out to the provider with any questions or concerns you may have.

What should I do if I’m involved in an accident in California?

+If you’re involved in an accident in California, it’s important to remain calm and take the following steps: First, ensure the safety of all involved parties. Then, contact the police to report the accident. Exchange information with the other driver(s), including names, contact details, insurance information, and vehicle details. Take photos of the accident scene and any relevant damage. Finally, notify your insurance provider as soon as possible to initiate the claims process.