Car Cheap Insurance Quotes

When it comes to finding the best car insurance deals, getting cheap insurance quotes is essential for savvy drivers. With the right approach and understanding of the market, you can secure comprehensive coverage at a fraction of the cost. This comprehensive guide will explore the ins and outs of cheap car insurance quotes, providing you with the knowledge and tools to make informed decisions and save money on your auto insurance policy.

Understanding Cheap Car Insurance Quotes

Cheap car insurance quotes are not a myth; they are a reality for those who take the time to explore their options and understand the factors that influence insurance premiums. While it’s true that factors like your driving record, age, and location play a significant role in determining your insurance rates, there are still ways to reduce costs and find affordable coverage.

One of the primary goals of seeking cheap car insurance quotes is to strike a balance between coverage and cost. It's essential to remember that the cheapest quote might not always offer the best value. You need to consider the level of coverage provided, the reputation of the insurance company, and any additional benefits or discounts available.

Factors Influencing Cheap Insurance Quotes

Various factors impact the cost of car insurance, and understanding these elements can help you negotiate better rates. Here’s a breakdown of some key factors:

- Driving Record: A clean driving record with no accidents or traffic violations is highly favorable for insurance companies. It indicates a lower risk profile, leading to more affordable quotes.

- Age and Experience: Younger drivers, especially those under 25, often face higher premiums due to their lack of experience on the road. However, as you gain more years of driving experience, insurance rates tend to decrease.

- Vehicle Type and Usage: The make and model of your car, its safety features, and how you use it can impact your insurance costs. Sports cars and luxury vehicles generally attract higher premiums due to their association with higher risk and potential for costly repairs.

- Location: Where you live and where you primarily drive your vehicle can significantly affect your insurance rates. Urban areas with higher traffic and crime rates often result in higher premiums compared to rural areas.

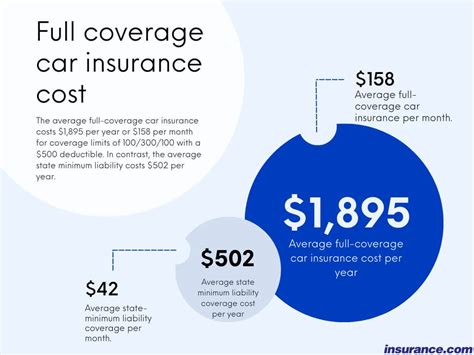

- Coverage Options: The level of coverage you choose will impact your insurance costs. While comprehensive coverage provides more protection, it comes at a higher price. Balancing your needs and budget is crucial when selecting coverage options.

Tips for Getting the Best Cheap Insurance Quotes

Now that we’ve explored the factors influencing insurance quotes, let’s delve into some practical tips to help you secure the best cheap insurance deals:

Shop Around and Compare

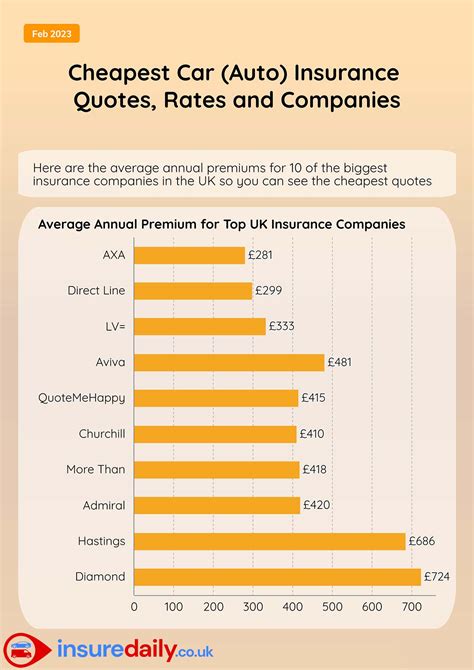

One of the most effective ways to find cheap car insurance quotes is to shop around and compare rates from multiple insurance providers. Each insurer has its own criteria and pricing structure, so obtaining quotes from various companies can help you identify the most competitive rates.

Use online comparison tools and insurance marketplaces to quickly gather quotes from a wide range of insurers. These platforms make it convenient to compare coverage options, deductibles, and premiums side by side. Additionally, consider reaching out to local insurance agents or brokers who can provide personalized quotes and advice.

Review Your Coverage Needs

Before requesting insurance quotes, take the time to assess your specific coverage needs. Consider the following factors:

- Do you need comprehensive and collision coverage, or will liability-only suffice for your vehicle and driving habits?

- Are there any optional coverages, such as rental car reimbursement or roadside assistance, that you might benefit from?

- Evaluate your deductible options. A higher deductible can lower your premium, but ensure you can afford the out-of-pocket expense in the event of a claim.

Explore Discount Opportunities

Insurance companies offer a variety of discounts to attract and retain customers. By understanding these discounts and meeting the criteria, you can significantly reduce your insurance premiums. Some common discount opportunities include:

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as home or renters insurance, can result in substantial savings.

- Safe Driver Discounts: Insurers often reward drivers with clean records and a history of safe driving. Maintaining a good driving record can lead to reduced premiums.

- Loyalty Discounts: Staying with the same insurer for an extended period can earn you loyalty discounts, so consider the long-term benefits of sticking with a provider.

- Safety Features: If your vehicle is equipped with advanced safety features like anti-lock brakes, airbags, or collision avoidance systems, you may qualify for safety discounts.

- Payment Options: Some insurers offer discounts for paying your premium upfront or opting for electronic billing and payment methods.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance rates. If you have a history of accidents or traffic violations, it’s crucial to take steps to improve your record. Here’s how:

- Practice defensive driving techniques to minimize the risk of accidents.

- Obey traffic laws and speed limits to avoid citations.

- Consider enrolling in a defensive driving course, which can lead to reduced points on your license and potential insurance discounts.

- If you have a clean driving record, ensure you inform your insurer to take advantage of safe driver discounts.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to car insurance that tailors your premium to your actual driving behavior. By installing a small device or using a smartphone app to track your driving habits, insurers can offer more accurate and potentially cheaper insurance rates.

This type of insurance is particularly beneficial for low-mileage drivers or those with a history of safe driving. It rewards drivers who practice good habits, such as avoiding aggressive driving, excessive speeding, and driving during high-risk hours.

Evaluating Cheap Insurance Quotes

Once you’ve gathered a range of cheap car insurance quotes, it’s important to carefully evaluate each option to ensure you’re getting the best value. Here are some key considerations:

Coverage Limits and Deductibles

Review the coverage limits and deductibles associated with each quote. Ensure that the limits are adequate to protect your assets and meet your financial obligations in the event of an accident. Higher deductibles can lower your premium, but make sure you’re comfortable with the out-of-pocket expense.

Reputation and Financial Stability

Research the reputation and financial stability of the insurance companies providing the quotes. Opt for reputable insurers with a solid financial standing to ensure they can honor claims in the future. Check customer reviews and ratings to gauge their reliability and customer satisfaction.

Additional Benefits and Perks

Beyond the basic coverage, some insurance providers offer additional benefits and perks that can enhance your overall insurance experience. These may include roadside assistance, rental car coverage, accident forgiveness, or discounts for completing safe driving courses. Evaluate these extras to determine their value to you.

Claims Process and Customer Service

Consider the insurer’s claims process and customer service reputation. A responsive and efficient claims process can make a significant difference when you need to file a claim. Read reviews and ask for recommendations from friends and family to assess the insurer’s customer service quality.

The Future of Cheap Car Insurance

The car insurance landscape is continually evolving, and technological advancements are playing a significant role in shaping the future of cheap insurance quotes. Here’s a glimpse into what the future may hold:

Telematics and Data-Driven Insurance

Usage-based insurance, powered by telematics technology, is expected to become even more prevalent. With advanced sensors and data analytics, insurers will have a more accurate understanding of individual driving behaviors, allowing for more precise and personalized insurance rates.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning algorithms are being utilized to analyze vast amounts of data, including driving patterns, weather conditions, and accident trends. This technology enables insurers to develop more accurate risk assessment models, leading to fairer and more affordable insurance rates.

In-Vehicle Safety Features

As vehicles become increasingly equipped with advanced safety features, such as automatic emergency braking, lane departure warning systems, and adaptive cruise control, insurers are likely to offer discounts for these technologies. The integration of these safety features into insurance policies will incentivize drivers to adopt safer driving practices.

Pay-Per-Mile Insurance

Pay-per-mile insurance, a variation of usage-based insurance, is gaining traction. This model charges drivers based on the number of miles driven, providing an incentive for low-mileage drivers to reduce their carbon footprint and save on insurance costs.

| Cheap Insurance Factor | Impact |

|---|---|

| Clean Driving Record | Reduces premiums significantly |

| Young Driver Age | Higher premiums due to inexperience |

| Vehicle Type | Sports cars and luxury vehicles attract higher rates |

| Location | Urban areas with high traffic and crime have higher premiums |

| Coverage Options | Comprehensive coverage offers more protection but costs more |

How often should I review my car insurance policy and seek new quotes?

+It’s a good practice to review your car insurance policy annually, especially during policy renewal. Insurance rates can fluctuate, and new discounts or coverage options may become available. By comparing quotes regularly, you can ensure you’re getting the best value for your insurance needs.

Can I switch insurance providers mid-policy if I find a better deal?

+Yes, you can switch insurance providers at any time, even mid-policy. However, be mindful of any cancellation fees or penalties associated with early termination. Make sure the savings from the new policy outweigh any potential fees.

What are some common mistakes to avoid when seeking cheap car insurance quotes?

+Avoid the following mistakes: accepting the first quote without comparison, neglecting to review coverage limits and deductibles, overlooking potential discounts, and assuming the cheapest quote is always the best option. Take the time to thoroughly evaluate your options and make an informed decision.